Near-Retirement Target-Date Investors Show Signs of Stress

Investors within 15 years of retirement pulled more than $9 billion in March.

Key Takeaways

- Investors in target-date mutual funds that are close to retirement pulled a net $9.4 billion in March as the coronavirus drawdown accelerated during the month. Investors further from retirement stayed the course.

- The net outflows from 2020 target-date funds equaled roughly 4% of assets. That's a much faster rate than the redemption of 2015 target-date funds in the first quarter of 2015.

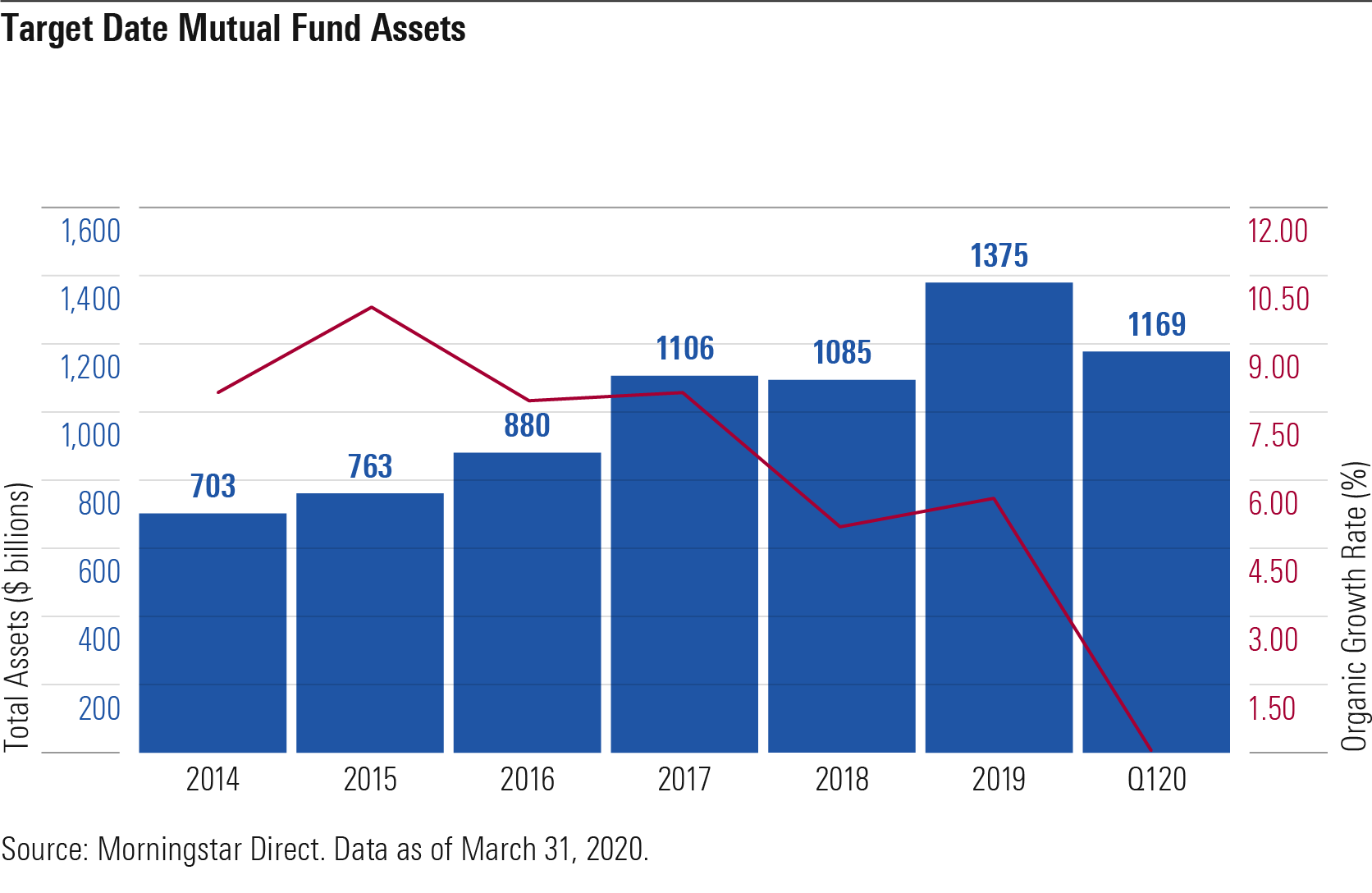

- Total assets in target-date mutual funds shrunk by 15% in the first quarter to approximately $1.17 trillion, down from $1.37 trillion at the end of 2019.

