What’s Behind Starbucks’ Best Trading Day Ever

How a simple change reversed negative market sentiment.

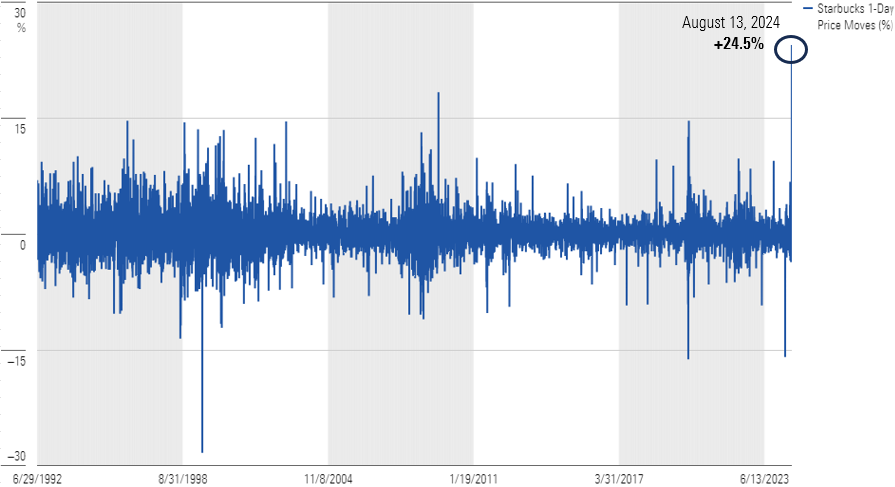

Starbucks SBUX went public in 1992, but it saved its best day as a public company for 32 years later.

The company’s shares were up 25% on Aug. 13, its best one-day percentage move in history.

Starbucks One-Day Price Returns (1992-Present)

The catalyst? A leadership change.

Starbucks appointed the former Chipotle chief as its new CEO, and the stock market responded with a standing ovation. Even after this news, Starbucks shares remain negative for the year—highlighting just how pessimistic the market had become on one of the world’s most iconic brands.

To be clear, a single day’s performance means little over an investing lifetime. However, the lead-up to this management change is one that often attracts true long-term investors.

Starbucks’ business has been under duress: The postcovid demand surge long fizzled, and consistent menu price increases in recent years have led to fewer store visits from its most loyal customers.

Put simply, Starbucks has long been ubiquitous in people’s daily routines, but cracks had been forming in that narrative. This was no secret, and the stock market had been pricing it in. Starbucks shares had recently been trading at one of their most depressed valuations in a decade.

For true long-term investors, great businesses trading at historically low valuations creates a Bat-Signal of sorts. It doesn’t always mean opportunity exists, but it’s certainly an opportunity to do homework. Market sentiment often swings between extremes of optimism and pessimism. While negative sentiment toward Starbucks was warranted to some degree, it likely overshot the reality.

Being valuation-driven contrarian investors means believing that, as assets become cheaper, the bar that needs to be cleared to drive future returns is lowered. Warren Buffett famously said, “I don’t look to jump over 7-foot bars: I look around for 1-foot bars that I can step over.” It could be reasonably argued that Starbucks fits that description; a simple leadership change propelled shares to their best day ever.

Seeking to own great businesses at below-market valuations can sometimes set the stage for unexpected catalysts that reward investors.

The Morningstar Wealth team is ready to discuss how our Select Equity Portfolios might fit into your practice and help address your clients’ goals. Call 800 886-1749 to schedule a meeting or contact your regional sales representative.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

Morningstar Investment Management LLC is a Registered Investment Advisor and subsidiary of Morningstar, Inc. The Morningstar name and logo are registered marks of Morningstar, Inc. Opinions expressed are as of the date indicated; such opinions are subject to change without notice. Morningstar Investment Management and its affiliates shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Before making any investment decision, please consider consulting a financial or tax professional regarding your unique situation.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/A5UY22L42ZASPAW6OW75IQHR2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/SRXFRUTTFZGPPK6U6Y5EG4WGMY.png)