Fund Managers’ Responses to Silicon Valley Bank’s Implosion

Active managers are revisiting pressured bank holdings, while some previously raised red flags about the failed stock.

Silicon Valley Bank’s meltdown has spooked investors and cast doubts on the regional bank industry overall. While the Federal Deposit Insurance Corporation has said it will back both insured and uninsured deposits at the bank, those who owned stock in SVB Financial Group SIVB (hereafter SVB) as of its March 10 collapse have not been so lucky. Signature Bank SBNY, a lender to the cryptocurrency industry, also failed, and other regional banks, such as First Republic Bank FRC, have seen extreme price swings in recent days. Here’s a roundup of how fund managers who owned these stocks or other regional banks as of their latest publicly available portfolios have responded so far. Some managers who sidestepped the trouble are also included.

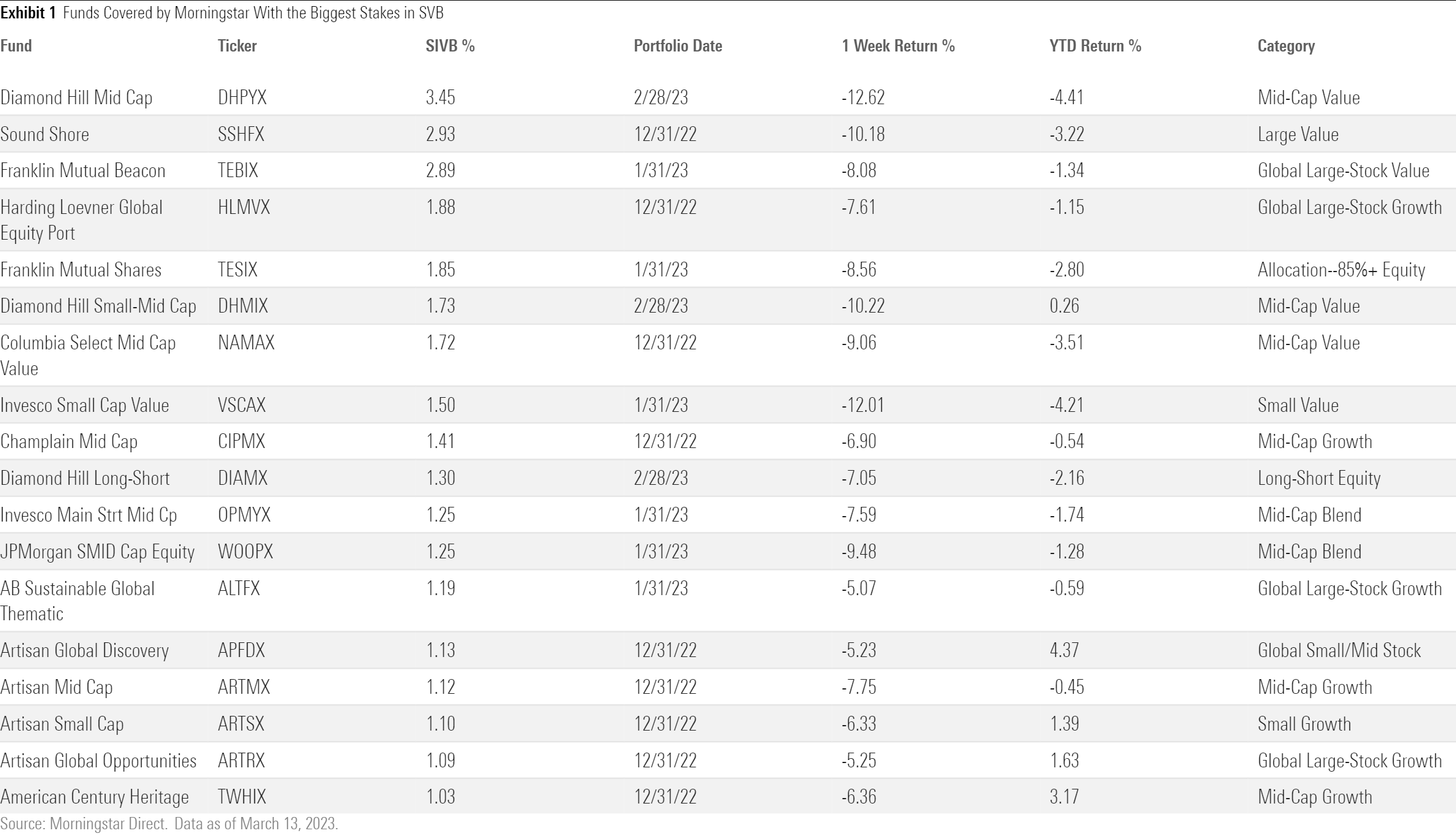

SVB Owners

Of the funds Morningstar covers, Diamond Hill Mid Cap DHPYX held the biggest stake in SVB at 3.4% of assets as of February 2023. It was the 55-stock portfolio’s third-largest holding, a big bet on a company that the government has now taken over. The fund, which has long had more financials exposure than the Morningstar US Mid Cap Broad Value Index, has owned the stock since 2016.

Diamond Hill Mid Cap also has been a longtime owner of First Republic, another stock that was punished. On March 10, the firm noted that First Republic (a 2.3% position in the fund in February) has a different asset and liability mix than SVB’s, which was unique. First Republic caters more to individuals than businesses and has lower customer deposit levels than SVB, Diamond Hill said, and First Republic also boasts healthy capital levels and a strong credit profile. Still, it and SVB drove the fund’s 4.5% loss for the year to date through March 13, which was worse than the index’s 3.3% loss, and ranked at the bottom of the mid-value Morningstar Category for the past week.

Sibling Diamond Hill Small-Mid Cap DHMIX, which had 2.7% of assets across the two companies, also got singed. Diamond Hill, whose Diamond Hill Large Cap DHLYX also had 1.2% in First Republic, says it’s looking closely at its bank holdings, including the mix of insured versus uninsured deposits, the quality and stability of banks’ deposit bases, and what types of unrealized losses exist on their books. This financial selloff is unique, however, since rising interest rates rather than deteriorating credit quality are the main culprit, the firm said.

