4 Notable Sustainable Fund Launches

Offerings from Goldman Sachs, BlackRock, and Fidelity broaden the choices for sustainable investors

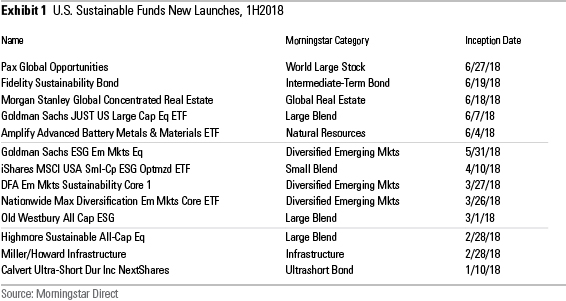

The sustainable funds universe in the United States continued to expand in the first half of 2018, with 13 new funds launched. Eight of them are open-end funds and five are exchange-traded funds. Seven are actively managed and six are passively managed. According to my count, there are now 285 sustainable open-end funds and ETFs available to U.S. investors. To make my list, a fund must make clear in its prospectus that it uses sustainability or environment, social, and governance criteria and/or seeks to deliver measurable impact alongside financial returns.

Here are four especially notable new sustainable funds:

Goldman Sachs JUST US Large Cap Equity ETF

JUST

This fund tracks the JUST U.S. Large Cap Diversified Index constructed and managed by JUST Capital, a not-for-profit created by hedge fund titan Paul Tudor Jones II, with a mission "to build a more just marketplace that better reflects the true priorities of the American people." The index comprises the top 50% of Russell 1000 companies in each industry, based on JUST Capital's annual rankings.

It's what is driving those rankings that's interesting about this new ETF. The organization uses sophisticated public opinion polling to understand the business issues that Americans care about most, then evaluates companies based on those issues and ranks them. The full rankings are available on JUST Capital's website.

Here's the takeaway on the issues Americans care about from the 2017 survey results:

“Perhaps surprisingly, given our divided nation, there’s a lot that Americans agree on when it comes to how companies should behave--across age, ideology, and income, people believe that the world needs more just companies. Companies that believe in fair pay and equal treatment for all workers. Companies that create good jobs and understand the value of strong communities. Companies that are committed to a healthy planet. In general, Americans agree on what the Roadmap for Corporate America should look like, and it starts with a re-evaluation of how to better balance priorities between key stakeholders: employees, customers, communities, the environment, and shareholders.”

That's a ringing endorsement for sustainable investing from Americans across all walks of life. One quibble I have with this ETF is that JUST Capital has aligned with Goldman Sachs to launch it. An investment with the financial-services firm most associated in the public mind with the 1% may not be exactly what many investors who want to help build a more just marketplace have in mind. But that's a marketing problem. As an investment, JUST is an innovative way to help connect everyday investors with investments that are meaningful to them and that make a difference.

iShares MSCI USA Small-Cap ESG Optimized ETF

ESML

After the February mass murder of students in Parkland, Florida, many investors were upset when they realized that their low-cost index funds contained gun manufacturers and gun retailers, and they were also disappointed to learn that, in the small-cap space, no low-cost passive ex-guns alternatives existed.

BlackRock moved quickly after Parkland to rectify that situation by launching iShares MSCI USA Small-Cap ESG Optimized ETF, which has an expense ratio of 0.17%. Based on MSCI's series of ESG optimized indexes, this ETF excludes stocks of producers and retailers of civilian firearms (also tobacco companies and those involved in the making of controversial military weapons). The resulting portfolio is then optimized to maximize exposure to companies with better overall ESG profiles.

ESML not only addresses the concerns of those not wanting to invest in guns but also fills a gap in the passive small-cap space for sustainable investors generally. In fact, those wanting to build a global equity portfolio of low-cost passive ESG funds could use this fund along with its U.S. large-cap (ESGU), EAFE (ESGD), and emerging-markets (ESGE) counterparts, all based on similar MSCI ESG optimized indexes.

Goldman Sachs ESG Emerging Markets Equity

GEBIX

Speaking of emerging markets and speaking of Goldman Sachs, this fund was launched in May and I include it mainly to talk more generally about the growing number of emerging-markets funds that are incorporating ESG. It wasn't so long ago that emerging markets were considered beyond the reach of sustainable investing because of a lack of transparency and data, on the one hand, and on the other hand, the impression that companies in many emerging markets couldn't really operate in an ethical, sustainable manner and still be successful.

But both of those conditions have changed. More ESG information is available to investors, and that enables a better understanding of how emerging-markets companies are handling their ESG risks and opportunities. Including the new Goldman Sachs offering, seven funds now use ESG criteria to build portfolios that are tilted toward companies with better sustainability profiles. At least another 17 funds now consider ESG criteria explicitly as part of their investment process to better analyze emerging-markets companies. I say "at least" 17 funds because that's how many have put that information in their prospectuses. In talking with emerging-markets managers, my impression is that the use of ESG information has become even more widespread as a way to better understand risks, in particular, in emerging-markets companies.

Fidelity Sustainability Bond

FNBSX This new passive fund tracks the MSCI U.S. Aggregate ESG Choice Bond Index, which includes governments, corporates, asset-backed, and mortgage-backed securities, all screened on ESG criteria. With this launch, Fidelity now offers passive sustainable funds covering bonds as well as U.S. and international large-cap equities. The

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)