Ultimate Stock-Pickers: Top 10 High-Conviction and New-Money Purchases

We uncovered two undervalued stocks that multiple top managers were buying earlier this year.

By Eric Compton | Equity Analyst

For the past nine years, our primary goal with the Ultimate Stock-Pickers concept has been to uncover investment ideas that not only reflect the most recent transactions of our grouping of top investment managers but are also timely enough for investors to get some value from them. In cross-checking the most current valuation work and opinions of Morningstar's own cadre of stock analysts against the actions (or inactions) of some of the best equity managers in the business, we hope to uncover a few good ideas each quarter that investors can dig in to a bit deeper to see if they warrant an investment.

With all our Ultimate Stock-Pickers having reported their holdings for the first quarter of 2018, we now have a good sense of what stocks piqued their interest during the period. The Morningstar coverage universe now trades at 96% of our aggregate fair value estimates, compared with 104% when this article came out last quarter. This is quite close to the 52-week low of 95%.

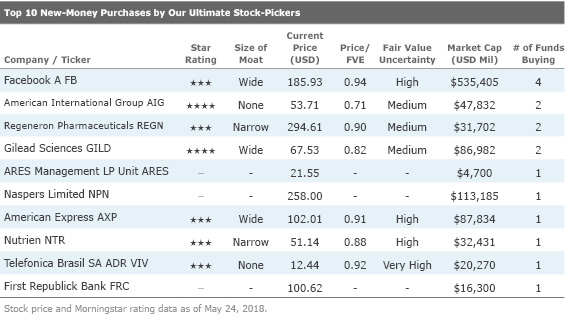

Recall that when we look at the buying activity of our Ultimate Stock-Pickers, we focus on high-conviction purchases and new-money buys. We think of high-conviction purchases as instances when managers have made meaningful additions to their portfolios, as defined by the size of the purchase in relation to the size of the portfolio. We define a new-money buy strictly as an instance where a manager purchases a stock that did not exist in the portfolio in the prior period. New-money buys may be done either with or without conviction, depending on the size of the purchase, and a conviction buy can be a new-money purchase if the holding is new to the portfolio.

We also recognize that the decision to purchase any of the securities highlighted in this article could have been made as early as the start of October, with the prices paid by our managers being much different from today’s trading levels. Therefore, we believe it is always important for investors to assess for themselves the current attractiveness of any security mentioned here based on myriad factors, including our valuation estimates and our moat, stewardship, and uncertainty ratings.

Looking more closely at the top 10 high-conviction purchases during the first quarter of 2018, the buying activity was similarly diversified compared with last quarter, with most bets seeming to be name specific rather than broad industry bets. The two names that stuck out to us from this list based on valuation were

Top 10 High-Conviction Purchases Made by Our Ultimate Stock-Pickers

Once again, there was a moderate amount of crossover between our two top-10 lists this period, with seven names on both lists. There were four names with at least two funds initiating new-money purchases this quarter. In addition to the names already mentioned,

Top 10 New-Money Purchases Made by Our Ultimate Stock-Pickers

From a valuation perspective, CVS was the most attractive to make our top 10 lists. This stock was covered extensively last quarter, as it was one of the most undervalued names then as well. Below we have a brief update.

The stock currently trades at a 44% discount to Morningstar analyst Vishnu Lekraj's fair value estimate. Lerkraj continues to believe that CVS presents an excellent opportunity for investors seeking to own a high-quality healthcare player at a significant discount. CVS recently reported first-quarter 2018 earnings, with Lekraj reiterating his $99 fair value estimate and wide moat rating for the firm. The firm reported a robust increase in revenue for all segments as its efforts to become a preferred pharmacy in restricted networks drove the retail top line, and a good gain in client wins and client member growth bolstered its PBM operations. While earnings were good, the main focus going forward will obviously be the acquisition of Aetna.

