4 Ways ETFs Capture Company Cash Flows

All of these strategies have found success recently. Which opportunity is the right fit for you?

Investing in stocks of companies that generate tons of cash has historically been a winning strategy. Exchange-traded funds offer investors options to take advantage of these opportunities.

Free cash flow measures how much money a company has left over after paying its operating expenses and capital expenditures. Some companies generate a lot of excess cash, while others generate a little or operate in the red. Company management has options for how to deploy positive free cash flow. They can pay down debt, reinvest in company operations, or return that cash to investors, among other uses.

There are numerous theories for how to best allocate that cash, and while we won’t get into the specifics of each here, investor outcome is influenced by how effectively management deploys that cash. Active stock fund managers have tried for years to determine which company management teams are best at deploying it, and which stocks might benefit most. ETF investors avoid the perils of betting on a select few management teams, and by extension a select few stocks. Instead, there are numerous ETFs that offer investors diversified exposure to stocks that A) generate substantial free cash flow, and B) return that cash efficiently to investors. Here, we’ll explore four of these strategies and debate the merits of each.

Capturing Cash Flow

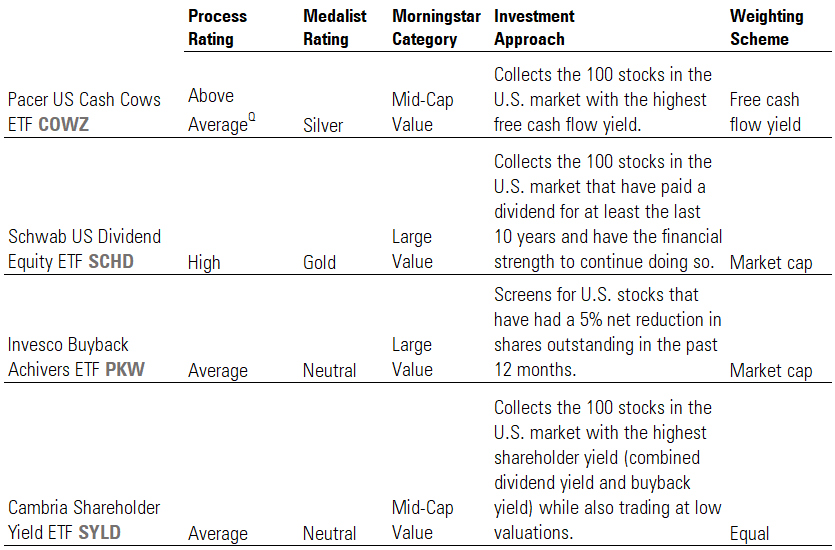

Four ETF strategies that directly or indirectly capture companies with high free cash flow are:

- Free Cash Flow: Captures the stocks with the highest free cash flow in the market.

- Dividend: Captures stocks that return cash to shareholders through dividend payments.

- Buyback: Captures stocks that return cash to shareholders through share repurchases (buybacks).

- Shareholder Yield: Combines dividends and buybacks to capture stocks returning the most value to shareholders in aggregate.

These strategies each offer investors something slightly different, with free cash flow the most direct way of capturing stocks generating lots of cash. The other three take different approaches to sweeping in companies returning much of that cash to shareholders—either through dividend payments, buybacks, or a combination of both (shareholder yield). The table below showcases four ETFs targeting each strategy and explains how their portfolios are constructed.

Returning cash to shareholders is a reliable way to make investors happy. Companies can return cash to shareholders one of two ways: dividend payments or stock buybacks. Paying dividends puts cash directly in investors’ pockets whereas buybacks give investors a slightly bigger piece of the pie by reducing the number of shares outstanding. Each can pad investors’ bottom lines, but dividend strategies are perhaps the most tangible realization of this benefit. This and investors’ thirst for income help dividend-focused strategies flourish. Dividend ETFs now hold more than $390 billion, with Schwab US Dividend Equity ETF SCHD—the largest ETF profiled here—holding nearly $50 billion as of July 31, 2023.

Free cash flow and shareholder yield strategies are more novel. Both aim to find quality companies generating lots of excess cash, but they approach the objective differently. Shareholder yield is an aggregate of a company’s dividend yield and buyback yield, less any net debt reduction. Free cash flow strategies simply collect stocks of companies that enjoy the most free cash flow, regardless of how that cash is deployed. Both should result in largely high-quality portfolios with the shareholder yield approach likely offering a higher dividend yield.

