5 Stocks With the Largest Fair Value Estimate Cuts After Q4 Earnings

Clean energy stocks like SunPower and Plug Power are among the ones with big reductions to their valuations.

While fourth-quarter earnings results were largely positive for the 885 US-listed stocks covered by Morningstar analysts, some companies saw their fair value estimates slashed.

The average change in fair value estimate after the fourth quarter was a 2.07% increase, compared with a 10-year average of a 1.43% increase each season. However, about 2% of the stocks saw their fair value estimates cut by a meaningful amount of 10% or more.

Three of the five stocks with the largest fair value cuts—SunPower SPWR, Plug Power PLUG, and Bloom Energy BE—are for clean energy companies. Supply chain issues, high interest rates, and decreased demand have created a challenging environment for such firms. Common threads in their quarterly reports included debt and declining revenue forecasts.

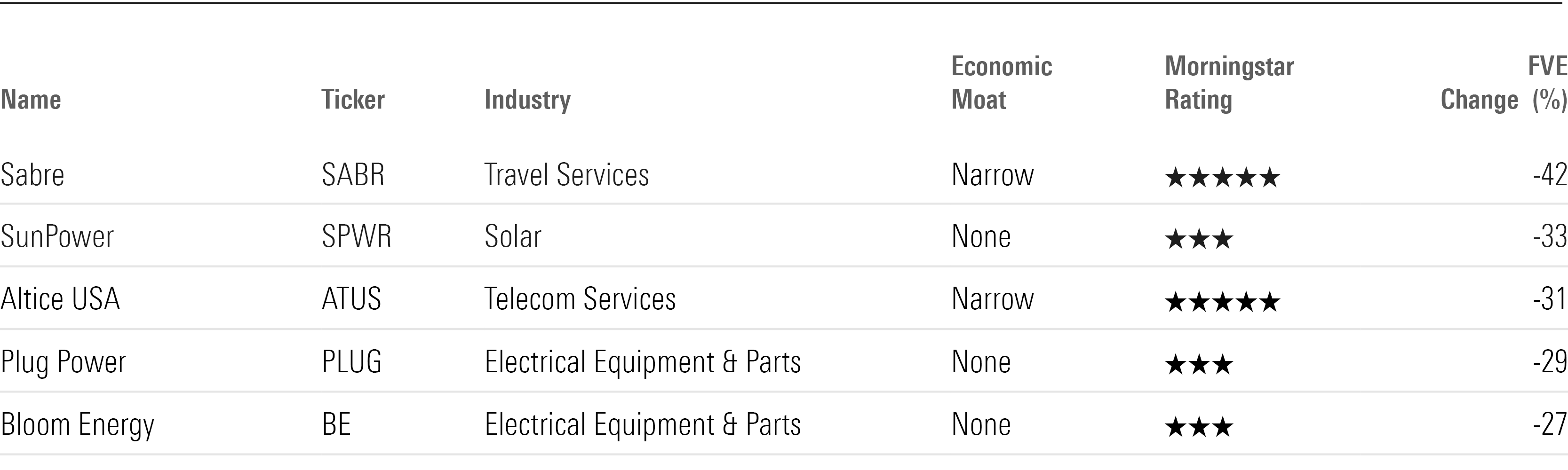

Stocks With the Largest Fair Value Estimate Cuts

A large cut or increase in a fair value estimate may signal to investors that a company’s fortunes are changing. However, it’s important to consider how a stock trades compared with its fair value estimate. Both Sabre and Altice are trading well below their estimates, so both have Morningstar Ratings of 5 stars, meaning our analysts think they’re attractively priced for long-term investors. This holds even after their big valuation cuts.

SunPower, Plug Power, and Bloom Energy are each rated 3 stars, meaning analysts think they’re trading near their (newly cut) fair value estimates.

Stocks With the Largest Fair Value Estimate Cuts

Here’s what Morningstar’s analysts had to say about these cuts.

Sabre SABR

- Fair Value Estimate: $5.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Fair Value Uncertainty: Very High

Morningstar senior equity analyst Dan Wasiolek cut the fair value estimate for travel services company Sabre by 42%, as industry air volume recovery is lagging expectations. “The industry’s subpar performance is attributable to a slower return of airlift capacity and demand for long-haul corporate travel (where Sabre has large exposure) relative to leisure and short-haul trips, as well as some business going to connections directly between agencies and carriers,” he says. “We expect shares to remain volatile with heightened corporate travel demand uncertainty.”

