Morningstar Research

Tap into independent investment research with global consistency

Built on a singular framework, the independent, global insights of our research analysts and quantitative models form the gold standard for analysing investment options. Our commitment to transparency and demonstrated performance fuel the strongest outcomes.

Equity Research

Make confident investment decisions powered by our commitment to fundamental research and a consistent methodology across our qualitative and quantitative universes.

Manager Research

Empower investors to make the most suitable choices with analyst-driven insights into funds’ sustainable advantages, along with forward-looking perspective into how they might behave in a variety of market environments, across all asset classes.

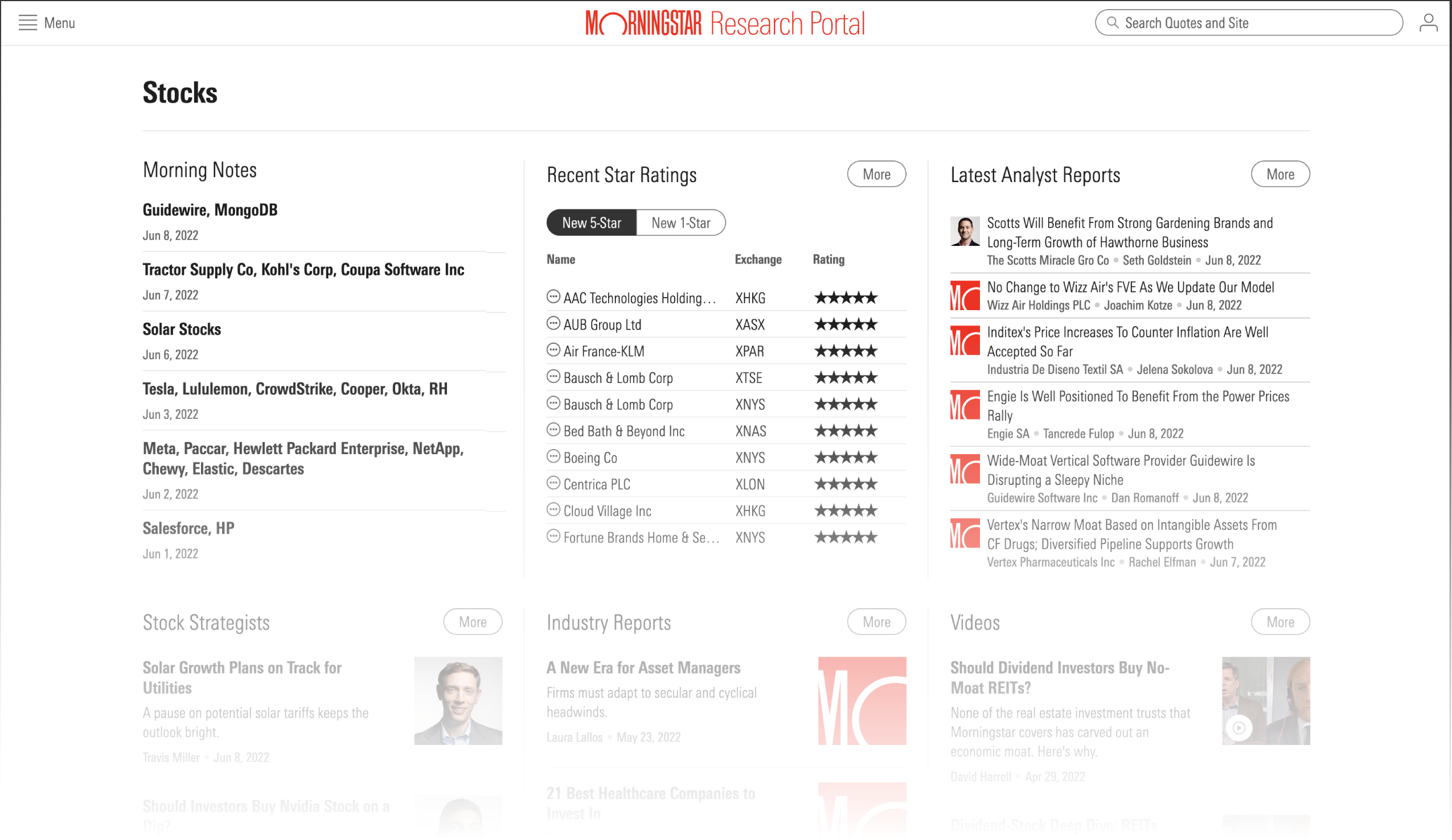

Morningstar Research Portal

Gain actionable insights from Morningstar's independent research to make building a comprehensive investment strategy for your clients easier than ever.

