SEC's Plan to Loosen Crowdfunding Restrictions Is a Bad Idea

Investors should beware of the risks.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

The SEC has recently proposed loosening the restrictions to allow ordinary people greater access to crowdfunding opportunities, as part of a broader package aimed at expanding access to private investment opportunities. While the recent proposal contains some provisions we support, it is way too permissive regarding crowdfunding. Additionally, a pandemic is no time to be experimenting with loosening investor protections. Crowdfunding is a particularly high risk investment. In this moment, when emotions are high, economic uncertainty is significant, and the public markets are volatile, expanding crowdfunding could lead to panicked ordinary people putting too much of their hard-earned savings in questionable crowdfunding schemes, particularly if local businesses tug on their heartstrings with their appeals.

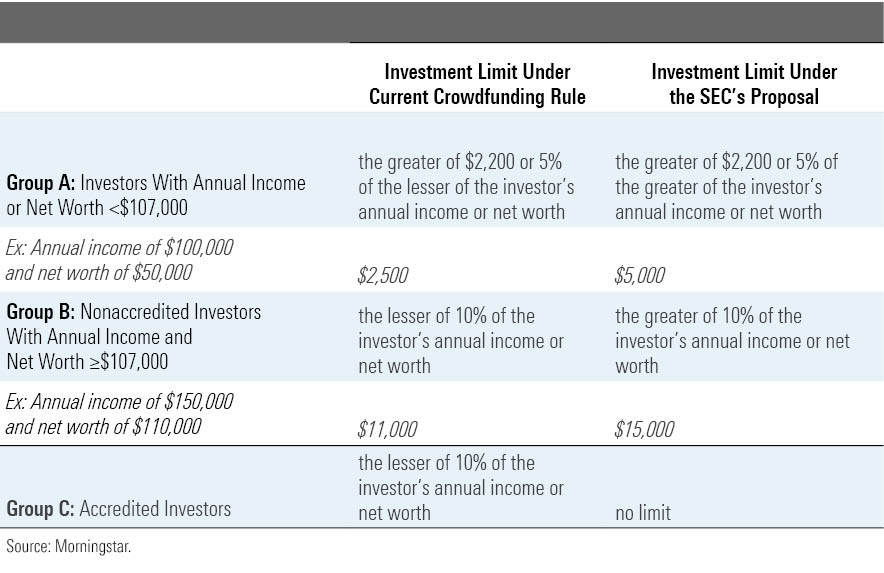

The Proposed Rule Would Make It Easy to Invest a Significant Part of One's Net Worth Into One Company The table below shows how the SEC's proposal would impact different groups of investors.

As the table shows, an individual in Group A would be able to invest twice as much under the SEC’s proposal than under current regulations. An individual in Group B would be able to invest over 33% more under the SEC’s proposal than under current regulations. We note that net worth for most individuals likely represents the value of a 401(k) balance minus nonmortgage debt, such as credit card debt. We could be supportive of loosening restrictions if net worth accounted for whether the individual had reasonable retirement security. Net worth only excludes the primary residence, which does not account for the financial well-being of renters and falsely assumes that a house is more necessary than a diversified retirement portfolio in determining an individual’s ability to take on investment risk.

We think the SEC should not loosen restrictions on Group A individuals at all. We think that any loosening on Group B individuals should be accompanied by some additional standards--for example, excluding retirement savings or demonstrating some knowledge of investing, akin to what the SEC is considering in its efforts to change the definition of accredited investors. We are not concerned with the lack of a limit on Group C individuals under the current definition of accredited investor because these investors have access to such opportunities through various means today.

Crowdfunding Opportunities Are Fraught With Risk Crowdfunding is a risky investment for several reasons. First, no source of investment advice exists for individuals investing in crowdfunded companies. Individuals are unlikely to obtain the type of investment advice on a particular crowdfunding opportunity that they might get from a broker or investment advisor on a public stock, fund, or annuity, making it harder to detect scams or determine how much of one's portfolio to invest.

Second, investments in more companies tend to generate higher investment returns. On average, median returns per year increase 9.0 basis points and mean returns per year increase 6.9 basis points for each additional company to which a limited partner is exposed. Nonaccredited investors do not have the means to diversify across companies.

Third, the current pandemic environment is not the right time to loosen restrictions on crowdfunding, which has shown a potential uptick.

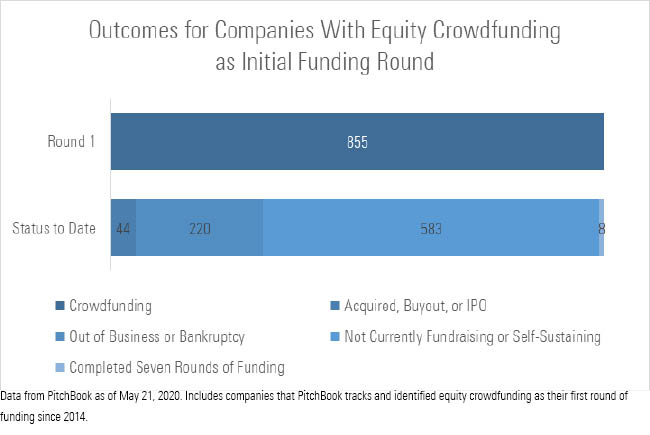

As illustrated in the preceding chart, while the number of filings submitted in the first half of 2019 dipped below 2018 numbers, fourth-quarter 2019 and first-quarter 2020 saw record numbers of crowdfunding opportunities come to market, with over 220 Form C filings submitted in each quarter. Even in normal times, crowdfunding is very risky. About half of new businesses do not make it to their fourth year. Of the 855 companies PitchBook tracks that had an initial round consisting of equity crowdfunding, 220 companies, or just over 25%, went out of business or filed for bankruptcy. Outcomes can be seen in the bar graph below.

Anecdotally, during the pandemic, individuals are more likely to be approached to invest in companies based on their desire to support them through hard times and in the hope that the companies can survive, even when pivoting or restructuring may be necessary. While such a motivation is charitable, it does not provide any standard for how an investment should be part of a diversified portfolio intended for retirement or other long-term needs. Investor protections are more vital in this environment than in normal times, and investors should beware of any loosening of restrictions.

In sum, the SEC’s proposal is a bad idea whose time most certainly has not come.

/s3.amazonaws.com/arc-authors/morningstar/c6d5b386-6df4-434b-bf56-ac0c9546e5aa.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/W33JXIXP5RG7LMJEHRPL74K7AQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c6d5b386-6df4-434b-bf56-ac0c9546e5aa.jpg)