U.S. Fund Flows: Investors Indeed Sold in May

The sluggish start to the year continues.

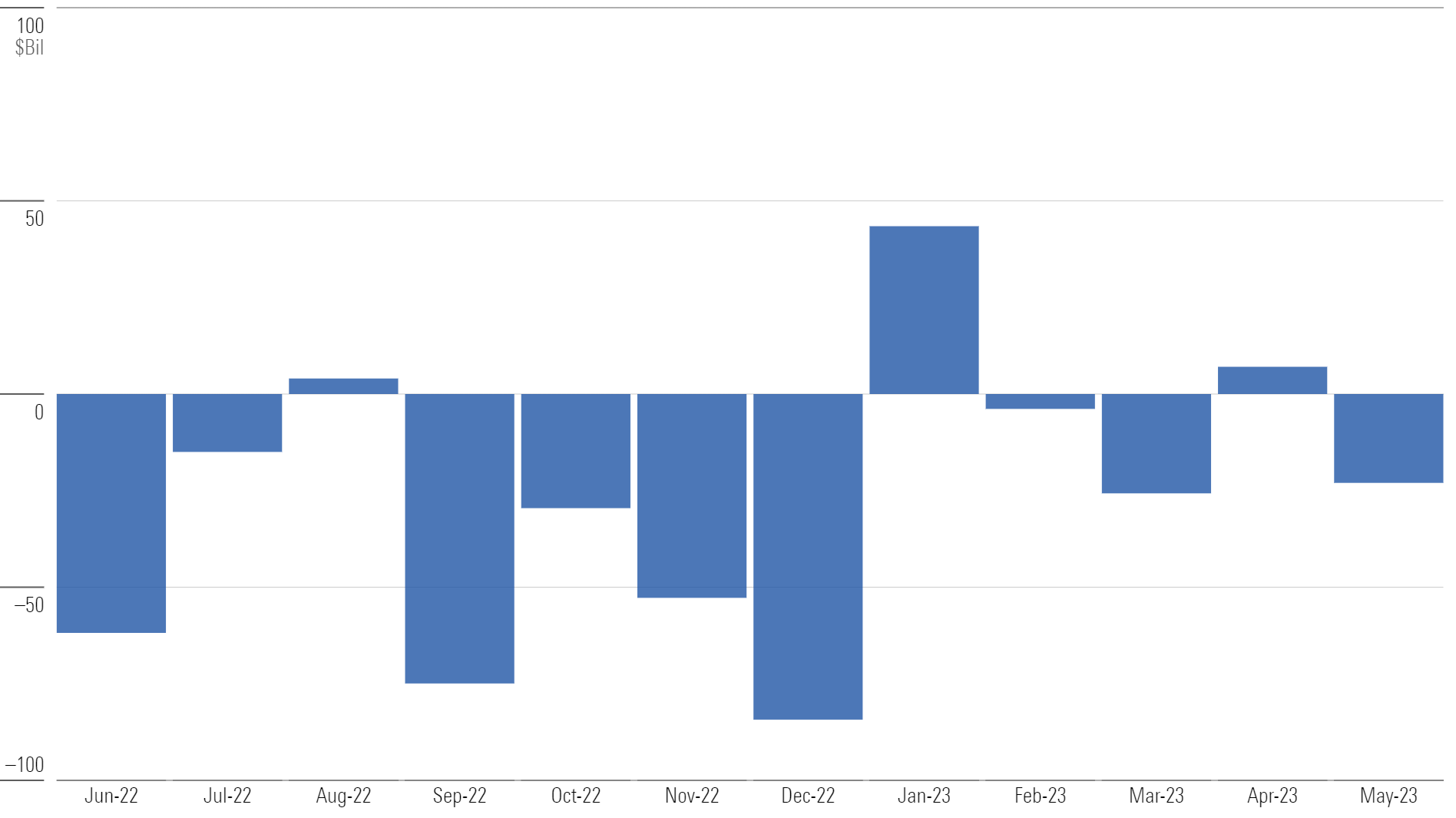

U.S. mutual funds and exchange-traded funds saw over $23 billion of outflows in May, furthering their dreary start to 2023. Just four out of the 10 U.S. category groups saw inflows. For the year to date, U.S. funds have shed nearly $1 billion, a rarity this far into a calendar year.

