Are Low-Volatility ETFs Dead?

These funds are down, but they’re not out.

Stock exchange-traded funds that intentionally cut back on risk have struggled over the past few years. Yet some of them continue to earn high marks.

These ETFs intentionally perform quite differently from the market. Their benchmark-relative performance tends to oppose the market’s trajectory, meaning they help cushion the market’s drawdowns but don’t fully tap into its upside. That last point has characterized their performance in a rather extreme way over the past few years, and it shows the risk courted by deviating from the market.

Revisiting Expectations

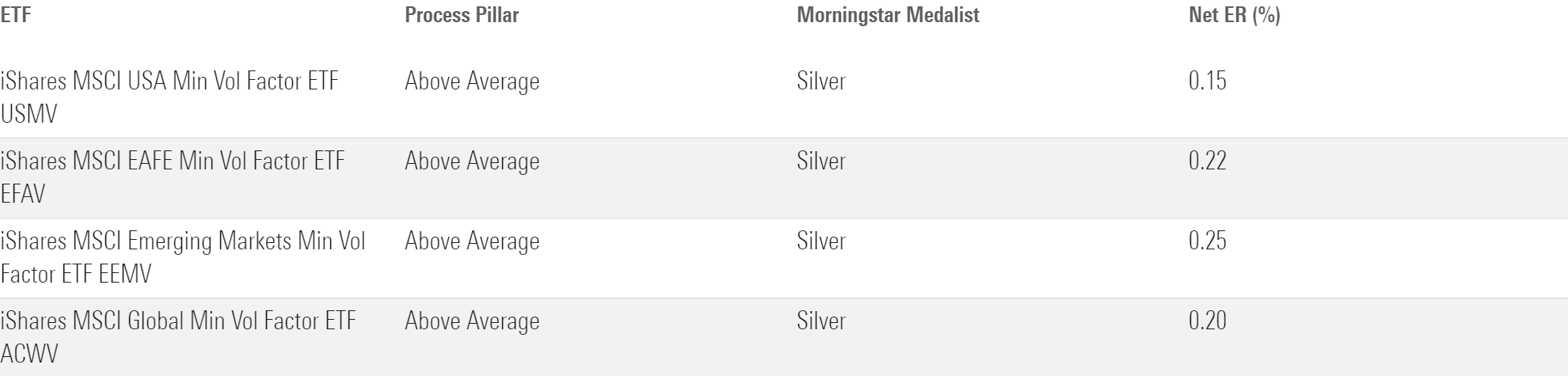

The iShares minimum-volatility factor ETFs listed in Exhibit 1 have typically found themselves among Morningstar’s top-rated low-volatility ETFs. All garner Above Average Process Pillar ratings and charge low fees that underpin their Silver Morningstar Medalist Ratings. Those ratings reflect a high degree of confidence in their forward-looking risk-adjusted returns.

Low-Volatility ETFs Earn High Marks

Risk-adjusted returns, not just total returns, are key to understanding Morningstar’s outlook. Risk-adjusted returns come in many forms, but it’s easiest to think about them as total return per unit of risk. Investment strategies employ a range of approaches to improve that ratio. The ETFs in Exhibit 1 aim to provide a similar total return to the market while substantially cutting back risk.

All three fully invest in stocks from their respective markets, so they should grow over the long term along with their respective economies while incurring less risk. In other words, they’re designed to be less sensitive to the market’s ups and downs. Investors in these ETFs should get some cushion when the market declines, but they’ll likely underperform when it rallies. That’s not a recipe that usually produces market-beating returns, so don’t expect their long-term total returns to do so. A marketlike total return with noticeably less risk is a more reasonable expectation.