Sound Shore SSHFX, a 35-stock value-leaning portfolio, held 2.9% in SVB as of December 2022. The fund bought the stock in 2019 at a valuation the managers found attractive given its above-average growth rates and limited credit risk. It also owned 3.2% in First Republic as of year-end, having added to both it and SVB in 2022′s fourth quarter. As market conditions recently changed, the managers said they reacted quickly and reduced their exposure to bank stocks and financials in general, without naming specific stocks or dates. For the year to date through March 13, the fund’s 3.2% loss trailed the Morningstar US Large-Mid Cap Broad Value Index’s 3.0% decline and beat 61% of its large-value category peers, though it’s significantly lagged both over the past week.

Franklin Mutual Beacon TEBIX and Franklin Mutual Shares TESIX bought SVB in late 2022 believing the bank’s focus on innovative firms provided a competitive advantage, and the managers said they found SVB’s valuation appealing owing to the stock’s sharp decline from its late-2021 highs. But rising rates and stress among venture capital firms led to the bank taking actions that triggered a panic and a bank run, according to the managers. According to the firm, Franklin Mutual Beacon owned a 2.8% position as of February, and Franklin Mutual Shares had a 1.7% stake.

Invesco Main Street Mid Cap OPMYX bought SVB in December 2022 and had a 1.2% position as of January. At the time of purchase, the manager thought the risks were reflected in the stock price, which had underperformed, and believed the credit risk of the portfolio was contained.

JPMorgan SMID Cap Equity WOOPX held 1.2% in SVB as of January and owned about 1% in Signature Bank. We didn’t hear from the fund’s manager directly about these positions, but the firm said in a recent online seminar that it expects regional bank volatility to persist for a while. This situation is different from 2008′s financial meltdown, though, said the firm, which also is watching how recent events affect future Fed decisions.

JPMorgan Large Cap Growth’s SEEGX position in SVB, its lone regional bank holding, stood at 0.8% as of January, having peaked at 1.6% of assets in October 2021. The team liked the firm’s Silicon Valley footprint and used it to get exposure to the upside of innovation and technology through financials.