Sabre is trading at a 58% discount to its new fair value estimate and has a Morningstar Rating of 5 stars.

Take a deeper dive into Wasiolek’s outlook for Sabre.

SunPower SPWR

- Fair Value Estimate: $3.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: None

- Fair Value Uncertainty: Extreme

Solar technology company SunPower saw its fair value estimate cut to $3.00 from $4.50, largely due to a reduced revenue forecast and share dilution. “The focus of SunPower’s fourth-quarter results was more on solving its ongoing liquidity challenge and less on reported results,” says Morningstar equity analyst Brett Castelli. “Regarding liquidity, the company secured up to $200 million in new capital commitments. The liquidity comes at a steep cost, however. The term loan carries a 13% cash interest rate and the company granted warrants for nearly 42 million shares (potentially increasing to 75 million if all liquidity is utilized) to the financing parties. The warrants represent meaningful dilution based on total shares outstanding of approximately 176 million as of year-end 2023.”

SunPower is trading close to its new fair value estimate and has a Morningstar Rating of 3 stars.

The rest of Castelli’s outlook for SunPower can be found here.

Altice USA ATUS

- Fair Value Estimate: $9.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Fair Value Uncertainty: Very High

Morningstar equity research director Michael Hodel cut the fair value estimate for telecom services company Altice USA by 31% following its fourth-quarter results. “Altice USA’s fourth-quarter results again showed incremental improvement, but the challenging broadband competitive environment offset some of these gains,” he says. “We like Altice’s assets and believe the firm can steadily improve its operating performance in the coming years. But we continue to caution investors that its extremely high debt load leaves little room for error. Small changes in our assumptions can yield big swings in our fair value estimate. The firm’s recent debt refinancing activity has pushed its next major maturity out to 2027, but at a high cost that raises the bar Altice must clear to deliver value for shareholders.”

Altice is trading at a 69% discount to its new fair value estimate and has a Morningstar Rating of 5 stars.

Hodel has more about Altice USA’s stock here.

Plug Power PLUG

- Fair Value Estimate: $3.50

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: None

- Fair Value Uncertainty: Extreme

Electrical equipment and parts company Plug Power saw its fair value estimate fall to $3.50 from $5.00 in late January, following the company’s annual business update. “The decreased valuation is driven by a lower revenue growth outlook, resulting in reduced operating leverage relative to our prior assumptions,” says Castelli. “The theme of the annual business update was the reduction of Plug Power’s cash burn as the company seeks financing options. The company is raising prices across the board on its products and service lines and exiting certain sale practices that constrained cash. Plug Power indicated that 2024 will see revenue grow year on year, but at a lower rate relative to its history.”

Plug Power is trading close to its new fair value estimate and has a Morningstar Rating of 3 stars.

Click here for more on Plug Power’s outlook.

Bloom Energy BE

- Fair Value Estimate: $10.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: None

- Fair Value Uncertainty: Very High

Castelli cut the fair value estimate for electrical equipment and parts company Bloom Energy by 29%, largely due to lower-than-expected 2024 revenue guidance and modest backlog growth. “Bloom expects 2024 revenue of $1.4 billion-$1.6 billion, below our estimate of $1.75 billion,” he says. “Additionally, the company reported system backlog up only 6% versus year-end 2022. Bloom noted it is seeing strong interest from data center customers but noted elongated sales cycles, given that these are greenfield developments. While we acknowledge the upside potential from these opportunities, we lower our medium-term revenue estimates, including 2025, by 25% as we await further sales execution and pushout electrolyzer sales.”

Bloom Energy is trading close to its new fair value estimate and has a Morningstar Rating of 3 stars.

Investors can find more of Castelli’s take on Bloom Energy here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/a8c4d0a1-24c6-4c96-81d6-7bb13a177a1e.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-09-2024/t_fab10267147f40fb93a1deb8a0b6553b_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/E3DSJ6NJLFA5DOKMPQRAH5STMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a8c4d0a1-24c6-4c96-81d6-7bb13a177a1e.jpg)