10 Undervalued Stocks That Crushed Earnings in Q2 2023

Western Union and Live Nation are among those that are still cheap despite impressive earnings beats.

Despite another overall negative earnings picture in the second quarter, a large swath of U.S. companies are beating estimates.

When combining results for the companies in the Morningstar US Market Index that have reported earnings with the analyst expectations for those still yet to publish, earnings are on track to decline 4.3% from the second quarter of 2022.

Yet more than half of the U.S.-listed stocks covered by Morningstar that reported as of May 23 managed to beat FactSet consensus estimates by 5% or more. Even better for investors looking to put money to work, analysts believe a number of these stocks remain undervalued relative to their fair value estimates.

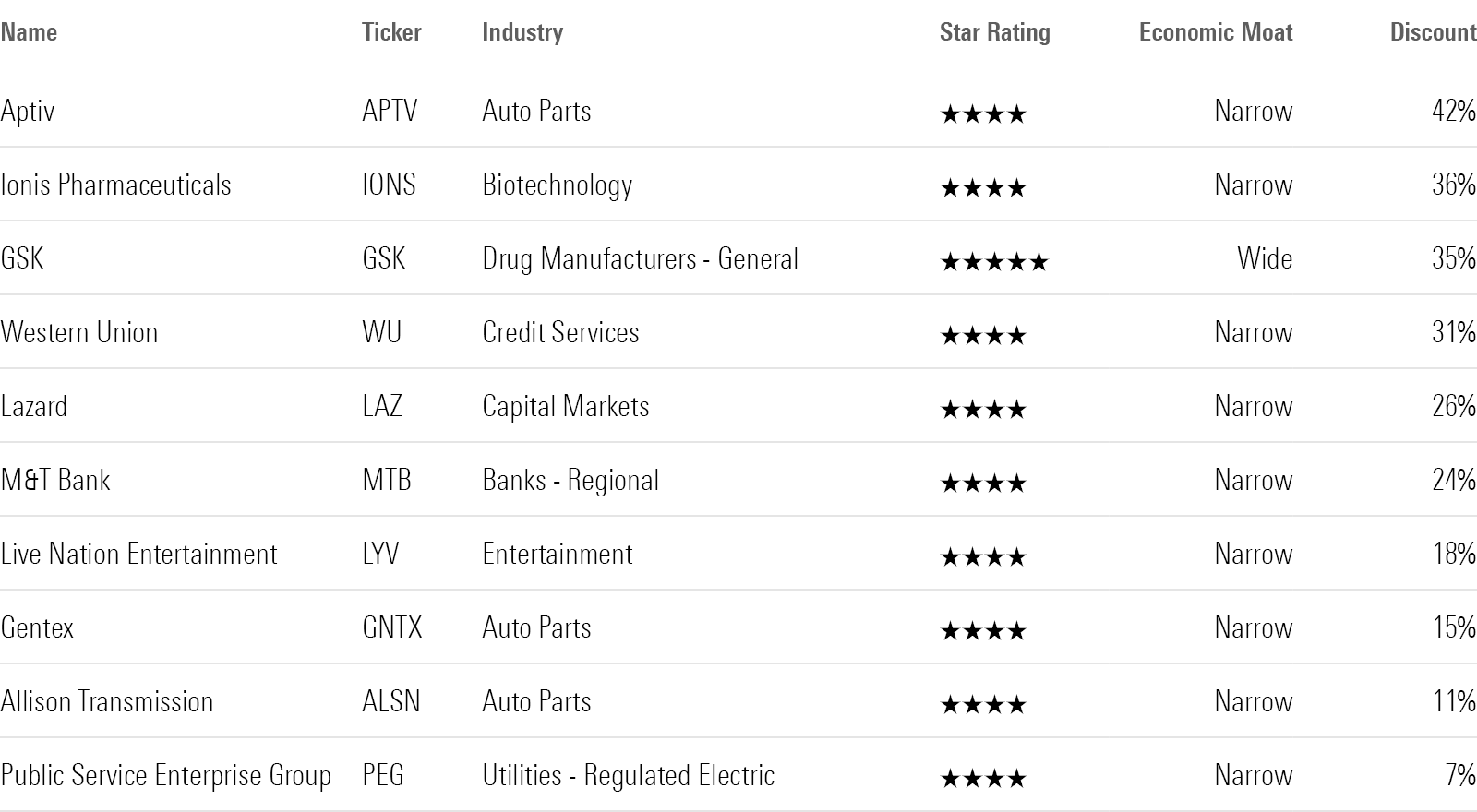

To highlight these opportunities, we ran a screen for undervalued stocks that crushed both earnings and revenue expectations for the second quarter of 2023. More details on our screen, along with comments on the stocks from Morningstar analysts, can be found later in this article.

