Markets Brief: Is the Bond Market a Buy Yet?

The Fed may be about to raise rates again, but some say yields are starting to look attractive.

While the Federal Reserve Board is on track to raise the federal-funds rate yet again next week, an unlikely investment could start providing some shelter from the storm: long-term U.S. Treasuries.

This might be the last place anyone would dream of seeking refuge after the carnage that has occurred this year in fixed-income portfolios, and at a time when sentiment has soured so significantly on bonds thanks to inflation holding in at four-decade highs and the Fed’s aggressive rate hikes. Prices on long-term government bonds are particular sensitive to changes in interest rates.

But the Fed’s push to raise interest rates, which is expected to see the central bank boost the federal-funds rate by three-quarters of a percent this coming week, is also leading to signs of an economic slowdown and raising worries about the potential for a recession. In the upside down world of the bond market, that’s potentially good news.

“With the Fed sticking to its hawkish guns amid an economy that’s already slowing—housing and manufacturing data are slowing, jobless claims are rising and consumer sentiment is near all-time lows—a rocky landing-recession scenario is building,” says Steve Chiavarone, senior portfolio manager and equity strategist at Federated Hermes, a Pittsburgh-based money-management company with $631 billion in assets under management.

“One area that could benefit is longer-term Treasuries, where yields may have peaked on increasing recession odds,” Chiavarone says.

