After Earnings, Is Roblox Stock a Buy, a Sell, or Fairly Valued?

With solid monetization and good progress on profitability, here’s what we think of Roblox stock.

Roblox RBLX released its third-quarter earnings report on Nov. 8. Here’s Morningstar’s take on Roblox’s earnings and stock.

Key Morningstar Metrics for Roblox

- Fair Value Estimate: $60.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Very High

What We Thought of Roblox’s Q3 Earnings

We think Roblox is making good progress on profitability after a period of heavy investment and likely bloated spending resulting from the surge in demand during the COVID-19 pandemic. Infrastructure, trust, and safety costs have leveled off after a period of rapid growth, and capital spending is moving lower. Management signaled that these two line items, which have been a major focus of investment, will remain in check for the foreseeable future. Specifically, the firm guided to lower capital spending in 2024 and 2025 versus 2023, which is poised to be lower than 2022. Free cash flow should expand nicely from here.

In addition, usage metrics and monetization on the Roblox platform were solid during the quarter. Europe looked especially strong, with 37% bookings growth year over year. Even with that growth, Europe trails the United States and Canada by a wide margin in terms of monetization—about $8 of quarterly bookings per active user versus $33. With more active users and relatively higher incomes in Europe than in the U.S. and Canada, this gap should continue to close as the European user base matures. We think seeing some sign of that happening in the quarter is also a positive.