- Organic growth, which measures the growth of assets caused by inflows and outflows, sank to about 0% for the quarter, down from 2% in the first quarter of 2019.

- Vanguard, which has roughly 38% of the market share in target-date mutual funds, had the most outflows in March, with a net $3.1 billion pulled from its series. The 2020, 2025, and 2030 vintages had the largest outflows.

Target-date fund investors have a reputation for shrugging off short-term stock market volatility, but as the coronavirus-driven sell-off accelerated in March, near-retirees saw an unusual amount of selling activity.

Investors planning to retire between 2020 and 2035 showed an unusual lack of discipline, withdrawing approximately $9.4 billion during March. On a positive note, investors further from retirement, where drawdowns were worse during the first quarter, didn’t evacuate the dance floor; the 2040 through 2060 vintages on average had net inflows during the month. Overall, target-date investors withdrew $8.1 billion during March but still realized a net inflow of $2.6 billion during the quarter. With target-date mutual fund assets at $1.37 trillion to start the year, that represents a quarterly growth rate of less than two tenths of a percent. With no organic growth, assets shrunk to $1.17 trillion at quarter-end--a 15% drop from the end of 2019--as global equities and bonds declined. Those numbers exclude collective investment trusts, which made up roughly 40% of the target-date market at the end of 2019. Most firms haven’t reported CIT assets for the first quarter as of April 7, so those target-date strategies aren’t included in this article.

Exhibit 1 shows the change in target-date mutual fund assets from 2014 through the first quarter of 2020 and the organic growth rate from period to period.

The good news is investors' retirement nest eggs are still benefiting from strong returns and a steady stream of contributions throughout 2019. Although total target-date assets fell in the first quarter, they are still higher than they were at the end of 2018. For the most part, although target-date funds posted meaningful losses during the first quarter, they performed as expected through the market volatility. More on the performance of target-date funds during the bear market can be found here.