Monthly Long-Term U.S. Fund Flows

U.S. Equity Funds Remain in Outflows

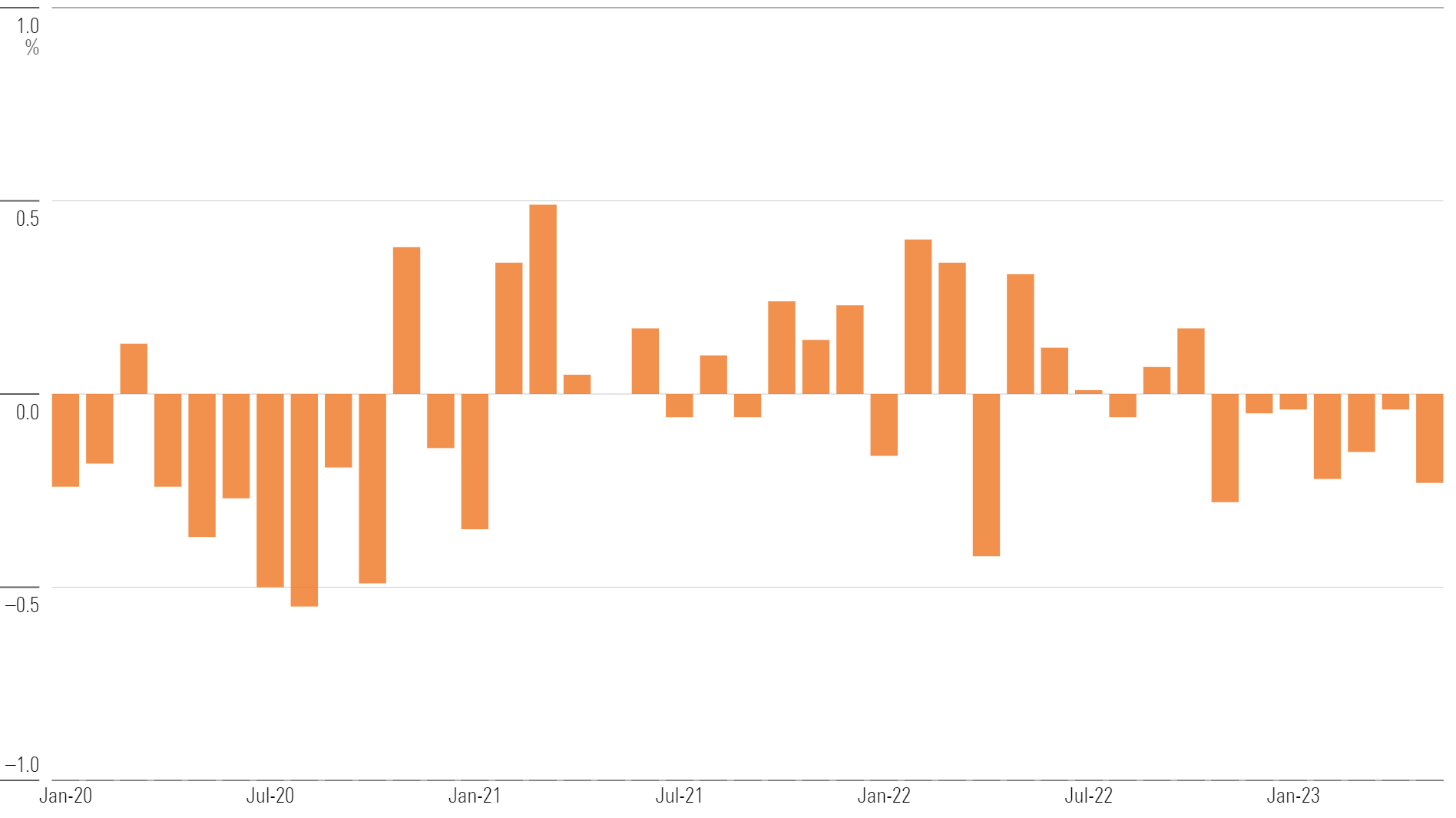

U.S. equity funds shed about $27 billion in May—their seventh consecutive month of net outflows. Aside from passive large-blend funds, few niches within the group have seen much interest. Eight of the nine U.S. equity categories suffered outflows in May. Momentum is poor for this cohort, but it hasn’t been as bad as during 2020′s second half.

