Do You Have the Wrong Index Funds for 2024’s Stock Market?

There are growing expectations that equal-weighted funds will shine in 2024.

After just a handful of mega-cap tech stocks drove returns of more than 20% in 2023, strategists say that in 2024, an ultraconcentrated rally could finally broaden to include the rest of the market and not just the “Magnificent Seven.”

With interest rates poised to fall and the economy on the cusp of a soft landing, strategists point to cyclical sectors like financial and real estate, value stocks, and even small- and mid-cap stocks as potential beneficiaries. If that happens, the index funds used by most investors may not be the best way to take advantage of the shift. Instead, some strategists say that equal-weighted index funds may finally have their day in the sun.

Market-Cap Weighted vs. Equal Weighted Returns

Equal Weight vs. Market Capitalization

The index funds used by the vast majority of investors—such as those tracking the S&P 500—have holdings that are weighted according to the market capitalization of the underlying stocks. That means the largest companies are the biggest holdings in the fund.

For example, the biggest holding in the $385 billion Vanguard S&P 500 ETF VOO is Apple AAPL, which accounts for a little more than 7% of the fund. Apple was also until very recently the largest public company in the United States by market value. It was just recently edged out in size by Microsoft MSFT, which accounts for just under 7% of the portfolio weight of the index fund.

Funds weighted by market capitalization are “a better representation of the market,” says James Ragan, director of wealth management research at D.A. Davidson & Co.

However, that also means that overall performance will be more influenced by price swings on the largest stocks. That’s why in mid-2023, the Magnificent Seven lifted returns on broad market indexes even though the vast majority of stocks either changed little or were down.

Equal-weighted indexes, on the other hand, do just what it says on the tin. They aim to invest an equal amount of money in each stock, regardless of sector or size. As a result, Ragan says, they “give you a better representation of how the average stock is doing.” That means, for example, that they’re not overly skewed by the outperformance of mega-cap stocks like Nvidia NVDA or Microsoft.

Weight of Top 6 Holdings

Equal-weighted indexes can help market watchers understand the ramifications of a more concentrated market, according to Ragan. “There are times when [concentration] can help performance, and there are times when it can hurt,” he says. Looking at the differences in how the two kinds of indexes perform can shed light on that issue.

When market-cap-weighted products outperform equal-weighted indexes by a significant margin, it’s a sign that the largest stocks are driving returns. “At the end of the day, it says poor market breadth and not a healthy market,” says Gene Goldman, chief investment officer at Cetera Financial Group.

Market Breadth Could Broaden: A Tailwind for Equal Weight

While warnings about unhealthy market concentration dominated headlines last year, strategists say the issue isn’t all that new. “It wasn’t just in 2023 that the U.S. market was top-heavy and narrow in leadership,” says Dan Lefkovitz, a strategist for Morningstar Indexes. He says the Morningstar US Target Market Exposure Equal Weighted Index has not outperformed its counterpart, the market-cap weighted Morningstar US Target Market Exposure Index, in a calendar year since 2016.

“We’ve been talking about this small group of mega-cap tech stocks leading the market for a long time,” he says.

But at long last, that dynamic began to change at the end of 2023. In the fourth quarter, the equal-weight index had an edge, returning 12.5% compared with the market-cap-weighted index’s 12.0%. It’s not an enormous margin, but it’s a big change from the past year.

Or take the example of the $49.4 billion Invesco S&P 500 Equal Weight ETF RSP versus the biggest S&P 500 ETF, the $477 billion SPDR S&P 500 ETF Trust SPY. The Invesco ETF is up 9.4% over the last 12 months, while the SPDR ETF is up 26%. However, in the fourth quarter of 2023, the equal-weighted S&P 500 ETF rose 11.8%, just ahead of the S&P 500 ETF.

Some believe that momentum can continue, especially if it the Federal Reserve can engineer a soft landing for the economy. “There seems to be a lot of optimism that things will broaden,” Lefkovitz says.

2023 Index Returns

Exposure to Cheap Stock Sectors

That broadening would be good news for equal-weighted investments, which have less exposure to Big Tech and more exposure to other sectors like industrials, real estate, and basic materials. Many of those sectors happen to be cheaper than Big Tech, too.

“From a valuation perspective,” Ragan says, the equal-weighted index is “much more compelling.” Financials lagged in 2023, but they could break out in 2024. The same is true for industrials and basic materials, which would get an extra boost from a soft landing for the economy but could struggle if growth is more sluggish than analysts expect.

Index Weights by Sector

Equal Weight Comes With Downsides

According to Goldman, equal-weight devotees miss out on something critical: momentum. If you made equal-weight investments during the AI-driven euphoria of the middle of 2023, you’d have profited significantly less than peers that stuck with cap-weighted indexes. “Momentum tends to be strong on the market-weight side,” Goldman says.

Equal-weight investors are also more exposed when sentiment turns negative. As stocks have given back some of their gains at the start of the year, investors have been looking to bigger, established tech companies for safety. The Morningstar US Target Market Exposure Index is up 0.21% so far this year. Meanwhile, the Morningstar US Target Market Exposure Equal Weighted Index is down 2.08%.