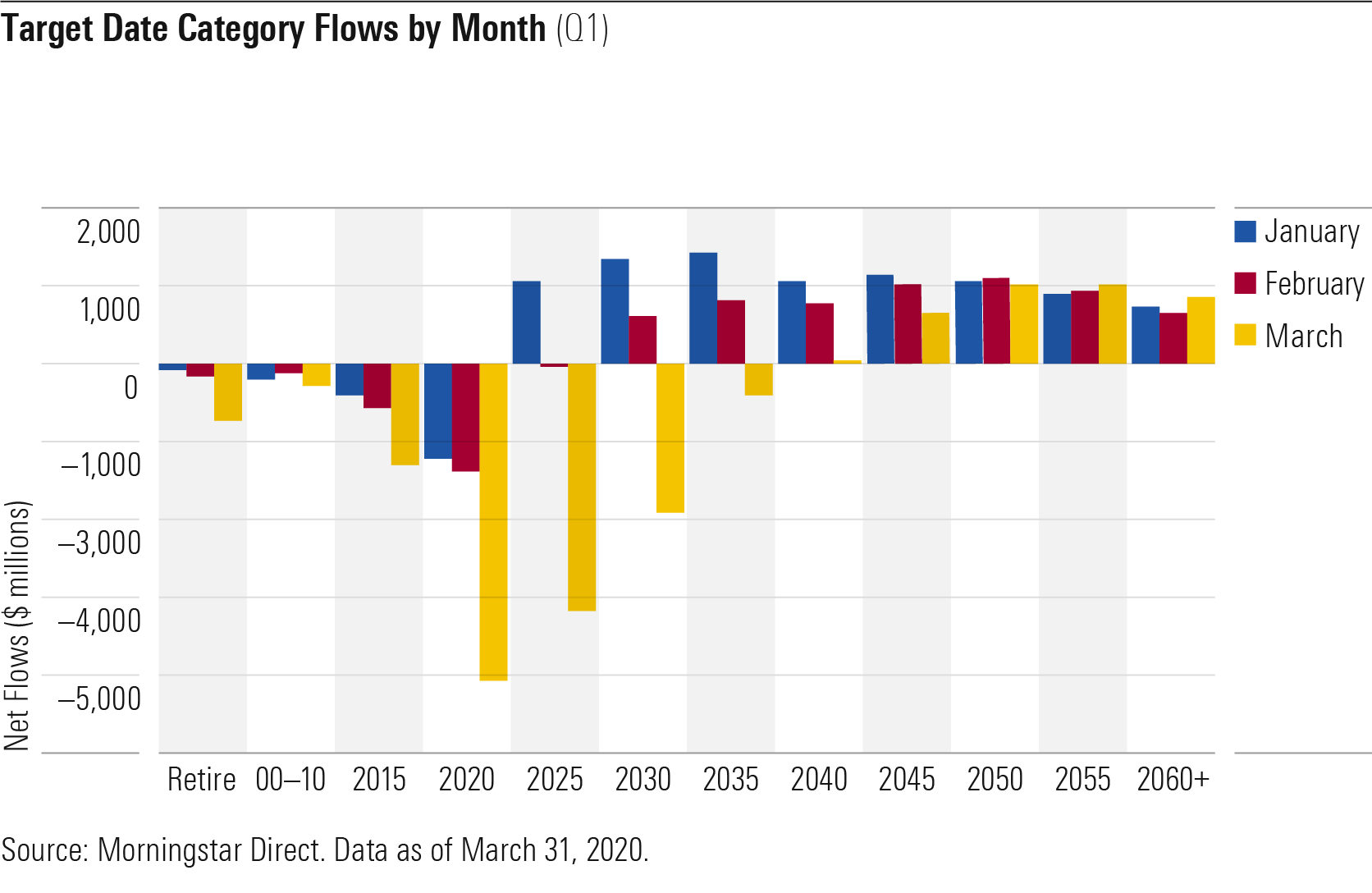

The Morningstar U.S. Markets Index hit its most recent peak on Feb. 19. From then through March 23, the index shed 32.6% before rebounding into the end of the quarter. The sharp sell-off, which marked the fastest 20% decline ever, clearly gave near-retirees the shivers. Exhibit 2 shows the monthly net flows for the first quarter in each target-date Morningstar Category.

In March, investors in 2020 target-date funds accelerated withdrawals while investors in 2025, 2030, and 2035 target-date funds went from flat or positive flows during the first two months of the year to net outflows. It’s not unusual to see net outflows at the target date, but it’s unusual to see investors between five and 15 years from retirement taking chips off the table. Target-date funds are designed to make it easier to have an investment plan and stick to it. Pulling assets during a bear market creates the risk of locking in losses, particularly when time is on an investors’ side.

