After Earnings, Is Albemarle Stock a Buy, a Sell, or Fairly Valued?

With low lithium prices impacting profits, here’s what we think of Albemarle stock.

Albemarle ALB released its third-quarter earnings report on Nov. 1. Here’s Morningstar’s take on Albemarle’s earnings and stock.

Key Morningstar Metrics for Albemarle

- Fair Value Estimate: $300.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

What We Thought of Albemarle’s Q3 Earnings

- Albemarle’s earnings showed the effect of lower lithium prices on its profits. Albemarle had multiple downgrades and saw its stock price fall as the consensus expected that lower lithium prices would weigh on third-quarter earnings.

- Albemarle’s results highlight the cyclicality of lithium due to fluctuating prices. While the market is focusing on lower near-term lithium prices, we think the more important takeaway is that lithium demand growth remains strong due to rising electric vehicle sales and the buildout of energy storage systems (utility-scale batteries). In our view, this should lead to lithium prices remaining well above historical levels, leading to solid profit generation for Albemarle, since lithium will be one of the largest beneficiaries of growing EV adoption. While lithium prices, profits, and Albemarle’s stock price will likely remain volatile, we see a strong demand environment for years to come.

- The current stock price assumes lithium prices fall well below the marginal cost of production and remain lower, closer to historical levels. We view this scenario as unlikely, as solid demand growth will require higher-cost supply to remain in production, which supports higher prices and profits than what is implied in Albemarle’s current stock price. We think the market is overly pessimistic about Albemarle’s future profits, but as it’s one of the lowest-cost lithium producers in the world, we think it should see solid profit generation even amid lower lithium prices.

Albemarle Stock Price

Fair Value Estimate for Albemarle

With its 5-star rating, we believe Albemarle’s stock is undervalued compared with our long-term fair value estimate.

Our fair value estimate is $300 per share. We assume roughly a 10% weighted average cost of capital. We use a multiple of 11.5 times midcycle EBITDA to value free cash flows generated beyond our 10-year explicit forecast horizon.

The bulk of the growth will come from lithium. We expect contract lithium prices will rise on average in 2023. Lithium carbonate spot prices, which tend to be a leading indicator of contract prices, are currently around $23,000 per metric ton (based on published indexes), down from $75,000 at the end of 2022, due to slowing lithium purchases as a result of inventory destocking. However, as demand growth remains strong and outpaces supply, we expect prices will stabilize during the end of the year and rise in 2024.

In the longer term, we expect lithium prices will remain well above our long-term forecast for lithium carbonate at $12,000 per metric ton through the rest of the decade. Based on our price elasticity analysis, we forecast index prices will average a little over $30,000 per metric ton range during the remainder of the decade. We expect high-quality lithium hydroxide used in long-range batteries will continue to sell at a premium to carbonate, reflecting higher conversion costs.

Read more about Albemarle’s fair value estimate.