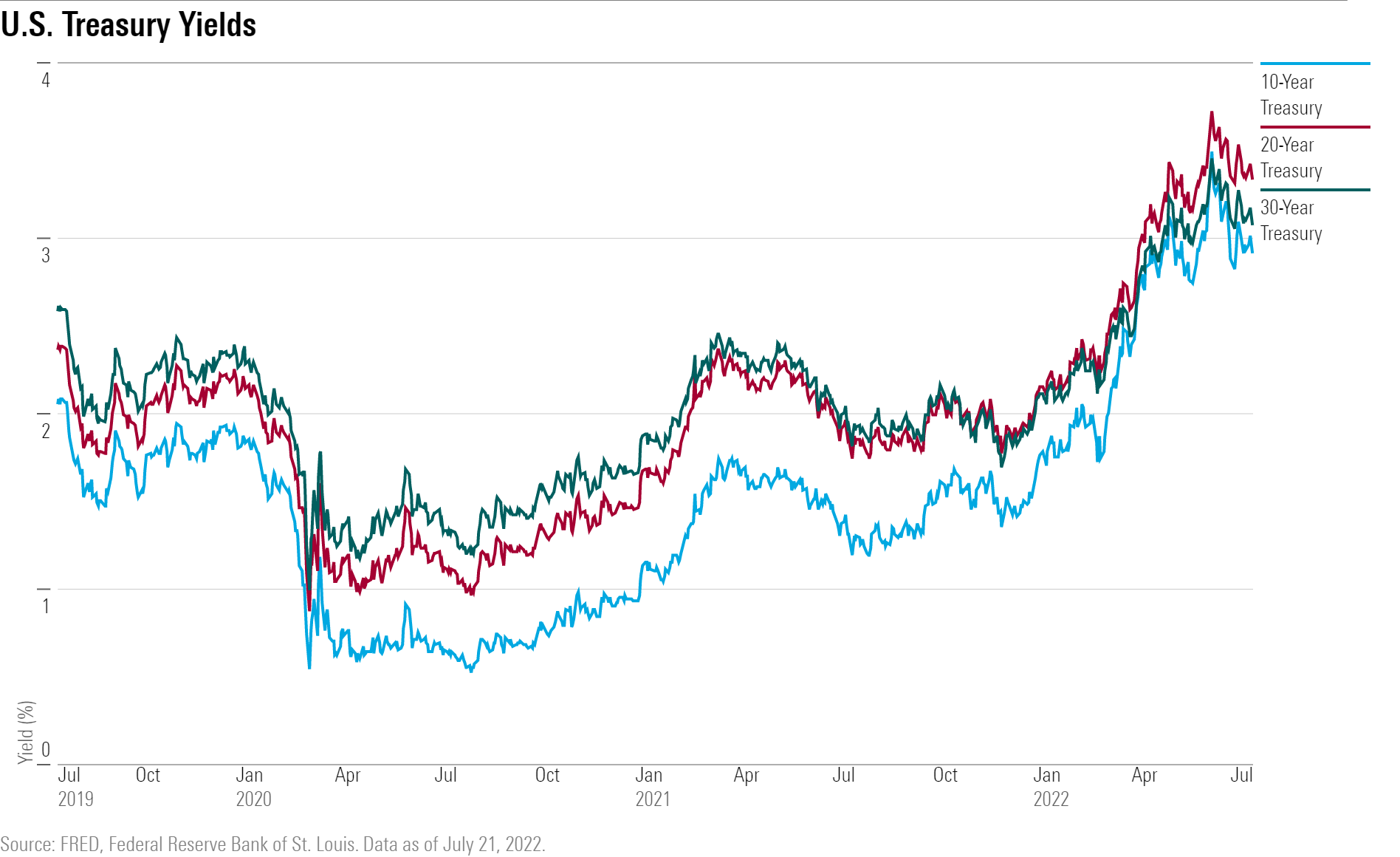

Morningstar’s U.S. Treasury Bond Index is down 20.11% this year on a price basis as its yield has risen to 2.77% from the lowest point ever in August 2020, according to Morningstar manager research strategist Eric Jacobson.

Two weeks ago, the yield on the 10-year stood at 3.09%. At the start of this year it was at 1.63%. Bond prices move inversely to yields. Treasury yields have declined recently as concerns about an economic slowdown have risen.

“If fed-funds probabilities tell us what the market thinks the Fed will do, yields for Treasury notes with several years to maturity give a sense of how successful the market expects those efforts to be,'' explains Jacobson. “Put another way, the lower those yields, the more confident the market is that the Fed’s rate hikes will work in taming inflation.”

Are Bonds a Buy Right Now?

“It is becoming increasingly clear that the only path for the Federal Reserve is to tame inflation by bringing down demand,” says Michael Contopoulos, director of fixed income at Richard Bernstein Advisors, an independent investment research firm in New York City. “And growth, not inflation, is the biggest driver of longer-dated bond yields. The 10-year Treasury yield can reach a cyclical peak even with very elevated levels of inflation.”

U.S Treasury Yields

Contopoulos adds, “Although we doubt the 10-year yields have reached their apex for this cycle, we are probably closer today than at any time over the last two years.”

For investors traumatized by this year's returns and are afraid of potential losses, know that the yield on the 10-year would have to increase to 4.3% in the next two years before you would realize a mark-to-market loss on the investment, he says.

“Although this is possible, if we enter a recession between now and then, and yields fall to 1.5%, the returns stand to be between 17% and 23%,” Contopoulos says. The risk reward profile has shifted, he notes, “creating an opportunity for us that we have not seen in some time.”

Historically, bonds have typically proved to be a good diversifier in portfolios and provided a cushion to stock market volatility. Not this year. For the second time in four decades, bonds and stocks posted losses for two straight quarters and the so-called 60/40 balanced portfolio structure, of 60% equities and 40% bonds failed miserably.

But Ricky Williamson, portfolio manager and head of U.S. outcome-based strategies for Morningstar Investment Management, thinks that dynamic could be changing back to the old relationships where bonds do a better job of protecting portfolios.

“The 10-year-yield is almost twice as high as it was to start the year,” says Williamson. The rise in yields on the longer-term Treasuries have “reignited the potential for the diversification benefits of high-quality bonds in a traditional recession if we begin to see inflation get under control. We have begun to see value in owning more Treasury duration to offset equity risks if the economy disappoints.”

(For a different take on long bonds, see Morningstar columnist’s John Rekenthaler’s July 18 piece “Are Long Bonds Still for Fools?”)

The Federal Reserve Board is widely expected to stay aggressive in raising the benchmark fed-funds rate when it meets next week, as it moves to rein in inflation running at the hottest pace in 40 years.

The magnitude and duration of the hikes will determine whether the Fed can successfully achieve the so-called soft landing it seeks, slowing down the economy without tipping it into recession. Or not.

Will it Be 0.75% or 1.00%?