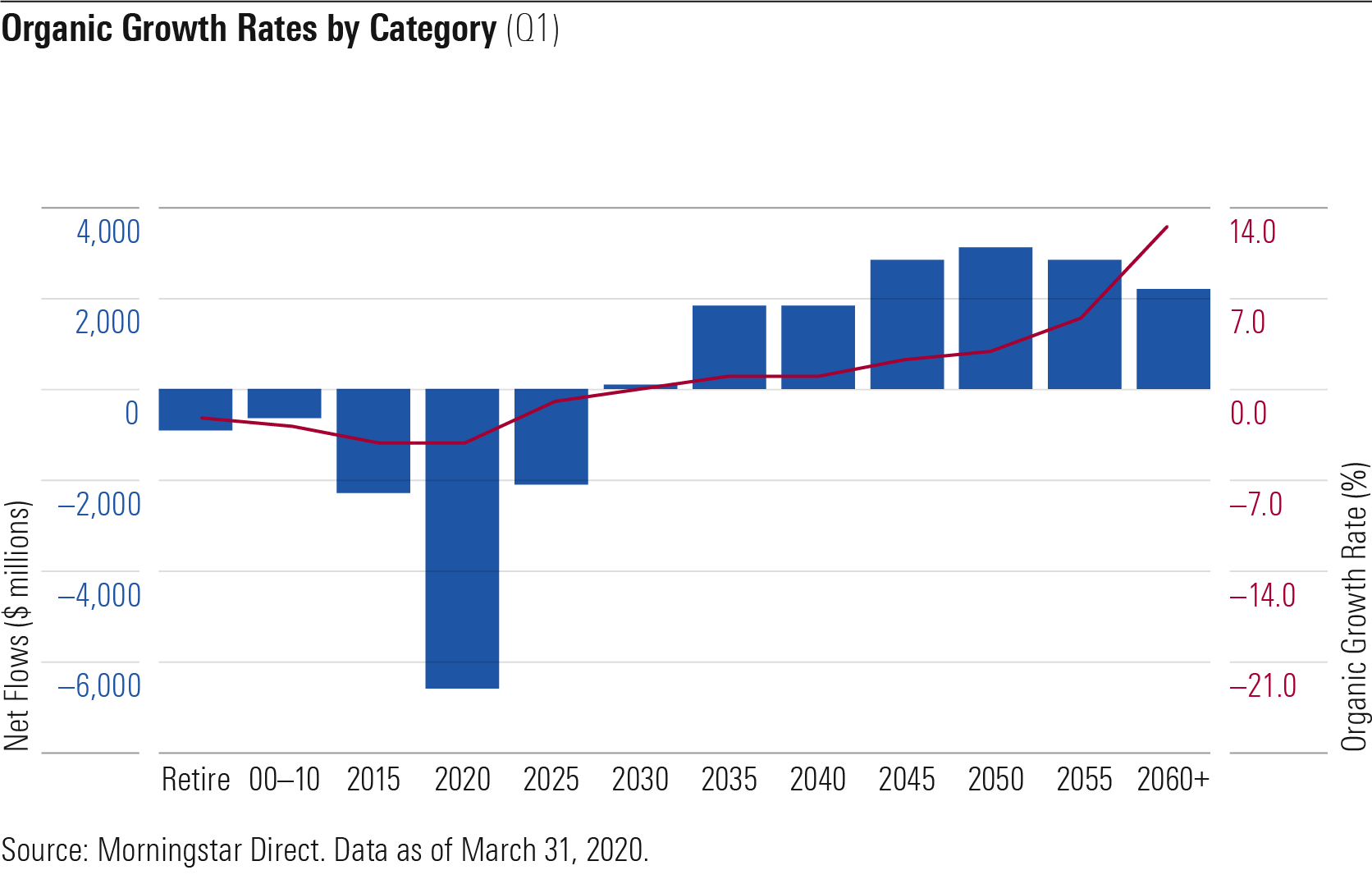

Near-Retirees Are Redeeming Faster Than Before To put the outflows in context, Exhibit 3 shows the total flows and organic growth rates during the first quarter of 2020 for each Morningstar Category.

During the quarter, 2020 funds saw an organic growth rate of negative 4%. Since these investors plan to retire this year, outflows are expected, but the rate of redemptions has been higher than recent history.