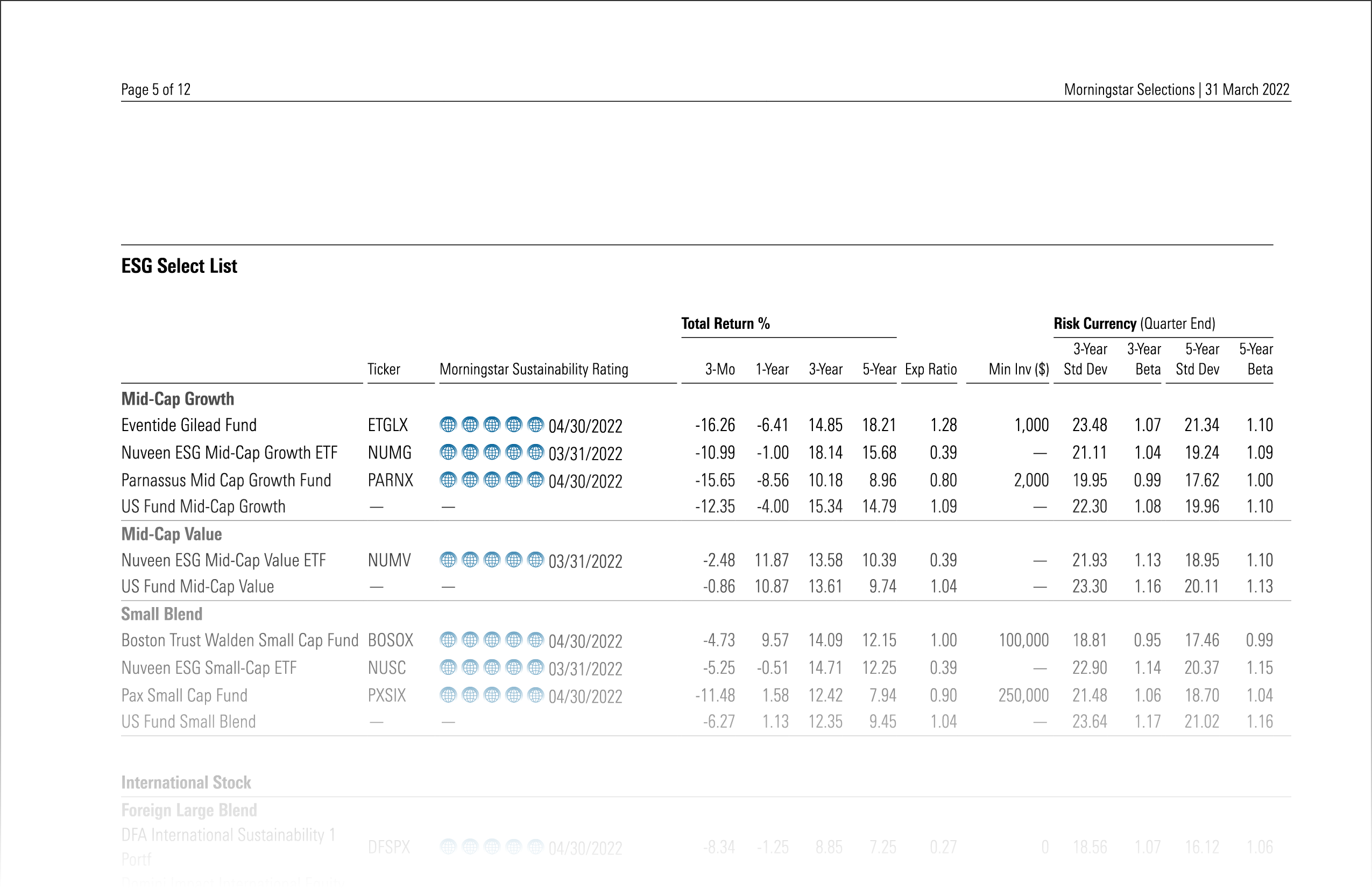

Manager Due Diligence and Selection Services

A list of managers and investments selected by our award-winning global manager selection team to drive better outcomes and help address compliance risk.