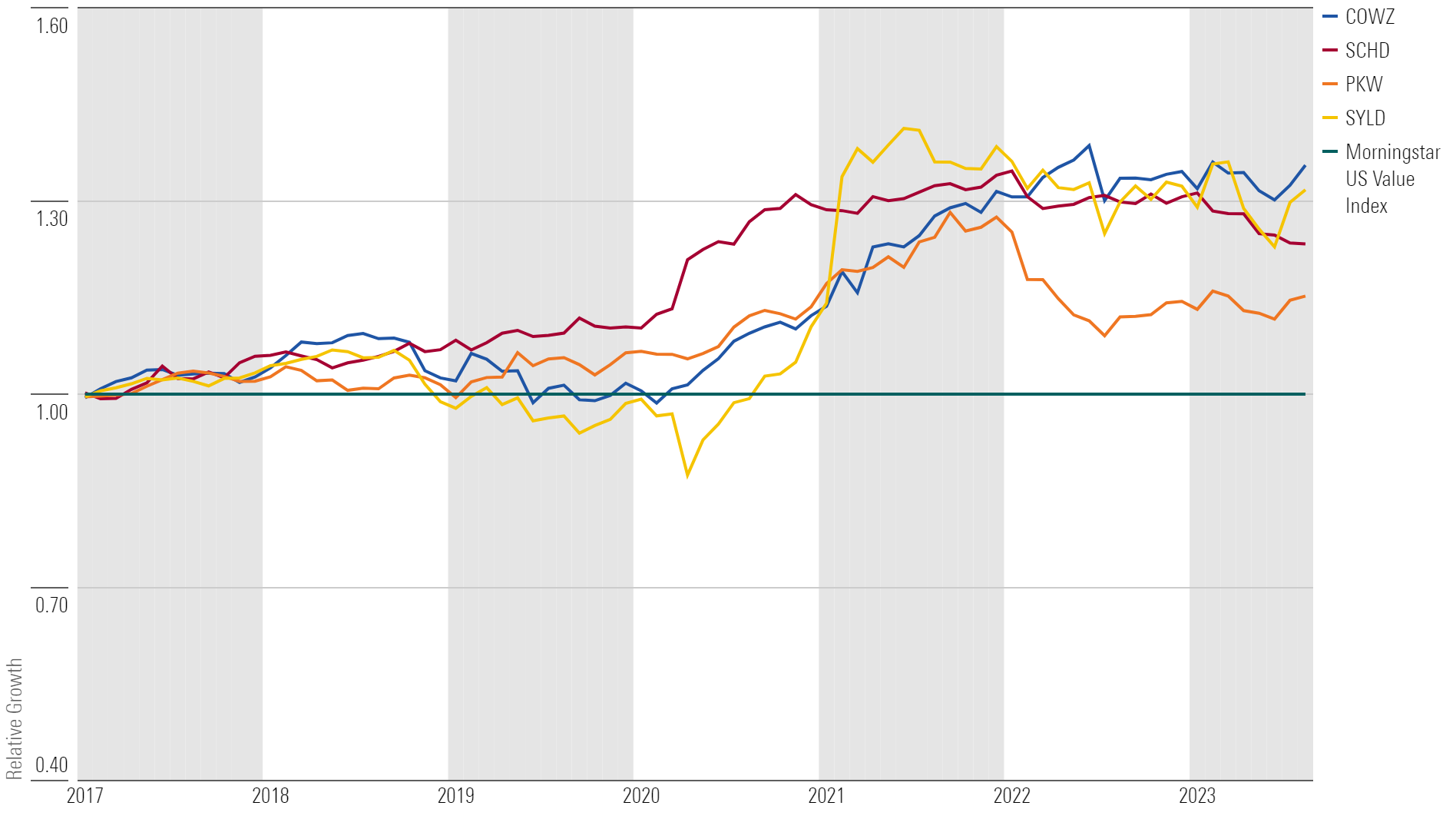

All four strategies have found success recently, boasting impressive track records relative to the Morningstar US Value Index. The below graph shows each ETF’s performance relative to the index since late 2016.

A Strong 2020 Recovery Proved Durable for Most

Over its short life, Pacer US Cash Cows 100 ETF COWZ outperformed each of the other strategies and the Morningstar US Value Index handily. It returned more than 14% annually, earning it top marks in the mid-cap value Morningstar Category. The other ETFs also performed well, demonstrating their efficacy across the varied market conditions of the last few years.

