Weakest Quarter for Fund Flows in 2 Years

Long-term mutual funds and exchange-traded funds collected just $30 billion in March 2022.

Editor's note: This is adapted from the Morningstar Direct U.S. Asset Flows Commentary for March 2022. Download the full report here.

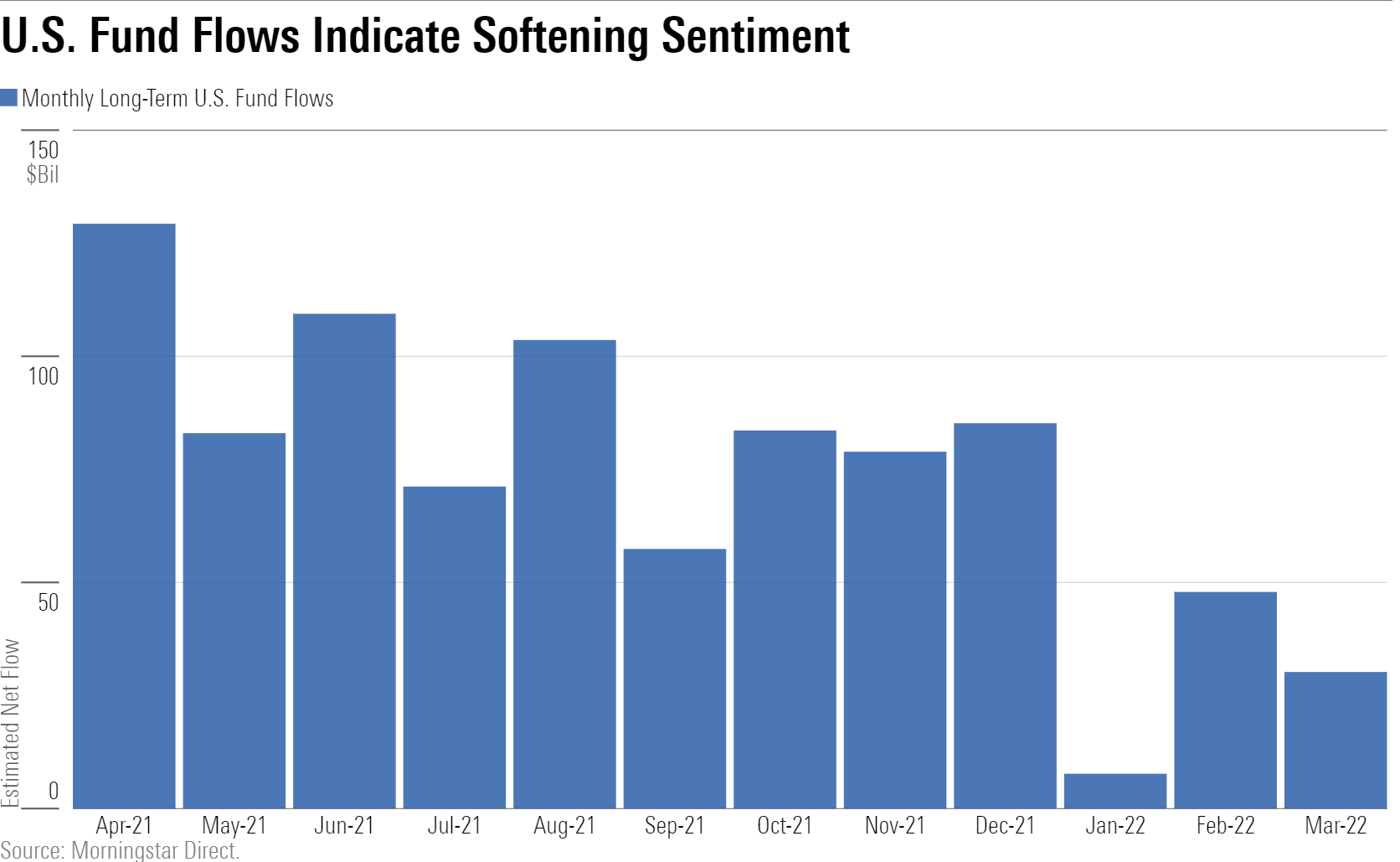

Long-term mutual funds and exchange-traded funds took in $30 billion in March 2022. After minimal inflows in the first two months of the year, this was the weakest quarter of inflows since the first quarter of 2020, which was heavily influenced by the onset of the pandemic and a bear market. With most equity and fixed-income markets in negative territory so far in 2022, investors appear cautious.

