Top 10 Holdings of Our Ultimate Stock-Pickers Index

Large cap growth strategies make a comeback in 2017; three new names caught our eye this quarter.

By Eric Compton | Equity Analyst

Every fund investor would like to see the manager of the actively managed funds that they own beat the market every year, but they've been left wanting for well over a decade. The lack of consistent outperformance on the part of large-cap active managers (the main contributors to the Ultimate Stock-Pickers concept) has been well documented by the S&P Indices Versus Active Funds (SPIVA) U.S. Scorecard. For the five-year period ending in December 2017, the index group noted that 84.23% of large-cap managers have lagged their respective benchmarks. The results over this five-year period have been similar across all investing styles. A paltry 9.01% of large-cap core managers have outperformed their index versus 14.93% of large-cap value managers and 19.08% of large-cap growth managers outperforming their respective benchmarks.

While five-year results have been poor, active management, and in particular Large-Cap Growth, did make a comeback in 2017. This is undoubtedly related to the fact that the much of the gains of the S&P 500 were driven by higher growth tech companies. Interestingly, active large-cap value also made a comeback in 2017, with a majority outperforming for the year. Morningstar's own large-cap core (8.71%), large-cap growth (24.4%), and large-cap value (10.82%) categories have posted one-year returns (as of May 31, 2018) revealing that growth continues to be the area with the most momentum.

The fund managers represented in our Ultimate Stock-Pickers concept have had their own issues with relative long-term performance. Only seven of our 22 top fund managers were beating the S&P 500 on a 10-year basis at the end of last week. However, 2018 may have better things in store, as eight of our 22 fund managers were beating the S&P year to date. The

As a reminder, the Ultimate Stock-Pickers concept was devised as a stock-picking screen, not as a guide for finding fund managers to add to an investment portfolio. Our primary goal has been to identify a sufficiently broad collection of stock-pickers who have shown an ability to beat the markets over multiple periods (with an emphasis on longer-term periods). We then cross-reference these top managers' top holdings, purchases, and sales against the recommendations of our own stock analysts on a regular basis, allowing us to uncover securities that investors might want to investigate further. There will always be limitations to our process, as we try to focus on managers that our fund analysts cover and on companies that our stock analysts cover, which reduces the universe of potential ideas that we can ultimately address in any given period. This is also the main reason why we focus so much attention on large-cap fund managers, as they tend to be covered more broadly on the fund side of our operations and their stock holdings overlap more heavily with our active stock coverage. That said, by limiting themselves to the largest and most widely followed companies, our top managers may miss out on some smaller ideas that have the potential to generate greater outperformance in the long run.

The overall market rally has essentially stalled out since the beginning of the year. Markets, after shooting above our analysts' aggregate fair value estimates through much of 2017, are now trading in line with these estimates, with our market fair value ratio at 100% at the end of last week (compared with levels such as 113% back in 2006).

Taking a look at the cyclically adjusted price/earnings, or CAPE, ratio, which divides the current market price by the average of 10 years of earnings (adjusted for inflation), it currently stands at around 32.83, above where it was for our last article (32.7). This is compared with a historical mean of 16.85 and median of 16.15, with Shiller relying on market data from both estimated (1881-1956) and actual (1957 onward) earnings reports from companies represented in the S&P 500 Index. It also represents the second highest ratio in history, behind only the dot-com bubble, where the ratio achieved a value of 44.19. Today's levels are also above levels seen for events like Black Tuesday or before the Great Financial Crisis. The CAPE ratio is generally used to assess potential returns from equities over longer time frames, with higher-than-average CAPE values implying lower-than-average long-term annual returns going forward, which is what we're gleaning from the current ratio. While not intended to be an indicator of impending market crashes, it has provided warning signs for investors in the past.