Management stated that the merger was on track and expected to close by the end of 2018. CVS has established an integration team, realigned its operations to make the transition easier, and issued acquisition-related bonds to lock in a low cost of debt. Aetna reported that it has also reorganized its own operations by combining all healthcare operations and selling its nonhealthcare businesses. In addition, the managed-care organization acquired 279,000 new Medicare members as it looks to build its portfolio in one of the fastest-growing and most consistent health insurance cohorts. This development falls in line with what the management teams of both CVS and Aetna said was their stated operational goal for the new healthcare services company. We believe this preparation well ahead of the transaction closing is a positive, as it should lessen any major integration issues between the two complex firms.

The combination of Aetna and CVS should allow the combined firm to acquire high-maintenance and higher-cost members where there is opportunity to service them more efficiently and cost-effectively. The new firm should also be able to drive as much healthcare servicing and consumption as possible to non-acute-care facilities, in particular to CVS retail locations and member home-care settings. Lekraj believes this overall strategy has significant potential to drive material economic profits over the coming decades. With this combination, the new CVS-Aetna healthcare services firm will fundamentally change how healthcare will be provided to individuals. The new entity will be one of the most powerful players in the healthcare ecosystem, becoming a healthcare services behemoth with the infrastructure to sell insurance and manage/treat members through every aspect of their healthcare treatment regimens.

Lekraj believes this capability will be a key asset in servicing members with chronic and recurring medical issues. The firms will be able to leverage the significant retail footprint of CVS and its powerful PBM to better control the cost of treating patients. The firms will also be able to leverage Aetna’s large insurance membership book, solid underwriting and plan design capabilities, and sales and marketing expertise. Lekraj further believes the combination of these operations will give the new CVS-Aetna entity a key advantage in bringing down the cost of treating traditionally higher-cost individuals, which should fit well within current topical trends within the industry. If investors are comfortable with the execution risk associated with a transformative acquisition, which Lekraj does admit is a material risk for shareholder value impairment, all within an industry that also has significant potential for regulatory changes, the name may make sense for further investigation.

The other compelling bargain to make our lists was no-moat rated American International Group. We don't often see insurance names on our lists, and AIG offers investors a unique opportunity, trading close to a 30% discount to book value.

AIG is still in turnaround mode, and CEO Brian Duperreault was the man brought in to affect a true turnaround in May of last year. The overall story is simple, Duperreault simply needs to bring the firm back to an underwriting profit and bring stability to the firm, and then it should be worth at least book value, which is roughly where Morningstar analyst Brett Horn values the firm, with a $76 fair value estimate.

Unfortunately, the latest earnings weren't impressive. For the quarter, AIG generated a 6% annualized return on equity, or 8% on an adjusted basis, with the pattern of strong results in life insurance partially offsetting weakness in property and casualty operations continuing. Some negative factors in the quarter, such as higher catastrophe losses and weaker investment results, did not particularly concern Horn. Underwriting results in P&C lines remain poor, highlighting the work the company needs to do to bring underwriting to a level in line with peers. The combined ratio for the quarter was 103.8% compared with 99.8% last year. Higher catastrophes weighed on results, but even the underlying combined ratio (which excludes catastrophes and reserve development) deteriorated a bit year over year, although it basically held level with the last couple of quarters. A higher expense ratio was an issue, which management attributed to a more active use of reinsurance (so the shift might make sense on a risk-adjusted basis), but management believes it has some opportunities to reduce costs to bring the expense ratio back in line.

Despite the relatively poor showing, Duperreault committed to generating an underwriting profit (assuming normalized catastrophe losses) by the fourth quarter. Horn notes that improving the underwriting culture at such a large organization is not a quick fix, and he appreciates that management is willing to lay out a specific target on a reasonable timeline. A turnaround of the P&C unit, to even a modest underwriting profit, would put the company in a position to generate adequate returns.

The top-line numbers showed that AIG continues to retrench. Excluding a one-time issue in Japan, Horn estimates that net written premiums were down 7% year over year. In Horn's view, AIG is wise to continue to actively reduce volume in its troubled commercial lines, which was exactly what happened with commercial net written premiums down 10%. Personal lines, which tend to be adequately profitable, were more stable.

