Dollars to Doctors: How the Coronavirus Could Reshape Healthcare Spending

Are this year's healthcare trends a short-term disruption, or will they continue to impact where our dollars go?

Healthcare isn't cheap. From consistent costs like health insurance premiums to ad-hoc events like surgeries, healthcare spending consumes a substantial portion of the typical U.S. household's income: approximately 11% (or $8,200 per year) for families without an elderly member, according to the Kaiser Family Foundation.

It's also high for the elderly: Fidelity estimates that over the course of retirement, the average cost of healthcare for a 65-year-old couple is near $300,000. (Morningstar's head of retirement research David Blanchett has explored more about this cost.)

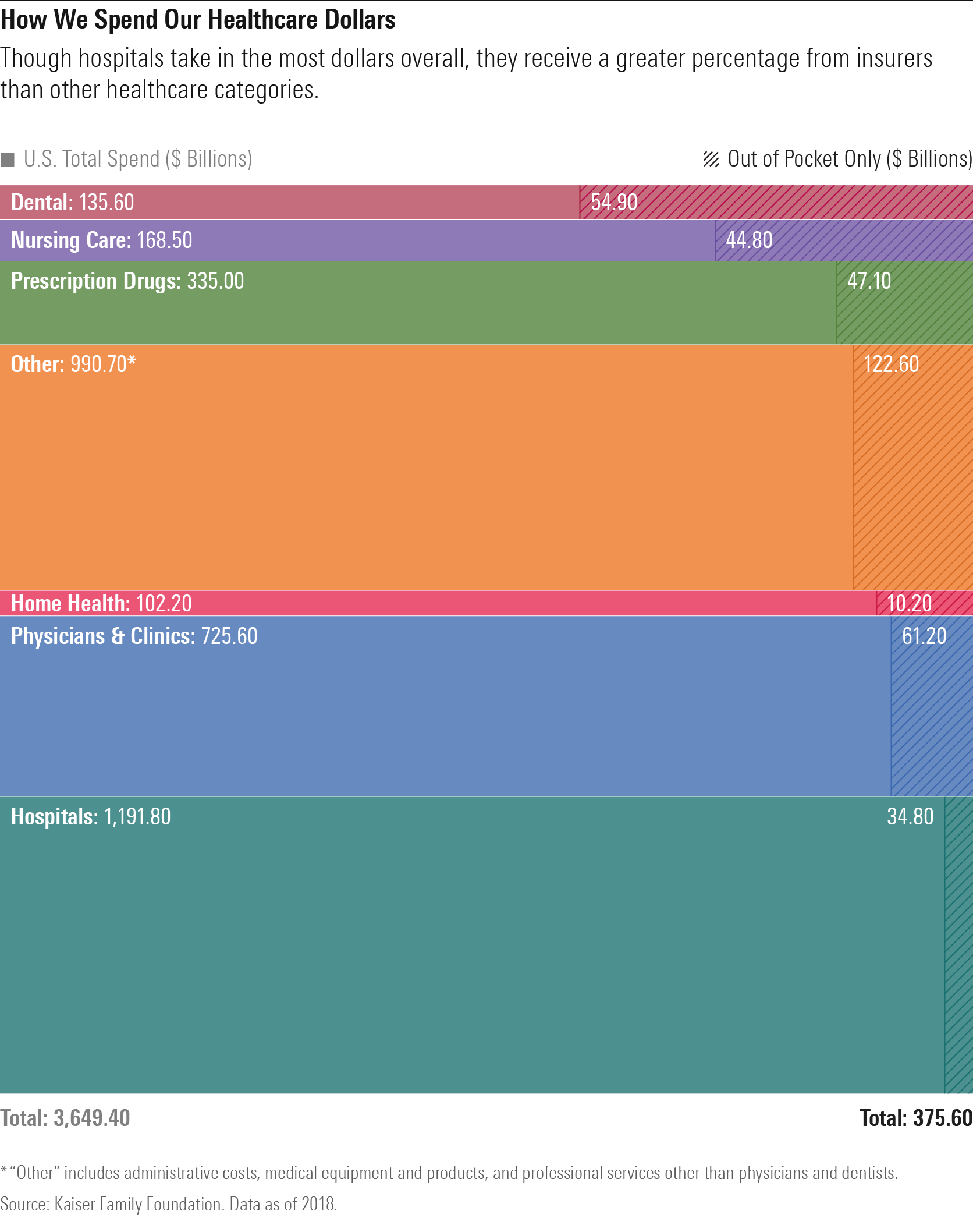

So, where are our dollars going? Taking into account all sources of funding (including costs covered by health insurance), hospitals and physicians/clinics absorb the largest portion of healthcare dollars. When it comes to our actual out-of-pocket spend, however, consumers allocate more dollars to physicians and clinics, dentists, prescription drugs, and nursing care.

However, the coronavirus somewhat upset these healthcare-spending trends. The Kaiser Family Foundation found that across all healthcare services (excluding pharmaceutical drugs), expenditures were down 38% in April 2020 compared with April 2019. Dental services, hospitals, and physician's offices were hit the hardest by this dip as homebound people delayed elective procedures--a shift that also led to increased telemedicine spending. On the other hand, spending on prescription drugs continued to grow during the pandemic.