Institutional Equity Research

Research on companies, deals, funds, investors, and service providers across the entire public and private investment lifecycle. Powered by PitchBook.

Close the Gap Between Complexity and Communication

Morningstar Rating for Stocks and Funds

Uncover the true value of stocks and find buying and selling opportunities with our forward-looking star rating for stocks. For funds, our star rating illuminates historical performance relative to peers.

Morningstar Analyst Rating

Identify funds and managed investments we expect to outperform their peers on a forward-looking basis. We use a five-tier scale for active and passive managed investments.

Morningstar Economic Moat Rating

Understand how a company's sustainable competitive advantages impact its ability to generate economic profits over the long term. We use a signature methodology focused on evaluating a firm’s Economic Moat.

Morningstar Quantitative Rating for Stocks

Help investors identify a broader set of investment opportunities across geographies, sectors, and styles. We use a forward-looking machine-learning approach that mimics our analyst-driven ratings process.

Morningstar Quantitative Rating for Funds

Expand investors’ breadth of coverage for more comprehensive decision-making. We base this rating on a machine-learning model that leverages past rating decisions to support analogous forward-looking ratings. Morningstar Quantitative Rating Analysis is a new lens to understand the justification behind this rating.

Morningstar Sustainability Rating

Show investors how the companies in their portfolios manage ESG risks relative to their peers. A refined design aims to establish systematic, reliable measures for this growing area of interest.

Harness Consistent Insights for Multiple Uses

EQUITY RESEARCH AT SCALE

Expand your reach to fuel competitive equity recommendations

Empower financial professionals to evaluate a broader set of equities and validate their assumptions against a trusted source for proven research and ratings.

Key financial professional activities:

Provide actionable buy-and-sell signals for investment selection

Identify and communicate equity investment ideas for client portfolios

Efficiently deploy a uniform equity recommendation solution

Improve investor outcomes by delivering recommendations with the greatest impact

Mitigate risks and contribute to regulatory compliance requirements

ESG INSIGHTS

Customise for Sustainable Suitability

Build a custom list of suitable funds and ETFs with a single market standard for assessing ESG risks and opportunities.

Key financial professional activities:

Get educated on sustainability trends and how to position your firm for policy changes

Directly compare funds and managed investments across parent firms and categories

Use company- and fund-level metrics to develop new investments and vet exclusions