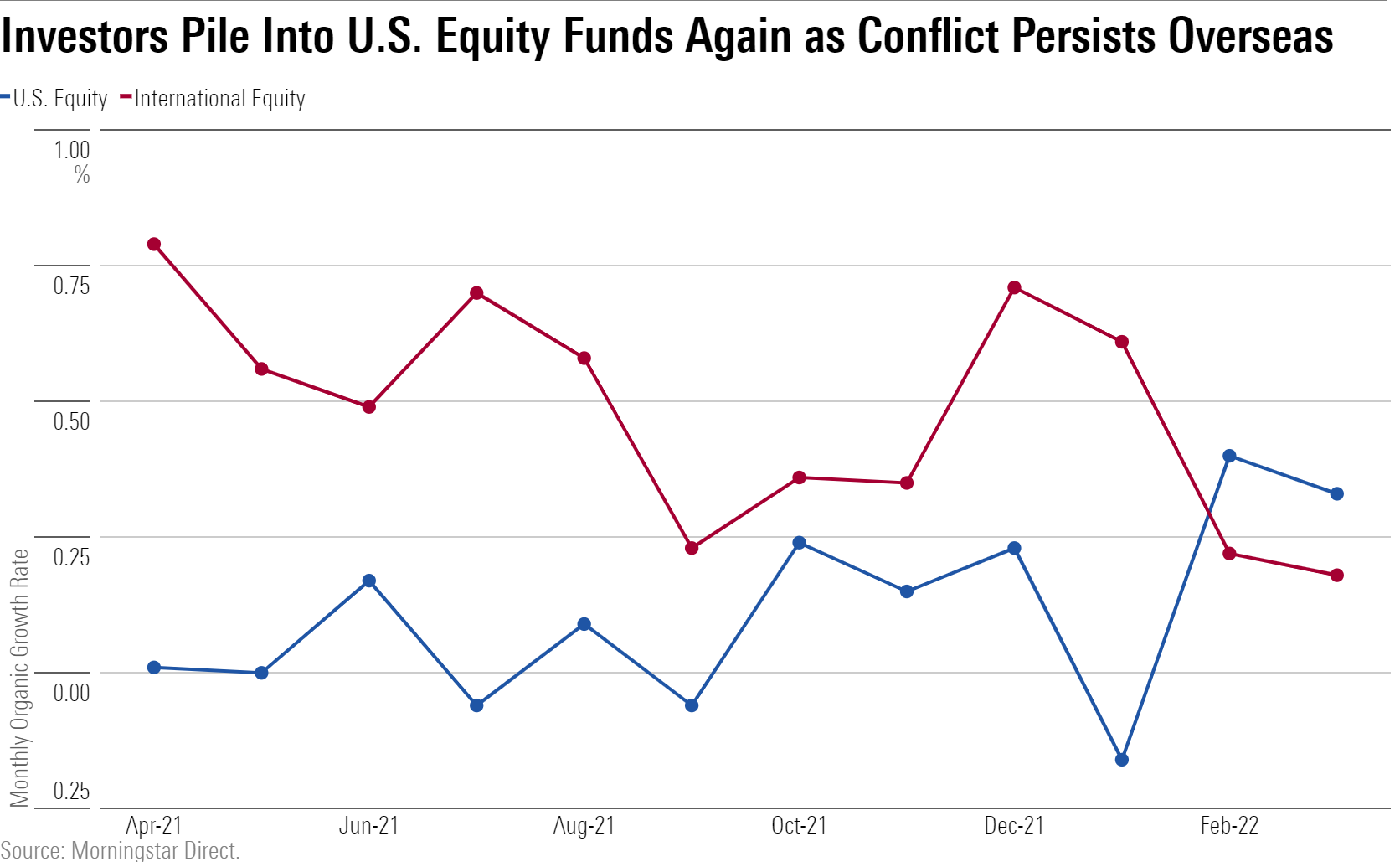

U.S. equity funds collected $41 billion in March after raking in $50 billion in February to lead all U.S. category groups. International-equity funds' momentum slowed noticeably beginning in February. They collected just $7.2 billion in March, their weakest inflow since December 2020. Large-blend funds took in $26.5 billion (led by S&P 500-tracking funds) to lead all Morningstar Categories.