For Horn, the biggest bright spot in the quarter was that the company recorded favorable reserve development, which equated to 1.6% of net earned premium. While the amount was modest, and Horn hesitates to make too much of one quarter, it has been some time since the company has been able to achieve this. After significantly de-risking the book with the Berkshire deal, and now, with internal results seemingly moving past the reserve development issues that have plagued the company, AIG appears to be much closer to stable and acceptable returns. While Horn sees these glimmers of hope for the firm, he does not believe the value prices in any meaningful opportunity for improvement, and this is despite the latest results and despite Duperreault's record of success in lines where AIG needs to improve.

No discussion would be complete without looking at what Berkshire has been up to, and lately that has primarily consisted of adding to the Apple stake. Berkshire purchased 74.2 million additional shares of Apple for an estimated $12.5 billion, which lifted the tech giant to more than one fifth of Berkshire's equity portfolio—and to the number one position—at almost twice the size of

We have been through the Apple thesis many times, which readers can find in previous publications. The most recent earnings generally fit with Colello's expectations. He notes that the third-quarter forecast, which was provided during the current earnings, was not as bad as he had feared. Although the iPhone X “super cycle” did not transpire over the past six months, iPhone unit sales did hold up well while higher average selling prices, or ASPs, per device continued to contribute to robust revenue growth. Colello was also impressed with growth seen in Other Products and Services, especially as he believes that sales of add-on hardware and services should continue to drive switching costs that will help Apple make repeat, high-margin iPhone sales to its customers over time. Meanwhile, the company is repurchasing shares at a blistering pace, authorizing another $100 billion of share repurchases (or just over 10% of the current market cap) while boosting its quarterly dividend by 16% to $0.73 per share (or roughly a 1.5% yield), taking advantage of changes in U.S. corporate tax policies.

For the June quarter, Apple expects revenue in the range of $51.5 billion-$53.5 billion which, at the midpoint, would represent 16% year-over-year growth. Colello calculates that this forecast implies iPhone unit sales in the low- to mid-40 million unit range, or low- to mid-single-digit year-over-year growth. Yet unit sales at such levels would also imply another quarter of low-double-digit revenue growth, again thanks to structurally higher ASPs with the iPhone X introduction than in the year-ago quarter. Decent growth for a company of Apple's size.

Colello notes that many component suppliers pointed out slowdowns in smartphone-related chip orders in recent weeks, implying Apple as the main culprit. From Colello's vantage point, it looks like demand for the iPhone lineup is still relatively healthy, but that Apple has a significant inventory buildup which it will attempt to drawdown in the June quarter. He notes Apple’s inventory balance of $7.7 billion as of the end of March, versus $2.9 billion at the end of the March 2017 quarter and $4.9 billion at the end of the September 2017 quarter. He suspects that Apple built up enough iPhone Xs to prepare for a super cycle, but as one did not emerge, the company will sell these prebuilt devices in the June quarter (and perhaps September as well), thus severely crimping its ongoing iPhone production and passing the ramifications down through its supply chain. He views this as an encouraging sign for not only Apple, but its suppliers as well, as any wireless chip weakness appears to be a timing problem rather than Apple losing market share. While the overall trends are positive, he believes the market is fairly accounting for this, with shares trading at roughly 7% above his current fair value estimate of $175.

Staying within the tech sector, we are highlighting

For the most recent quarterly earnings, Facebook reported better-than-expected top- and bottom-line results while posting growth in daily and monthly active users, which Mogharabi sees as indicative that the firm’s all-important network effect (a key source of its wide economic moat) is intact. Mogharabi argues that Facebook’s first-quarter results provide some support for his view that the firm can regain user trust and weather the Cambridge Analytica and overall data privacy issues it is currently facing. He believes Facebook is likely to endure the short-term impact of the scandal and does not expect a significant long-term headwind to Facebook's platform, operations, or wide moat rating.

