Global Markets and ETF Inflows Build Momentum in November

U.S. ETFs reeled in $62.7 billion in last month, as bond and international-stock portfolios posted banner monthly returns.

Inflation and the Federal Reserve’s anticipated response to it have dictated the trajectory of global markets all year. In November, that was a good thing. A promising inflation print, and the encouraging remarks from Fed Chair Jerome Powell that followed, sparked a fervent rally in stocks and bonds alike. The Morningstar Global Markets Index, a broad gauge of global equities, climbed 7.73% to seal its first back-to-back months of gains since the summer of 2021. Meanwhile, the Morningstar US Core Bond Index had a banner month of its own: Its 3.65% November return marked the best month of its 22-year track record.

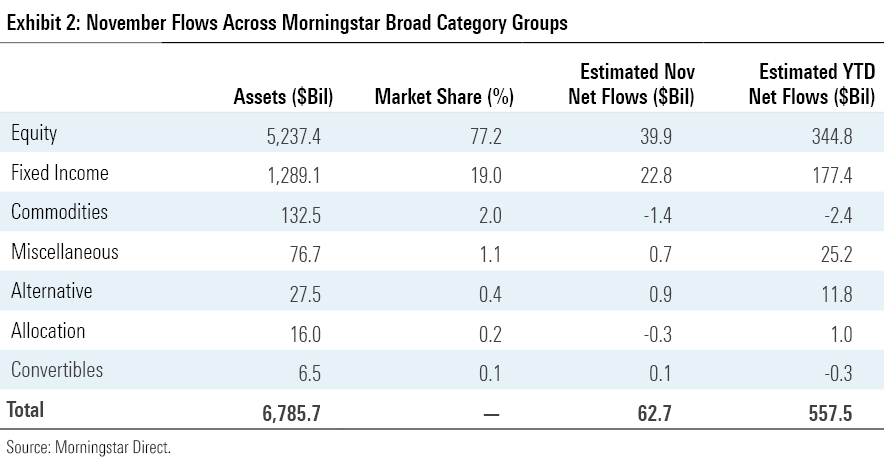

That performance was a green light for investors, who continued their march into U.S. exchange-traded funds by adding $62.7 billion of new money in November. U.S. ETFs have now collected $557.5 billion for the year to date. Barring extreme outflows in December, ETFs will finish the year with the second-most calendar-year inflows on record after clearing the $505 billion mark from 2020.

Stock ETFs absorbed $39.9 billion in November. That led all asset classes in absolute terms, but bond ETFs’ $22.8 billion haul translated into better organic growth because of their smaller asset base. Commodities ETFs endured outflows for the seventh consecutive month, while alternatives welcomed modest inflows.

Here, we’ll take a closer look at how the major asset classes performed last month, where investors put their money, and which corners of the market look rich and undervalued at month’s end, all through the lens of ETFs.