U.S. Equity Organic Growth Rate

Historic Outflows From Large-Value Funds

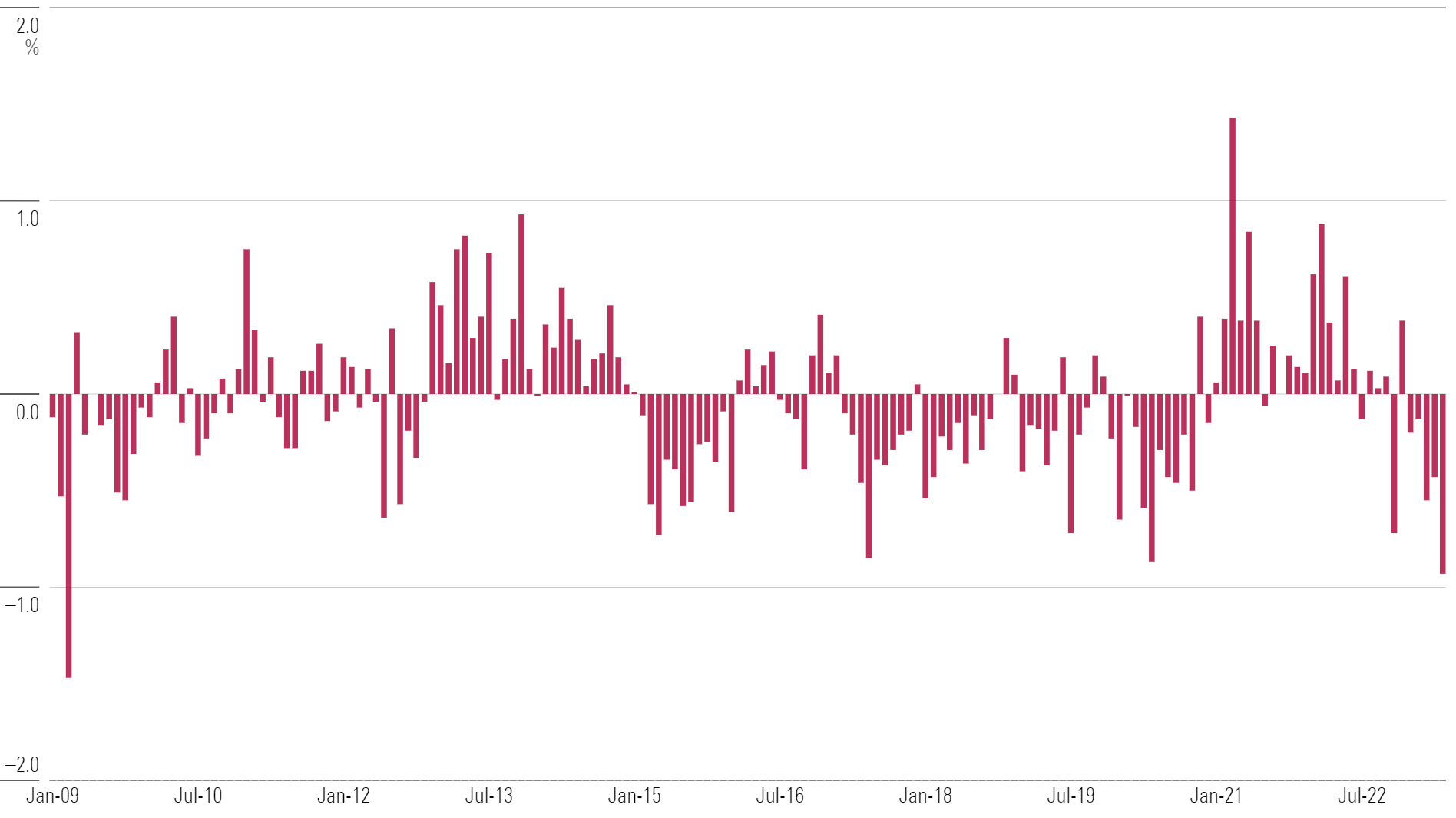

Amid a resurgence in large-cap growth stock performance, investors may be rethinking their allocations to value funds. Large-value funds suffered their worst month of flows on record in May, dropping $15.1 billion. As a percentage of beginning assets, it was their worst month since March 2009, a month that marked the bottom of the market during the financial crisis.

