Communication Services: Surge In Digital Advertising Impressive, but Expect Moderation In 2024

Our favored stocks here include Verizon, Disney, and Comcast.

We estimate that digital advertising revenue increased roughly 15% year over year during the third quarter, with growth accelerating impressively throughout 2023 following a modest revenue decline in late 2022. Nearly every platform has benefited, but Meta Platforms META and Amazon.com AMZN stand out as clear winners. Amazon’s ad revenue is approaching $50 billion annually, making it the clear number three in the online ad world. We believe the market now fully appreciates the strength of these businesses, as Alphabet GOOGL trades at only a modest discount to our fair value estimate and Meta trades at a slight premium.

Our top picks among communication services stocks are:

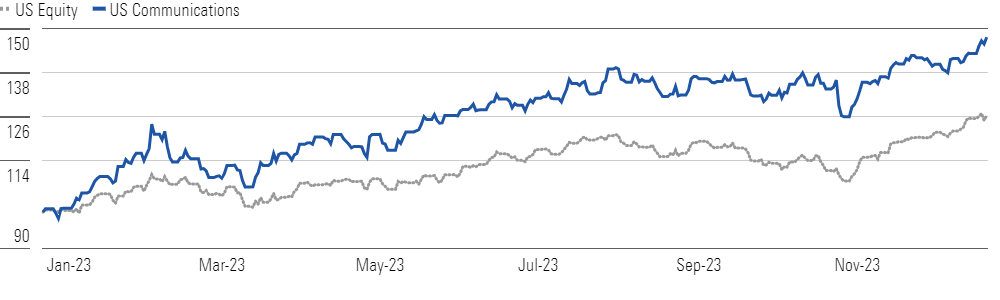

Alphabet and Meta Have Powered Communication Services Gains

We wouldn’t be surprised to see a slowdown in digital ad spending growth in 2024. The industry will start to lap recent improvements in measurement capabilities which have helped offset the impact of changes to Apple’s AAPL privacy policies implemented in 2021. Improved sales on new features like Meta’s Reels may also provide less of a benefit going forward. In addition, Morningstar expects slower economic growth in 2024, and advertisers may simply take a breather after a period of very strong demand, at least partially offsetting political spending.

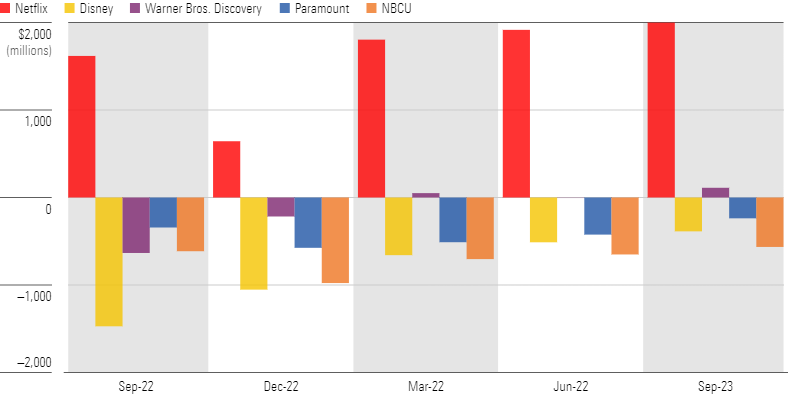

Traditional television advertising and subscription revenue remain in a tailspin as audiences cut the cord on cable television. However, most media companies have increased prices for their streaming services, somewhat lifting the relative cost of streaming content versus cable. The major media firms have also sharply curtailed content spending recently, improving profitability overall. While the actor and writer strikes caused some of this decline, we believe the industry is taking a more measured approach to the content investments surrounding their streaming offerings.

Monthly Broadband Revenue per Customer: Competition Remains Rational

In the U.S. telecom services market, AT&T T and Verizon have lapped the price increases they implemented in mid-2022, slowing reported growth. T-Mobile TMUS has outperformed primarily because of its aggressive push into the fixed-wireless home broadband market. We continue to see stability and rationality within the wireless market, which bodes well for cash flow across each of the Big Three U.S. carriers in 2024, which we expect will lead to improved stock performance.

Top Communication Services Sector Picks

Verizon

- Fair Value Estimate: $54.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Medium

Verizon remains the cheapest of the three major U.S. wireless carriers relative to our fair value estimate. Investors have soured on the company and its peers as Comcast and Charter Communications CHTR have taken market share. Verizon has struggled to improve wireless customer growth over the past year. We believe the firm will likely continue to gradually lose wireless market share, which we’ve factored into our fair value estimate. Pricing gains and a modest contribution from new services like edge computing should enable the company to slowly increase revenue. Continued cost-reduction efforts should allow margins to hold roughly steady over time as well.

Walt Disney

- Fair Value Estimate: $115.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

We recently lowered our fair value estimate for Disney, but we still believe the company’s deep content library, teeming with major franchises and strong studios, provides it with the necessary resources to be successful over the long term. We believe the firm will remain aggressive in its streaming ambitions, but we expect it will also look to shore up its legacy television business. This effort will likely blur the lines between these business models, as Disney+ and Hulu are included in the packages offered by traditional distributors like Comcast and Charter. We also expect fans will continue to flock to the company’s parks and resorts, providing a source of revenue while helping build and reinforce major content franchises.

Comcast

- Fair Value Estimate: $60.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Medium

We expect very modest broadband customer growth in the coming years, with fiber and wireless networks gaining share, but we also believe price competition will remain rational, allowing broadband prices to rise. Comcast will need to increase network spending in the coming years to keep pace with the capabilities of phone companies’ fiber networks. The net result is that we expect cable cash flow to grow modestly over the coming years. The NBCUniversal business isn’t as strong, in our view, but it remains an important media asset. The firm’s theme parks also remain a strong and growing contributor.

Top Communications Services Sector Picks Performance

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4JOND5R2SBFPZE63XWPYQDG56A.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BG4IFJHA25B6RKD3XNUYKROBBM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)