All Rise

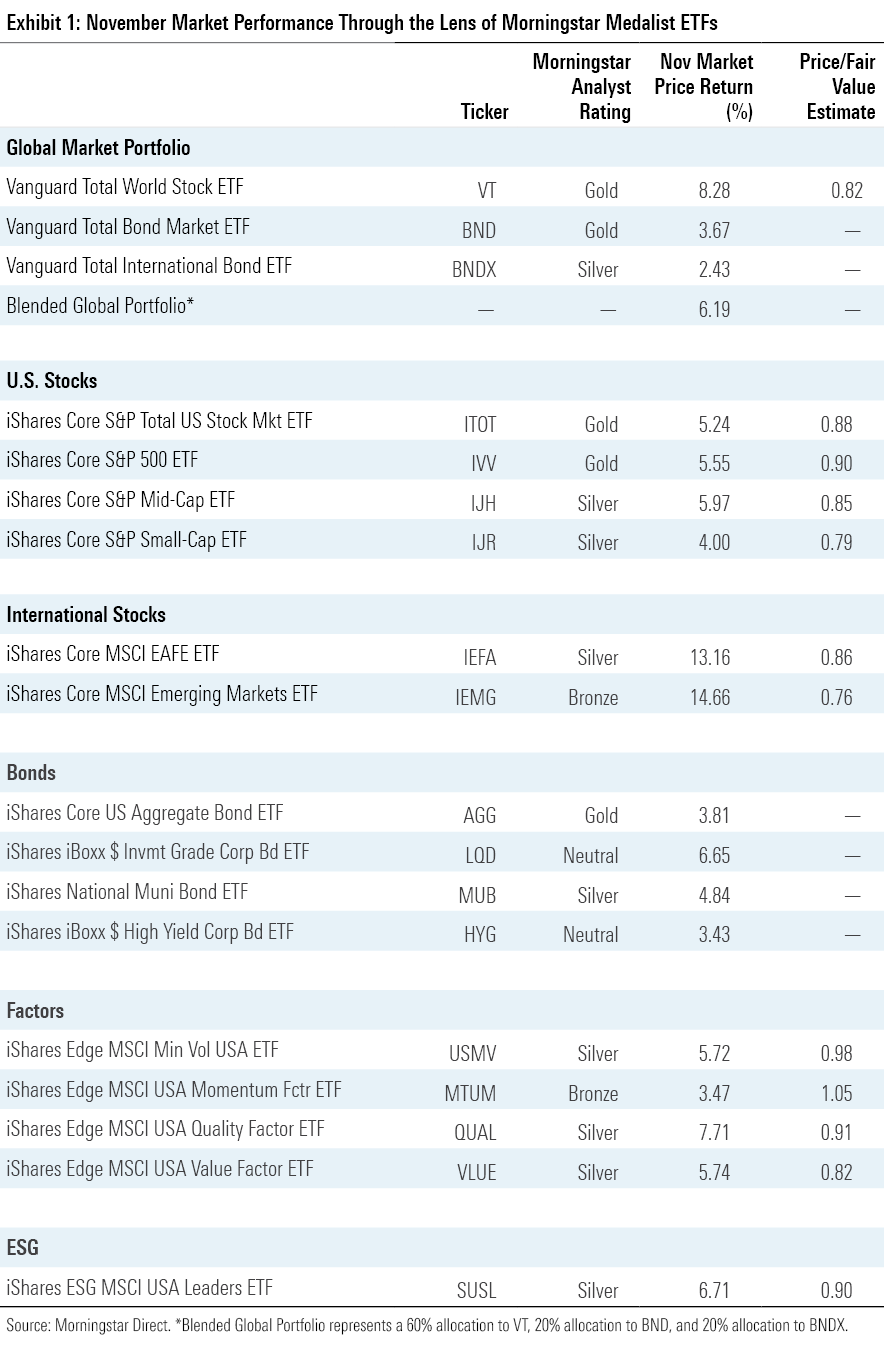

Exhibit 1 shows November returns for a sample of Morningstar Analyst-rated ETFs that serve as proxies for major asset classes. Investors in a blended global portfolio earned a 6.19% return in November.

Persistent inflation and interest-rate hikes have made it a dark year for bonds, but November was their month in the sun. Vanguard Total Bond Market ETF BND leapt 3.67%, its best month since December 2008. More than half of that return came on Nov. 10 alone, as bonds rallied on the news that inflation cooled off significantly in October, coming in lower than consensus estimates. According to the CME FedWatch tool, the chance of a 0.5-percentage-point interest-rate hike rose to 77% from 45% over the course of November, supplanting a 0.75-percentage-point raise as the most likely outcome.

Optimism from the latest inflation prints reverberated around the world. Vanguard Total International Bond ETF BNDX climbed 1.33% the day of the print and finished November 2.43% higher than where it started the month.

