How Good Is the Federal Government’s G Fund?

Comparing the Thrift Savings Plan’s offering to Treasury bills and I Bonds.

A Family of One

I will not bait and switch by extolling the merits of the massive G Fund—at $210 billion, only slightly smaller than the nation’s largest bond fund, Vanguard Total Bond Market II VTBIX—only to later inform you that you cannot buy the fund unless you work for the federal government. I admit to that drawback now. G Fund can only be held through the Thrift Savings Plan, which is the federal government’s equivalent of a 401(k) account. (Officially, it is 403(a) plan, but never mind that.)

If anything resembles G Fund, I have yet to encounter it. The fund invests short and pays long. That is, G Fund emulates a money market investment by quoting a stable net asset value and providing daily liquidity, but its yield is pegged to longer-term interest rates rather than short-term rates. How is this investment miracle accomplished, you might ask? Simple: The government cheats.

By which I mean that the portfolio managers of G Fund do not use a wonderfully clever strategy that somehow delivers high yields, while eliminating bond market risk. Rather, they hold a note that was created exclusively for the Thrift Savings Plan. By construction, the security that the U.S. Treasury Department devised for G Fund can always be redeemed at par. It pays a yield that matches the average of all outstanding Treasury securities that have maturities exceeding four years.

Better Than Inflation

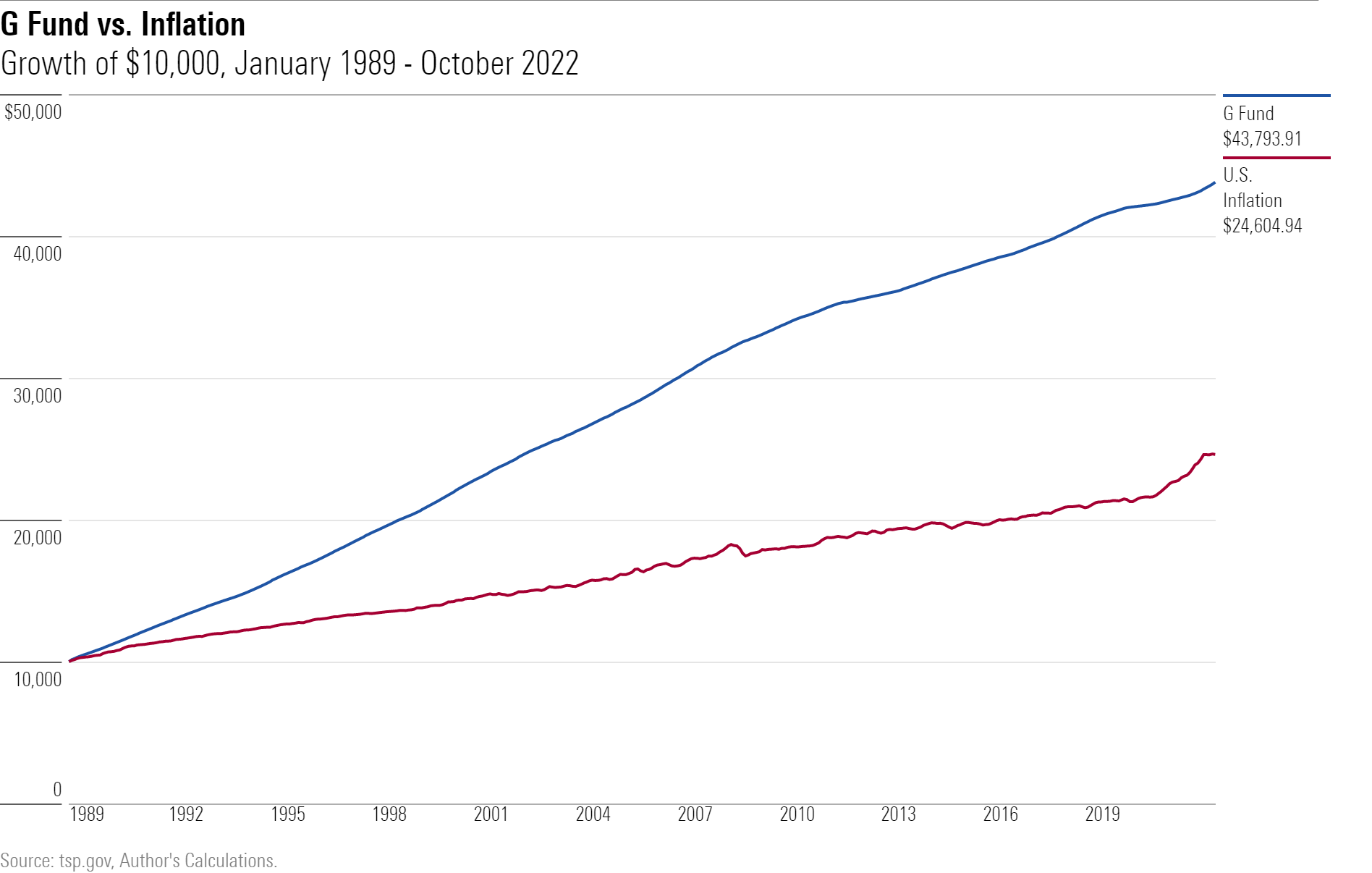

One of the first items I encountered when researching this article was a warning from a financial planner: “Historically, long-term investments in G Fund [have] lost purchasing power.” That claim struck me as obviously wrong. Given that intermediate- and long-term bonds customarily carry real positive yields, it was highly unlikely that G Fund has trailed the rate of inflation since its 1987 launch.

In fact, it has not. As the following chart shows, G Fund has easily outpaced the growth of the Consumer Price Index. (The exhibit begins in 1989, the first year for which the Thrift Savings Plan’s administrators provide G Fund’s monthly returns.) Over the past 34 years, an investment in G Fund almost doubled its real value.

(As it turns out, the financial planner was misquoted. His argument was instead that G Fund’s returns have declined over time. True enough, until very recently, when Treasury yields surged. The moral of the story: Don’t trust internet sources—except this one.)

Although G Fund stands alone, there are three publicly available ways to buy short-term debt that is guaranteed by the U.S. government: 1) Treasury bills, 2) Series I Savings Bonds, also known as I Bonds, and 3) Series EE Savings Bonds. The third is a poor option. The other two, however, are popular securities often recommended by investment researchers. (In August, for example, I published a paean to I Bonds.) They are reasonable alternatives for G Fund.

