How Do Capital Group’s Latest Active ETFs Stack Up?

A closer look at the budding lineup.

Capital Group, a relative latecomer among big asset managers to the active exchange-traded fund race, has forged ahead of earlier entrants in terms of asset flows and new launches.

While other active management mutual fund giants like Fidelity and T. Rowe Price moved first, the parent company of the American Funds rolled out its first ETFs in 2022 with a key distinguishing feature. The firm opted to launch fully transparent ETFs, which means they disclose their holdings daily. That call proved prescient, as investors have flocked to fully transparent ETFs and the Capital Group firm has been one of the top beneficiaries this year. In June 2024, it also introduced seven more active ETFs—bringing its total to 21. Let’s look at the budding lineup.

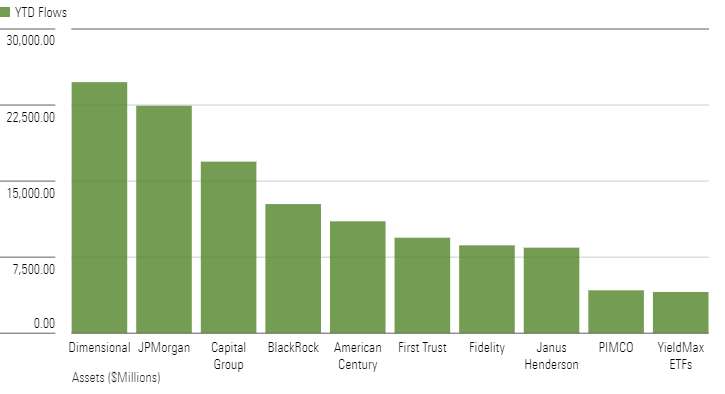

As of August, Capital Group ranked third in active ETF flows for the year to date, with almost $17 billion in assets.

Estimated Year-to-Date Active ETF Net Flows by Firm

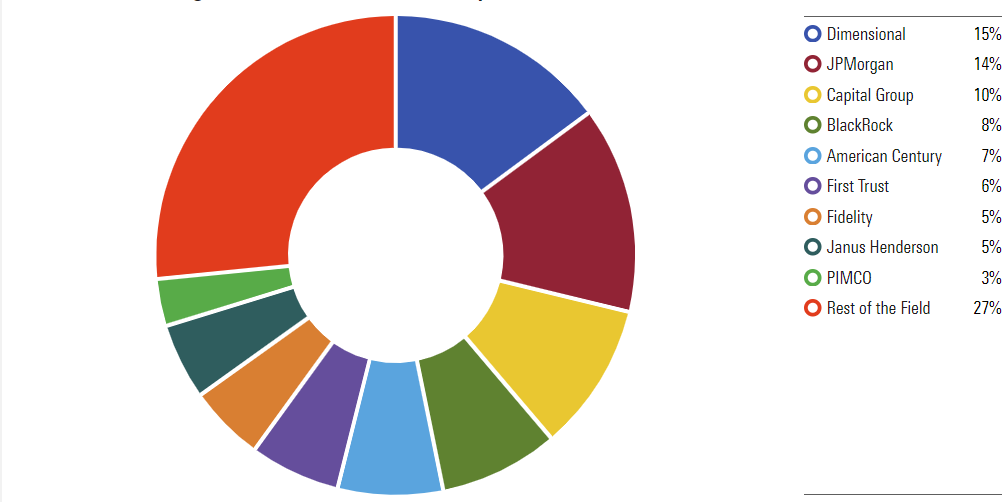

A small group of firms is accumulating most of the active ETF assets. As of August, the top 10 firms took in 75% of total active ETF assets for the year.