In November, the rewards were best for the bond funds that have fared the worst the rest of this year. IShares 20+ Year Treasury Bond ETF’s TLT long investment horizon spelled a negative 29.39% return for the year to date, but it leapt 7.15% in November. Comparably inelastic, Vanguard Short-Term Bond ETF’s BSV 5.5% year-to-date drawdown is far milder, but so was the 1.41% it climbed in November. Each fund clawed back roughly 20% of its year-to-date losses this month. That said, longer-dated bond portfolios have a lot of ground to make up after their historic struggles this year.

High-yield bond funds tend to have shorter time horizons and riskier credit profiles than the broad bond market, a combination that suited them just fine in November. SPDR Bloomberg High Yield Bond ETF JNK, whose shorter duration means it didn’t receive as much of an inflation-related boost as BND, notched a 3.61% gain that rivaled the broad market. High-yield bond portfolios tend to be more closely correlated with the stock market than traditional fixed-income strategies. As the outlook improved for U.S. companies, so it did for the bond funds that buy their debt.

The prospect of slower interest-rate hikes also powered excellent returns for equities. International stocks went on a tear as the outlook for stocks brightened and the U.S. dollar weakened. Vanguard Total International Stock ETF VXUS clocked a 13.04% return that made November the best month on its record, which dates back to January 2011. Both VXUS and its domestic cousin Vanguard Total Stock Market ETF VTI have lost between 14% and 15% since the start of the year.

Both emerging- and developed-markets stocks excelled in November, but the former came out ahead: iShares Core MSCI Emerging Markets ETF IEMG advanced 14.66%, to iShares Core MSCI EAFE ETF’s EFA 13.17%. IEMG got a boost from Chinese and Taiwanese stocks, which reversed course in November after dismal performance in the two months prior. It is ironic that Chinese stocks broke out as the country flooded with protests over its COVID-19 safety protocols. But the stock market is a forward-looking mechanism, and hints that China may loosen its zero-COVID policy were a catalyst for its market’s resurgence.

While international stocks set the pace, the U.S. market had an excellent month of its own. Since VTI hit a fresh nadir in the middle of October, it has climbed 13.88%, including a 5.17% return in November. Large-cap stocks fared a bit better than their smaller peers. IShares Core S&P 500 ETF’s IVV 5.55% gain outpaced iShares Core S&P Small-Cap ETF IJR by 1.55 percentage points. IJR maintained its year-to-date edge, however, holding up about 3 percentage points better than its larger-cap sibling. Small-cap stocks tend to be more sensitive to the market’s ebbs and flows, but the strengthening U.S. dollar has hurt them less than their heftier, globally connected peers. Should the U.S. enter a recession (and fulfill the predictions of many), the more economically sensitive small caps will face a fresh challenge.

Each fund in State Street’s suite of sector ETFs finished November in the black. Materials Select Sector SPDR ETF XLB led the pack with an 11.7% gain. The basic materials sector tends to be more responsive to commodities than most others, especially the firms whose operations focus on precious metals. Indeed, a nice month for metals equated to a 25.59% November return for Freeport-McMoRan FCX, one of the world’s heftiest gold and copper producers. Fellow materials firm Air Products & Chemicals APD climbed 23.87%, getting a jolt from a better-than-expected earnings report.

Semiconductor stocks were also winners in November. The year has not been kind to these companies, whose high-growth forecasts leave their valuations more susceptible to interest-rate hikes than most. But last month reversed the trend: VanEck Semiconductor ETF SMH advanced 20.35%, as marquee holdings Nvidia NVDA and Advanced Micro Devices AMD both posted November gains north of 25%.

Vanguard Growth ETF VUG tends to be more sensitive to interest rates than Vanguard Value ETF VTV—and holds about twice the semiconductor stake—but it still trailed its cheaper counterpart by about 1.4 percentage points in November. Heavy hitters like Amazon.com AMZN and Tesla TSLA did not share the broad market’s success, sliding 5.76% and 14.43%, respectively. VTV also won in the financials sector, where familiar franchises J.P. Morgan Chase JPM, Goldman Sachs GS, and Morgan Stanley MS climbed between 9% and 13% apiece, and Coinbase’s COIN 30.97% November decline gave VUG a taste of the cryptocurrency fallout that dominated last month’s headlines. VUG has endured a 27.06% drawdown so far this year, while VTV has scraped out a 1.27% gain. Growth investors may find solace in the fact that growth’s recent woes leave them attractively valued looking ahead.