Artisan Global Discovery APFDX, Artisan Global Opportunities ARTRX, Artisan Mid Cap ARTMX, and Artisan Small Cap ARTSX each held about 1.1% of assets in SVB as of December. The team behind these strategies has owned SVB on four separate occasions over the past 15 years. In 2020, the managers thought SVB was trading well below its intrinsic value, especially for its high reserves, and noted SVB’s strong brand and high market share for healthcare and tech-related IPOs. In 2022′s fourth-quarter commentary, the managers noted the headwinds SVB faced from rising interest rates but viewed concerns as short-term and expressed confidence in the company’s credit risk exposure. On March 9, the firm reported positions across its four funds were between 0.3% and 0.5% of assets. On March 10, the team sold a chunk of its position in SVB before the FDIC took receivership of the bank, but the managers could not liquidate it all before trading was halted. Additionally, the team exited its position in First Republic, which was a more than 1% position in both the mid-cap and global discovery portfolios.

Parnassus Value Equity PARWX, Parnassus Mid Cap Growth PARNX, and Parnassus Mid Cap PARMX owned stakes between 1.2% and 1.6% in Signature Bank as of February, according to the firm. The managers noted that investors pulled out money from Signature following SVB’s collapse because its customer accounts were generally above insured levels. The bank disclosed that deposits were growing as recently as March 9, but a bank run occurred on March 10, and regulators took over on March 12. Parnassus said it pared back its position in Mid Cap as its price declined and had sold its full position in Mid Cap Growth, deploying it into First Republic (since sold). All remaining positions were marked to zero value upon the bank’s collapse.

Parnassus disclosed that Mid Cap owned 2.4% in First Republic Bank as of February, whose share price also plunged during the turmoil. The managers believe First Republic has a broader client base and larger market capitalization and noted it has secured a liquidity facility from JPMorgan allowing it to continue operating. Even so, the firm disclosed that it sold its First Republic Bank positions in Mid Cap and Mid Cap Growth. The managers said they don’t believe the recent bank failures will create a contagion like in 2008 because the financial system is better capitalized and the Federal Reserve has taken steps to improve consumers’ confidence. They also think the biggest banks could benefit if customers move their money. As such, the managers said they increased Parnassus Core Equity’s position in Bank of America BAC and upped Parnassus Value Equity’s stakes in Bank of America and Citigroup C. The managers also said they will distance themselves from regional banks because they don’t think they’ll be able to attract new clients in the months ahead.

Managers from several funds covered by Morningstar that had positions of at least 1% in SVB as of their most recently disclosed portfolios would not comment, including Harding Loevner Global Equity HLMVX (1.9% in SVB plus 2.7% in First Republic), Emerald Finance & Banking Innovation HSSAX (2.1% across SVB, First Republic, and Signature), Columbia Select Mid Cap Value NAMAX (1.7% in SVB), Champlain Mid Cap CIPMX (1.4% in SVB), AB Sustainable Global Thematic ALTFX (1.2% in SVB), and American Century Heritage TWHIX (1% in SVB).