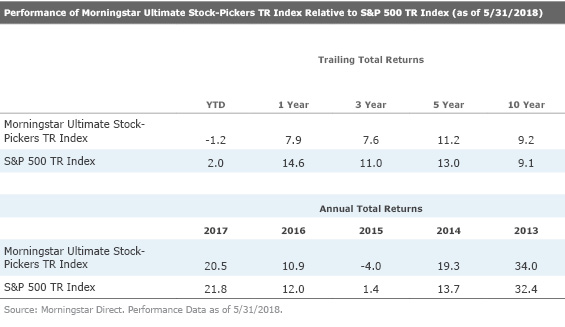

Performance of Morningstar Ultimate Stock-Pickers TR Index Relative to S&P 500 TR Index (as of 5/31/2018)

- source: Morningstar Analysts

Aside from tracking the holdings, purchases, and sales as well as the ongoing investment performance of our Ultimate Stock-Pickers, we also follow the makeup and results of the Morningstar Ultimate Stock-Pickers TR Index. For those who may not recall, the Ultimate Stock-Pickers index was set up to track the highest-conviction holdings of 26 different managers, a list that includes our 22 top fund managers as well as the investment managers of four insurance companies—

The index itself is composed of three subportfolios—each one containing 20 securities—that are reconstituted quarterly on a staggered schedule. As such, one third of the index is reset every month, with the 20 securities with the highest conviction scores making up each subportfolio when they are reconstituted. This means that the overall index can hold anywhere between 20 and 60 stocks at any given time (because some stocks may remain as the highest-conviction score holders in any given period, meaning there can be overlaps in the holdings, reducing the total number of different stocks held). In reality, the index is usually composed of 35 to 45 securities, holding 41 stocks in all at the end of May. These stocks should represent some of the best investment opportunities that have been identified by our Ultimate Stock-Pickers in any given period. It can also have more concentrated positions than one might find in a typical mutual fund, with the top 10 (25) holdings in the index accounting for 44.8% (82.5%) of the total invested portfolio at the end of last month. The size and concentration of the portfolio does change, though, as this is an actively managed index that tries to tap into the movements and conviction levels of our top managers over time.

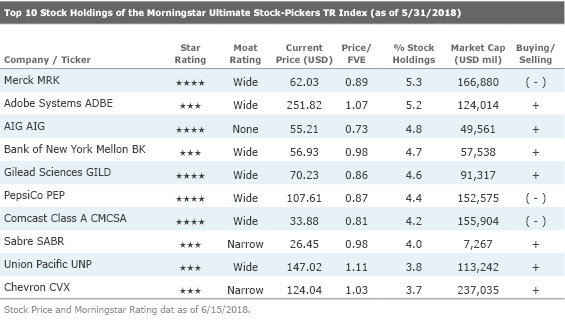

Top 10 Stock Holdings of the Morningstar Ultimate Stock-Pickers TR Index (as of 5/31/2018)

- source: Morningstar Analysts

Looking at the top 10 stock holdings of the Morningstar Ultimate Stock-Pickers index at the end of May, there are currently only a couple of names trading at over a 15% discount to our analysts' fair value estimates. No-moat-rated

The other name trading at a more sizable discount on our list is

Bidding war for Fox assets aside, Macker has left his wide moat rating and $42 fair value estimate in place. Macker believes that Comcast is the best-positioned U.S. communications firm, especially in the face of disruption by technology companies. Irrespective of the challenges faced by traditional pay TV, broadband demand continues to accelerate. Macker believes Comcast is better situated to benefit from this trend due to its faster Internet speeds compared with many of its telco peers. With Comcast improving its broadband speeds further with the deployment of DOCSIS 3.1, he believes its performance advantage over the telcos could widen. Most importantly, even though the implications of 5G wireless are far from certain at this time, he views the deployment of 5G as more of an opportunity than a threat for Comcast. Fiber will be critical for a 5G backhaul. Therefore, Macker would rather be a regional cable company with near-ubiquitous dense fixed-line coverage than a national wireless company with limited fixed-line coverage. Even in the current 4G marketplace with unlimited data, around 75% of Internet traffic still travels via Wi-Fi. If a substantial portion of current fixed-line traffic switched over to wireless, Macker doubts wireless networks would be able to handle the added load.