Buying Up Bonds

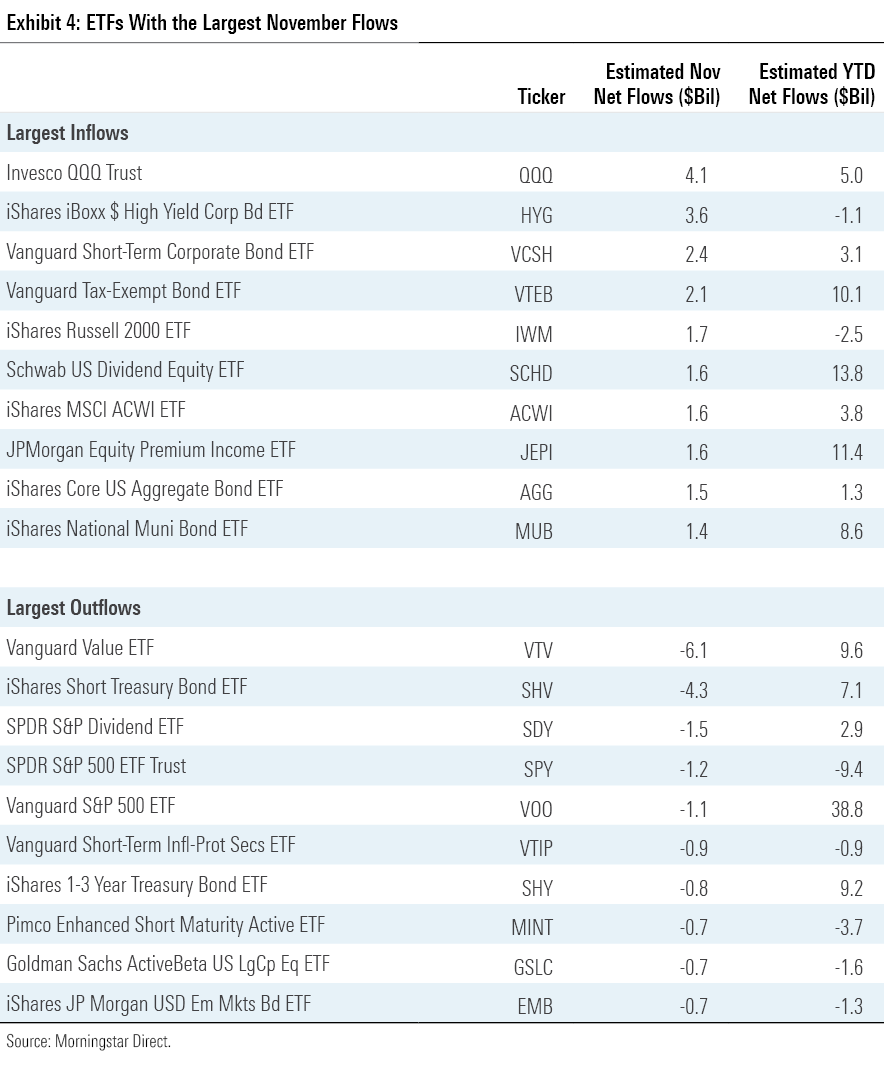

U.S. ETFs reeled in $62.7 billion of new money in November in a strong follow-up to the $88.6 billion they absorbed in October. Investors have piled $557.5 billion into ETFs this year, which now ranks as the second-most calendar year flows of all time after eclipsing the $505 billion mark from 2020. That said, the first-place record from 2021, $901.7 billion, looks well out of reach this year.

