David Swensen: The Peter Lynch of Institutional Investing

A genius to admire but not emulate.

Almost Famous

Last Wednesday, David Swensen succumbed to cancer. He died as he had lived during the past 35 years, as the CIO for Yale's endowment fund.

Although Swensen wasn’t a household name, he was a superstar within his field. Just saying “Swensen” made pension-fund managers nod approvingly. Say “David” and they would also know to whom you referred, smirking at your attempt to convince them of your mutual familiarity. He was that famous.

The numbers were responsible. While personalities (Jim Cramer!) drive media ratings, the reverse occurs within the investment industry. There, the results create the personalities. By consistently beating its peers, year after year, decade after decade, Yale's fund became the endowment benchmark--and Swensen its charismatic talisman. Other investment professionals wanted to be like David.

Year by Year

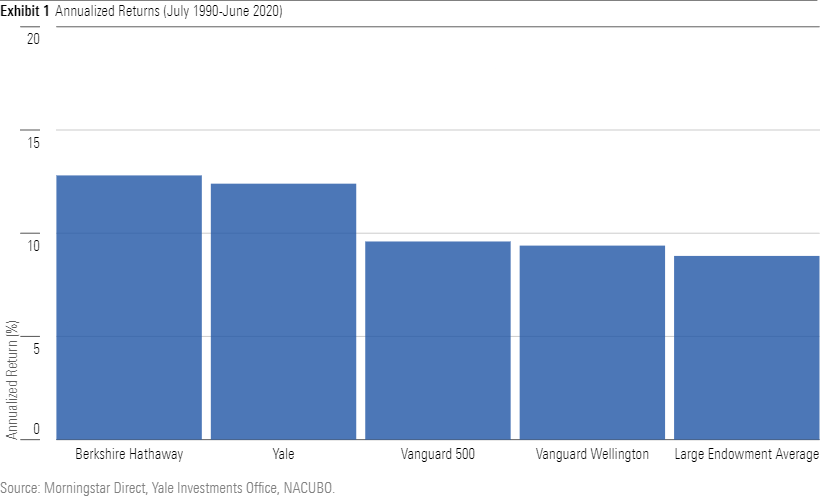

The chart below portrays the 30-year performance for Yale Endowment, through its most recent fiscal year of June 30, 2020. Accompanying its annualized returns are those for: 1) Warren Buffett’s Berkshire Hathaway BRK.B, 2) Vanguard 500 Index VFINX, 3) the largest balanced mutual fund of 1990, Vanguard Wellington VWELX, and 4) the average large educational endowment fund, courtesy of data from the National Association of College and University Business Officers, or NACUBO.

Berkshire Hathaway has struggled over the past several years, leading many to question whether Buffett has lost his touch, but its 30-year credentials are unquestioned. There's no shame in slightly trailing Berkshire during that time. Yale Endowment clocked all the other contestants. Admittedly, Swensen's pension-fund rivals didn't cover themselves in glory by lagging a traditional balanced fund, but Yale's victory margin was nevertheless substantial.

Cumulative Totals

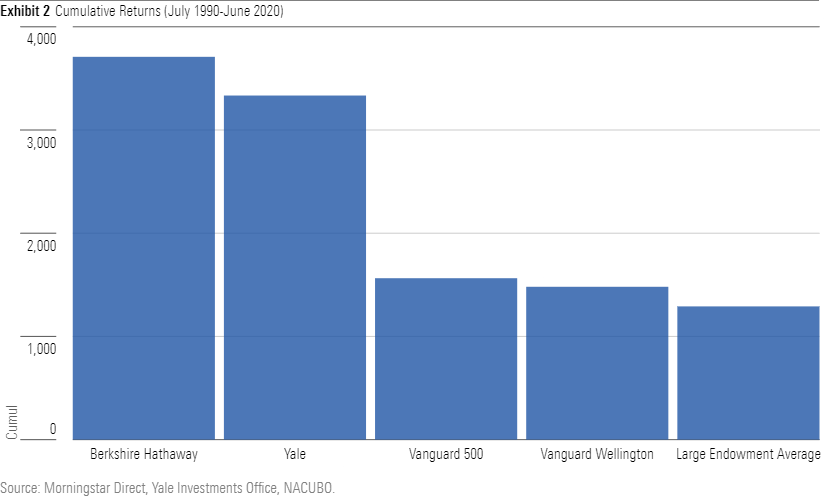

Presenting annualized results over such a long period obscures the investments’ cumulative differences. The next chart better illustrates Swensen’s achievement.

