Your 2019 Medicare Open Enrollment Checklist

Contributor Mark Miller explains how to effectively and efficiently re-evaluate your prescription drug or Medicare Advantages coverage.

This is the time of year when seniors get some key numbers that will affect their pocketbooks in 2019: Social Security announces its cost-of-living adjustment, and Medicare releases key information about premiums and plan choices.

It's also the time of year when seniors can do something about the cost of healthcare. The annual Medicare fall enrollment began on Oct. 15 and runs through Dec. 7. During this period, you can make money-saving changes to your Medicare coverage and make sure your insurance coverage provides the best match of healthcare providers.

So far, the numbers don't look bad. Earlier this month, the federal government announced a 2.8% Social Security cost-of-living adjustment for 2019; seniors will see the raise in their January benefit payment. That is the largest increase since 2012, when the COLA was 3.6%.

Even better, most seniors will get to keep most of the COLA after it is adjusted for any dollar amount increase in the Medicare Part B premium. The premium typically is deducted from Social Security benefits; while the official number won't be released until later this year, the Medicare trustees forecast last summer that the standard premium will rise just $1.50 to $135.50. If that forecast holds up, most beneficiaries will keep most of the COLA (the math varies among beneficiaries due to the quirky recent history of the "hold harmless" rule, but roughly 70% of beneficiaries will get the full COLA next year minus whatever dollars increase is announced for the standard Part B premium, probably in November).

Shopping for Plans Even if you like your current coverage, it can pay to take a careful look during open enrollment. The design of your prescription drug plan coverage can change annually, and Advantage plans can make changes to their networks of healthcare providers at any time.

Start your shopping process by reviewing the Annual Notice of Change letter that arrives each autumn from your Medicare prescription drug or Advantage plan provider. The Annual Notice of Change details any changes in rules for cost-sharing, coverage of specific medications--and even whether a specific drug will be covered.

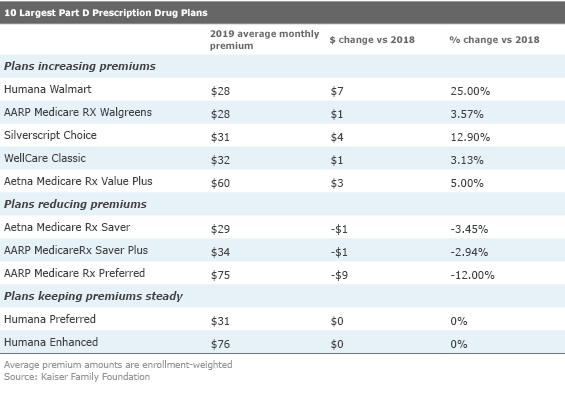

For drug plans, the average Medicare prescription drug plan premium is projected to rise 2% to $42.21, according to analysis by the Kaiser Family Foundation--a weighted figure reflecting actual enrollment in the most popular plans. Importantly, that figure assumes that current enrollees don't switch plans.

But premiums for specific plans can fluctuate widely from year to year, so pay attention to whatever rate is announced in your Annual Notice of Change. According to the Kaiser Family Foundation, among the top 10 plans, average premiums will range from a low of $28 per month (Humana Walmart) to $76 (Humana Enhanced). Among the top 10, premiums will increase for five plans, fall for three, and remain unchanged for two plans, based on current enrollment, the foundation reports (see table below). And a larger share of plans will charge a deductible than in 2018--71% of plans vs. 63% in 2018.

Medicare Advantage Fall enrollment also is the time to switch between traditional fee-for-service Medicare and Medicare Advantage, the all-in-one managed care alternative to the traditional program.

Medicare Advantage has continued to be a popular option--the Centers for Medicare & Medicaid Services projects enrollment for next year of 22.6 million, up 11.5% from this year and accounting for 37% of all Medicare beneficiaries.

Advantage plans provide all-in-one coverage of hospitalization and outpatient services, sometimes for the same monthly Part B premium you pay for traditional Medicare. Most plans offer extra benefits such as basic dental and vision coverage; next year, 90% will include prescription drug coverage, and about 45% of those plans will charge no additional premium for that coverage.

Advantage plans also put an annual limit on your maximum out-of-pocket expense. Plans cannot set the maximum out-of-pocket expense higher than $6,700 per year, and the average next year will be $5,185, according to the Kaiser foundation. The cap often is framed as a plus for Advantage plans--and that is true for healthier enrollees with lower healthcare costs. But seniors with more intensive medical needs likely would be better off in traditional Medicare paired with Medigap supplemental coverage, which typically smooths out spending. You have the predictability of Medigap premiums in exchange for very low out of pocket expenses.