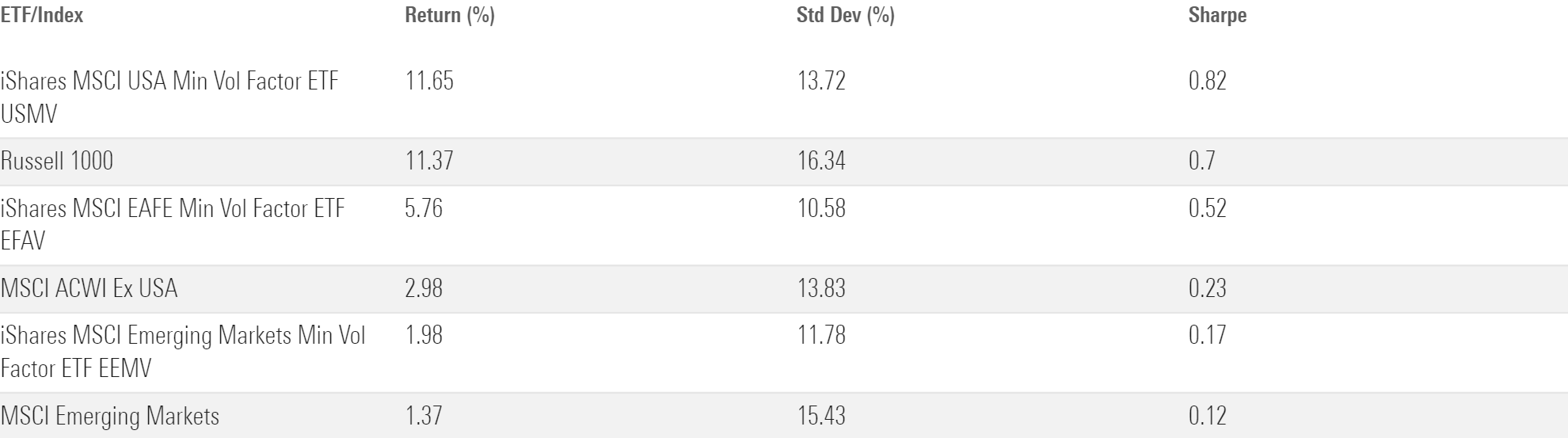

That’s generally accurate as a rule of thumb. Exhibit 2 shows the total return, risk (standard deviation), and risk-adjusted return (Sharpe ratio) for each of the iShares minimum-volatility ETFs and their corresponding Morningstar Category benchmarks. These observations span from their October 2011 inception through the trough of the pandemic-driven drawdown in March 2020.

Off to a Good Start

The US and emerging-markets ETFs lived up to the hype: Marketlike returns with less risk translated into higher risk-adjusted returns than their category index. The total and risk-adjusted returns from iShares MSCI EAFE Minimum Volatility Factor ETF EFAV got a boost because it excludes emerging markets, which performed poorly, while the category index includes them.