Percentage of Total Active ETF Flows by Firm

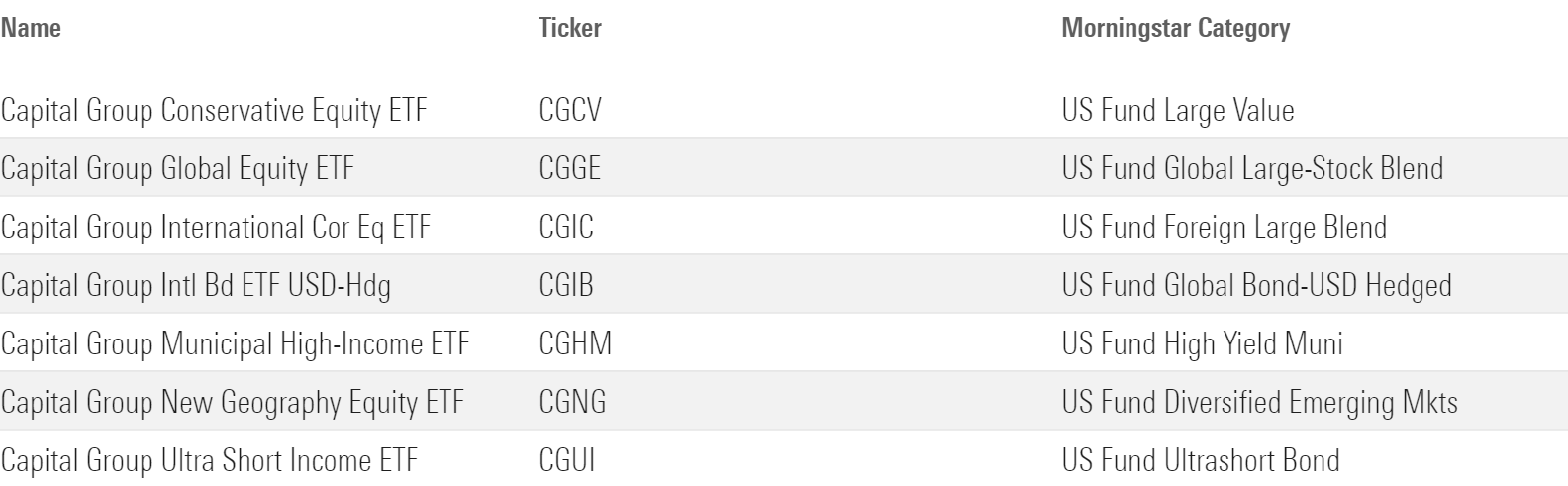

Like all of Capital’s strategies, its ETFs use the firm’s signature multimanager approach. Capital’s newest launches, unlike its first efforts, more closely resemble existing funds in its mutual fund lineup. For example, Capital Group Conservative Equity ETF’s CGCV management team is the same as American Funds American Mutual’s AMRMX. The older American Funds Global Insight’s AGVFX team runs Capital Group Global Equity ETF CGGE. Unlike American Funds New World NEWFX, Capital Group New Geography Equity ETF CGNG has no fixed-income sleeve or manager, but their management teams are otherwise the same.

The main difference between this batch of Capital Group ETFs and their corresponding mutual funds is their number of holdings. Capital Group uses an optimizer to replicate its legacy strategies’ portfolios, which distills the number of holdings to a smaller number, while maintaining the portfolios’ stylistic traits. The optimization process also considers tax management and liquidity.

Capital Group Active ETFs: New ETFs Launched June 25, 2024.

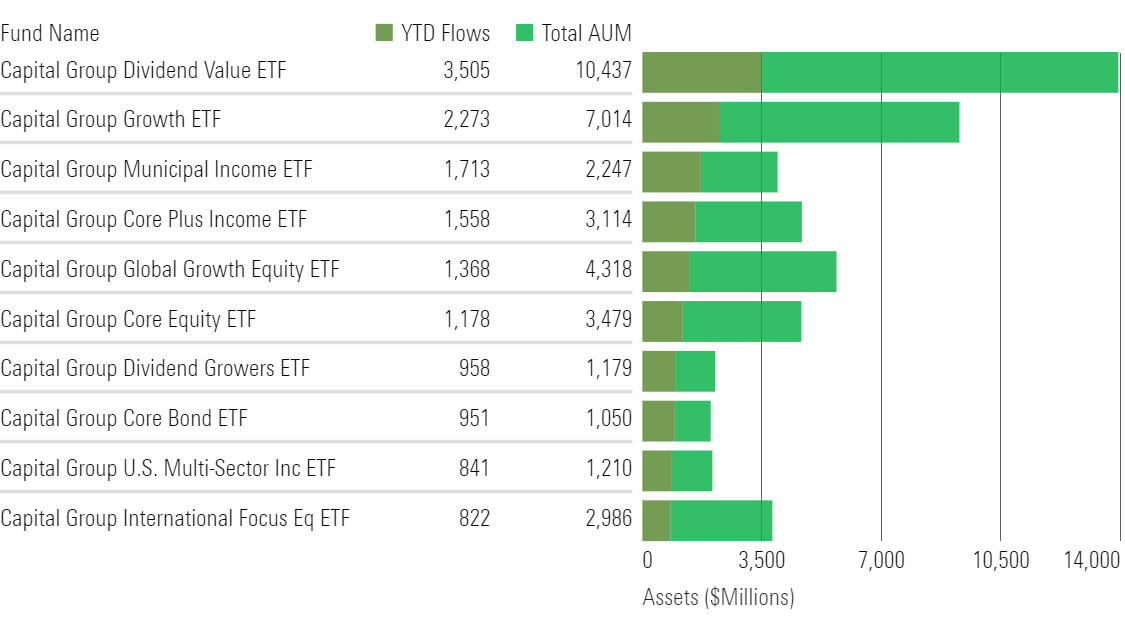

One or two ETFs have not driven Capital’s flows. Eleven funds have each garnered more than $500 million assets this year, with Capital Group Dividend Value ETF CGDV leading the way at $3.5 billion.

Capital Group Active ETF Flows

Capital Group’s immense size—the firm manages more than $2.2 trillion in assets—allows it to pass on lower expenses to investors. That has historically been the case on its American Funds mutual funds, and its ETFs are no exception. Expense ratios range from 18 to 64 basis points, which are very reasonable for active funds. They typically fall among the cheapest share classes relative to comparable mutual funds.

The firm chose to go with Capital Group for its ETF names instead of the more widely known American Funds brand in the US because it hopes to sell the suite globally. The lineup now comprises nine fixed-income, 11 equity, and one allocation strategy. Capital Group’s CEO, Mike Gitlin, wants to give investors options across vehicles, and the firm is well on the way to building out a complete suite of ETFs.

Two ETFs stand out from Capital’s earlier launches. Capital Group Dividend Value ETF, which has a Morningstar Medalist Rating of Silver, has an experienced team that runs the income-oriented portfolio with an eye on quality that is well within the firm’s wheelhouse. Silver-rated Capital Group Growth ETF CGGR is a good option for large-growth exposure that benefits from a veteran management crew, deep research support, and a flexible approach.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c52d2eba-3a3c-478f-b3bd-c3ca80a5100f.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-24-2024/t_c34615412a994d3494385dd68d74e4aa_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c52d2eba-3a3c-478f-b3bd-c3ca80a5100f.jpg)