Rival #1: Treasury bills

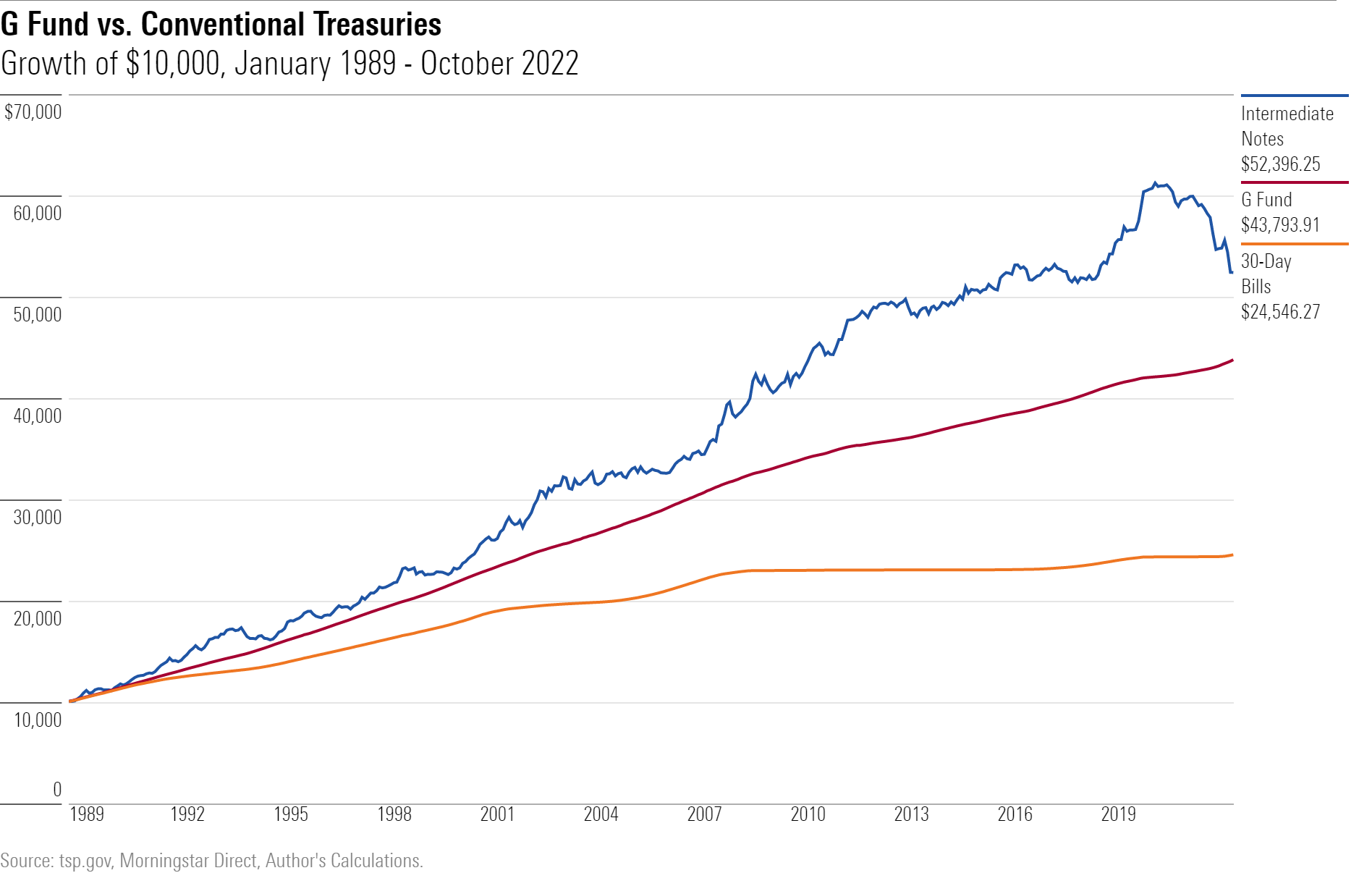

Let’s start with 30-day Treasury bills. Over the past century, the return on Treasury bills has closely tracked inflation. We should therefore expect G Fund to have handily outgained Treasury bills during its lifetime—a notable achievement, given that G Fund is every bit as liquid and creditworthy as a T-bill fund.

G Fund delivered as anticipated. Once again, Treasury bills mirrored inflation’s change (a $10,000 purchase of 30-day Treasury bills trailed the cumulative growth in inflation by a mere $60). That performance affirmed their status as a safe investment, in real terms, but it paled next to G Fund’s gains. Intermediate-term Treasuries posted higher returns yet, but with much greater volatility.

A triumph for G Fund. It predictably beat its short-term competitor, and was also better than intermediate-term Treasuries, on a risk-adjusted basis. What’s more, the latter will struggle to repeat their triumph. Intermediate-term Treasuries posted higher returns than G Fund because they earned capital gains. But those profits were generated from a starting yield of 8%. With today’s payouts at less than half that level, intermediate-term Treasuries are unlikely to record similar capital gains heading forward. Indeed, they may not post any capital gains at all.