But when COVID-19 is behind us, can we expect these trends to revert, or will the pandemic permanently change our healthcare spending? We explore the long-term impact that COVID-19 may have on telemedicine, elder care, and drug prices--and what that means for how we may spend our healthcare dollars in the future.

Healthcare Trends Support the Rise of Telemedicine Many warmed to the idea of virtual doctor's visits--whether via the telephone or a web-based solution--to avoid doctor's offices during lockdowns.

The New York Times reported that nearly $4 billion was billed nationally for telehealth visits during March and April 2020, compared with less than $60 million for the same two months of 2019. That's a 66-fold increase year over year.

"COVID-19 has definitely accelerated the adoption of technology across all industries--and healthcare is not an exception," notes Morningstar healthcare analyst Soo Romanoff. "We probably observed a significantly faster adoption in the last six months than in the last several years as it was [often] the only method to interact with providers."

Regulatory hurdles have been a headwind for telemedicine historically because of issues related to privacy/HIPPA compliance and liability, say the authors of a recent analyst note from Morningstar subsidiary PitchBook.

During the pandemic, however, several steps were taken to broaden telemedicine's capabilities. For instance:

- The U.S. government waived Medicare's limitations on telemedicine services, including temporary reimbursement for services provided through virtual appointments.

- The U.S. government enabled registered telemedicine practitioners to issue prescriptions as appropriate.

- A growing number of insurers added temporary telemedicine coverage to existing plans.

So, will telehealth displace traditional in-office and hospital care for the longer term? Romanoff says we will not likely return to historical levels for traditional care but telehealth is unlikely to completely displace in-person care for two reasons: reimbursement and quality issues.

"The temporary reimbursement waivers [to pay for telehealth] provided during the pandemic are anticipated to expire," she explains.

Further, physicians and systems will want to see patients in their facilities so they can be reimbursed at significantly higher rates than they are with telehealth. She says, "Physicians will want to connect with their patients in the interest of continuity and consistency. This aligns with a system that rewards providers for quality and penalizes for poor care, such as patients that are readmitted for the same condition. So, it's in physicians' interest to encourage patients to continue their care with them in person."

Romanoff does think there may be more interest in sticking with telehealth in areas such as mental health, where appointments are arranged in advance with the same provider. These types of appointments have increased over the past few months as individuals seek ways to decrease stress and anxiety during the pandemic, and they may want to continue to conduct these appointments from the privacy of their homes.

What does this mean for our healthcare spending? Not much, since most will return to in-office visits with doctors. Any additional dollars that consumers spend on telehealth is unlikely to be significant.

Healthcare Trends Could Drive More At-Home Elder Care The pandemic was particularly dangerous to those in assisted living and nursing home facilities. According to The Foundation for Research on Equal Opportunity, nursing homes and assisted living facilities accounted for 45% of all COVID-19 deaths as of the end of summer.

Given the sizable number of COVID-19 cases we've seen in comprehensive nursing home facilities, are we likely to shift our long-term-care-related dollars to in-home care solutions instead? The cost for both is steep: The median cost for a nursing home facility (private room) exceeds $100,000 annually, while a 40-hour per week home-health aide can run more than $50,000 per year, on average, according to Genworth.

"We think there will be increased demand for in-home care thanks to the pandemic," says Morningstar senior analyst Debbie Wang. "Aside from demand for in-home aide services and hospice service, we think this issue could also manifest itself in new zoning ordinances, for example, that will allow for more mother-in-law 'cottages' or carriage houses to be built on property that is currently for single-family homes."

Further, if President-elect Joe Biden makes good on his announced national caregiving plan, this new government program would help cover the costs for more in-home elderly care (instead of relying mostly on Medicaid), providing benefits to a much broader swath of people, not just for those who can prove need, says Wang.

Although we expect elevated demand for at-home care, numerous factors will influence how large the increase is and how quickly any shift occurs. Uncertainties such as personal preferences, financial means, and how long COVID-19 remains a pressing concern make it difficult to forecast how prominent this shift will be.

What We Anticipate for Healthcare Spending on Prescription Drugs The pandemic's impact on drugmakers could be profound, says Morningstar sector director Damien Conover. If drugmakers can offer COVID-19 vaccines at cost or at very little profit--and help bring the world back to something closer to "normal"--they may be able to generate some much-needed goodwill for Big Pharma. And in doing so, the drugmakers will have a good chance of protecting their longer-term pricing.

Further, although government policy can have a large impact on how we spend on drugs, Conover says that new policies are hard to implement.

Take, for instance, President Trump's executive orders targeting drug prices. As of today, Conover doesn't expect these to pose too much of a threat to drug pricing.

"The order allowing the importation of drugs from Canada would significantly reduce U.S. drug prices (which are close to double international prices)," he explains. "But safely implementing this is challenging, given the different labels across countries, and drug firms are likely to limit Canada sales. Importation of drugs [from Canada] has been passed by Congress twice, only to fail in implementation largely due to safety concerns."

