Checklist for new subscribers

Start off on the right foot with our checklist of Investor essentials.

We encourage new Morningstar Investor subscribers to try this six-step guide during their free trials—and beyond.

Don't have a subscription to Morningstar Investor yet? Start your free trial today.

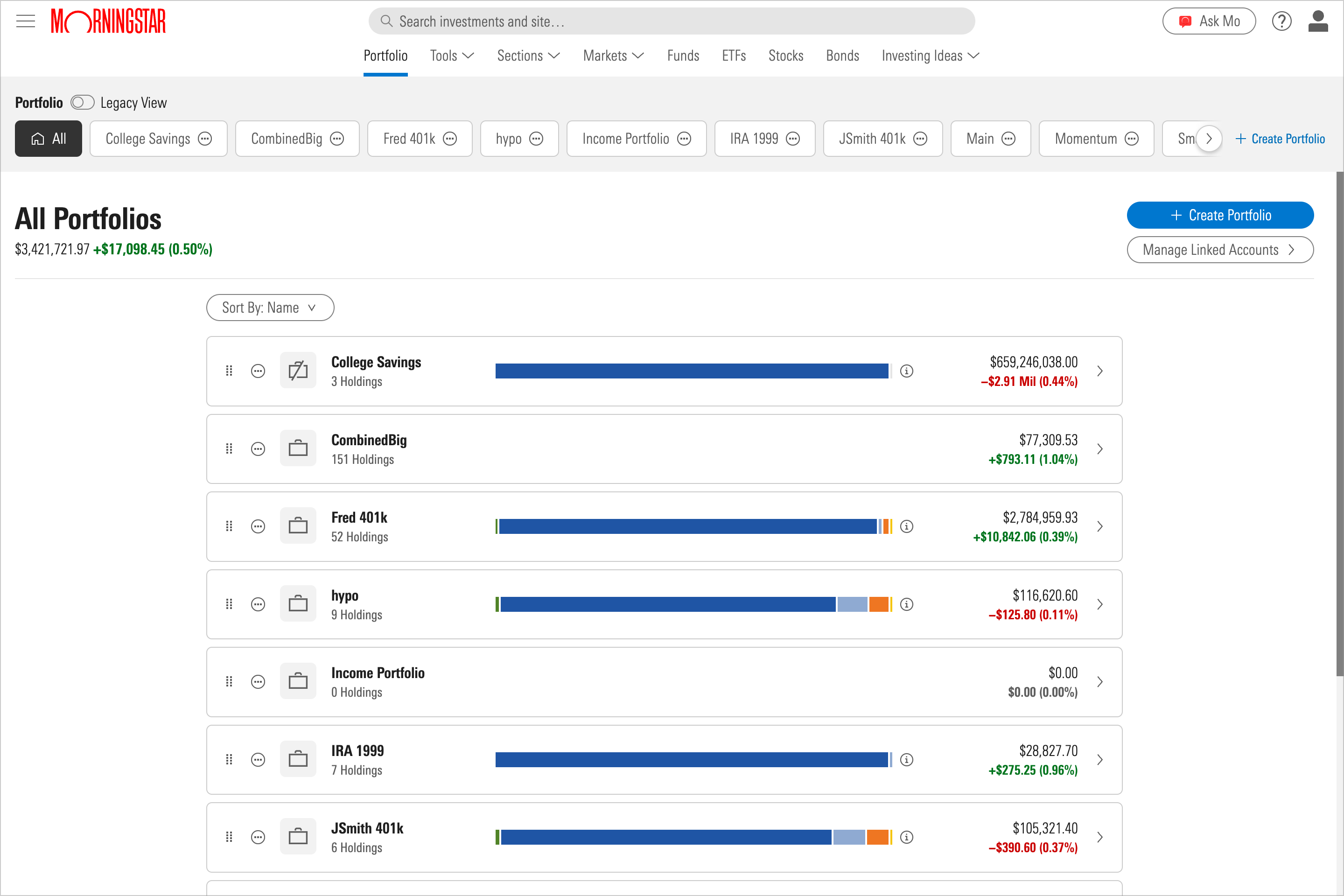

1. Add your investments to one or more portfolios.

You can use Portfolio to monitor your accounts and create portfolios for each unique investing goal. Start by manually adding your holdings or linking an account from a financial institution. Manually adding your holdings gives you even deeper analysis of your investments. Learn more about which method may work better for you.