10 Undervalued Earnings Crushers

- Aptiv APTV

- Ionis Pharmaceuticals IONS

- GSK GSK

- Western Union WU

- Lazard LAZ

- M&T Bank MTB

- Live Nation Entertainment LYV

- Gentex GNTX

- Allison Transmission ALSN

- Public Service Enterprise Group PEG

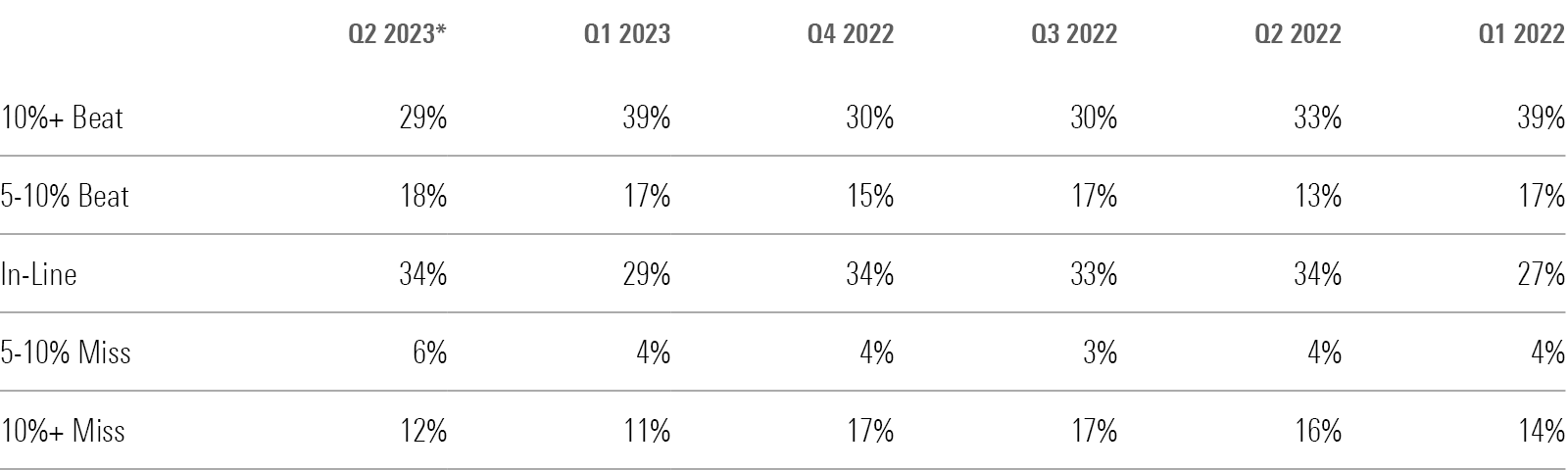

How Do Second-Quarter Earnings Stack Up?

As of the time of writing, 87% of the 864 U.S.-listed stocks covered by Morningstar analysts have reported earnings. Of those, 47% beat the FactSet mean estimates for their earnings by 5% or more—a decline compared to the 53% that beat their mean earnings estimates by the same amount last quarter. About 18% missed earnings estimates by 5% or more—an uptick compared to the first quarter, but otherwise the lowest share of misses this size since the fourth quarter of 2021.

Quarterly Results for U.S.-Listed Stocks Covered by Morningstar

Digging deeper, the largest shift in this earnings season from the first quarter was that fewer companies beat estimates by 10% or more—just 29%, versus 39% in the first quarter. About 18% surpassed expectations by 5%-10%, just a hair more than the 17% that did so in the first quarter.

The quantity of earnings misses was slightly higher as well, with 6% of companies reporting earnings 5%-10% below FactSet estimates and an additional 12% of companies reporting earnings 10% or more below estimates—up from 4% and 11% in the first quarter, respectively.

How We Did Our Stock Screen

While Morningstar stock analysts pay close attention to earnings, they focus on long-term results and valuations. One quarter doesn’t usually lead to a change in the long-term assumptions behind the assessment of a stock’s fair value estimate unless there’s new material information that affects those assumptions. For example, new data on a drug could raise the probability of its approval, or pricing gains on a key product line could affect an analyst’s long-term thinking. Still, looking at quarterly earnings against the valuation backdrop can help long-term investors identify opportunities.