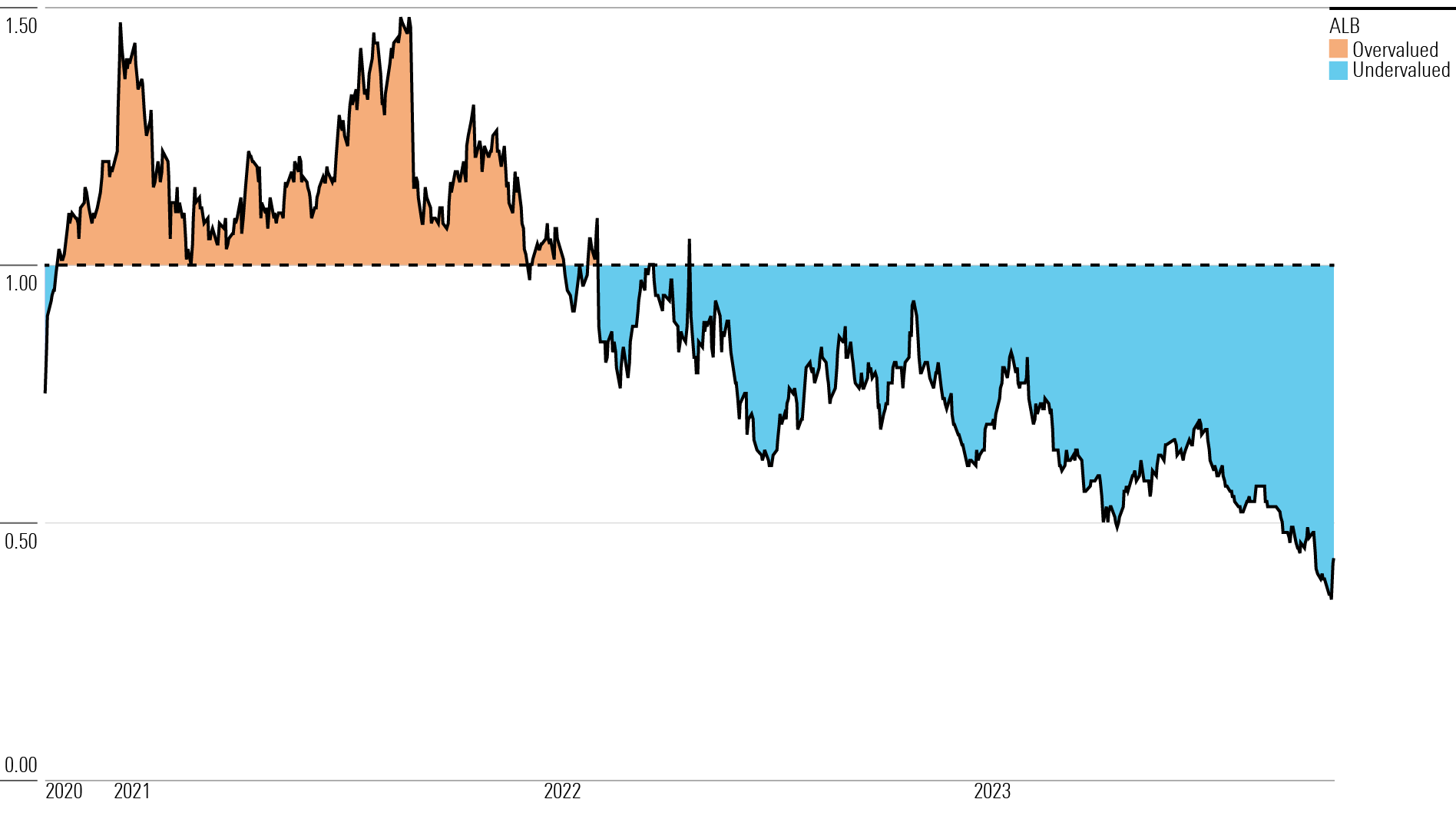

Albemarle's Historical Price/Fair Value Ratio

Economic Moat Rating

Cost advantages and switching costs form the basis of Albemarle’s narrow moat. The firm possesses the lowest-cost sources of lithium and bromine production. The company also benefits from switching costs in its catalyst business, wherein refiners and petrochemical producers tend to stick with existing catalysts tailored to their facilities to maximize product yields.

Globally, lithium carbonate is produced from either lower-cost evaporation of brine or higher-cost mining of spodumene minerals. Albemarle has a cost advantage in lithium carbonate production due to its lucrative brine assets in the Salar de Atacama in Chile. Albemarle also has lithium brine assets in Silver Peak, Nevada. While not as advantaged as the prime Chilean asset due to lower lithium concentration, this Nevada asset still sits on the lower half of the lithium carbonate cost curve.

Albemarle’s advantaged position in bromine comes from its low-cost, long-lived assets in the Dead Sea and Arkansas. The company also benefits from switching costs in refining catalysts, which are tailored to specific refineries to maximize customer profits. Existing catalyst providers hold the advantage of being able to tweak their catalyst over time and maintain customer relationships, as catalyst suppliers continually improve refiner economics.

Read more about Albemarle’s moat rating.

Risk and Uncertainty

We assign Albemarle a High Uncertainty Rating. The company’s biggest risk is volatile lithium prices. Prices could decline if EV demand grows more slowly than expected, or if new low-cost supply ramps up quicker than demand. New batteries, such as sodium-ion, could overtake lithium as the preferred energy storage resource.

Lithium production could ramp up more quickly than demand warrants if producers bring too much supply to the market. Further, new lithium production technologies could alter the cost curve in carbonate and hydroxide. Albemarle faces execution risks in ramping up its lithium production, such as production delays and cost overruns. Albemarle is also subject to political risk, especially in Chile. President Gabriel Boric announced plans to nationalize lithium, whereby the Chilean government would own a majority stake in all projects.

Albemarle’s largest ESG risks come from potential new regulations. Regulations that limit emissions in the bromine business could hurt profit margins, as the firm’s profits come from its cost advantage rather than pricing power, and it may not be able to pass along the cost increases. Albemarle could also have its products banned due to the environmental impact, which has occurred before in the bromine business.

Read more about Albemarle’s risk and uncertainty.

ALB Bulls Say

- Albemarle has top-tier lithium assets through its brine operations in Chile and spodumene hard-rock operations in Western Australia, which are among the lowest-cost sources of lithium production in the world.

- Lithium prices should remain well above the marginal cost of production through at least the remainder of the decade, leading to excess profits and return on invested capital for Albemarle.

- Albemarle has low-cost bromine production through its highly concentrated brines in the Dead Sea and Arkansas.

ALB Bears Say

- Lithium prices will fall if new supply comes online faster than demand, which will weigh on profitability. Albemarle’s plans to increase its lithium production capacity will prove value-destructive in the wake of lower prices.

- Albemarle’s bromine business will decline from weak demand for flame retardants as consumers shift from computers to less bromine-intensive tablets and smartphones.

- Chile’s plan to nationalize lithium could result in Albemarle being forced to sell a majority stake to the government at a price around asset book value, destroying shareholder value.

This article was compiled by Adrian Teague.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4QBQ2NBJMFG5HGQTDEYCXY5OOI.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2RGHQJTF4ZEURNSAGBY7CSHCUQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EAAEIIRVVNE7HNVXBSGTD3WPSI.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)