Further, Macker also likes Comcast’s positioning with business customers. Established in 2015, Comcast’s enterprise division has delivered impressive share gains in the small-business segment. With its share of the enterprise market still only about 5%, he believes a sizable opportunity remains. While he is less favorable on the NBCUniversal side of the business given the changing media and distribution landscape, he expects NBCU’s broad and deep content offerings, including sports programming, to remain in demand. He also thinks that a strong film slate and continued theme park strength could help mitigate challenges in the cable and broadcast TV businesses. With Comcast shares tumbling over 20% since their peak in late January, now may be a good time to gives shares a look.

Moving on to other names trading at discounts,

Vora attributes Pepsi's underperformance this year to apprehension around industrywide pressures facing the soft drink category (stock returns across the soft drink companies Morningstar covers have declined year to date) as well as concerns that Pepsi's competitive position in this market is weakening. While performance in the firm's North American beverage segment has softened, with volume declining over the past three quarters, Vora posits that Pepsi's renewed commitment to allocating resources to its trademark brand will help curb further share losses in the cola category. Vora also notes that the firm has been able to drive low-single-digit improvements in price/mix within this segment over the same time frame, indicating that its brand equity remains healthy. As such, Vora's view of Pepsi's competitive edge hasn't wavered, and she contends that its enviable portfolio of beverage and food brands (with 22 brands that each generate $1 billion in annual sales) has helped it ingrain itself in retailers' supply chains and secure valuable shelf space. This intangible asset, coupled with economies of scale in manufacturing and distribution, forms the basis of her wide moat rating.

Vora's longer-term outlook for the North American beverage segment remains modest, with sales averaging low-single-digit growth over the next decade, primarily driven by improvements in price/mix as the firm continues to benefit from price-pack architecture and brings more premium products to market. Vora's current fair value estimate of $123 incorporates 3% sales growth (two thirds contribution from price and mix) and average operating margin in the high-teens over our forecast period. She thinks the current discount in share price, combined with a 3% dividend yield, provides a potential opportunity for long-term investors.

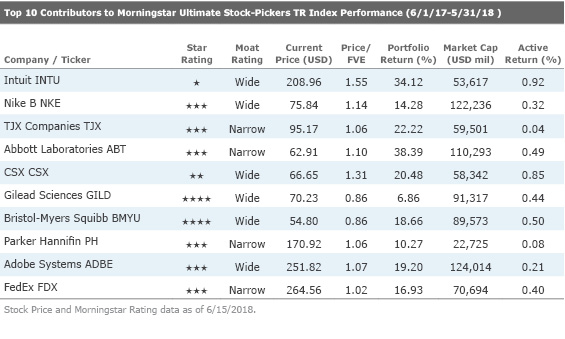

Top 10 Contributors to Morningstar Ultimate Stock-Pickers TR Index Performance (6/1/17-5/31/18)

- source: Morningstar Analysts

Looking at the year-over-year performance of the Morningstar Ultimate Stock-Pickers Index from June 1, 2017, to May 31, 2018, two high performing standouts from the top 10 contributors included wide-moat

Intuit shares have appreciated substantially over the past year and a half, up over 80% since the start of 2017. This rapid rise in share price has run away from Morningstar analyst Andrew Lange's fair value estimate of $135. Most readers will likely be familiar with Intuit because of its online tax services. The firm owns brands such as TurboTax and QuickBooks, and it is even trying to grow in the banking/budgeting space with its Mint platform. The firm recently upped guidance for growth in its last quarterly earnings, but even factoring in these higher growth rates only gets Lange's fair value estimate up to its current level of $135 (from $120 previously). Lange currently projects the company growing revenue at roughly an 11% CAGR over the next five years while margins expand and the return on invested capital reaches over 50%. Even with these types of projections for the wide-moat firm, Lange can't get anywhere close to today's prices, and it seems likely that the outperformance from Intuit may have run its course.