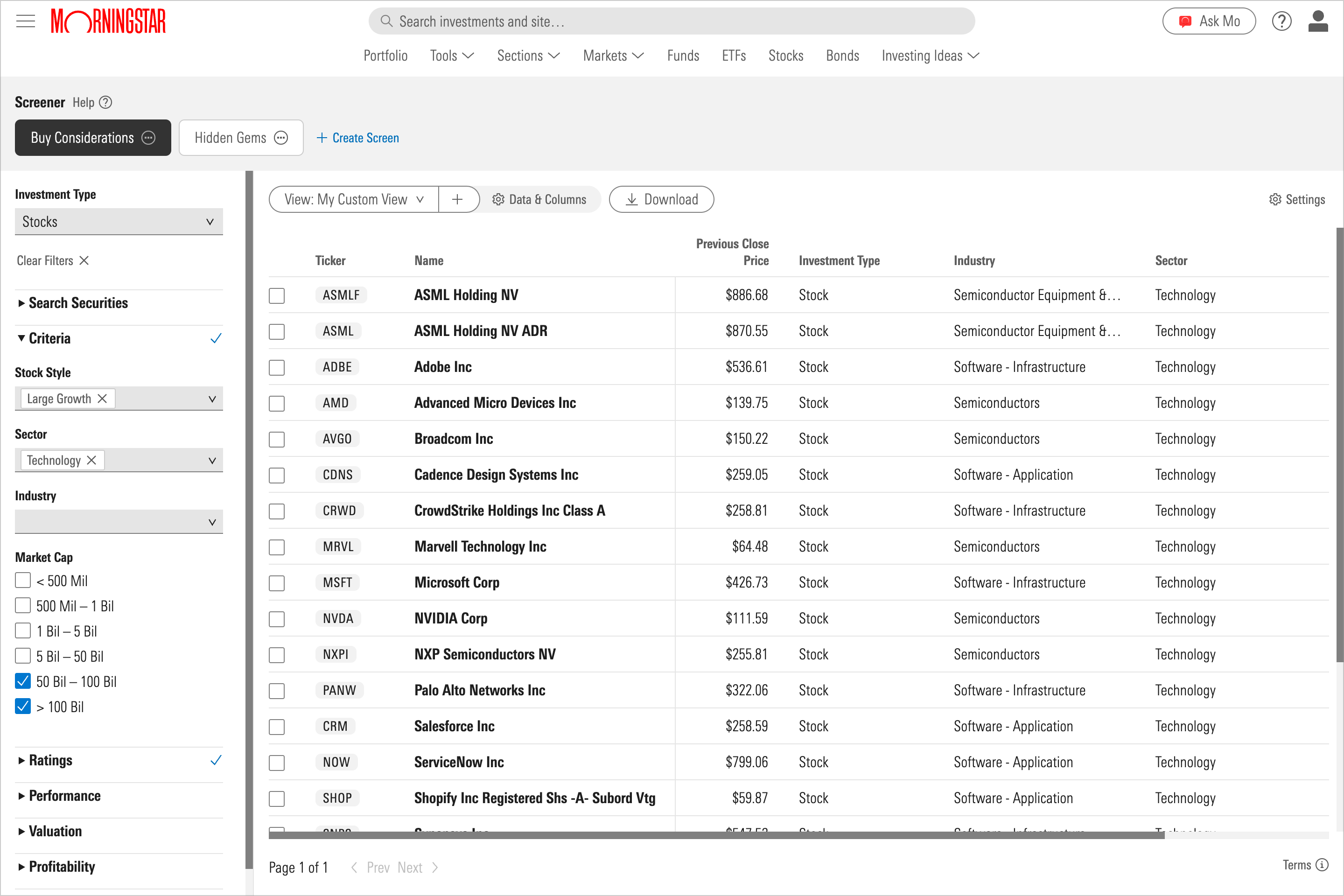

2. Explore Screener.

Use our powerful Screener tool to quickly find and evaluate securities and indexes. You can use one of our pre-filtered views, or create your own custom views to find securities that fit your risk tolerance and diversification needs—all while layering in Morningstar's exclusive stock and fund ratings and performance and valuation data.