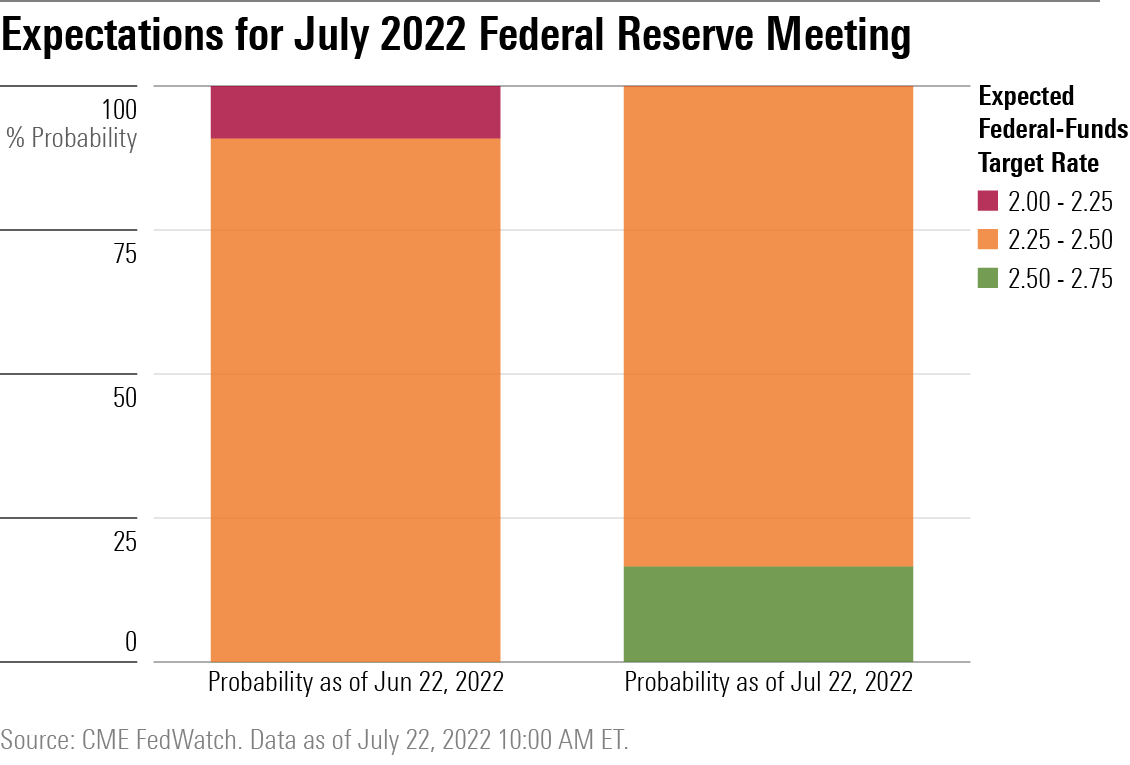

Market consensus sees a three-quarter percentage point hike, though there is a 30% chance the Fed goes bigger with a full-percentage increase, according to the CME Group's FedWatch Tool, which provides the latest probabilities of Fed interest-rate moves.

Expectations for July 2022 Federal Reserve Meeting

The possible outcomes are keeping investors on their toes as they determine how to best manage the risks in their portfolios associated with the fastest pace of interest-rate tightening since the Paul Volker-era at the Fed in 1979 through the early 1980s, and position themselves at this stage of the cycle.

Fed Chair Jerome Powell has said a move of between 0.50% and 0.75% is on the table next week but the higher-than-expected 9.1% reading on June’s Consumer Price Index introduced the notion that a full-percentage point might be considered.

“We believe recent economic data on balance support a 0.75% rate hike, though a 1.00% rate increase might be considered,” says Kathy Bostjancic, chief U.S. economist at Oxford Economics, an independent global advisory firm. “With inflation poised to remain around 9% year over year through September, we anticipate another 0.75% rate increase in September, before the Fed starts to downshift to 0.25% rate increases through early 2023, which would lift the fed-funds target range to 3.75% to 4%.”