Companies with positive free cash flow are well positioned to take advantage of opportunities to increase enterprise value and stock price. This helped all four ETFs enjoy stellar returns in the post-coronavirus recovery period. Additionally, with the flexibility excess cash offers, these businesses should also be relatively insulated from major market events and economic disruptions, allowing most to maintain their advantage through a turbulent 2022. However, performance only tells part of the story.

Bulls Say/Bears Say

Risk plays an important role in determining the suitability of an ETF for an investor. Strategy risk and expected volatility are central to determining an ETF’s Morningstar Medalist Rating. The Morningstar Medalist Ratings of Silver and Gold assigned to COWZ and SCHD, respectively, suggest the ETFs are highly likely to outperform a relevant benchmark index on a risk-adjusted basis. SCHD’s risk-conscious approach should give it a leg up on the benchmark, while expected strong performance from COWZ should outweigh any extra volatility resulting from its concentrated portfolio. Neutral ratings for Invesco Buyback Achievers ETF PKW and Cambria Shareholder Yield ETF SYLD indicate their long-term risk-adjusted performance should be closer to their category benchmark, with higher volatility expected to wash out any total return advantage.

Inspired by Morningstar Stock Analysts’ “Bulls Say Bears Say,” the points below highlight considerations behind each Morningstar Medalist Rating. They summarize why investors might be confident in a strategy (Bulls Say), as well as risks investors should be aware of (Bears Say).

Free Cash Flow: Pacer US Cash Cows ETF COWZ

Bulls Say:

- Companies with high free cash flow yields have the greatest opportunity to return cash to shareholders and finance further growth.

- In the ETF’s short history, it’s handily beaten most peers and relevant value indexes, demonstrating its efficacy in different market conditions.

Bears Say:

- The strategy frequently turns over and exposes investors to higher risk than its average peer and relevant value indexes.

- The portfolio can concentrate in certain industries and sectors, limiting diversification and elevating active risk.

Dividend: Schwab US Dividend Equity ETF SCHD

Bulls Say:

- The strategy offers a dependably high yield with less risk than many peers. Good for income-seeking and risk-conscious investors.

- The strategy effectively skirts risks inherent to dividend strategies by focusing on companies with a long track record of paying dividends and the fundamentals to continue doing so.

Bears Say:

- Dividend funds can concentrate in sectors and industries that pay consistent dividends like defensives, elevating active share.

- Dividends are taxable, so high-yielding dividend funds can reduce tax-related flexibility for investors in taxable accounts.

Buyback: Invesco Buyback Achievers ETF PKW

Bulls Say:

- Companies buying back stock should be in a strong financial position to do so, which focuses the portfolio on high-quality companies.

- Academic research suggests that stocks of companies which consistently reduce outstanding share count perform better than those that don’t.

Bears Say:

- Companies buy back stock at inconsistent rates and for different reasons, leading to high turnover and an ever-changing portfolio.

- Buying back shares is not always the most efficient use of capital. In some cases, more value can be created for shareholders by deploying that capital differently.

Shareholder Yield: Cambria Shareholder Yield ETF SYLD

Bulls Say:

- Companies reducing debt, paying dividends, and repurchasing shares should be in a strong financial position.

- By combining dividend and buyback yields, a shareholder yield strategy is the best way to benefit from companies returning cash to shareholders.

Bears Say:

- Numerous value screens dilute the positive effect of selecting largely quality companies with the highest shareholder yield.

- The strategy’s complexion may change rapidly given its various screens targeting multiple, sometimes conflicting, factors.

Different Strokes for Different Folks

All four strategies profiled here accomplish something similar, yet different. Each effectively collects companies generating excess cash, but investors must choose the strategy that’s right for them. Gold-rated SCHD’s reliably high dividend yield and quality-focused approach offer risk-conscious income-seeking investors an attractive proposition. Silver-rated COWZ offers compelling historical performance, but investors must be willing to stomach the high volatility associated with its excess returns. Neutral ratings on PKW and SYLD indicate our lack of conviction about whether either fund will underperform or outperform its category benchmark, but both are solid options for investors with high conviction in buyback or shareholder yield strategies.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/5db00d6b-9c2f-4da7-8f94-da4290cf3b4a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHTKX3QAYCHPXKWRA6SEOUGCK4.png)

/d10o6nnig0wrdw.cloudfront.net/05-13-2024/t_4a71dba80d824d828e4552252136df22_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5db00d6b-9c2f-4da7-8f94-da4290cf3b4a.jpg)