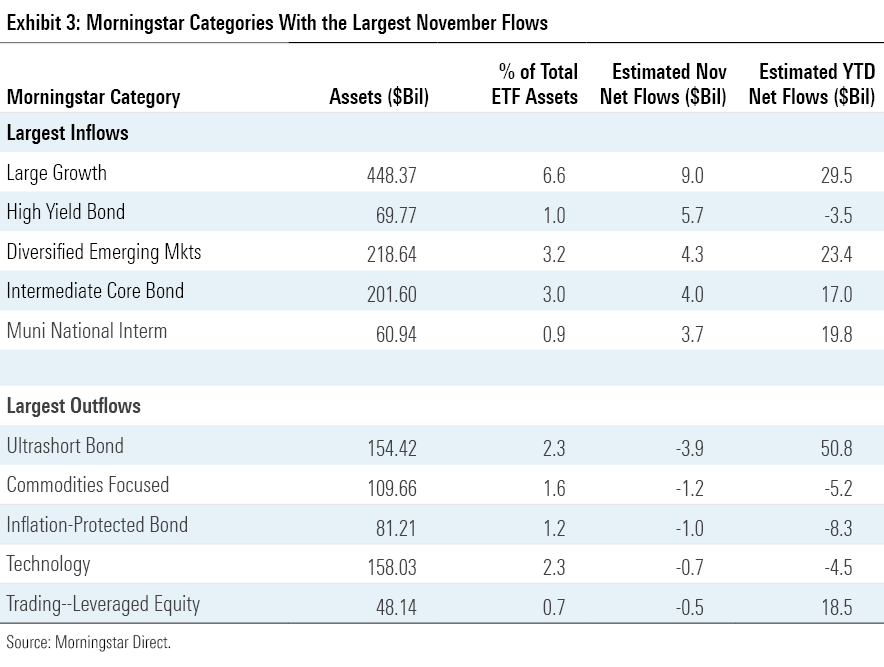

Fixed-income ETFs hauled in $22.8 billion in November, exceeding equities’ organic growth for the fifth consecutive month. High-yield bond funds led all fixed-income Morningstar Categories in flows for the second month in a row. These funds looked left for dead over the year’s first three quarters, when they leaked about $17 billion, worst of all categories. But a revitalized market breathed life into the riskier bond portfolios. High-yield bond funds collected $7.6 billion in October, then followed it up with a $5.7 billion haul in November. IShares iBoxx $ High Yield Corporate Bond ETF HYG has stood out, collecting $5.7 billion over the past two months after shedding $6.3 billion over the first nine.

Renewed faith in high-yield bond funds signals investor optimism, as does the fact that ultrashort bond funds lost $3.9 billion in November, most among all categories. Effectively a cash substitute, these uber-conservative portfolios see inflows when ETF investors have little faith in the market. Indeed, ultrashort bond funds entered November with the third-most inflows of all categories so far this year ($53.4 billion) despite starting it with only the 14th-most assets. It’s not a surprise to see these funds in outflows when the market thrives. If they remain out of fashion in a turbulent month, investors’ confidence will look ironclad.

Some safer corners of the bond market still attracted attention in November. Treasury funds, backed by the full faith of the U.S. government, collectively hauled in $4.9 billion. Short-, intermediate-, and long-term government bond funds pulled in a total $72.9 billion for the year to date, nearly half of all bond ETF flows over that span. It was another billion-dollar month for TLT. After tacking on a fresh $1.1 billion in November, the fund’s year-to-date intake sits at $14.9 billion, tops among all bond ETFs by a wide margin.

International equities collected $13.7 billion in November, spearheaded by flows into diversified emerging-markets funds. Dismal performance by Chinese and Taiwanese equities—which made up about 45% of IEMG entering 2022—has made it a difficult year for these strategies. But these markets have recently showed signs of life, and investors took notice. Diversified emerging-markets funds welcomed $4.3 billion in November, their best monthly inflow since March. IEMG pulled in $864 million to lead the way.