Rival #2: I Bonds

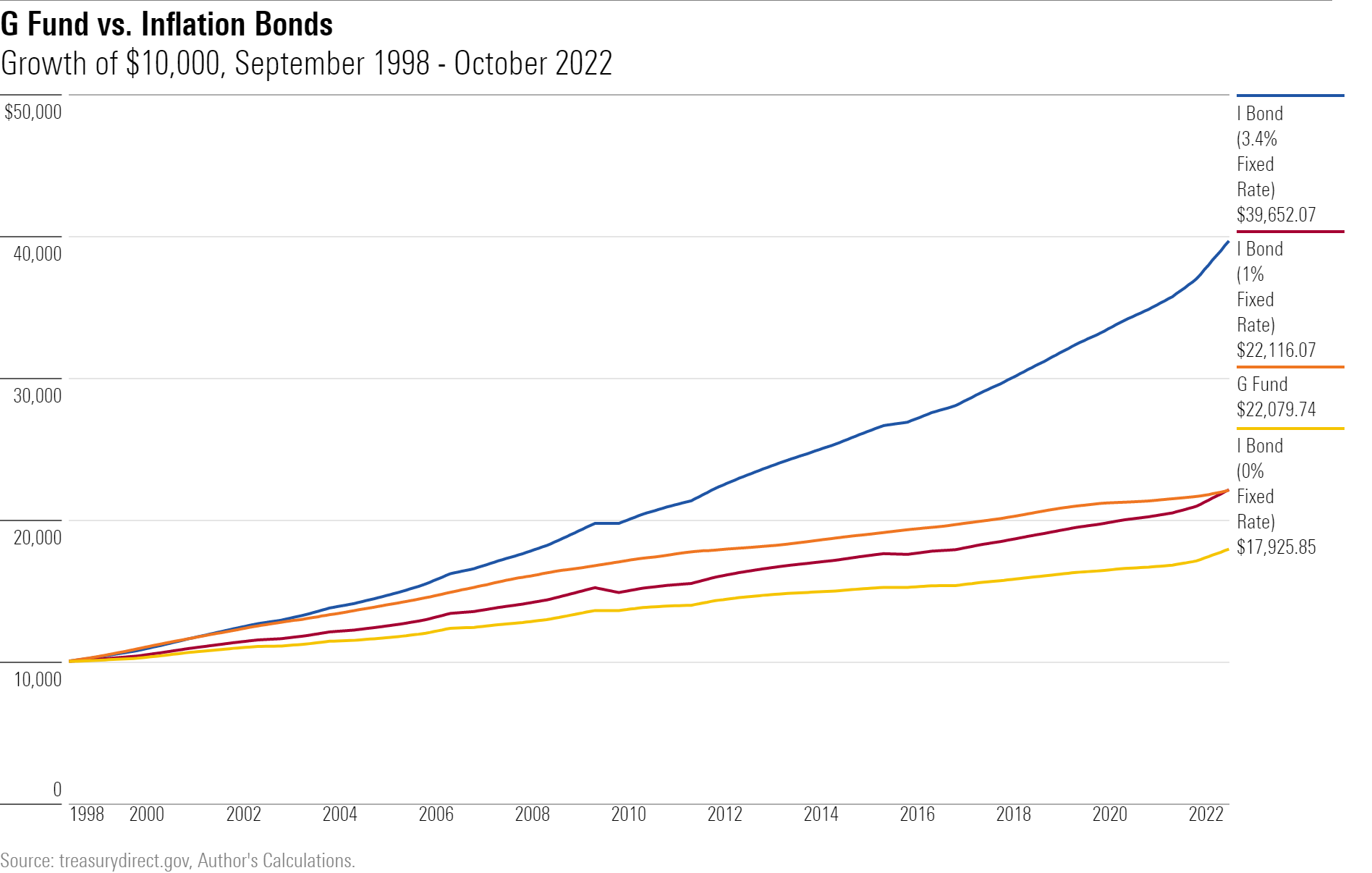

While Treasury bills are implicitly correlated with inflation, I Bonds are explicitly so. They directly yield the inflation rate from a few months previous. Consequently, I Bonds should also not be expected to keep pace with G Fund over the long haul.

That said, I Bonds have fared somewhat better than Treasury bills. With the performance comparison, I Bonds have benefited partially from timing, as they did not exist during most of the 1990s, when G Fund scored unusually high returns. In addition, they were also helped early on because the early version of I Bonds featured fat fixed-rate yields in addition to their inflation-based payouts.

The evidence appears below. I Bonds debuted with a 3.4% annual fixed rate, which gradually withered away as I Bonds gained popularity, leading the Treasury Department to be less inclined to sweeten the deal. I Bonds sold under those terms have comfortably outgained G Fund. However, those lacking a fixed-rate enticement have trailed G Fund. The breakeven fixed rate has been 1%.

As newly issued I Bonds currently offer a 0.40% annual fixed-rate bonus, G Fund is clearly the superior long-term bet. An additional attraction is that G Fund may always be redeemed on daily notice, while I Bonds cannot be exchanged under any condition for cash within 12 months of being bought, and they extract an interest penalty if the transaction occurs after 12 months but in less than five years.

Summary

Ironically, G Fund suffers the problem of being too appealing. Considering both the monies that the fund owns from employees who bought it directly, and as part of the Thrift Savings Plan’s lifestyle funds, G Fund now accounts for more than 30% of TSP’s assets. That is clearly too much for a retirement plan. While G Fund offers an unparalleled blend of safety, liquidity, and relatively generous yields, it is in the end a short-term investment—and should be used as such.

Postscript

Tuesday’s column asserted that growth stocks are considerably more correlated with interest-rate changes than are value stocks. On command, Federal Reserve Chairman Jerome Powell hinted the next day that the Federal Reserve might slow interest-rate hikes, thereby sparking a stock market rally that was based on interest-rate expectations. Large-growth U.S. stocks gained three times as much as did large-value stocks on the day, 4.74% versus 1.61%.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XLSY65MOPVF3FIKU6E2FHF4GXE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)