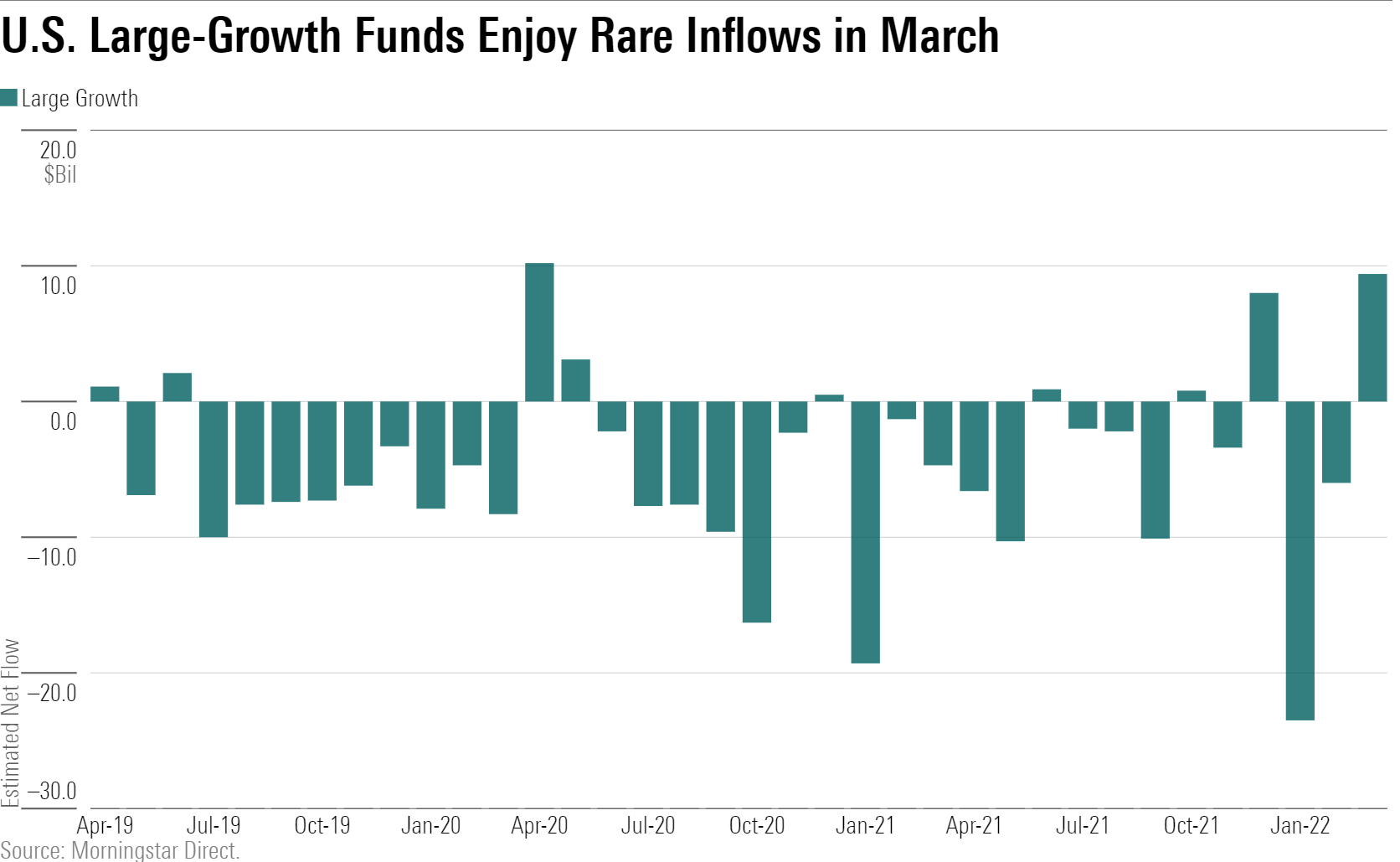

Investors have regularly redeemed from large-growth funds, but the category gathered $9.3 billion in March, good for its fourth-highest monthly organic growth rate over the past 10 years. Growth stocks' poor start to 2022 may have lured investors who are looking to buy on weakness. Inflows went to passive strategies: Index funds gathered $15.3 billion, while active funds shed $6.0 billion.