Had Yale Endowment matched the performance of its typical competitor, claims its report, it would have forgone $34 billion in gains.[1] One can understand why Swensen, not the football coach, was perennially the university's highest-paid employee. (Well, that and the fact that, unless Harvard is in town, the team draws about 10,000 fans per game, with Yale students attending for free.) The ability to add alpha when managing a large sum of money is highly valuable.

The Road Less Traveled

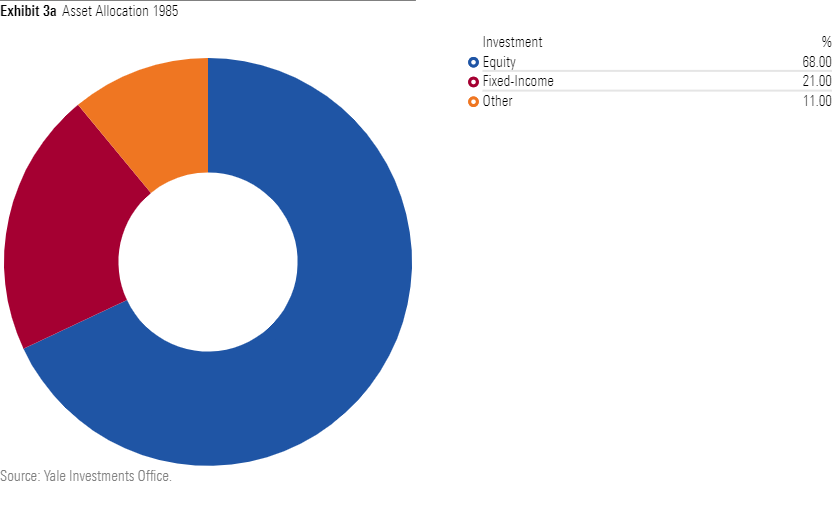

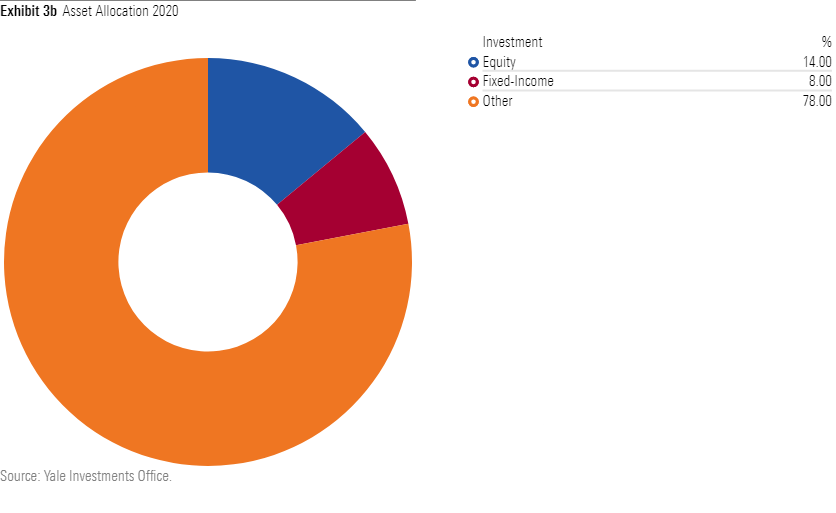

Swensen built his career with alternative investments. When he took over the fund in 1985, it was conventionally positioned. Aside from a small real estate position, Yale Endowment looked much like a mutual fund, holding two thirds of its assets in stocks, largely U.S. equities, and most of the rest in bonds and cash. Swensen had other ideas. In time, he transformed the fund almost completely. Today, its equity stake is only 14%.