To help investors capitalize on new investment opportunities, we screened for stocks that beat earnings expectations by 10% or more but remained undervalued.

To help keep the focus on companies that had truly strong results and did not beat on earnings through accounting gimmicks or one-time factors, we also screened for revenue beats of 5% or more. Of those results, we filtered for stocks with a Morningstar Rating of 4 or 5 stars.

Of the 864 U.S.-listed stocks covered by Morningstar analysts, only ten companies met our criteria. We’ve highlighted what our analysts had to say about their earnings below.

10 Undervalued Stocks That Beat Earnings Estimates

Aptiv

- Earnings Per Share: Gain of $1.25 versus the consensus estimate of $1.01

- Revenue: $5.2 billion versus the consensus estimate of $4.8 billion

- Morningstar Rating: 4 Stars

- Discount: 42%

“Aptiv reported second-quarter earnings per share before special items of $1.25—$0.24 above the $1.01 FactSet consensus estimate and $1.03 higher than the $0.22 year-ago result. Second-quarter revenue also beat consensus by 8%, rising 28% to $5.2 billion from $4.1 billion last year due to solid flow-through on volume growth, new business launches, and contributions from acquisitions of Wind River and Intercable, partially offset by periodic supply chain disruptions from the chip shortage and unfavorable foreign exchange. Excluding currency, acquisitions, and divestitures, organic revenue climbed 25%, exceeding a 15% increase in global light vehicle production weighted to Aptiv’s customer base by 10 percentage points.

“Despite continued headwinds from the chip shortage, increased commodity cost, higher labor cost, and other inflationary cost pressures, second-quarter adjusted EBIT was $530 million for a margin of 10.2%, more than doubling from $213 million with a 5.3% margin in the prior year. Free cash flow was $313 million versus negative $112 million in the prior year on improved earnings, reduced capital spending, and working capital discipline.”

—Richard Hilgert, senior equity analyst

Ionis Pharmaceuticals

- Earnings Per Share: Loss of $0.60 versus the consensus estimate of $0.88

- Revenue: $188 million versus the consensus estimate of $140 million

- Morningstar Rating: 4 Stars

- Discount: 36%

“We’re maintaining our $62 fair value estimate for Ionis following in-line second-quarter results, and more importantly, indications that the firm’s late-stage pipeline remains on track.

“Steady royalties from partner Biogen on spinal muscular atrophy drug Spinraza, as well as revenue growth from collaboration agreements, drove Ionis’ second-quarter revenue to $188 million, up 40% year over year.

“Ionis is still preparing to bring three drug candidates to the market in the near term: eplontersen (partnered with AstraZeneca) and wholly-owned olezarsen (high triglycerides) and donidalorsen (hereditary angioedema). As a result, operating expenses are continuing to climb, although with an expected net operating loss of less than $425 million for the full year, $2.4 billion in cash and short-term investments at the end of the quarter, and refinanced convertible debt due in 2028, we think Ionis remains in a solid financial position.

“We think shares look undervalued, as the market underappreciated Ionis’ ability to translate its antisense technology platform into multiple drug launches across rare diseases, neurology, and cardiology. We think approved spinal muscular atrophy drug Spinraza and ALS drug Qalsody both provide solid proof of concept for Ionis’ technology, supporting a narrow moat.”

—Karen Andersen, sector strategist

GSK

- Earnings Per Share: Gain of $1.00 versus the consensus estimate of $0.89

- Revenue: $9.3 billion versus the consensus estimate of $8.8 billion

- Morningstar Rating: 5 Stars

- Discount: 35%

“GSK reported better-than-expected second-quarter results and slightly raised 2023 guidance, but we don’t expect any major changes to our fair value estimate based on the minor outperformance. We continue to view the stock as undervalued, with the market not fully appreciating the growth potential of the firm’s key innovative products, which also support GSK’s wide moat.

“In the quarter, total sales increased 11% operationally (excluding COVID-19 product sales), a rate that should likely continue over the next two years. Key to continued growth is the shingles vaccine Shingrix (up 20%), representing close to 12% of total sales. While Shingrix growth in the United States will likely slow, as the penetration rate is close to one-third, we expect continued growth in the U.S. to approach the flu and pneumococcal vaccine penetration rates (over 60% for ages 65 years and older, according to the Centers for Disease Control and Prevention). The decline in U.S. sales of Shingrix (down 10%) in the quarter was partly due to stocking patterns. Also, in most markets outside the U.S., the penetration rate is in the low single digits, opening major avenues of growth.