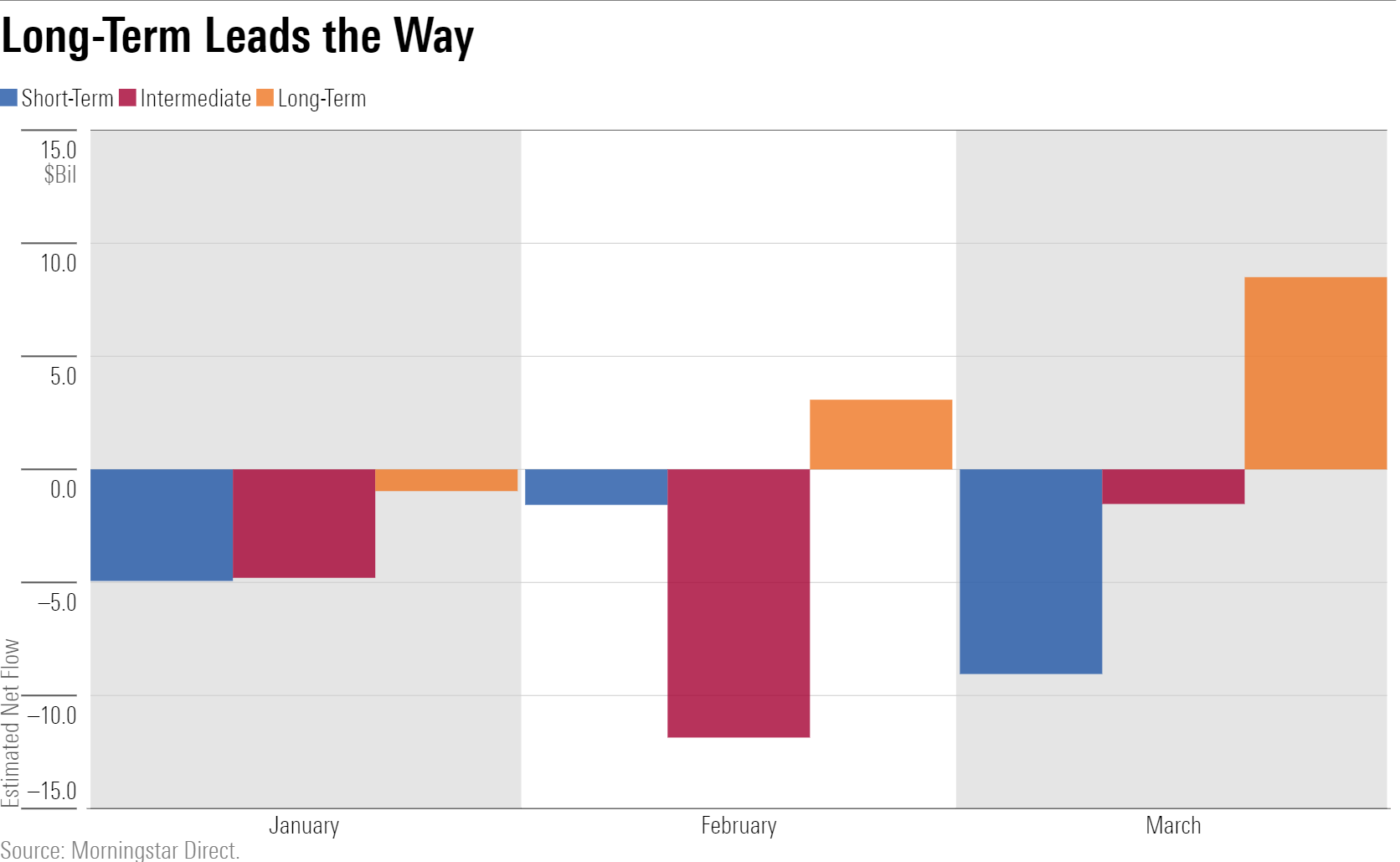

Taxable-bond funds collectively bled $20.9 billion in March, but the long-government category was a bright spot. These funds collected $8.7 billion, which translated into a 9.8% one-month organic growth rate—their best since February 2016. In government-only and diversified funds, investors preferred longer-term bond offerings in the first quarter.