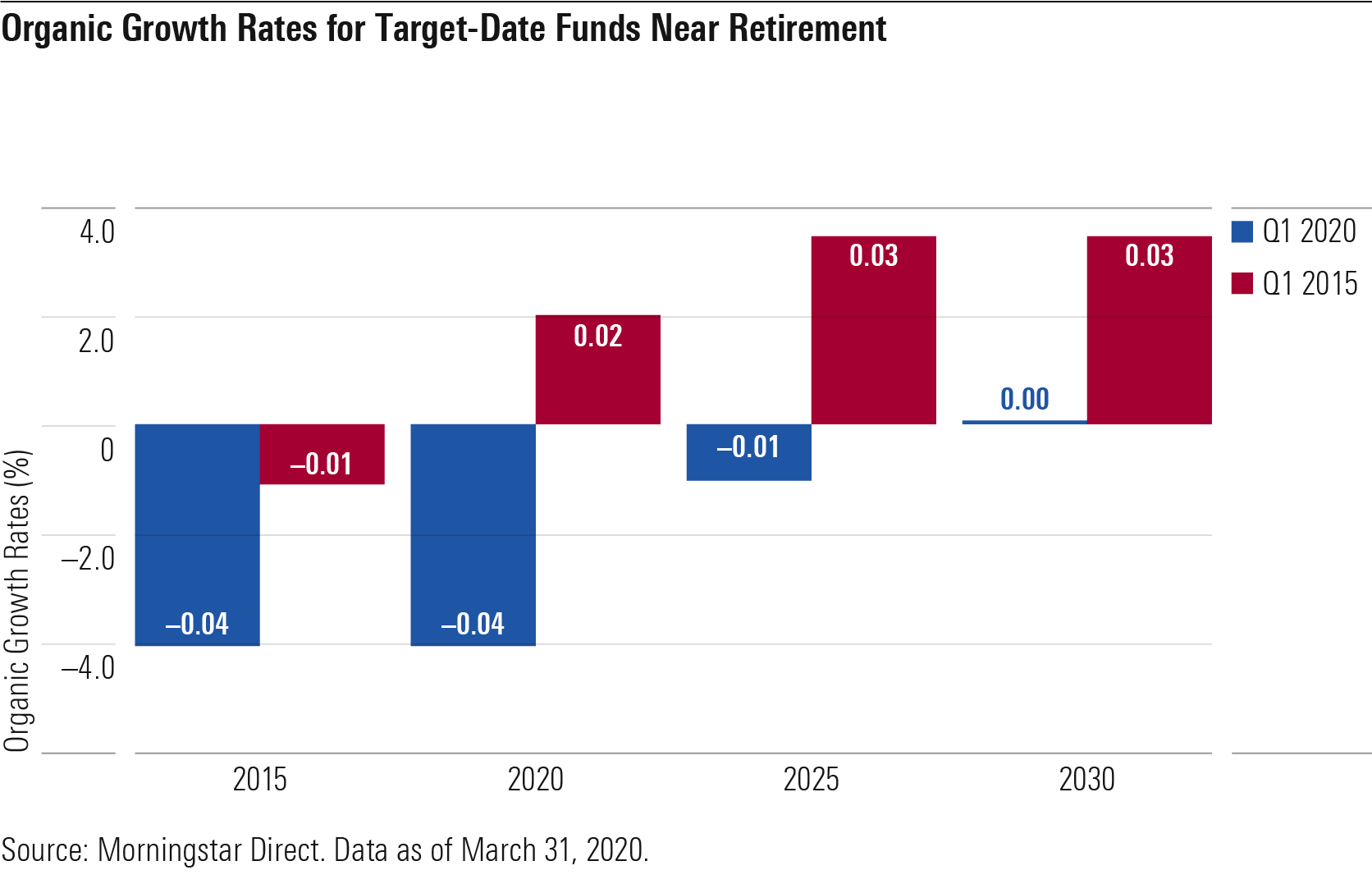

Exhibit 4 shows the organic growth rates for funds near retirement in the first quarter of 2020 and the first quarter of 2015 (since target-date funds are offered in five-year increments, that’s the last year a target-date vintage hit its target-date).

In the first quarter of 2015, funds that hit their target-retirement date only realized a negative 1% organic growth rate in the first quarter, and vintages between five and 15 years from retirement received net inflows. Of course, the market environment in first-quarter 2015 was much different from how it is now, but it’s a good baseline for how target-date fund investors behave in more-normal periods.

