Which Funds Are Contrarian?

A position-by-position approach that compares a portfolio’s holdings with those of category peers.

Which managers are contrarian? In this article, we propose a slightly different extension of the term “contrarian,” gauging it by the degree of how many similar funds hold positions that a given fund holds. In this application, if a manager holds issues that are unpopular among peers, that manager is somewhat contrarian.

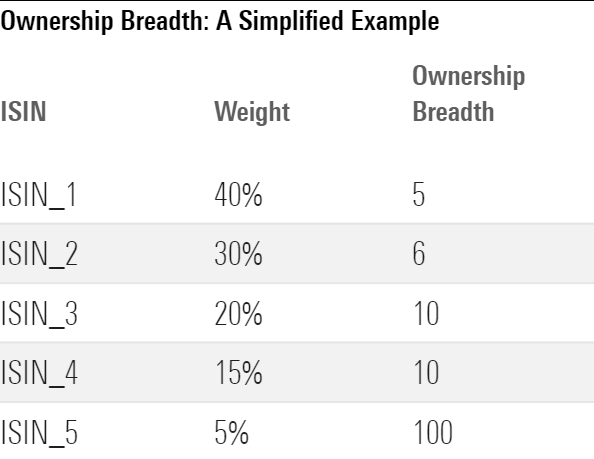

The methodology of this approach is as follows. For a given Morningstar Category, we gather all its funds’ most recent portfolios, provided they are not more than six months old (that’s to avoid too much of a mismatch between different funds’ portfolio dates). We then screen out the issues that don’t have an international securities identification number, a unique 12-character alphanumeric code assigned to financial securities such as stocks, bonds, and derivatives; the ISIN serves as a standardized global identifier for these financial instruments. If the ISIN part of the portfolio accounts for 80% or more of its assets, we include that portfolio in our analysis and rescale all the weights by the total weight of the ISIN part. Given that filter, we count how many funds hold each ISIN in our group; we call it “ownership breadth.” Finally, for each fund, we calculate the average of all its ISINs’ ownership breadth, weighed by the rescaled weights described above. To use a simplified example, let’s imagine a fund with five ISINs whose weights and ownership are noted in the table.

Ownership Breadth: A Simplified Example

Note that ISIN 5 is owned by 100 other funds, but the fund has only 5% of its weight in that ISIN. The metric we are calculating is the sumproduct (for those familiar with Excel) of the Weight and Ownership Breadth columns. In this case, the result would be 12.3, the indication of the asset-weighted ownership breadth of the positions the fund holds.

Let’s start with better-known funds with low ownership breadth averages. DoubleLine Total Return Bond DBLTX showed an average of around 5. This means that, asset-weighted, this fund held bonds that were held by five other funds in the intermediate core-plus bond category. Now, this number doesn’t mean much until it is compared with the highest ownership-breadth-average portfolios. These include such well-known funds as Fidelity Total Bond FTBFX and TCW MetWest Total Return Bond MWTRX, which clocked in at 17 and 20, respectively. These are outliers. The ownership breadth metric was closer to the midteens for many funds on the MorningstarFundInvestor 500 list, such as American Funds Strategic Bond ANBEX at 13, Baird Core Plus Bond BCOSX at 11, and Dodge & Cox Income DODIX at 11.

It is thus clear that there is a meaningful differentiation among funds in this category. DoubleLine Total Return Bond, which shares its holdings with five other category funds on average, is much more contrarian, in the sense of not holding what others do, than Fidelity Total Bond, which shares its holdings with 17 other category funds. This shows up in their performance profiles. Between DoubleLine Total Return Bond’s inception on May 1, 2010, and June 30, 2024, its R-squared against the Bloomberg US Universal Index, the category benchmark, was 0.83. In contrast, Fidelity Total Return Bond’s R-squared came in at 0.95, which means it performed more in line with the index.

While we do not claim this is a perfect metric, it still underscores that some funds are more consensus-driven than others, and investors might benefit from knowing whether they are buying a consensus or contrarian fund to fill the core fixed-income slot in their portfolio.

This article first appeared in the August 2024 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting this website.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/fadee740-dfeb-494d-95b1-c462d0ac1f59.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/44L3CW3LNVDWRJVLPDI4GZKEIM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fadee740-dfeb-494d-95b1-c462d0ac1f59.jpg)