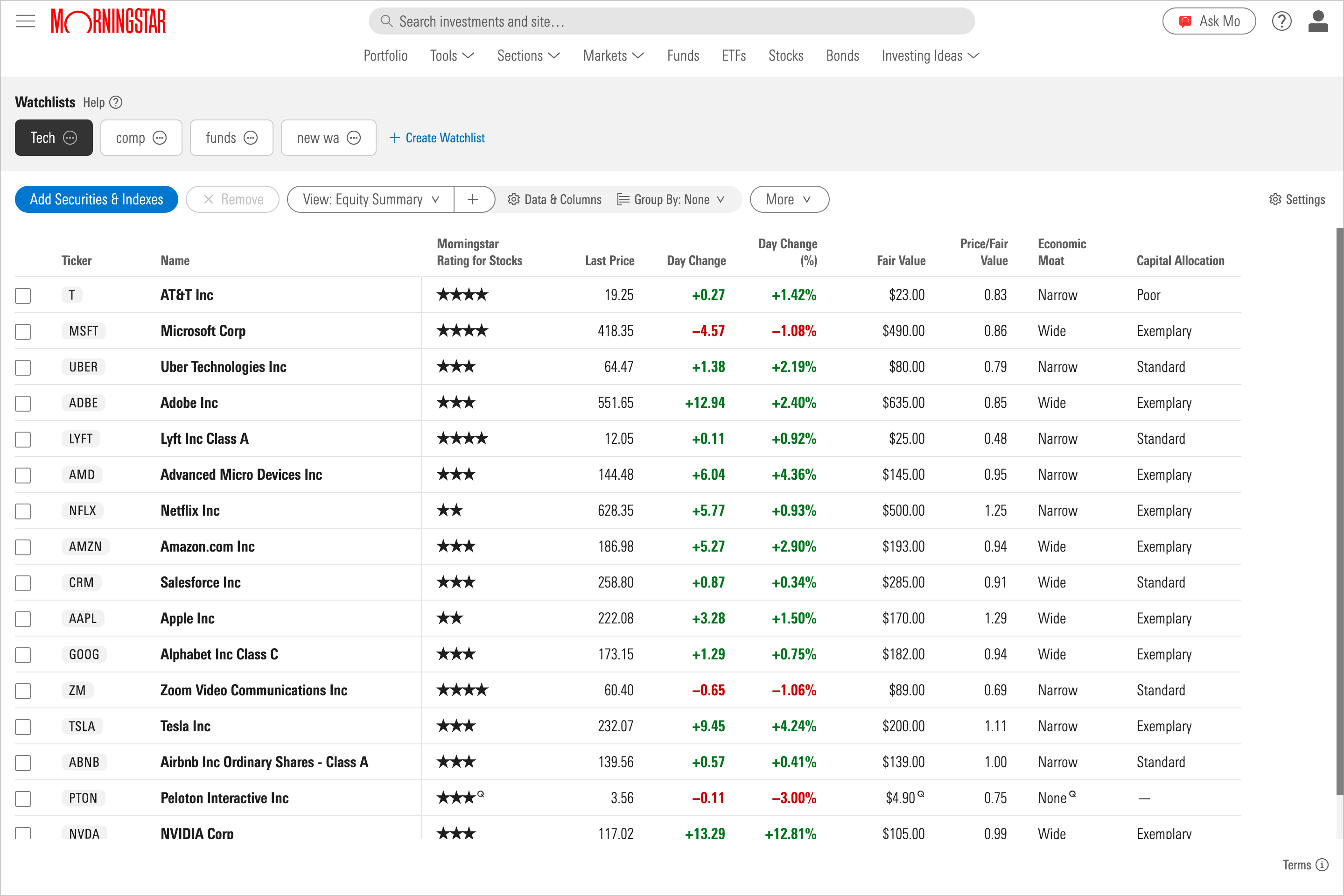

3. Create a watchlist.

Watchlists help you keep tabs on securities and indexes you don't currently own. You can customize them using our expansive performance and valuation metrics, so you can pinpoint buy opportunities quickly. They're an excellent way to keep track of investment ideas as your portfolio evolves.