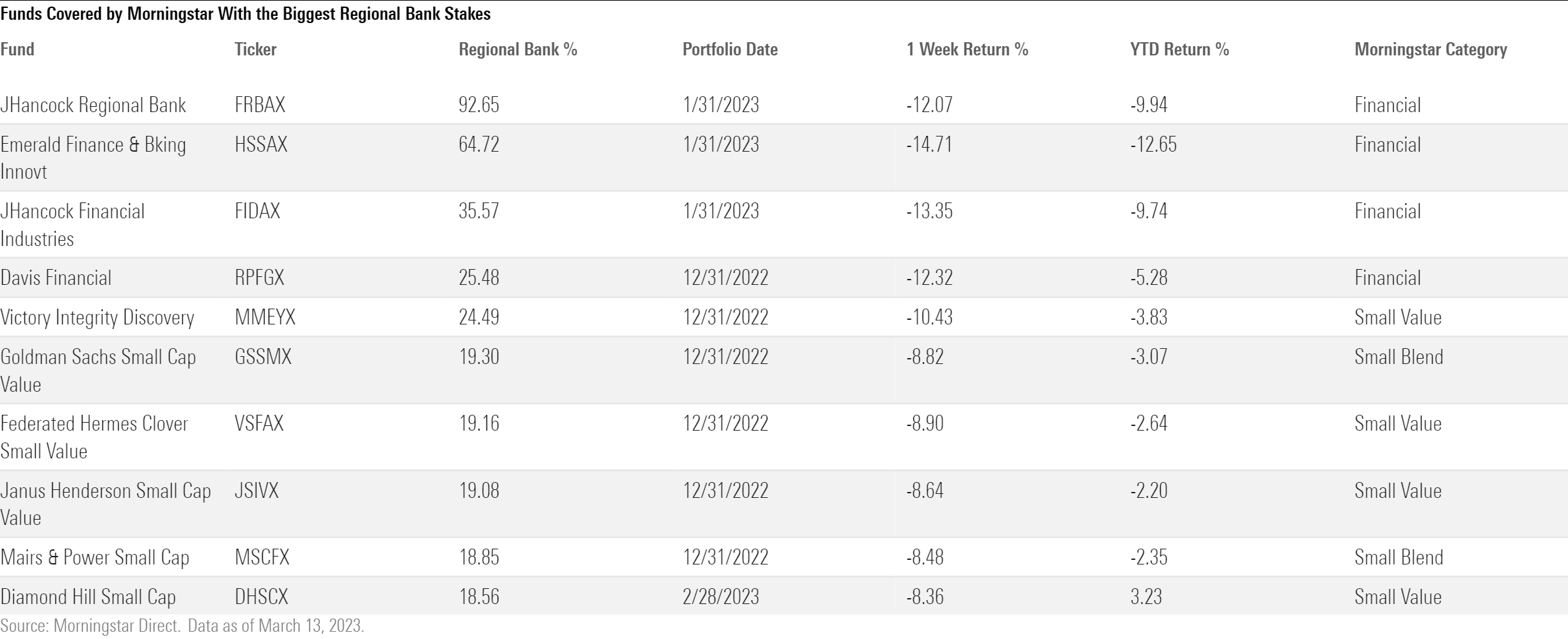

Funds With Big Regional Bank Stakes

Mairs & Power Small Cap MSCFX held nearly 19% in regional banks at the start of the year, one of the higher levels of exposure to that industry for diversified funds on Morningstar’s coverage list. The fund mostly targets companies in the Upper Midwest, including seven regional banks. While those came under pressure amid SVB’s collapse and the market’s worries about investors taking their deposits to more-established financial institutions, the bank holdings in this fund don’t resemble SVB’s profile. Plus, the management team has decades of experience across other financial stress periods, including the global financial crisis, and the fund remains otherwise diversified by sector.

Janus Henderson Small Cap Value JSIVX owned 19% in regional banks as of year-end, though it didn’t own the worst offenders. The team tries to own banks with solid balance sheets and historically good credit profiles that can withstand turbulence, but the market seems to be ignoring company fundamentals, the managers said. Bank earnings estimates likely will fall, but there could be attractive opportunities, they said. The recent failures underscore the need for banks to have diversified asset bases, even with assurances from the FDIC. While investors focused on loan growth prior to recent events, that’s now secondary to keeping deposits, especially at smaller banks that may have to pay more to keep customers, the managers said. Higher loan losses and higher costs for FDIC insurance are other issues bank investors should watch.

The team at Westwood Quality SmallCap WHGSX had 17.8% in regional banks recently. The managers said they have focused on banks’ liquidity for the past five or six months after conversations with management teams illustrated struggles with keeping deposits as interest rates rose. The team is looking at some bank stocks after recent price declines but is waiting to make larger moves until they get a clearer picture on earnings. The team’s financial analyst as of March 14 did not think the potential for future contagion was over but applauded regulatory efforts to provide backstops and return the focus to bank liquidity risk rather than just credit risk.