“Offsetting the eventual generic pressures, GSK is making progress with the pipeline. In particular, RSV vaccine Arexvy looks poised to post peak annual sales of close to GBP 3 billion based on strong efficacy, which should support gaining close to half of the market versus Pfizer’s Abrysvo (approved in May) and Moderna’s mRNA-1345 (approval likely in 2024). We expect GSK to meet its 2031 goal of sales over GBP 33 billion.”

—Damien Conover, sector director

Western Union

- Earnings Per Share: Gain of $0.51 versus the consensus estimate of $0.39

- Revenue: $1.2 billion versus the consensus estimate of $1.0 billion

- Morningstar Rating: 4 Stars

- Discount: 31%

“While Western Union still faces some headwinds, the company appears to have experienced some improvement in the second quarter.

“We see the quarter as encouraging, but the results don’t materially alter our long-term view, and we will maintain our $17 fair value estimate for the narrow-moat company. We believe shares are meaningfully undervalued at the moment.

“Revenue for the money transfer segment grew 5% year over year on a constant-currency basis, driven mainly by a 4% increase in transactions. This represents a sharp improvement from the mid-to-high-single-digit revenue declines the company had been experiencing over the past few quarters. While the growth appears to be primarily due to one-time benefits in Iraq, there appears to be solid underlying improvement.

“We see digital volumes as critical to maintaining the company’s scale-based moat, given the industry shift in this direction. On this front, results were encouraging, with year-over-year transaction growth accelerating to 12%. This continues to come at the expense of pricing, and digital revenue was down 2% year over year. However, we think being aggressive with pricing to maintain share is the correct move from a long-term perspective, even if it pressures near-term results.”

—Brett Horn, senior equity analyst

Lazard

- Earnings Per Share: Gain of $0.24 versus the consensus estimate of $0.11

- Revenue: $620 million versus the consensus estimate of $572 million

- Morningstar Rating: 4 Stars

- Discount: 26%

“The bulk of Lazard is in a rough part of its business cycle, but the company has prepared to weather it, and there are signs of the very early stages of recovery.

“In the second quarter, Lazard had $147 million of charges related to cost-saving initiatives. Pro forma net income was $23 million, or $0.24 per diluted share. Net revenue increased 1% from a year ago and 27% from the previous quarter; however, it was still 7% lower than the 2022 quarterly average and 19% lower than the 2021 quarterly average. We don’t anticipate making a material change to our $45 fair value estimate, and assess the shares as modestly undervalued.

“Over half of Lazard’s business is financial advisory on matters such as mergers and restructuring. Companies have been anticipating a recession, and financing costs have risen for much of the previous one-and-a-half years, so merger activity has significantly slowed. While restructuring activity is often countercyclical to merger activity, the economy has been trudging upward and many companies locked in low interest rates on their corporate debt for years, so restructuring also hasn’t significantly increased.

“More of the market has shifted toward the perspective of a soft landing for the economy, but it often takes six to nine months between a merger announcement and its closure, when the majority of revenue is recognized. So Lazard and its peers won’t see a strong recovery in revenue and earnings for several more quarters. The company has taken steps to weather the low-revenue environment, and has embarked on a cost-saving initiative that it estimates will reduce its cost base by 10%.”

—Michael Wong, sector director

M&T Bank

- Earnings Per Share: Gain of $5.05 versus the consensus estimate of $4.16

- Revenue: $2.6 billion versus the consensus estimate of $2.4 billion

- Morningstar Rating: 4 Stars

- Discount: 24%

“M&T Bank reported decent second-quarter results, which supported our overall thesis that while there will be incremental pressure on funding costs and net interest income, or NII, it will be manageable.

“The bank’s EPS of $5.05 beat our own estimate of $4.31 and the FactSet consensus of $4.16, largely due to a one-time gain on the sale of the bank’s Collective Investment trust unit. Adjusted EPS of $4.11 was closer to our estimate, with the main difference being slightly higher expenses.

“M&T Bank’s full-year outlook was modestly changed, as deposit costs are expected to come in slightly higher and NII is expected to come in at the low end of the previous range of $7.0 billion-$7.2 billion. We were already favoring the lower end of the range, so we do not expect to materially change our NII outlook.”

—Eric Compton, strategist

Live Nation Entertainment

- Earnings Per Share: Gain of $1.02 versus the consensus estimate of $0.65

- Revenue: $5.6 billion versus the consensus estimate of $5.0 billion

- Morningstar Rating: 4 Stars

- Discount: 18%

“Live Nation benefited once again from the ongoing demand growth for live events, as second-quarter revenue jumped by 27% year over year. Management touted the strength of 2023 demand, with over 117 million tickets sold to date for shows, tracking 20% ahead of 2022 at the same point.