And then there’s earnings. In the very near term, Ragan cautions that the earnings prospects of the Magnificent Seven are looking “pretty good.” He thinks there’s a case to be made that earnings will sustain the market’s narrow leadership.

And Long-Term Benefits

Ragan says that wouldn’t be good for equal-weighted indexes in the short term, but it’s a different story over the long term. For one thing, he explains, equal-weight indexes are much more in line with historical valuations, meaning they’re cheaper on a relative basis than their market-cap-weighted counterparts.

These indexes can also capture good opportunities in smaller, growing companies that may be outside the spotlight. Ragan points out that since 2000, an equal-weighted version of the top stocks in the market has outperformed the market cap-weighted version. “Over time, we will see better performance from the average stock.”

Some strategists say that as small companies get bigger, they get clunkier and their growth eventually slows down. Market-cap-weighted indexes are skewed toward larger companies. “Once companies get to a certain size,” Ragan says, it’s harder to generate blockbuster returns. Smaller companies, on the other hand, have more room to run. “The equal-weight index reflects that a little more.”

Goldman says that during years like 2023, “people forget about the magic and the power of diversification.” Equal-weight investing helps prevent a sharp move in a narrow part of the market from pushing an entire portfolio out of whack.

“It’s tough when you go through a year like last year,” Ragan says. In 2023, there was such a big discrepancy between the equal-weight index and its market-cap-weighted counterparts. “There’s a tendency to want to commit to what’s working.”

For the Trading Week Ended Jan. 19

- The Morningstar US Market Index rose 1.09%.

- The best-performing sectors were technology, up 4.11%, and communication services, up 1.60%.

- The worst-performing sector was utilities, down 3.64%.

- Yields on 10-year U.S. Treasury notes rose to 4.13% from 3.96%.

- West Texas Intermediate crude prices rose 1.22% to $73.83 per barrel.

- Of the 844 U.S.-listed companies covered by Morningstar, 377, or 45%, were up, three were unchanged, and 464, or 55%, were down.