Stateside, large-growth funds exploded for $9 billion of inflows, their most lucrative month since March. Large-value funds, on the other hand, shed $306 million. Systematic rebalancing—or the new interest-rate outlook—could help explain the flow patterns between these categories. Since value stocks have trounced their growth counterparts this year, some investors likely moved money from their winners to their losers to keep their portfolio allocations intact. If that was indeed the case last month, investors were slow to pull the trigger. This year, large-growth funds have added $29.5 billion to value funds’ $71.2 billion. Should that margin hold, it would be the widest annual flows disparity between the two categories in Morningstar’s database, which dates back to 1993.

Not even stellar performance could curb outflows from commodities ETFs in November. These funds leaked $1.4 billion last month and extended their streak of outflows to seven months. Funds that track baskets of commodities have held up fine, but more-focused portfolios—notably those that home in on precious metals—have faltered. For example, SDPR Gold Shares GLD has shed $2.9 billion for the year to date after $649 million exited its doors in November. That has been the story for a variety of funds that investors turned to for inflation protection. Commodities, Treasury Inflation-Protected Securities, and bank-loan funds all saw tremendous inflows in 2021 and/or early 2022, only for investors to dump them when they believed the worst of inflation had blown over.

Active Investigation

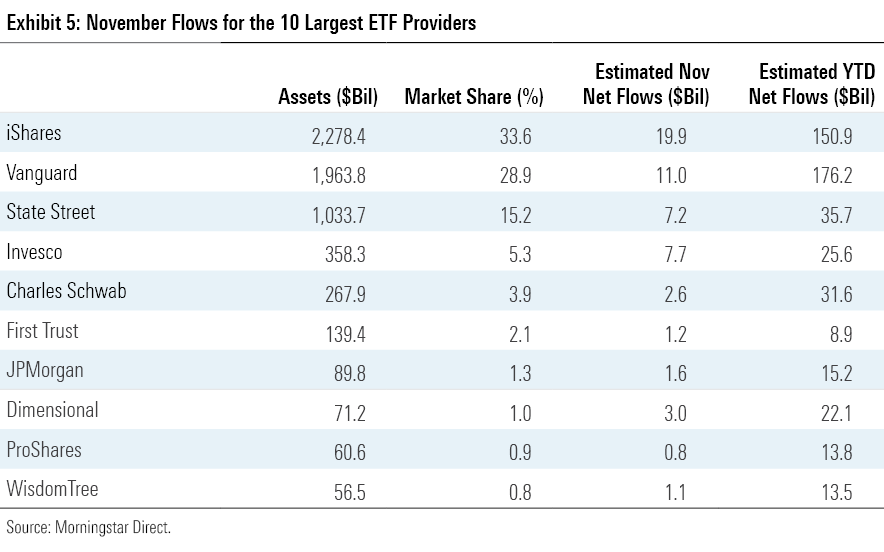

A balanced effort earned iShares the fund family flows crown in November. The firm pulled in $19.9 billion, bolstered by flows into both its stock ETFs ($11.6 billion) and fixed-income ETFs ($8.8 billion).

With one month left on the calendar, it will take a heroic December run for iShares to stop Vanguard from earning its third consecutive annual flows title. Vanguard occupies the catbird seat with $176 billion of inflows for the year to date, while iShares’ $151 billion makes it the only other contender. If iShares does hop into first place, it will be courtesy of TLT and the rest of the fixed-income suite. IShares’ bond ETFs have absorbed $92.7 billion this year. That translates into about 61% of all iShares inflows, despite representing only less than 25% of their total assets.