It's understandable that investors would be skittish about dipping their toes back into longer-term Treasuries given this year’s hellish performance. Yet, investors were happy to own Treasuries when they were grossly overpriced the past few years. Now that the asset class is beginning to look more reasonably priced, it could be a mistake to ignore them.

Events Scheduled for the Coming Week Include:

- Tuesday: Microsoft MSFT, Google GOOGL, Visa V, Coca-Cola KO, General Motors GM report earnings. Federal Reserve Open Market Committee to begin two-day meeting.

- Wednesday: Meta Platforms META and Ford F report earnings.

- Thursday: Apple AAPL, Amazon AMZN, Mastercard MA, Sirius XM SIRI, PG&E PCG, Pfizer PFE, Tilray Brands TLRY report earnings. Gross Domestic Product update for the second quarter from the Bureau of Economic Analysis.

- Friday: Exon Mobil XOM, Procter & Gamble PG, and AbbVie ABBV report earnings. Personal Consumption Expenditures Price Index update for June.

For the Trading Week Ending July 22:

- The Morningstar US Market Index rose 2.76%.

- The best-performing sectors were consumer cyclical, up 6.66%, and basic materials, up 4.34%.

- The worst-performing sector was utilities, down 0.36%, and healthcare, down 0.19%

- Yields on the U.S. 10-year Treasury fell to 2.79% from 2.93%.

- West Texas Intermediate crude-oil prices fell $2.95 to $94.64 per barrel.

- Of the 859 U.S.-listed companies covered by Morningstar, 696, or 81%, were up, and 163, or 19%, declined.

What Stocks Are Up?

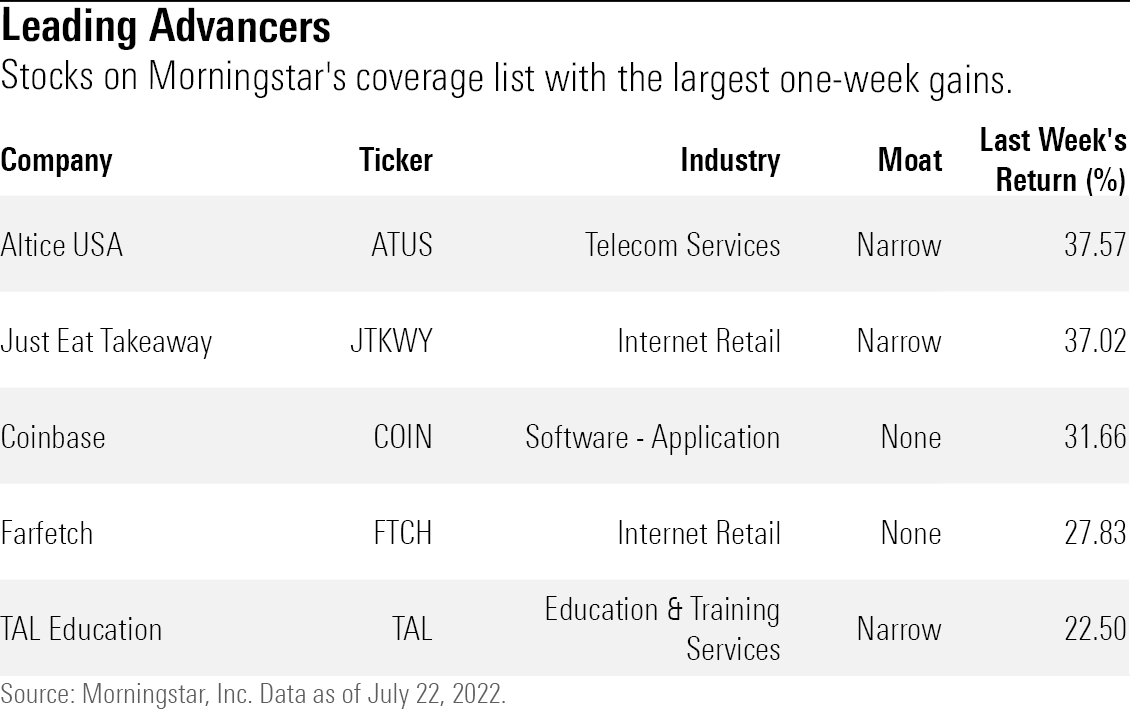

The best-performing companies this past week were Altice USA ATUS, Just Eat Takeaway JTKWY, Coinbase COIN, and Farfetch FTCH.