How We Got Here

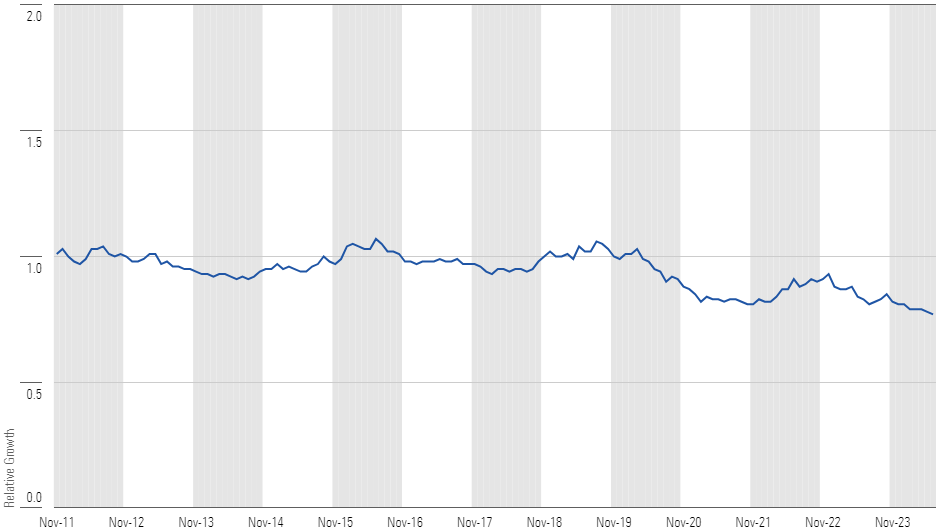

Those eight-plus years represented somewhat boring conditions. Exhibit 3 charts the growth of $1 invested in iShares MSCI USA Minimum Volatility Factor ETF USMV relative to the Russell 1000 Index from its October 2011 inception through the end of June 2024. An upward-sloping line indicates the ETF outperformed the index, while a downward-sloping line means the opposite. A flat line means the ETF’s total return equaled that of the index.

Growth of USMV relative to Russell 1000.

The ETF’s index-relative performance stayed close to the Russell 1000 Index’s between October 2011 and the end of March 2020. Its ups and downs opposed the market’s direction as expected, but the differences were mild. It trailed the index by 2.1 percentage points per year in 2016 and 2017 when the market grew at a steady clip. Then it outperformed by 7.1 percentage points during 2018′s second-half correction.

A basic observation from that period should not be overlooked. The Russell 1000 Index was relatively stable over those eight-plus years by historical standards. Its standard deviation landed at 12.3%, or a little below its long-term historical average of about 15%.

Why is that important? Stability often accompanies broad economic growth that reaches across many segments of the market. Major technology stocks like Apple AAPL and Microsoft MSFT flourished over this period, but they were volatile. Others, including Home Depot HD and Visa V, offered similar—and in some cases better—total returns with considerably less risk. USMV had larger stakes in these stocks, so it cut back on risk while keeping its total return in check with the market.

That fell apart around March 2020 after the coronavirus drawdown hit its nadir. The Russell 1000 Index’s standard deviation clocked in at 18% between April 2020 and June 2024, well above its long-term norm. Low-risk strategies really showed their colors in this volatile environment. The ETF cut back on risk, with a standard deviation of just 14%.

Furthermore, the total return of USMV tended to align with expectations. It fell behind between April 2020 and March 2021 when the Russell 1000 Index stormed back from its low point. It outperformed in 2022 when the market tanked after Russia invaded Ukraine. Then it returned to its downward trend as the market rebounded in 2023 and into 2024.

That pattern makes sense, but the magnitude of those fluctuations was nothing short of astounding. The ETF trailed the market by 30 percentage points between April 2020 and March 2021, and it logged another 25-percentage-point deficit between January 2023 and June 2024. Likewise, EFAV, iShares MSCI Emerging Markets Minimum Volatility Factor ETF EEMV, and iShares MSCI Global Minimum Volatility Factor ETF ACWV also saw their index-relative total returns deteriorate, especially between April 2020 and March 2021.

Down but Not Out

Much of the explanation rests with how the market changed after the pandemic drawdown. In short, it has not been kind to many stocks. Major tech companies such as Apple, Microsoft, and Nvidia NVDA continued to lead the market from April 2020. That’s partially because their products and services helped us live reasonably normal lives during the depths of the pandemic lockdowns. More recently, they have become some of the major benefactors of artificial intelligence technology. The rest of the market has been a performance wasteland. Just about everything other than a handful of large-cap stocks has struggled.

As before, none of these large tech stocks looked particularly attractive to USMV. Most of the market’s winners were considerably more volatile than the Russell 1000 Index over these four-plus years. Exhibit 4 lists the top contributors to the total return of the Russell 1000 Index over this period along with their weightings in the index and the ETF. The ETF had much smaller stakes in the few it held, and seven of the 11 didn’t even make the cut.

USMV's Holdings Explain Its Poor Recent Performance

Has the main thesis behind low-volatility ETFs fallen apart? Hardly. They’ve continued to chart a course that aligns with expectations. Their shortfall boils down to the unusual circumstances of today’s market, circumstances that have befuddled a lot of otherwise reasonable investment strategies.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-24-2024/t_c34615412a994d3494385dd68d74e4aa_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)