In greater detail, Facebook’s monthly average users (MAU) increased, and daily average user (DAU) counts were up 13% year over year, which was helped by growth in all regions. Mogharabi was impressed by the sequential increase in U.S. and Canada DAUs, after the company had reported a 1% sequential decline in the fourth quarter of 2017. It appears that some improvement in the user experience, possibly due to more relevant content being made available, is helping to maintain users on the platform, driving DAUs higher. In addition, user engagement, which we view as the DAU/MAU ratio, remained at 66%, the level it has been at since early 2016, which Mogharabi believes will continue to attract ad dollars. Relatedly, the average price per ad was up 39% year over year, helping drive a 31% increase in the average revenue per user (ARPU).

While current growth numbers remain quite positive, it is Facebook's dominant position in the industry and wide moat—making the firm nearly impossible to disrupt—that give Mogharabi confidence in the firm's continued success. Mogharabi points out that Facebook owns the two most valuable social-networking properties in the U.S., and any migration of users or usage away from Facebook may simply shift toward the company's Instagram platform. Unlike the Facebook platform, Mogharabi sees room for additional Instagram ad loads per user to accommodate the increasing number of advertisers on the platform, raising Instagram's ARPU. He foresees Instagram's revenue growing at a faster pace than Facebook, with or without the recent data issue. In addition, future regulations, such as the General Data Protection Regulation, or GDPR, in Europe or some bills being proposed in the United States are likely to create barriers to entry. This might actually make it harder for competing social networks to collect valuable user data to sell ads and in turn may help Facebook maintain its dominant position as the social network of choice for advertisers.

Finally, Gilead may also be worth a look, as it had two funds making new-money purchases, and the name currently trades at an 18% discount to Morningstar analyst Karen Anderson's fair value estimate of $82. Anderson writes that Gilead generates stellar profit margins with its HIV and HCV portfolio, which requires only a small salesforce and inexpensive manufacturing. While Gilead's HCV portfolio has been under pressure—and is likely to decline by 50% in 2018—she sees it stabilizing by 2019, helping bring some relief for the firm. She thinks the firm's portfolio and pipeline support a wide moat, but Gilead needs HCV market stabilization, strong continued innovation in HIV, solid pipeline data, and smart future acquisitions to return to growth.

While Gilead is certainly strongest within the HIV and HCV segment, the firm is currently building a pipeline outside of HIV and HCV but will need more acquisitions like Kite (with CAR-T therapy Yescarta) to see strong growth. Gilead's first cancer drug, Zydelig, launched in 2014, is limited by safety concerns, but Anderson is more optimistic about the firm's immunology portfolio, including JAK1-inhibitor filgotinib from the Galapagos collaboration. Lead NASH program selonsertib is also in phase 3, opening up a multi-billion-dollar opportunity.

Anderson believes the market is currently undervaluing Gilead’s HIV portfolio as well as the oncology portfolio and immunology/NASH pipeline. One catalyst that may help bring more clarity would be key pipeline data from NASH drug selonsertib and immunology drug filgotinib in RA through the first half of 2019.

Another concern surrounding the industry is related to politics and regulation. In a recent note, Morningstar analyst Damien Conover wrote that the Trump administration’s policy paper, “The Trump Administration Blueprint to Lower Drug Prices and Reduce Out-of-Pocket Costs,” offers proposals that don’t impact Morningstar's moat ratings in the Big Pharma and Biotech industries, and the pricing power of branded drugs in the U.S. still looks strong. The blueprint’s near-term focus largely supports increasing generic drug competition, slightly strengthening Medicare drug price negotiations, improving drug price transparency, and providing more information to help patients lower out-of-pocket costs—all of which Conover believes will have a limited impact on branded U.S. drug prices. The mild policy proposals appear to largely build on the 2019 U.S. Budget Proposal and the drug white paper issued by the Council of Economic Advisors in February. In aggregate, Conover thinks the proposals would likely impact less than 1% of U.S. drug spending, excluding the potential changes to negotiations for Medicare Part B drugs, which could offer another 1%-2% reduction in U.S. drug spending depending on the exact implementation.

Disclosure: As of the publication of this article, Eric Compton has no ownership interests in any of the securities mentioned above. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)