Roblox Stock Price

Fair Value Estimate for Roblox

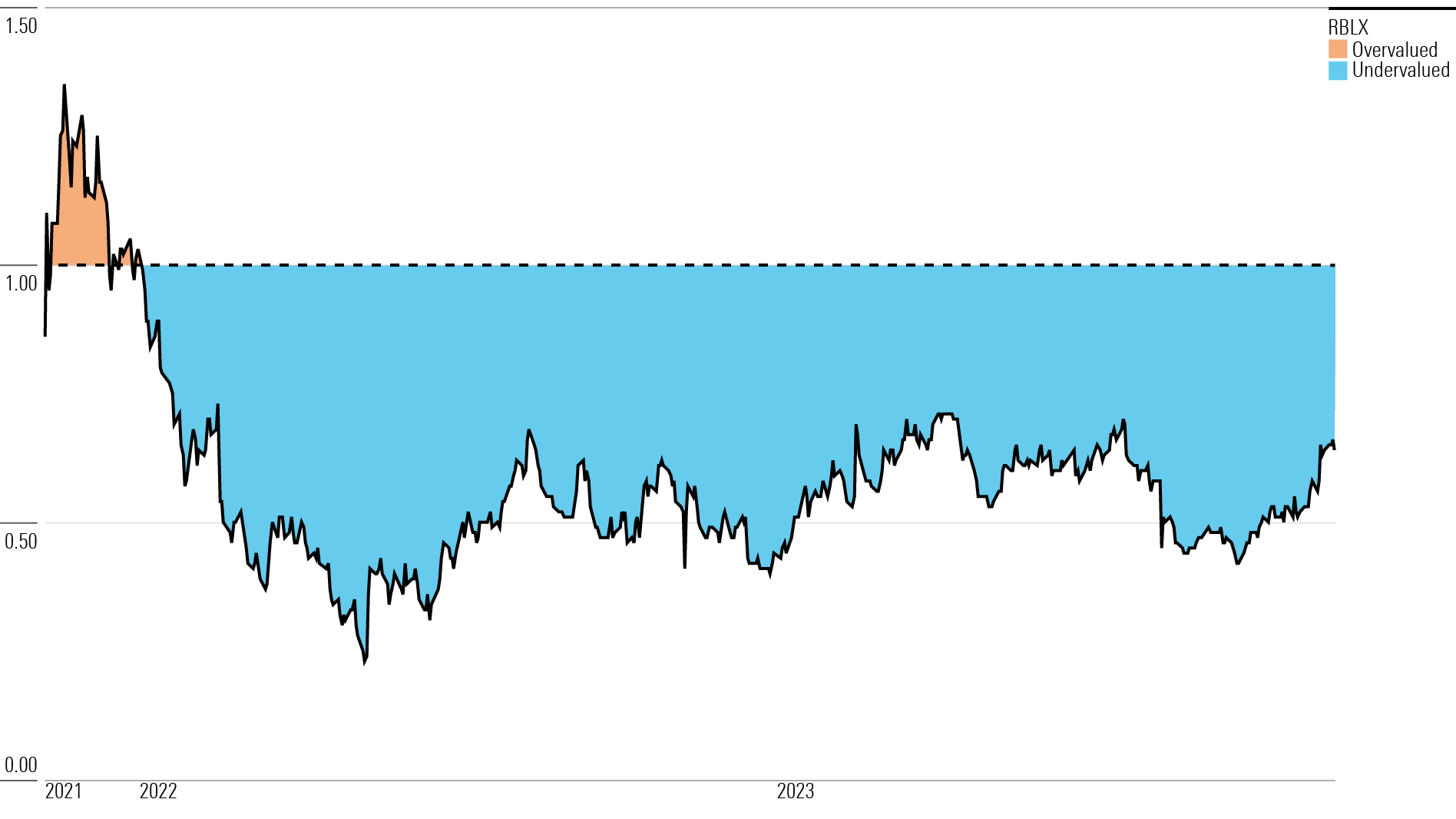

With its 4-star rating, we believe Roblox’s stock is undervalued compared with our long-term fair value estimate. Our $60 fair value estimate is generated using non-GAAP revenue (bookings), as Roblox is largely self-funded thanks to deferred revenue as customers provide cost-free capital to invest back into the business.

We project that bookings will grow 14% annually over our 10-year explicit forecast, driven by continued expansion of the user base, increasing daily average users to 152 million in 2032. The substantial user base continues to attract developers, who create new games that in turn attract more users. The social aspects of playing with friends will also help expand the base.

We also expect continued growth in monetization, albeit in a lumpy manner. We project that average bookings per daily active user will drop over the next three years as the new user mix shifts toward emerging markets. Afterward, we expect growth to be driven by a slight increase in the age profile of users, along with more diverse and complex games. We expect growth in the latter half of our forecast to also come from advertising/branding, as the growing user base will attract sponsors targeting young adults.

Read more about Roblox’s fair value estimate.

Roblox Historical Price/Fair Value Ratio

Economic Moat Rating

We assign Roblox a narrow moat derived from its network effect. The platform consists of three separate pieces that work together. The first is the Roblox Client, which players use on PCs, Android, iOS, and Xbox One to play games, connect and chat with friends, and make purchases. The second piece is Roblox Studio, the development environment for users to create, publish, and operate their games. The final piece is Roblox Cloud, the infrastructure for both online games and development.

The firm’s network effect derives from its unique business model. By providing a game engine, tools, and servers along with monetization opportunities, Roblox offers a tempting starting point for young creatives who are interested in making games with a relatively simple-to-use engine and a robust set of tools and tutorials. The library of user-developed games attracts more young players who spend money in-game. The growing user base, along with the ability to monetize games, entices more developers—not only amateurs from the current player base, but also experienced developers and brands/celebrities looking to market to younger users.

Additionally, the social aspect of the Roblox Client helps reinforce the network effect, as the relatively young players entice friends to join and play games with them. Players can use Robux to create a private server to ensure they and their friends can play a specific game.

Read more about Roblox’s moat rating.

Risk and Uncertainty

Roblox operates in a highly competitive marketplace against firms with more financial and development resources. While its platform is a unique offering, the firm still competes with traditional game publishers to both attract new users and hold on to their current players as they grow older. A key factor for the firm’s long-term growth will be keeping younger users as they age into and out of their teen years, as over two-thirds of users are under the age of 17 and around 40% are under 13.

The young user base could also bring increasing regulatory inquiries, as parents and authorities have historically been very concerned and vocal about games with very young users, particularly ones that allow chat, user-created content, and randomized in-game purchases. This additional scrutiny could force the firm to invest further in both algorithmic and human moderation, limiting its margin expansion.

Read more about Roblox’s risk and uncertainty.

RBLX Bulls Say

- Roblox is uniquely positioned to take advantage of the trend toward increased screen time among younger consumers.

- Roblox’s business model allows it to self-finance while it focuses on expanding its subscriber base and monetization.

- Roblox will benefit as its user base grows older and has more disposable income.

RBLX Bears Say

- Roblox’s tremendous subscriber growth was highly stimulated by the COVID-19 pandemic. Growth has since slowed sharply, especially in established markets.

- Roblox’s model will invite regulatory scrutiny, forcing it to spend more money on moderation, limiting margin expansion.

- Roblox’s competitors have more development resources and offer games with better graphics and deeper gameplay. As users grow up, they will leave the firm’s platform for other gaming experiences.

This article was compiled by Adrian Teague.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4JOND5R2SBFPZE63XWPYQDG56A.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BG4IFJHA25B6RKD3XNUYKROBBM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)