“Despite the relatively weak global ad market, over 90% of the planned sponsorship for 2023 is already booked with double-digit growth. We are maintaining our fair value estimate of $105.

“Revenue of $3.1 billion was driven by strong growth in all three segments. Ticketing revenue improved by 23% to $709 million. Consumer demand and Live Nation’s focus on ticket pricing helped drive a 25% increase in total fee-bearing gross transaction value. The segment benefited from increased demand from ancillary services like insurance and upgrades, which grew double digits. Even with the negative headlines over the last year, Ticketmaster has signed new clients accounting for 14 million net new tickets in 2023, with over half in international markets.”

—Neil Macker, senior equity analyst

Gentex

- Earnings Per Share: Gain of $0.47 versus the consensus estimate of $0.41

- Revenue: $584 million versus the consensus estimate of $555 million

- Morningstar Rating: 4 Stars

- Discount: 15%

“Gentex’s management has long said it needed more volume as the chip shortage ravaged production, and second-quarter results show why.

“Mirror unit shipments rose 20.8% year over year to a quarterly record of 12.9 million, with double-digit growth for both interior and exterior mirrors. This led to revenue growing 25.9% to a record $583.5 million, which beat Refinitiv consensus, as did diluted EPS, which rose 51.6% to $0.47 versus the $0.41 consensus.

“We raised our fair value estimate to $38 per share from $35 to reflect higher than previously modeled global light-vehicle production and higher content per vehicle, given that 2023 is progressing above our prior expectation, as well as management raising its guidance. "

—David Whiston, sector strategist

Allison Transmission

- Earnings Per Share: Gain of $1.92 versus the consensus estimate of $1.63

- Revenue: $783 million versus the consensus estimate of $736 million

- Morningstar Rating: 4 Stars

- Discount: 11%

“Following second-quarter earnings, we’ve elected to leave our $66 fair value estimate unchanged for Allison. The quarter showed that 2023 is shaping up to be another solid year. The on-highway business globally performed well, growing by a mid-teens percentage. Solid pricing growth pushed gross margins to expand by 190 basis points in the quarter compared with the same period a year ago.

“The supply chain also continued to improve. Supply constraints held back demand for transmissions across various bus and truck markets. We also continue to point to elevated fleet ages as a key demand driver, even if the broader truck market softens. The potential for truck refreshes is what gives us the confidence to project 7% sales growth for the consolidated business in 2023, which would be impressive considering the tough sales comparison from a year ago (revenue grew 15% in 2022).

“In our view, Allison should get more credit for its ability to transition to zero-emission products. New technology entrants can pose a threat, but we think the more likely scenario is that Allison takes the strong returns of its traditional business and invests it into next-generation technologies. The company has already started to do this with its hybrid-electric propulsion systems and e-axle product lines. We view this as positive early progress on the transition to zero emissions.”

—Dawit Woldermariam, equity analyst

Public Service Enterprise Group

- Earnings Per Share: Gain of $0.70 versus the consensus estimate of $0.63

- Revenue: $2.4 billion versus the consensus estimate of $2.0 billion

- Morningstar Rating: 4 Stars

- Discount: 7%

“We reaffirmed our $65 per share fair value estimate for Public Service Enterprise Group after the company reported $0.70 per share of operating earnings in the second quarter, up from $0.64 in the second quarter of 2022. We are maintaining our narrow moat rating.

“We continue to believe the company will hit the high end of management’s 5%-7% annual long-term earnings growth target as capital investment accelerates during the next four years. Our 2023 operating earnings estimate remains in line with management’s $3.40-$3.50 EPS guidance.

“Earnings growth at PSEG’s rate-regulated New Jersey utility, Public Service Electric and Gas, offset a slight drop in earnings at its nonutility business during the second quarter, in line with our expectations.

“A key development during the second quarter was PSEG’s sale of its 25% offshore wind ownership option to Orsted DOGEF in return for reimbursement of PSEG’s investment in the Ocean Wind project. We think this is a positive outcome for shareholders as PSEG offloads project risk without a material financial impact.”

—Travis Miller, strategist

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KIQMCCUZ2RGWZKSCKM2Z4ZULFU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MGEDEFIRZJFHTAFNLDHG46SDXI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6HLXVGQ6DFCQDC3WHBZC6TLS2U.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)