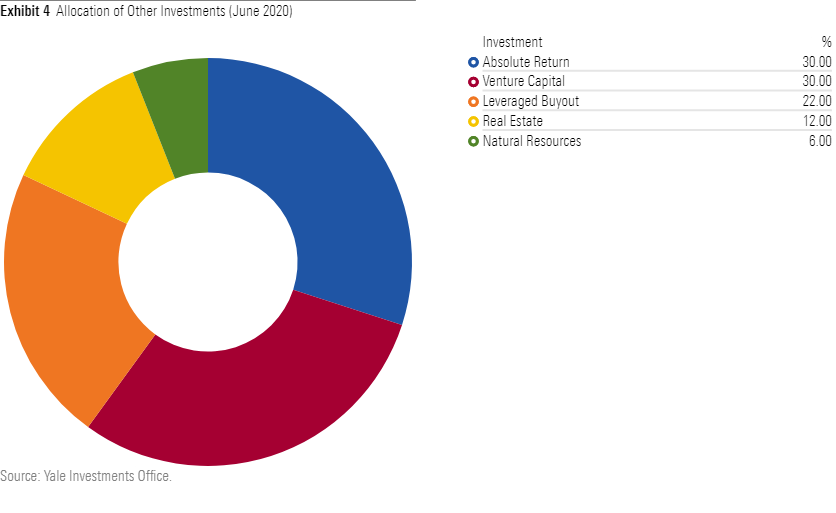

What was lost in equities--or, to a lesser extent, fixed-income securities--has been gained in alternatives. The current composition of the portfolio’s “Other” slice appears below. The fund’s biggest exposures are to three types of private fund: 1) absolute return (Yale's term for what others call hedge funds), 2) venture capital, and 3) leveraged buyout. Rounding out the portfolio are two tangible assets: 1) natural resources and 2) real estate.

Managing Actively

This shift in allocation was based partially on investment math. Why should endowments, which are exempt from the Investment Act of 1940 that governs public funds, limit themselves to commonplace securities? Diversification's highest rewards come to those who invest most broadly. Spreading Yale Endowment's wealth across the investment spectrum permits the fund to pursue higher returns while affording it the protection that comes from owning assets that move irregularly. When one part of the portfolio sinks, another might rise.

However, the change also stems from Swensen's desire to invest actively. For him, adopting alternative investments not only modernized the fund's allocation, but permitted him more opportunity to select winners. States Yale's report, "Alternative assets, by their very nature, tend to be less efficiently priced than traditional marketable securities, providing an opportunity to exploit market efficiencies through active management." But such chances are only infrequently seized. Only the elite managers can accomplish the feat consistently.

And who better than the well-placed Swensen, with his team of researchers, to identify and hire those elite? Nobody, as it turned out. Over the years, many pension-fund managers would mimic Yale Endowment’s asset allocation; most learned, to their regret, that Swensen’s greatest skill was manager selection. By Yale’s calculations, only 40% of its fund’s alpha owes to asset allocation. The remaining 60% comes from having superior managers. The alternative funds in Yale’s portfolio have comfortably outgained their peer-group averages.

No Role Model

Swensen was his industry's Peter Lynch. Like Swensen, former Fidelity Magellan FMAGX manager Lynch thrived by combining uncommon insight with privileged access. (Back in the day, Fidelity wielded as much power when summoning CEOs to its Boston office as Swensen did when inviting hedge fund managers to New Haven.) Each refuted the strongest form of investment skepticism, that even the best portfolio managers cannot outrun the pack. Lynch and Swensen were the best of their times and places, and they certainly did.

But theirs were solo achievements. Few who read Lynch's "Beating the Street" found their own collection of "ten baggers." Lynch was not only more skilled than almost all his imitators, but also better equipped. He possessed both the staff and the near-insider information. Similarly, pension-fund managers who wished to become the next David Swensen rarely succeeded. Indeed, many lowered their portfolio's returns, at least for the near term, by swapping equities for alternative investments before stocks began their long bull run. (Yale benefited from its allocation for the first 25 years of Swensen's tenure, but not during the most recent decade.)

Within his field, Swensen was regarded as a popularizer. Many contemporaries followed his lead. In doing so, they misunderstood Swensen’s true gift. His brilliance lay not in showing others the way, but rather in accomplishing what they could not.

[1] This note initially puzzled me, given that Yale Endowment held $31 billion in assets when that statement was written. How could Swensen have generated more wealth than the fund contains? But of course, Yale continually spends the portfolio, which accounts for about one third of the university’s revenues. Yale's point: Had the university instead retained those assets, the fund would be double its current size.

Editor's Note: The name and ticker symbol of Vanguard Wellington VWELX have been corrected in this version.

John Rekenthaler (john.rekenthaler@morningstar.com) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)