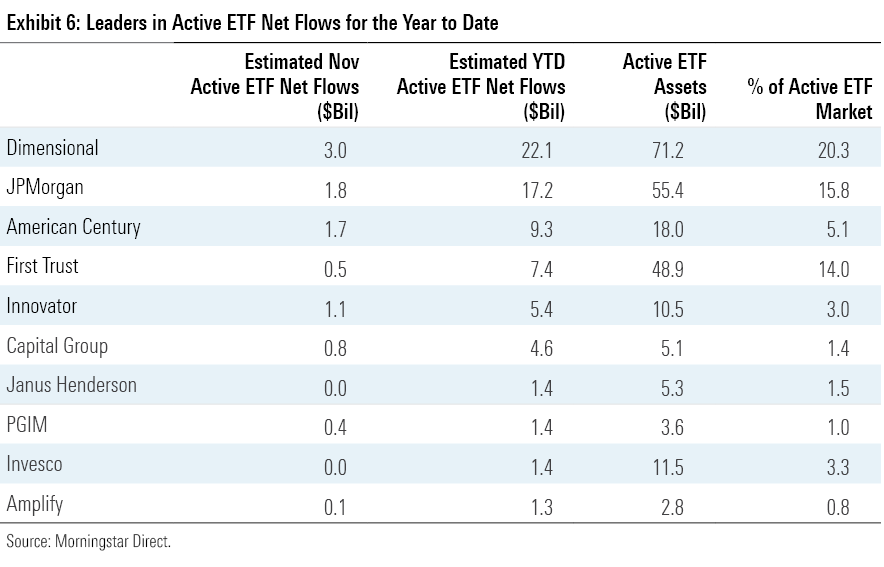

Old fixtures of the ETF realm—iShares, Vanguard, and the like—consistently dominate the flows leaderboard. The low-cost products these firms peddle make their businesses rely on volume. But as the rise of active ETFs has only accelerated in 2022, some firms’ active offerings have vaulted them into the center of the flows conversation. Exhibit 6 features the five fund families that have set the pace in active ETF flows this year.

Two of the top five families, Dimensional and American Century (which includes its Avantis ETF brand), stretch the definition of active. These firms run systematic strategies, building portfolios with a preordained set of rules rather than a discretionary hand. The funds earn their “active” stripes with trading: Rather than follow a fixed rebalancing schedule like their traditional index peers, what and when these funds trade comes down to what makes the most sense from a cost and stylistic standpoint. As the parents of index-adjacent funds, these firms are sensible newcomers to the ETF ecosystem.

Less conventional funds have driven J.P. Morgan and Innovator to the top of the list. Nearly all of J.P. Morgan’s active inflows trace to JPMorgan Equity Premium Income ETF JEPI, a covered-call strategy that tallied $5.4 billion in assets at the end of 2021 and has raked in a whopping $11.4 billion since. Innovator has benefited from its series of defined outcome funds, which use options to buffer investors from a specified percent of the market’s drawdown (but limits their returns when the market rallies). Capital Group has accumulated ETF interest by repackaging strategies similar to its tried-and-true mutual funds into the ETF wrapper.

The world of active ETFs is nascent. The firms that jumped out to promising starts have showed us that there will be a multitude of ways to succeed within it.