The other orders, which target issues like middlemen discounts and Medicare drug prices, are similarly difficult to implement.

Moreover, the U.S. presidential election creates only modest uncertainty on the policy front.

"Overall, we expect U.S. drug pricing to remain fairly similar to the current structure, which should bode well for the biopharma industry as the group has seen pressure over concerns about potential major U.S. drug policy changes," says Conover.

Conover adds that there's bipartisan support--along with support from the Big Pharma--to have drugmakers cover the cost of Medicare Part D drugs at the catastrophic phase (at which point Medicare recipients are responsible for 5% of the cost of drugs, representing more than $2 billion annually).

These costs often represent a large cost per individual: With some specialty drugs costing upward of $100,000 per year, an individual may be responsible for paying $5,000 of that, says Conover. Shifting that sizable cost from recipients to drugmakers will reduce a voter complaint about high out-of-pocket costs for specialty drugs--and may even remove the threat of drug pricing reform.

And what do we expect to be the result? No significant threat to drug prices--and therefore, in general, consumers will likely continue to spend at least as much, if not more, on prescription drugs.

The Long and the Short of Healthcare Spending At the end of 2019, the Kaiser Family Foundation projected per-capita healthcare spending to increase by less than 5% annually during the next decade, which is well below the double-digit annual healthcare spending increases of prior decades but still ahead of inflation. Prescription drug costs were forecast to rise at just a slightly higher pace annually but well below the rate in the mid-2010s.

That forecast was, of course, before COVID-19. It remains to be seen what impact the virus will have on spending in the coming year. It is possible that the preventive care and chronic disease management that many delayed during the pandemic could lead to an uptick in costs in the next year or two.

But we think one thing is for certain: Our healthcare spending will continue to be significant, as healthcare companies continue to devise new ways to treat unmet medical needs and extend and improve our quality of life.

Stock Synopsis: 3 Healthcare Stocks for the Future

Teladoc Health TDOC Economic Moat Rating: None Fair Value Estimate (as of Oct. 31, 2020): $183.00

Even before the pandemic, Teladoc was the leading telehealth provider, listing 40% of the Fortune 500 as clients. If approved by regulators, its definitive agreement to acquire Livongo LVGO would only add to its girth. But we don't think Teladoc has carved out an economic moat just yet. "Although Teladoc has established itself as the national telehealth leader with global reach, the virtual care delivery market remains fragmented and the current offering and infrastructure are not mature enough to support economic profits," notes analyst Soo Romanoff. But we think the company has some characteristics that could help it carve out a moat at some point, including its scale and valuable insights about navigating complex healthcare-related regulations.

Pfizer PFE Economic Moat Rating: Wide Fair Value Estimate (as of Oct. 31, 2020): $42.50

Pfizer has garnered headlines during the COVID-19 crisis for its partnership with BioNTech BNTX to develop a coronavirus vaccine; as of this writing, we're increasingly bullish that most of the vaccines entering late-stage development in the United States will meet FDA guidelines for approval. Regardless of the outcome, though, we think wide-moat Pfizer boasts one of the largest economies of scale in the pharmaceutical industry. "We expect continued market share gains and new approvals from existing drugs along with new pipeline drugs will drive Pfizer's growth," says sector director Damien Conover.

Anthem ANTM Economic Moat Rating: Narrow Fair Value Estimate (as of Oct. 31, 2020): $370.00

As the exclusive licensee of the trusted Blue Cross Blue Shield brand in 14 states, Anthem boasts the second-largest medical membership in the United States--which we think is impressive, given its limited geographic reach compared with other insurers, according to senior analyst Julie Utterback. In 2020, Anthem benefited from less healthcare utilization because of COVID-19. And although insurers face uncertainty around shrinking employer-based insurance rolls because of pandemic-related layoffs and possible policy-related matters, we think the narrow-moat company can manage those risks and thrive over the long term. Sector Summary: Spending on Fitness and Mental Health Technologies Along with broader healthcare trends, the pandemic will also likely shift how we spend our dollars on fitness and mental health.

Lockdowns and social distancing requirements have had an impact on the fitness industry. People are staying away from the gym and adapting their fitness routines to digital at-home offerings, notes analyst Kaia Colban with PitchBook (a Morningstar company).

This will have a positive short-term impact on our spending on at-home fitness solutions and apps. Fitness application Aaptiv saw a 50% increase in user engagement the week of March 16, and RVIVE reported organically acquiring 5,000 new users in the first two months of the pandemic.

However, the longer-term impact for at-home fitness devices is muted, says Colban, because the pandemic has largely pulled forward demand.

PitchBook also expects that the pandemic will lead to increased spending on virtual mental healthcare offerings, with consumers spending on tools for decreasing stress and anxiety.

In March, online therapy platform Talkspace reported a 25% month-over-month increase in user volume, and digital health application Livongo reported a 140% increase in use between September 2019 and March 2020.

"While some of this demand may be transitory, we believe much of the addressable market growth will be retained in the long term, as consumers rely on mental health services to adjust back to the 'normal' world and develop ongoing mental health practices, such as meditation," argues Colban.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)