Leading Advancers

Cable provider Altice's stock popped following news the firm was considering a sale of one of its subsidiaries, Suddenlink Communications, for as much as $20 billion, Bloomberg reports.

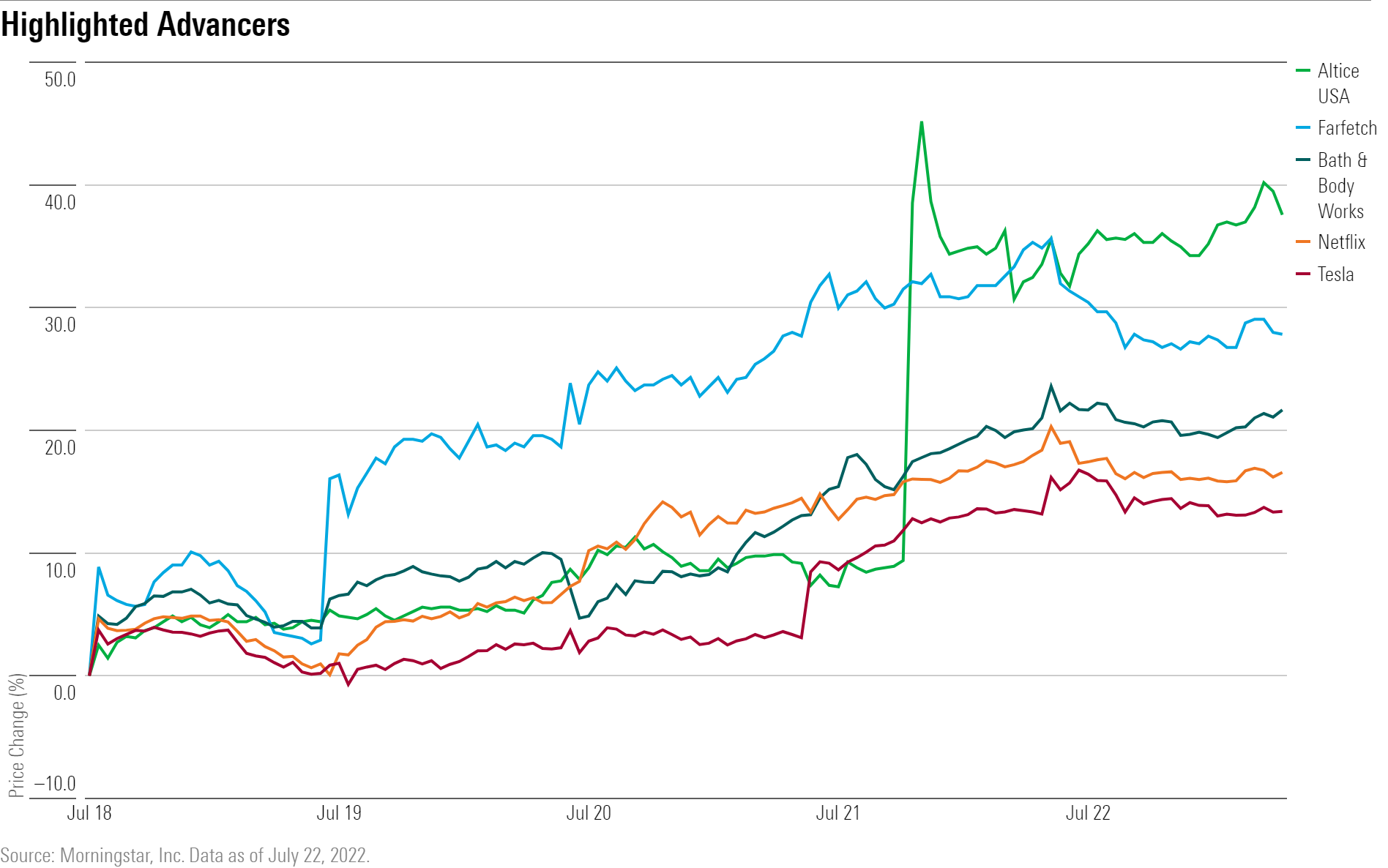

Netflix NFLX and Tesla's TSLA stock rose on better-than-expected earnings. Netflix saw a net decrease of roughly 900,000 subscribers, less than half the 2 million it anticipated. While Tesla's gross profits declined in the second quarter, it was still up 45% year over year.