Build custom lists of suitable funds to capture upside performance versus peers

Reach a new generation of investors with differentiated products

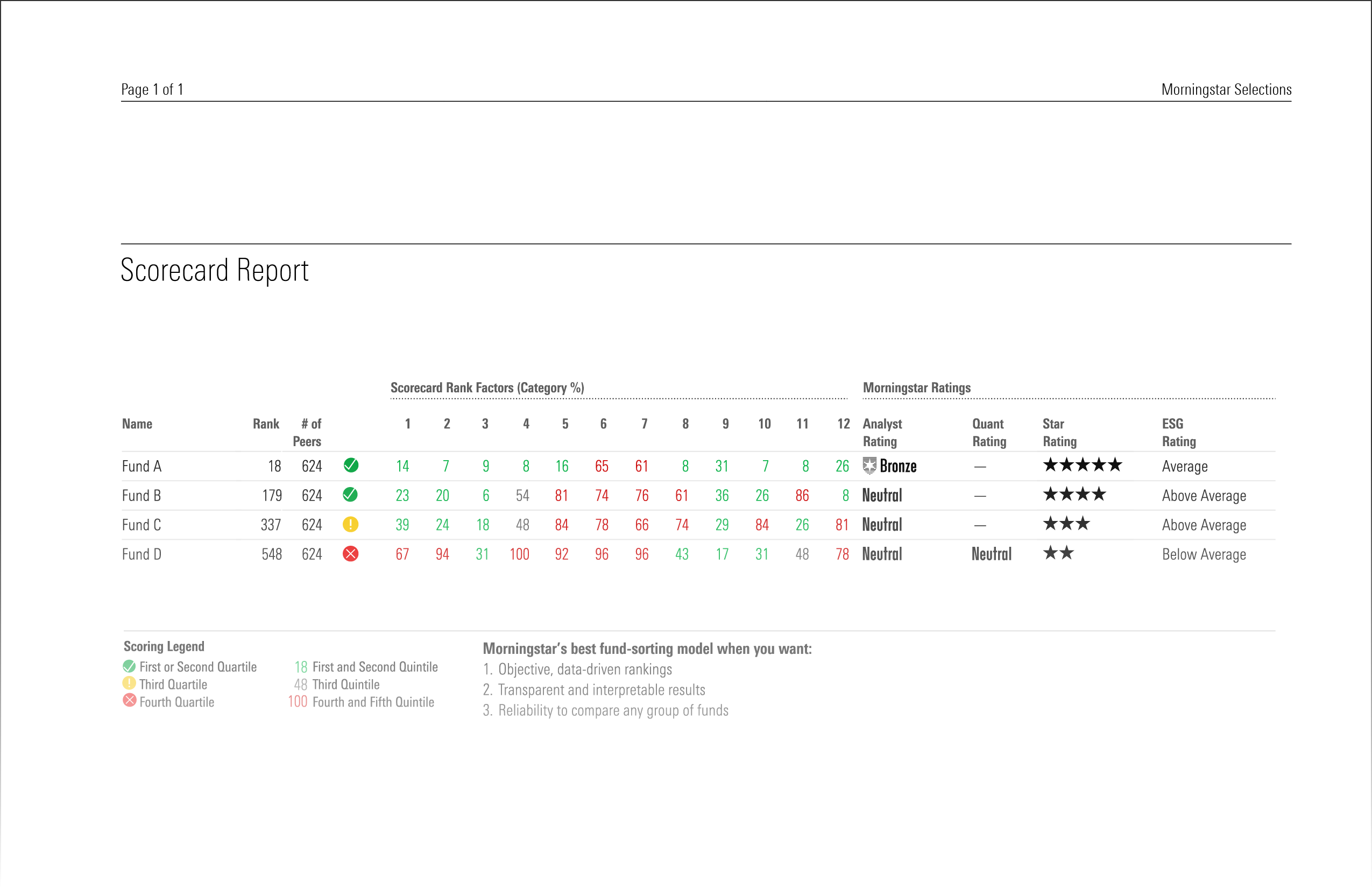

DUE DILIGENCE & SUPPORT

Meet Evolving Regulatory Standards

Establish a curated product shelf and help investors evaluate suitability, separate cost from commission, and surface reasonably available alternatives to ensure best interest decisions.

Key financial professional activities:

Develop investment lineups that serve the best interest of clients

Enhance your firm’s product shelf with our objective research and ratings

Review your product shelf to ensure every fund has a purpose

Guide your fund selection process to determine reasonable recommendations

Empower financial professionals to perform their own analysis using data and insights

Power Actionable Decisions with Consistent Frameworks

Learn more about Morningstar research methodologies.

Economic Moat

Our equity analysts use a long-term approach to valuation, based on a signature methodology that contextualizes and conveys investing insights simply and clearly.

Analyst Rating for Funds

Our manager analysts assign this forward-looking, qualitative rating based on their assessment of a fund's investment merits using a five-tier scale for active and passive managed investments.

Quantitative Rating for Stocks

Our quantitative equity star ratings expand the universe of forward-looking insights to a large universe of more than 50,000 global stocks.

See Our Research in Action

Global Sustainable Fund Flows Report

Sustainable funds represent a substantial and growing portion of the fund universe—in part due to the launches of new funds, and in part due to existing funds adding ESG factors to their prospectuses. This report explores activity in the global sustainable funds universe within the past quarter, detailing regional flows, assets, and launches.

Morningstar's Cryptocurrency Landscape

Cryptocurrencies have become increasingly popular over the past seven years and at $1.7 trillion in total market capitalization, this volatile asset class can no longer hide in the shadows. In our inaugural Cryptocurrency Landscape, we shed light on the risks associated with digital currencies and share what we’ve learned about the future of the space.

Sustainable Funds U.S. Landscape Report

Sustainable investing has gained considerable traction and attention over the last five years. These funds are varied in nature, offering investors exposure across geographies, asset classes, and investment strategies. In our annual Landscape Report, Morningstar’s ESG research team examines the growth, performance, and changing nature of this emerging fund group.