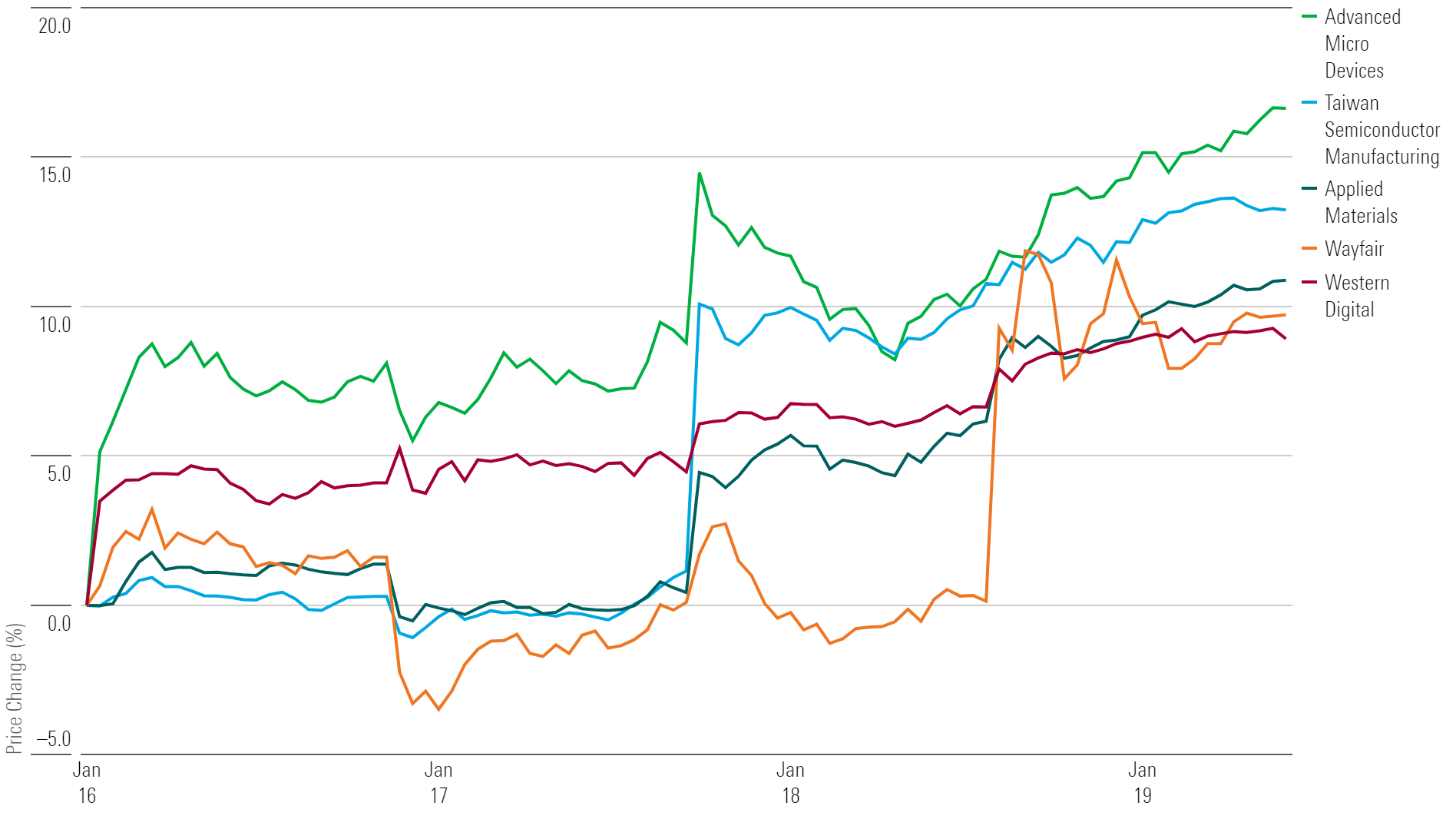

What Stocks Are Up?

Advanced Micro Devices AMD, Taiwan Semiconductor Manufacturing TSM, Applied Materials AMAT, Wayfair W, and Western Digital WDC.

Week's Top Winners

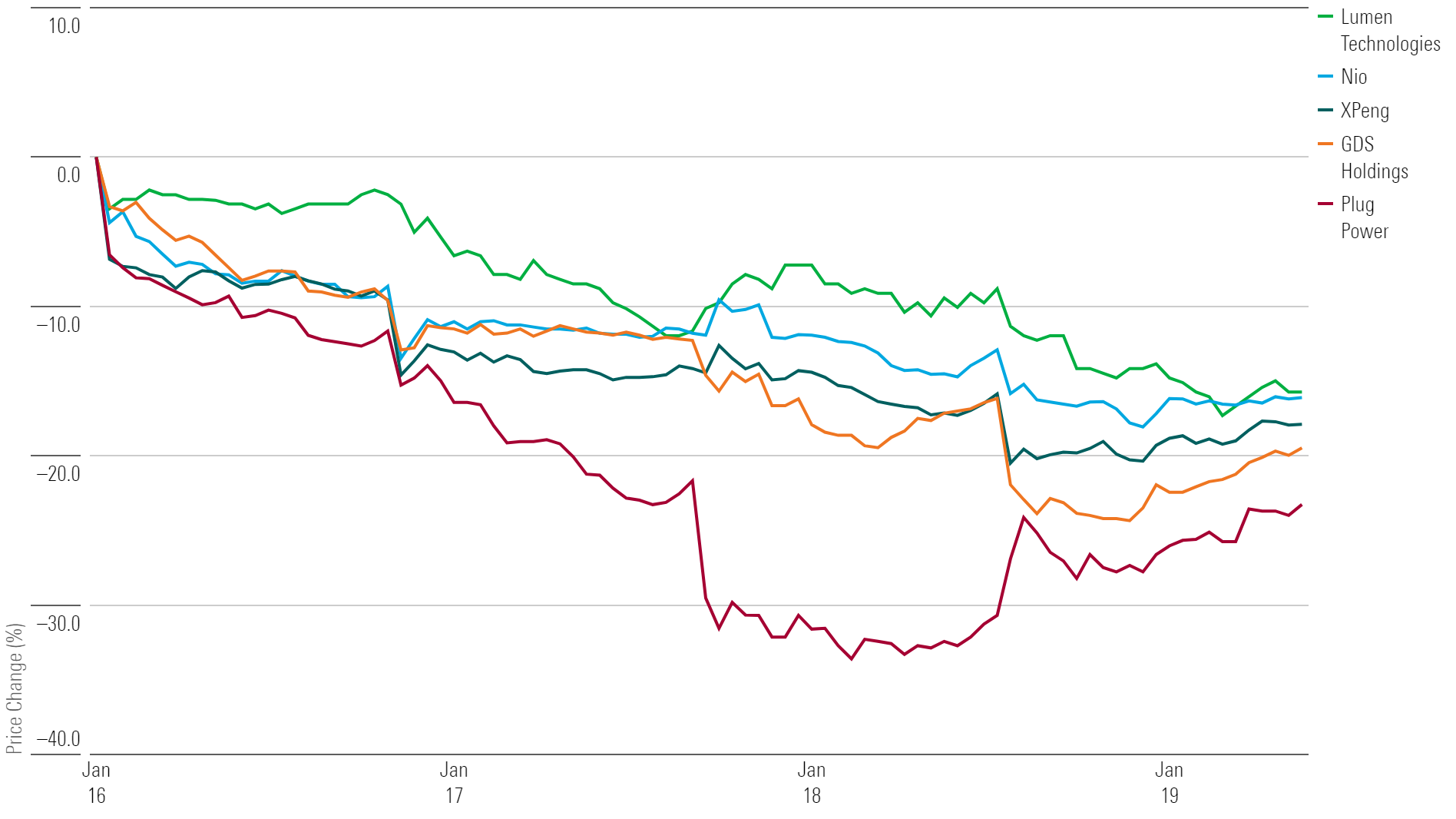

What Stocks Are Down?

Plug Power PLUG, GDS Holdings GDS, XPeng XPEV, Lumen Technologies LUMN, and Nio NIO.

Week's Top Losers

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)