Guggenheim SMid Cap Value SVUIX held 12% in regional banks as of January. CIO Anne Walsh said in a statement, “The fallout from the SVB situation is still fluid, and we do not believe that this is a Lehman moment. It may, however, be a Bear Stearns moment. The risks in the market that catalyzed the SVB collapse are still out there. Regulators have given financial market participants a break by backstopping the SVB depositors and creating the Bank Term Funding Program. Investors must remain alert to the disintermediation risks that have been brought on by the Fed’s unrelenting and ongoing quantitative tightening. Complacency is the investor’s enemy.”

Neuberger Berman Genesis NBGNX had no exposure to any failed bank but owned 11.4% in regional banks as of year-end, well above the Morningstar US Small Cap Broad Growth Index’s 2.2%. The managers noted that the funding bases of the banks that collapsed are idiosyncratic but said liquidity concerns are rippling through the banking industry. While the government’s backstop may lessen liquidity concerns, the team says bank earnings could still get hit if they see deposits leave for larger banks. The managers think the fund’s bank holdings are in good standing from a deposit, credit, and liquidity standpoint but acknowledge the volatility in these companies, with short-selling activity not helping. Longer term, the managers think small banks will see increased regulation, stricter stress tests, tighter liquidity rules, and higher funding costs, resulting in lower potential returns, in their minds.

Jeff John held 11.3% in regional banks in VY American Century Small-Mid Cap Value IACIX as of January. While credit risk seemed the biggest threat to financials a week ago, liquidity has become the top concern for him. John says most of the regional banks he owns don’t cater to venture capital companies and wealthy clients with deposits over the insured limits. He thinks there’s less pressure on the banks he owns to raise deposit rates to keep clients from leaving for other options and noted the market wasn’t appreciating the Fed’s backstop. While he remains comfortable with the fund’s regional bank exposure, he’s taken a measured approach to adding to banks during the turmoil, focusing on those with the best balance sheets and deposit structures.

Managers Who Spotted Red Flags

Some managers made prescient sales of SVB before its collapse. Clearbridge Appreciation SHAPX sold the stock in 2022′s third quarter because of balance-sheet issues, with the managers specifically mentioning a concern about the duration mismatch between the firm’s deposits and lending.

Mani Govil previously owned SVB in Invesco Main Street MSIGX but sold in 2022′s fourth quarter after looking at its quarterly report and realizing the company’s tangible book value would be negative if it had to mark its investments to market rates.

Sudhir Nanda, who runs quantitative funds including T. Rowe Price QM U.S. Small-Cap Growth Equity PRDSX, did not own SVB but in 2022 had a small position in Signature Bank, which the government recently took over. He sold the stock when he realized that Signature’s stock price was becoming increasingly correlated to cryptocurrencies.

Royce Small-Cap Special Equity RYSEX had no exposure to regional banks despite being in the small-value category, where the average fund held 13%. Manager Charlie Dreifus, who looks closely at companies’ financial statements, avoids them because he thinks they’re black boxes.

Davis Advisors, well known for its big financials stake, had no exposure to SVB, Signature Bank, or First Republic. However, Davis Financial RPFGX had a fourth of its assets in regional banks at year-end. Chris Davis says that the firm has long focused on interest-rate risk and that while SVB’s unique deposit base affected its situation, it’s not the only bank that was stretching for yield when interest rates were low. Davis says his team discussed this issue in fall 2022 and closely reviewed each bank holding’s asset portfolios to better understand their mix of fixed- and floating-rate bonds, leading them to trim Charles Schwab SCHW and avoid First Republic. Now the question is whether bank customers with deposits above the FDIC’s insured limit can feel comfortable in banks—an issue regulators tried to quell by ensuring all banks could meet deposits. Davis is relieved none of the affected banks had credit problems, a key difference from the 2008 meltdown and the savings and loan crises. The team has also observed a flight to quality and thinks the bigger banks will be net beneficiaries of customers leaving smaller banks.

Morningstar will continue monitoring events as they unfold.

Correction: Guggenheim SMid Cap Value SVUIX held 12% in regional banks as of January.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/7528c6c6-0184-4151-a5ce-274ce6ae0589.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/7528c6c6-0184-4151-a5ce-274ce6ae0589.jpg)