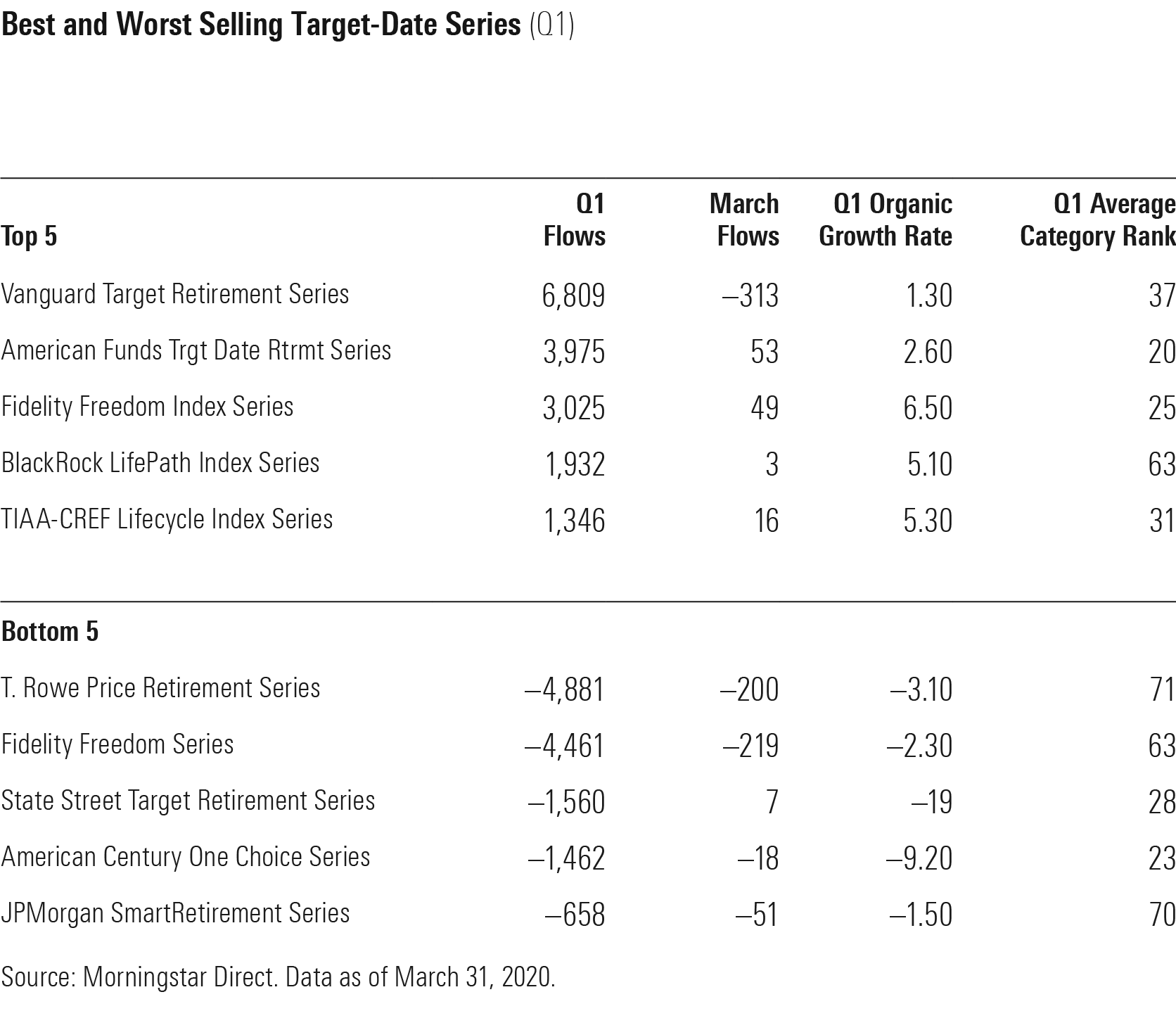

How Target-Date Series Fared Vanguard Target Retirement, which holds around 38% of the target-date mutual fund market share, had more outflows than any other series in March but still was the top asset-gatherer for the first quarter. Exhibit 5 shows the top- and bottom-five target-date series ranked by net flows during the quarter. The average category rank for the quarter of each series' cheapest share class is also included.

It is clear that Vanguard’s outflows weren’t driven by poor relative performance. On average, its cheapest share class finished the quarter ahead of most peers. Its 2020 fund holds slightly more equity than peers, which caused those vintages to fall near the middle of the pack. Even though results were in line with expectations, the 2020 fund still suffered a 10.7% loss for the quarter. That’s obviously a scary proposition for an individual set to retire in the near term, especially given heightened levels of uncertainty for the foreseeable future.

The outflows from Vanguard’s target-date series weren’t isolated to the 2020 fund, however. The 2025 and 2030 funds also saw outflows. Investors pulled $1.38 billion from the 2025 fund, nearly matching the 2020 fund’s outflows. The 2030 fund saw a net $600 million redemption. Investors in 2025 and 2030 funds have time on their side to make back recent losses and risk locking in those lower account values by selling during this bear market.

American Funds, which had the second most inflows for the quarter, realized less severe but still negative flows from its 2020 and 2025 funds, and its 2030 investors were net contributors, which contributed to positive inflows across the series in March.

There aren’t any surprises among the series suffering the most outflows during the quarter. Both T. Rowe Price Retirement Series and the Fidelity Freedom Series have seen a trend in net redemptions from their mutual funds for multiple years. T. Rowe’s outflows have been driven by a shift toward its lower-cost CIT offerings. (It’s likely the shift toward CITs also partially explains the large first-quarter outflow from State Street’s target-date mutual funds; approximately 88% of the firm’s target-date assets resided in CITs at the end of 2019). Fidelity has seen a shift in preference for its lower-cost Fidelity Freedom Index series.

Conclusion The uncertainty around the length and depth of COVID-19's impact on the global economy and financial markets has given investors chills, especially those on the cusp of retirement. Still, staying the course is usually the most prudent option. Target-date funds are designed to make that as easy as possible thanks to their automatic rebalancing and risk reduction over time, which makes them an ideal investment for most retirement savers.

Editor's Note: The fourth exhibit has corrected dates in this version of the article.

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)