CSX Corp. has also outperformed recently, up over 30% since the lows seen in February, pushing it past Morningstar analyst Keith Shoonmacher's current fair value estimate of $51. CSX is one of the major railroad operators in the United States, and the firm has seen several significant events in the last half year. Former CEO Harrison was a railroad turnaround legend, and he passed away in December before he had completed what was to be his turnaround of CSX's operations. CSX has since installed Jim Foote as the new head of the company. Foote had robust experience working with Harrison in the past, making Schoonmacher believe Foote can implement many of the changes Harrison would have done, but Schoonmacher also believes some caution is warranted and doesn't quite project the full level of successes he would have if Harrison had still been at the helm. However, even Schoonmacher's original projections for operations under Harrison only pushed his fair value up to $54. This estimate was then lowered to $51 after Harrison passed away. Schoonmacher also believes coal is in a long-term, secular decline given current trends in the energy industry. With shares currently trading above $66, investors may do better to look elsewhere or wait for a better entry point.

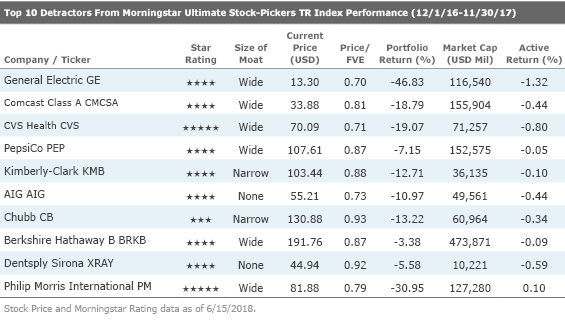

Top 10 Detractors From Morningstar Ultimate Stock-Pickers TR Index Performance (12/1/16-11/30/17)

- source: Morningstar Analysts

While lists of top-performing stocks would expectedly be largely composed of stocks that have run up, our top detractors list can sometimes be a good area to pick through the wreckage. We have already covered Comcast and PepsiCo in this article, and we covered

Philip Morris is, of course, one of the most famous tobacco companies in the world, and poor industry headlines and worries about the long-term future of the business are not new by any stretch of the imagination. Philip Morris recently reported disappointing quarterly results, causing the stock to drop roughly 15% largely due to lower sales volumes within the company's iQOS product segment. iQOS is a product where tobacco is heated in an electronic device but to a much lower temperature than what would be caused by burning with fire. According to Philip Morris, this releases much lower toxin levels while still releasing similar taste and nicotine levels as a normal cigarette.

The headline number shows that Philip Morris' first-quarter shipment volume of Heatsticks (i.e. the tobacco supply for the iQOS devices) in Asia fell by almost half sequentially from the fourth quarter. Gorham has argued in the past that he expects demand to plateau, but not collapse for this product set, and several indicators from the quarter support his view. First, Philip Morris' share was slightly up sequentially, so significant market share shifts to competitive products offered by

Gorham had been concerned over the margin profile expectations being built into heated tobacco products prior to the stock's decline. A bull case can be made for Heatsticks being higher margin even than cigarettes, if the planets align. The devices, on the other hand, are unlikely to have much pricing power, as barriers to entry for other tobacco manufacturers are fairly low. Indeed, since the entry of British American and Japan Tobacco into Japan last year, Gorham has noticed some discounting of the iQOS device to the tune of around 30%, and he expects this promotional activity to intensify in the face of the device oversupply. It is more likely than not, in Gorham's view, that the heated tobacco category reverts to a razor-and-blade business model, where the devices are not profitable and the margin is made entirely through the sale of Heatsticks.

With the stock down 30% from its peak, however, all of this appears to be priced in, and Philip Morris is undervalued relative to Gorham's fair value estimate. The company's wide economic moat is intact, despite this wake-up call to investors, and he thinks the pullback presents an opportunity to invest in a high-quality name at a reasonable discount.

If you're interested in receiving e-mail alerts about upcoming articles from The Ultimate Stock-Pickers Team, please sign up here.

Disclosure: Eric Compton has no ownership interests in any of the securities mentioned. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ROHC7ZXJXZU7LIKGTTYJTD667I.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)