Good Value in Growth

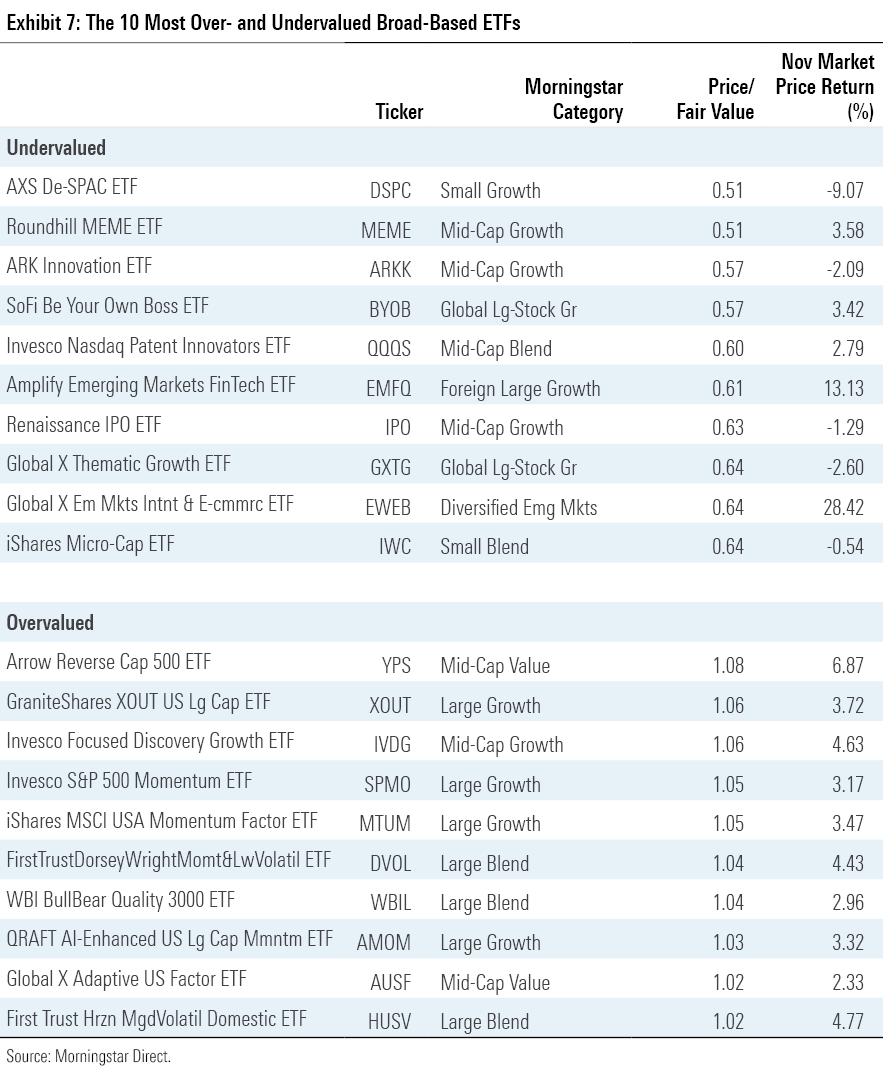

The fair value estimate for ETFs rolls up our equity analysts’ fair value estimates for individual stocks and our quantitative fair value estimates for stocks not covered by Morningstar analysts into an aggregate fair value estimate for stock ETF portfolios. Dividing an ETF’s market price by this value yields its price/fair value ratio. This ratio can point to potential bargains and areas of the market where valuations are stretched.

Growth stocks have rich valuations because they usually boast attractive outlooks and enviable competitive positions. But these stocks have taken a beating this year—the Morningstar US Growth Index is down 31.43% for the year to date—leaving many growth funds looking undervalued.

A pair of actively managed ETFs with Morningstar Analyst Ratings of Silver may be worth a look. Fidelity Blue Chip Growth ETF FBCG takes an aggressive growth stance that stuck its year-to-date returns in the large-growth category’s bottom quintile, but its skilled, well-resourced manager and prudent portfolio construction should serve it well when the growth slump subsides. It traded at a 31% discount to its fair value at the end of November. T. Rowe Price Growth Stock ETF TGRW carried a 30% discount after trailing the Russell 1000 Growth Index by about 9.5 percentage points for the year to date. Still, this fund’s deep resources and sound investment process instill confidence that it can stage a rebound.

Even after an excellent month, some overseas stock portfolios still look cheap. Vanguard FTSE Emerging Markets ETF VWO, whose broadly diversified portfolio and rock-bottom fee earn it a Bronze rating, clocked in with a 32% discount at November’s end. Vanguard FTSE All-World ex U.S. Small-Cap ETF VSS traded 29% below its fair value. This is a riskier offering that requires intestinal fortitude of its investors, but its array of attractive traits earn it a Gold medal.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)