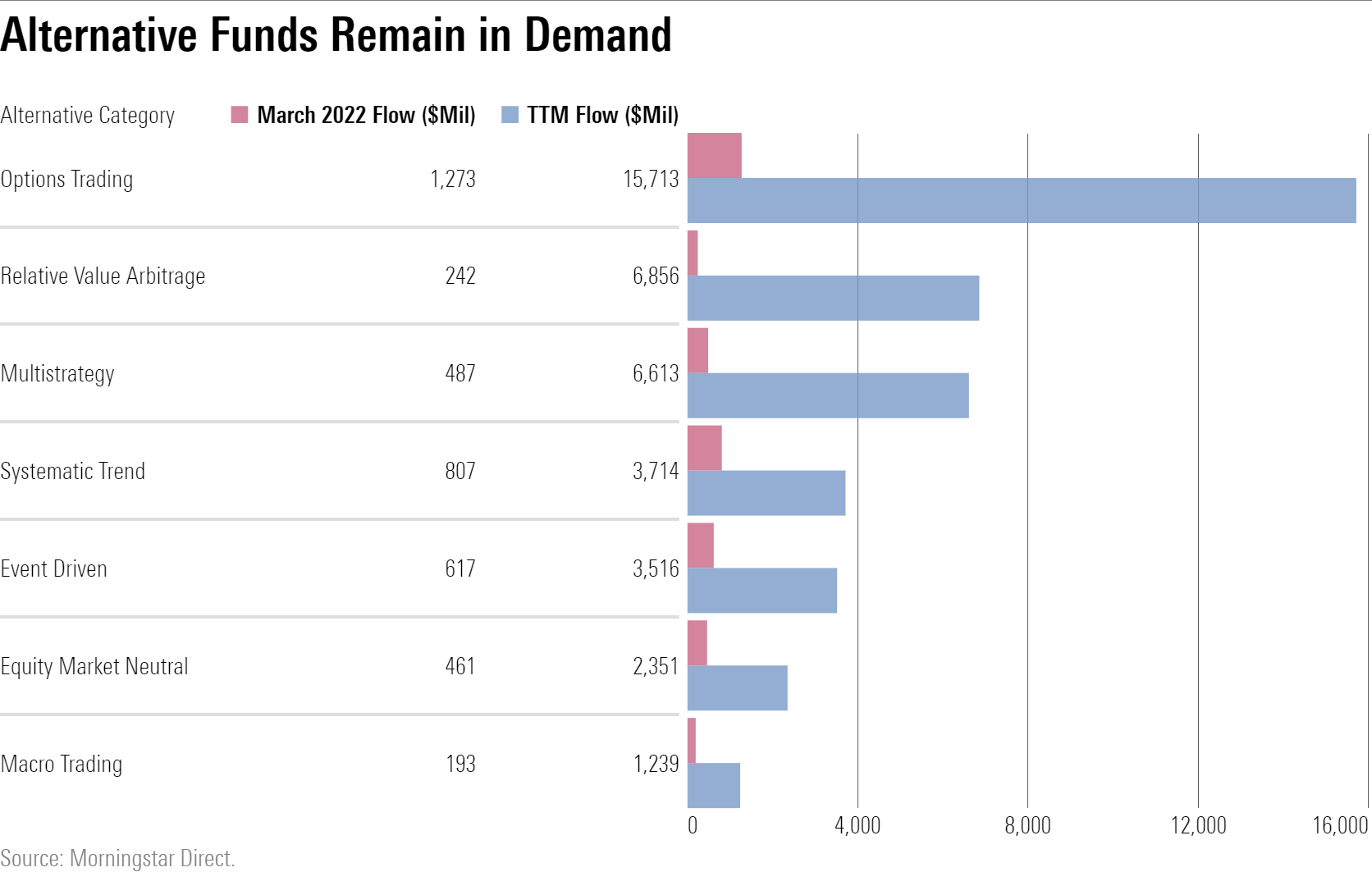

As equity and bond markets faltered, investors sought safety in alternative funds designed to serve as portfolio diversifiers. Alternative funds' 9.3% first-quarter organic growth rate was the third-highest of any category group and their highest since 2011. All seven alternative categories collected inflows over the past quarter and trailing 12 months.

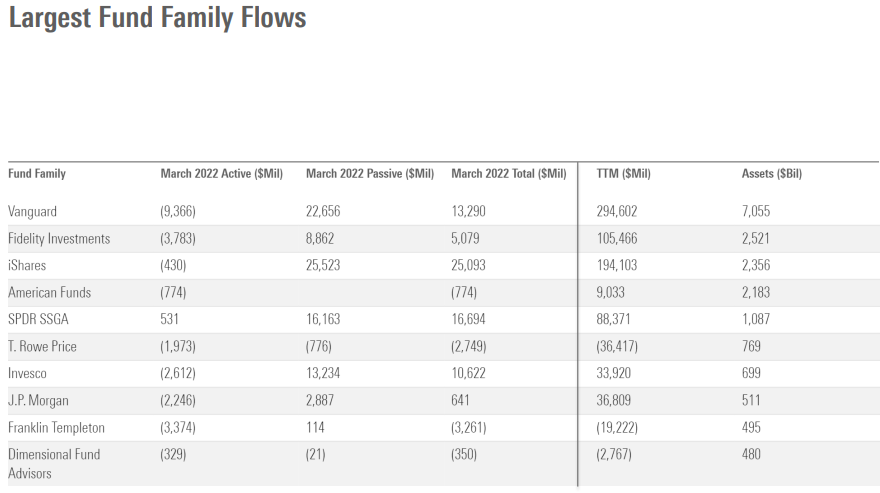

IShares' $25.1 billion March haul led all fund families, and Invesco shook off a slow start to the year and collected $10.6 billion.

Note: The figures in this report were compiled on April 11, 2022, and reflect only the funds that had reported net assets by that date. The figures in both the commentary and the extended tables are survivorship-bias-free. This report includes both mutual funds and ETFs, but not funds of funds unless specifically stated. It does not include collective investment trusts or separate accounts. Morningstar Direct clients can download the full report here.

/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-14-2024/t_958dc30e28aa4c8593f13c19505966e3_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)