Large-Value Organic Growth Rate

Retreat From Value Stocks Bleeds Into Sector-Equity Funds

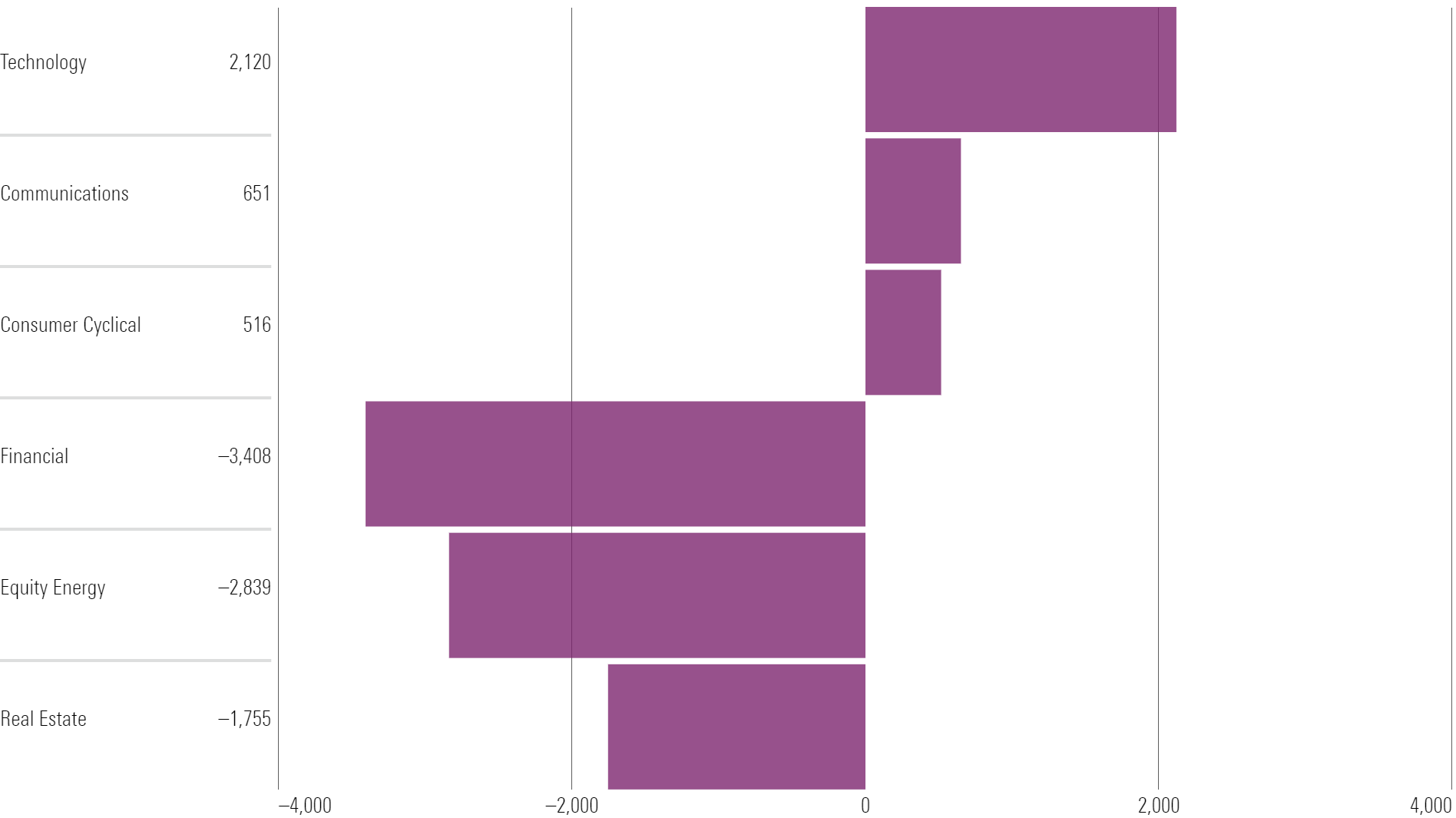

Sector-equity funds dropped over $8 billion in May—their sixth consecutive monthly outflow. Investors redeemed most heavily from value-leaning sector funds such as financial, equity energy, real estate, and natural resources. Conversely, technology funds enjoyed the strongest inflows.