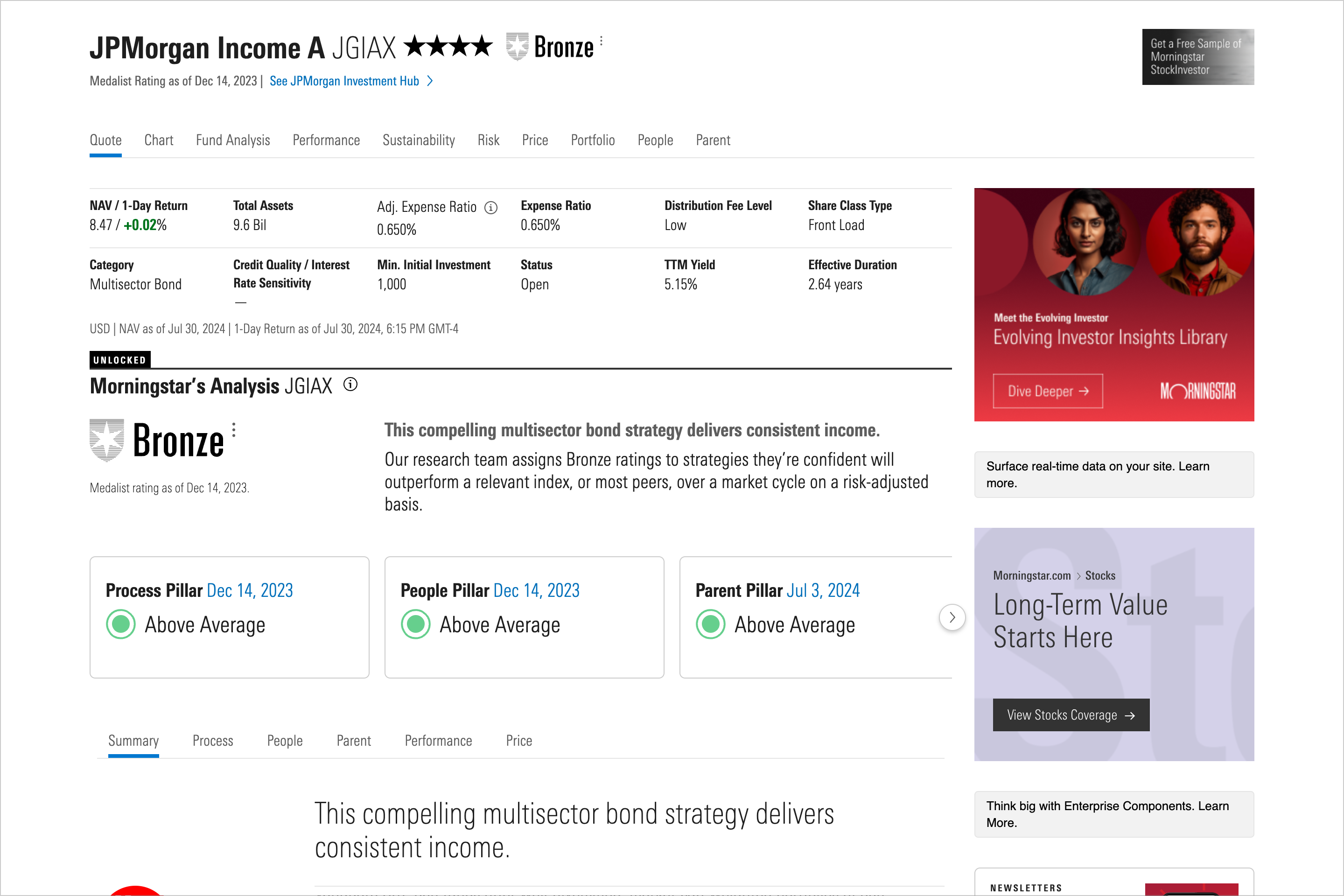

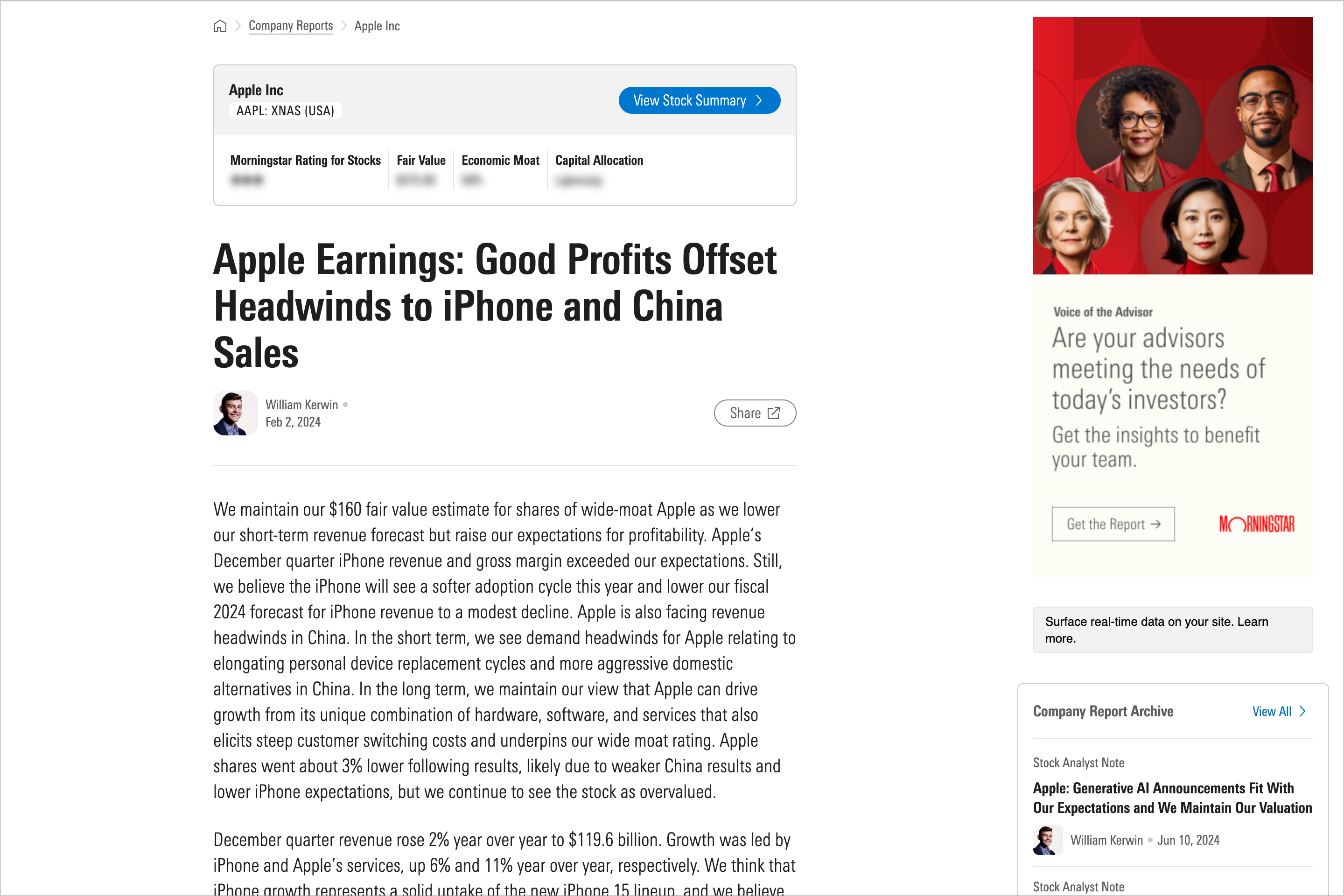

4. Study company reports and fund analyst reports.

Company reports (for stocks) and fund analyst reports (for mutual funds and ETFs) contain comprehensive data paired with a thorough evaluation of an investment’s merits and drawbacks. They're perfect for evaluating the value of a security over time and make excellent companions while screening. Find them across Morningstar.com, including on stock and fund quote pages.

5. Read Analyst Notes.

Your Morningstar Investor subscription gives you exclusive access to our analysts’ take on the most decisive factors leading to the overall rating of a stock, fund, or ETF. Our analysts are committed to reporting on investments fairly, accurately, and from the investor’s point of view, offering objective insights you can trust. You can access the latest notes via company reports.