Shares of retailers rebounded from losses seen in recent weeks, with Farfetch, Nordstrom JWN, and Bath & Body Works BBWI among the best performers.

Highlighted Advancers

What Stocks Are Down?

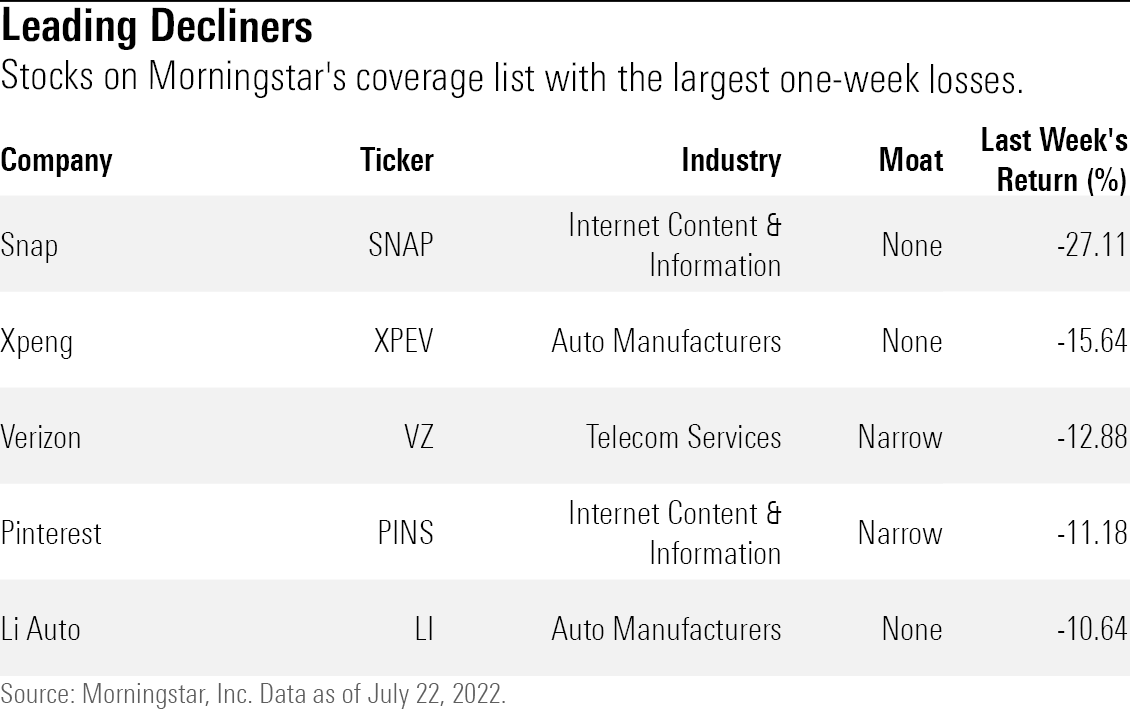

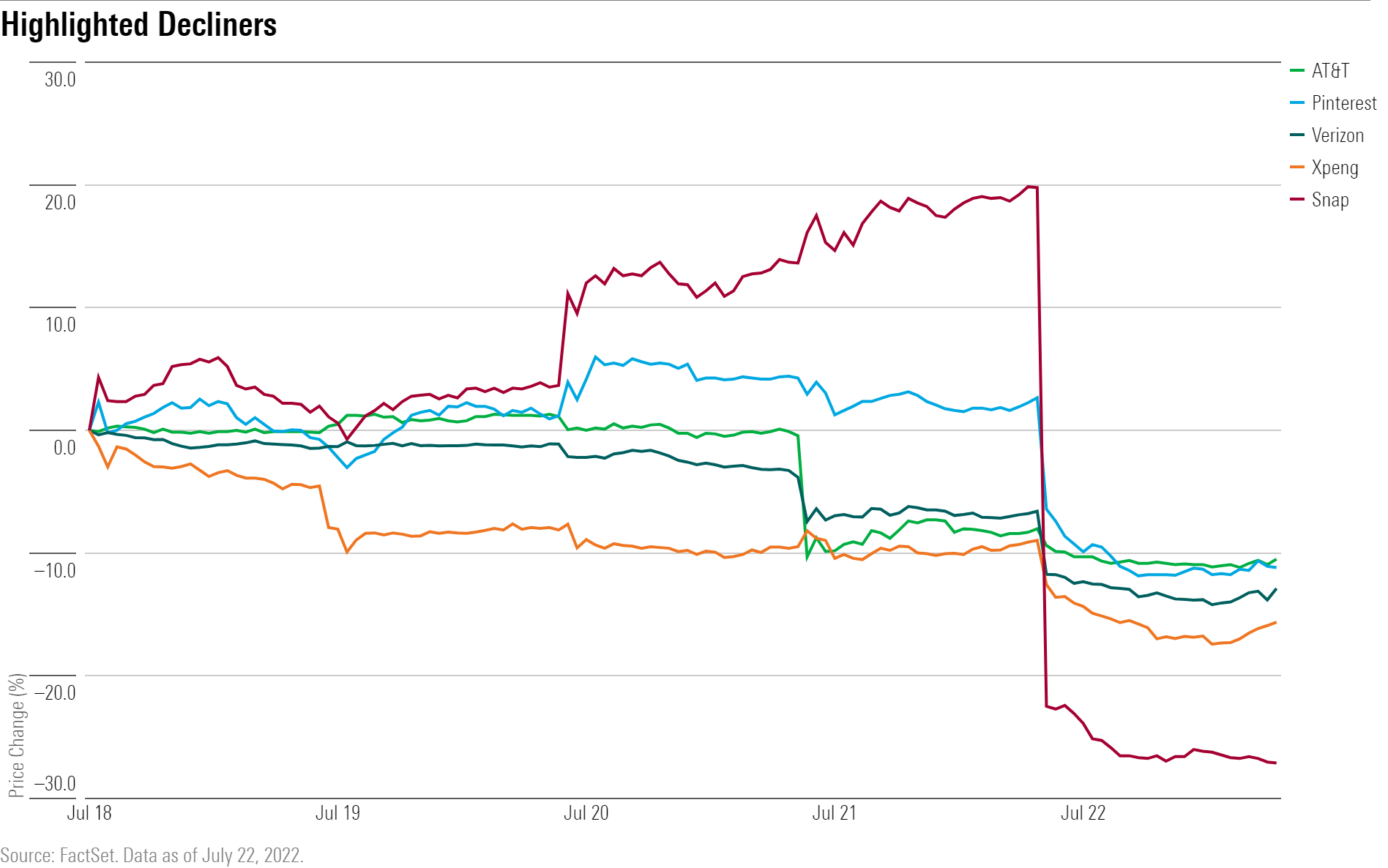

The worst-performing companies in the past week were Snap SNAP, Xpeng XPEV, Verizon VZ, Pinterest PINS, and Li Auto LI.

Leading Decliners

Social media company Snap’s stock tumbled on weak results for the second quarter. Revenue totaled $1.11 billion versus an estimate of $1.14 billion, and earnings per share came in at a loss of $0.26 loss per share, versus an estimated loss per share of $0.21. Uncertainty about demand from advertisers due to Apple’s recent privacy changes continues to plague the company. Pinterest PINS also fell.

Wireless service providers AT&T T and Verizon closed the week lower. Shares of AT&T fell as the company cut its free cash flow target for 2022 to $14 billion from $16 billion. Verizon's stock slid after missing earnings expectations and cutting its forecasts for wireless service revenue growth for 2022 to 8.5% to 9.5%, from 9% to 10%.

Highlighted Decliners

/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PNCGQ5M56VGC5PJRBI7FPQIR7E.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/44L3CW3LNVDWRJVLPDI4GZKEIM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)