Sector-Equity May 2023 Net Flows ($Mil)

Taxable-Bond Inflows Buck the Trend

Flows into taxable-bond funds have been a bright spot in 2023. The category group collected over $18 billion in May to push its year-to-date haul to nearly $113 billion—about $100 billion more than the next-closest category group. Meanwhile, municipal-bond funds have failed to build the same momentum after a promising start to the year.

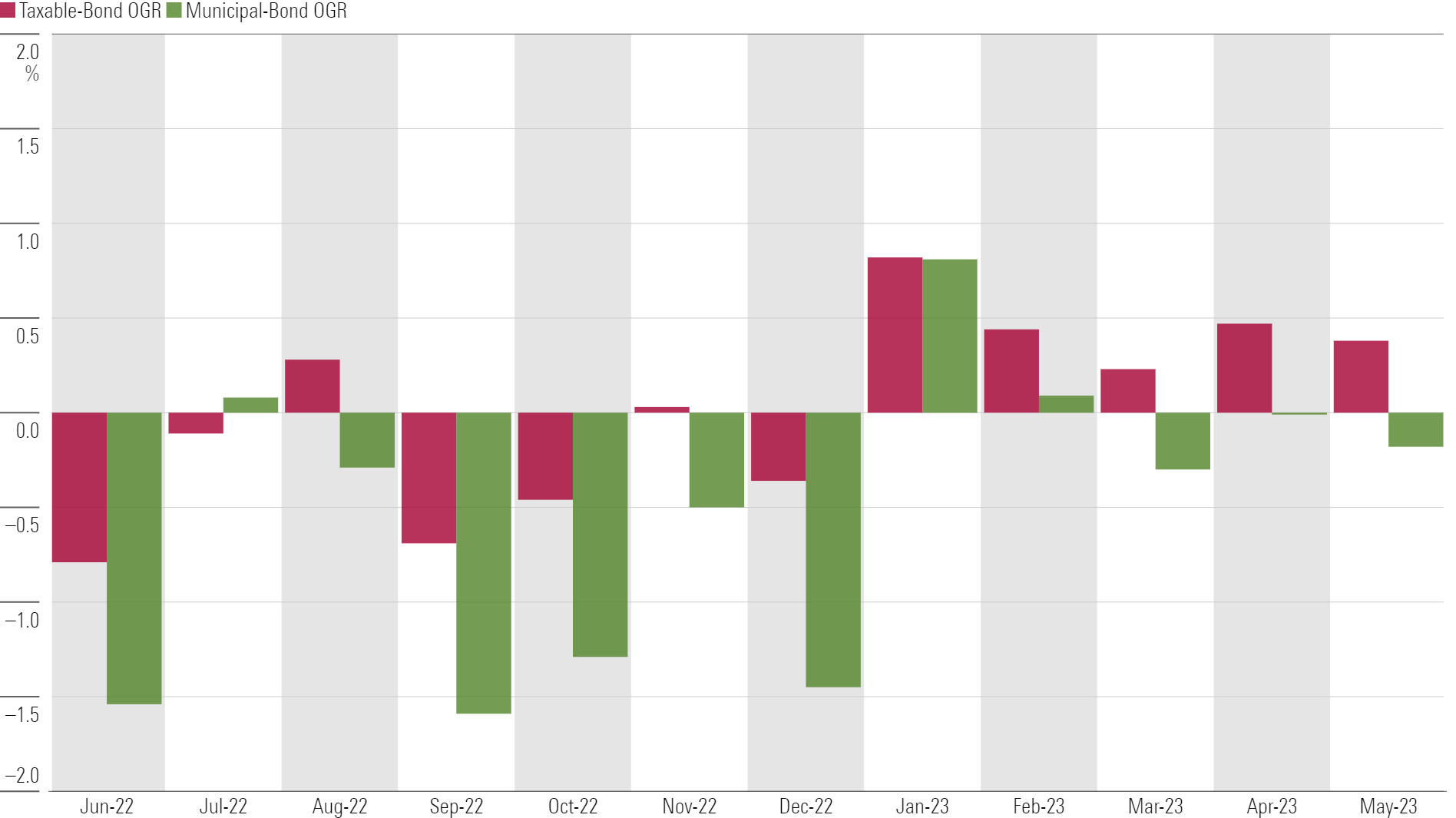

Fixed-Income Organic Growth Rate

Vanguard Hits a Speed Bump

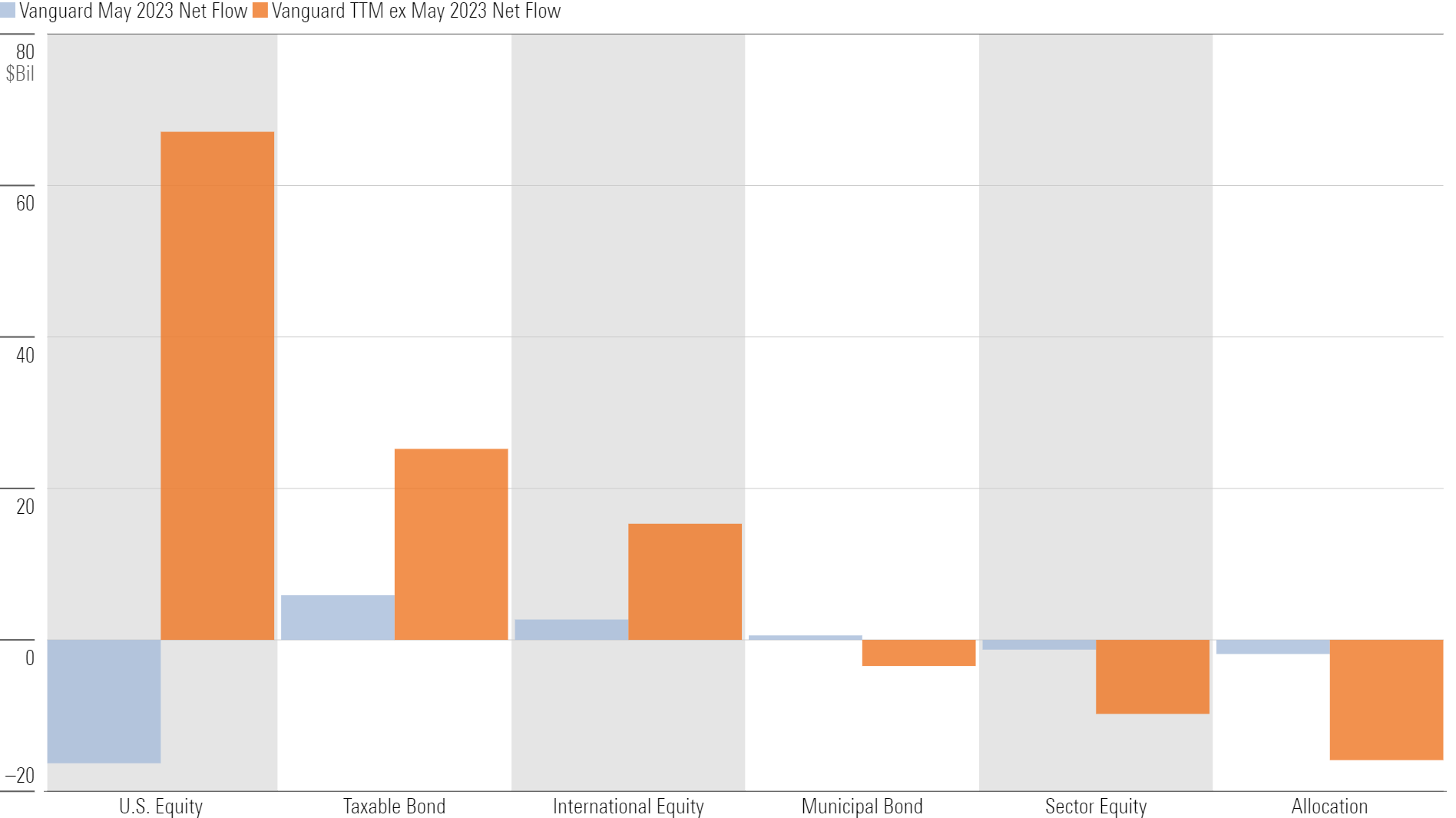

Vanguard shed $10.5 billion in an uncharacteristic month of outflows. That translated into its worst organic growth rate since March 2020. Over $16 billion of outflows from Vanguard’s normally steady U.S. equity lineup torpedoed its overall flows in May. Still, Vanguard’s $30.5 billion year-to-date haul leads all fund providers even after the May outflows.

Vanguard Flows by Category Group

This article is adapted from the Morningstar Direct U.S. Asset Flows Commentary for May 2023. Download the full report here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-14-2024/t_958dc30e28aa4c8593f13c19505966e3_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)