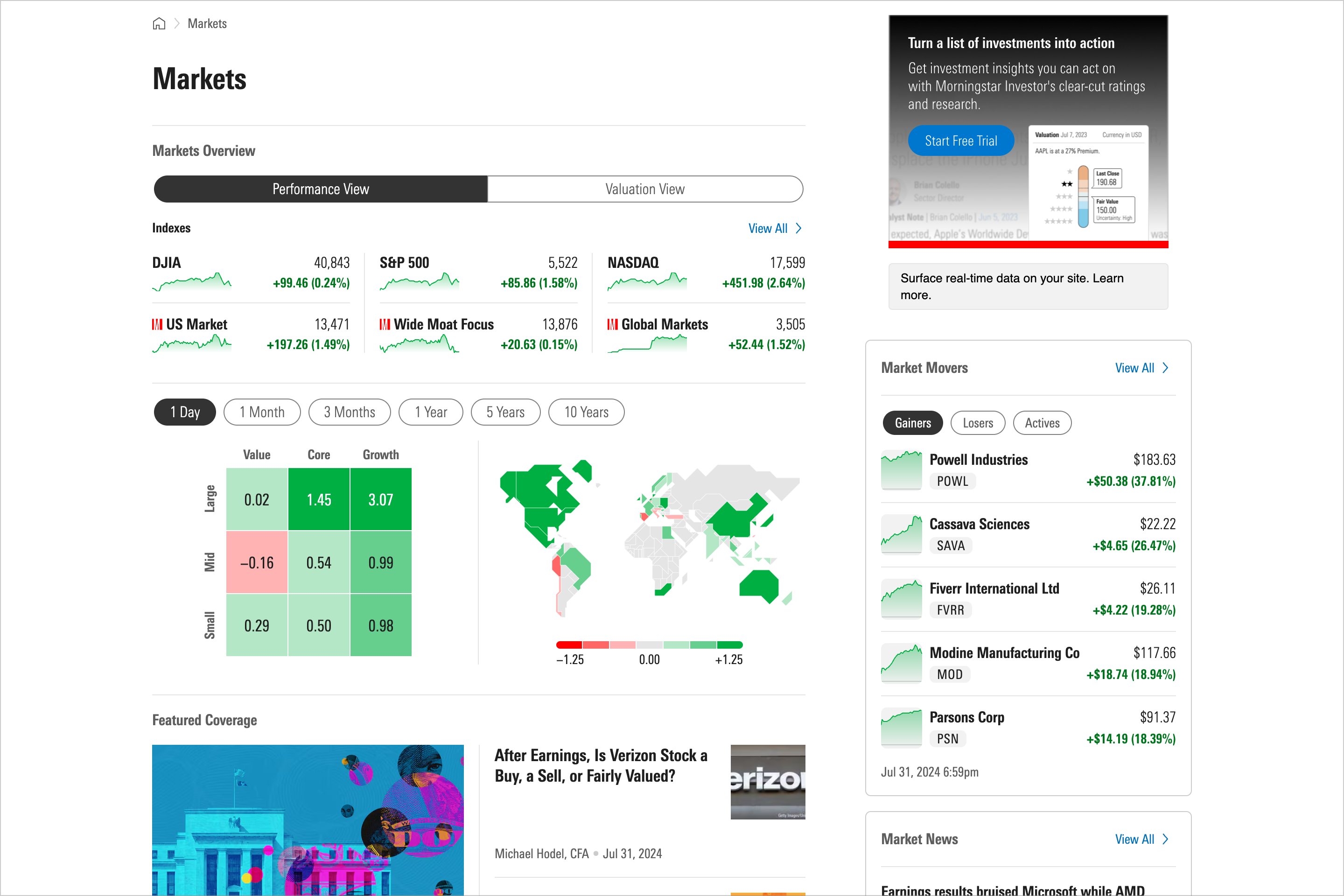

6. Track markets at a macro level.

Our refreshed Markets page is dedicated to market monitoring, with real-time trackers to help you zoom out for greater context as you evaluate investing opportunities.