Medigap premiums range annually from as little as $2,000 to $7,000 for the most comprehensive plans. The most comprehensive policies--C and F--cover 100% of Part A coinsurance charges and hospital costs up to an additional 365 days after Medicare benefits are exhausted. (Sales of new C and F policies will be phased out for new buyers starting in 2020, but D and G plans are nearly as comprehensive). This article summarizes what various plans cover.

But here's the sticking point: The choice between traditional Medicare and Advantage is best made at the point of initial Medicare enrollment. That's because you have a six-month Medigap open enrollment period that begins on the first day of the month in which you are age 65 or older and also enrolled in Medicare Part B. During this open enrollment-- also referred to as the guaranteed issue period--insurers cannot charge you more for a Medigap policy due to any pre-existing conditions. Just as important, they cannot cite pre-existing conditions as a reason to refuse to sell you a policy. After that open enrollment, insurers often can charge higher rates or turn you away entirely if you have pre-existing conditions.

New in Advantage Next Year For next year, the Centers for Medicare & Medicaid Services has given insurers the option to add services, such as adult daycare and home-based palliative care or home health aides. Equipment that helps frail seniors stay in their homes also can be covered, including grab bars and stair rails.

But few plans will offer the expanded services for 2019, since the Centers for Medicare & Medicaid Services just announced the new rules in April.

"We'll mainly be doing some experiments on expanded services in 2019 and evolving them further in 2020," says Christopher Ciano, senior vice president for Aetna Medicare.

Another change this year: Enrollees in Medicare Advantage will have an expanded "do-over" opportunity. A new Advantage open enrollment and disenrollment will run from Jan. 1 through March 31. During this period, you can switch between Advantage plans or switch to traditional Medicare. (Previously, it was possible only to disenroll from an Advantage plan.)

Despite the money-saving potential of Advantage, it's important to understand the trade-offs. Traditional fee-for-service Medicare continues to offer the widest choice of health providers; Advantage plans typically are HMO or PPOs that limit you to a network of providers.

Healthcare, Long Range Despite the good news for 2018, the long-range picture on healthcare inflation for retirees remains a concern.

Social Security benefits are becoming less valuable over time. The key reason is the gradual increase in retirement ages set in motion by the reforms of 1983. These act as benefit reductions.

Beyond that, the cost of healthcare continues to rise more quickly than general inflation. For example, the Medicare trustees project that the Part B premium will start rising at a faster pace beginning in 2020, rising anywhere from 5.6% to 10 % annually through 2026.

Overall healthcare inflation is projected to rise 4.22% over the coming 20 years, according to a recent report by research firm HealthView Services. That is down from HealthView's 2017 projection of 5.47%, due mainly to moderation of projected prescription drug costs. HealthView cited ongoing shifts by consumers from brand names to less expensive generics, and the earlier than expected closing of the doughnut-hole gap in plan coverage.

Still, HealthView calculates that healthcare expenses will consume about half (48%) of lifetime Social Security benefits for a healthy 66-year-old couple retiring this year. And the squeeze will get worse in the years ahead due to healthcare cost inflation. HealthView calculates that a 55-year-old healthy couple will need 57% of their benefits to cover future retirement healthcare costs, and a 45-year-old couple will spend 63%.

Useful Resources Medicare Plan Finder: Use Medicare's official plan shopping site to identify good-fit plans. Plug in your Medicare number and drugs (you will need each drug's name and dosage). The plan finder then displays a list of plans that match your needs, including their estimated total cost (premiums and out-of-pocket expenses); which drugs are covered; and customer-satisfaction ratings. The finder also will give you advice about drug utilization and restrictions.

Enrollment FAQ: The Kaiser Family Foundation offers this handy FAQ page on Medicare enrollment.

Medicare & You: Centers for Medicare & Medicaid Services mails out this free handbook in late September; it contains plenty of useful information about Medicare coverage and programs. If you have not received it, call 1-800-Medicare to get a copy, or download it.

State Health Insurance Assistance Programs: Each state has a federally funded state health insurance assistance program that provides free counseling on coverage options. The Medicare Rights Center also offers free counseling by phone (1-800-333-4114).

Mark Miller is a journalist and author who writes about trends in retirement and aging. He is a columnist for Reuters and also contributes to WealthManagement.com and the AARP magazine. He publishes a weekly newsletter on news and trends in the field at https://retirementrevised.com/enewsletter/. The views expressed in this column do not necessarily reflect the views of Morningstar.com.

Mark Miller is a freelance writer. The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)