The Last Free Lunch in Investing?

Fallen angel bonds are risky for ETF investors, but the rewards could be worth it.

Fallen angel bond strategies are inherently contrarian. Exchange-traded funds like iShares Fallen Angels USD Bond ETF FALN buy bonds precisely when most investors are selling. These types of funds have also enjoyed a strong run of performance, possibly supporting the Chartered Alternative Investment Analyst Association’s claim that they’re the last free lunch in investing.

Fallen Angels Fly High

Fallen angels are bonds whose credit ratings have dropped from investment-grade to junk. Downgrades tend to result in forced selling by investors that cannot hold sub-investment-grade debt, suppressing the bond’s price. Funds that track this niche exploit the mispricing with the hopes that the price appreciates as the market for each bond stabilizes. The CAIA found in its 2019 report that bonds entering a fallen angels index [1] are priced 150 basis points cheaper than high-yield peers, on average. This, combined with their higher credit quality than the broader high-yield universe, delivers a portfolio of bonds that offer upside potential and less credit risk than most high-yield peers, an attractive combination for fixed-income investors.

ETF investors seeking to capitalize on this market phenomenon have limited options because effectively executing a strategy of this kind can be difficult. IShares Fallen Angels USD Bond ETF and VanEck Fallen Angel High Yield Bond ETF ANGL are the only two fallen angel index ETFs available to US investors. Both offer broadly similar portfolios and charge the same 0.25% annual fee. Here, we’ll focus on iShares Fallen Angels USD Bond ETF.

How Fallen Angels Work

IShares Fallen Angels USD Bond ETF tracks the Bloomberg US HY Fallen Angel 3% Capped Index. This market-value-weighted bogy sweeps in bonds from developed-markets issuers whose credit ratings have recently fallen from investment-grade status. The index requires constituents to have an outstanding face value greater than $150 million and mature in at least one year. Issuer weight is capped at 3% to promote diversification and mitigate downside risk.

A portfolio of fallen angels tends to have a longer duration and higher credit quality than other high-yield bond portfolios, but those traits don’t meaningfully differentiate the fund’s performance from peers. Timing matters far more. When a bond is downgraded from investment grade to junk, large institutional investors may have to sell their stakes in those bonds, as their investment mandates prohibit them from owning sub-investment-grade debt. This creates a short-term imbalance in supply versus demand. After a downgrade, or in anticipation of a downgrade, there are likely to be more sellers than buyers, causing a bond’s price to fall. Once certain investors have cleared the shelves of these newly junk indentures, the market will, in theory, stabilize and reinflate a bond’s price, possibly closing the 150-basis-point gap noted by CAIA. Once prices normalize, fallen angels are moved by the same forces deciding bond prices elsewhere: credit and interest-rate risk.

IShares Fallen Angels USD Bond ETF systematically buys fallen angels immediately after they’ve been downgraded [2]. Investors in this fund hope that, by doing this, the fund consistently benefits from the short-term price appreciation of these bonds, delivering better returns than the high-yield segment and the broad fixed-income market.

There are challenges to an approach like this one, evidenced by the lack of offerings in this seemingly promising space. Managing trading costs is the greatest challenge iShares Fallen Angels USD Bond ETF and other fallen angel strategies face. Indexing high-yield bonds is difficult, and adding fallen angels precisely at a time when the market for them is unbalanced makes it even more challenging. After the dust settles on a bond’s downgrade, that once-investment-grade bond trades as any other junk bond would—inefficiently.

Junk bonds are usually traded over the counter, and the available pool of buyers and sellers is far smaller than in the investment-grade market. This increases trading friction, reduces supply and demand, lowers liquidity, widens spreads, and raises trading costs. Both active and passive managers are susceptible to these heightened costs. For iShares Fallen Angels USD Bond ETF, which is beholden to the index’s complexion and monthly rebalance schedule, it may have relatively few tools to combat ballooning trading expenses.

Only strategies able to minimize the frictions and costs associated with trading fallen angels and other high-yield bonds will be able to capitalize on the upside offered by the structural return advantages offered by a fallen angel strategy.

Assuming iShares’ managers can control trading costs, the portfolio can be evaluated much the same as other fixed-income strategies. Duration measures around 5.0 years, about a third longer than most high-yield funds but shorter than many investment-grade peers. With more than 70% of constituent bonds rated BB, compared with around 45% for the high-yield bond Morningstar Category average, credit quality measures better than nearly all high-yield peers but understandably worse than core- or core-plus benchmarks. These portfolio traits position the portfolio to be compared favorably in the high-yield universe—a safer credit profile with only moderately higher interest-rate sensitivity.

Focusing on portfolio stats misses the point of a strategy like this one. The upside for an investor is realizing the short-term price appreciation potential of fallen angels and the ability for an index ETF to capture it systematically and consistently. The ability for a fund and its managers to do this is at the crux of an investor’s decision whether to embrace this contrarian approach.

How Fallen Angels Perform

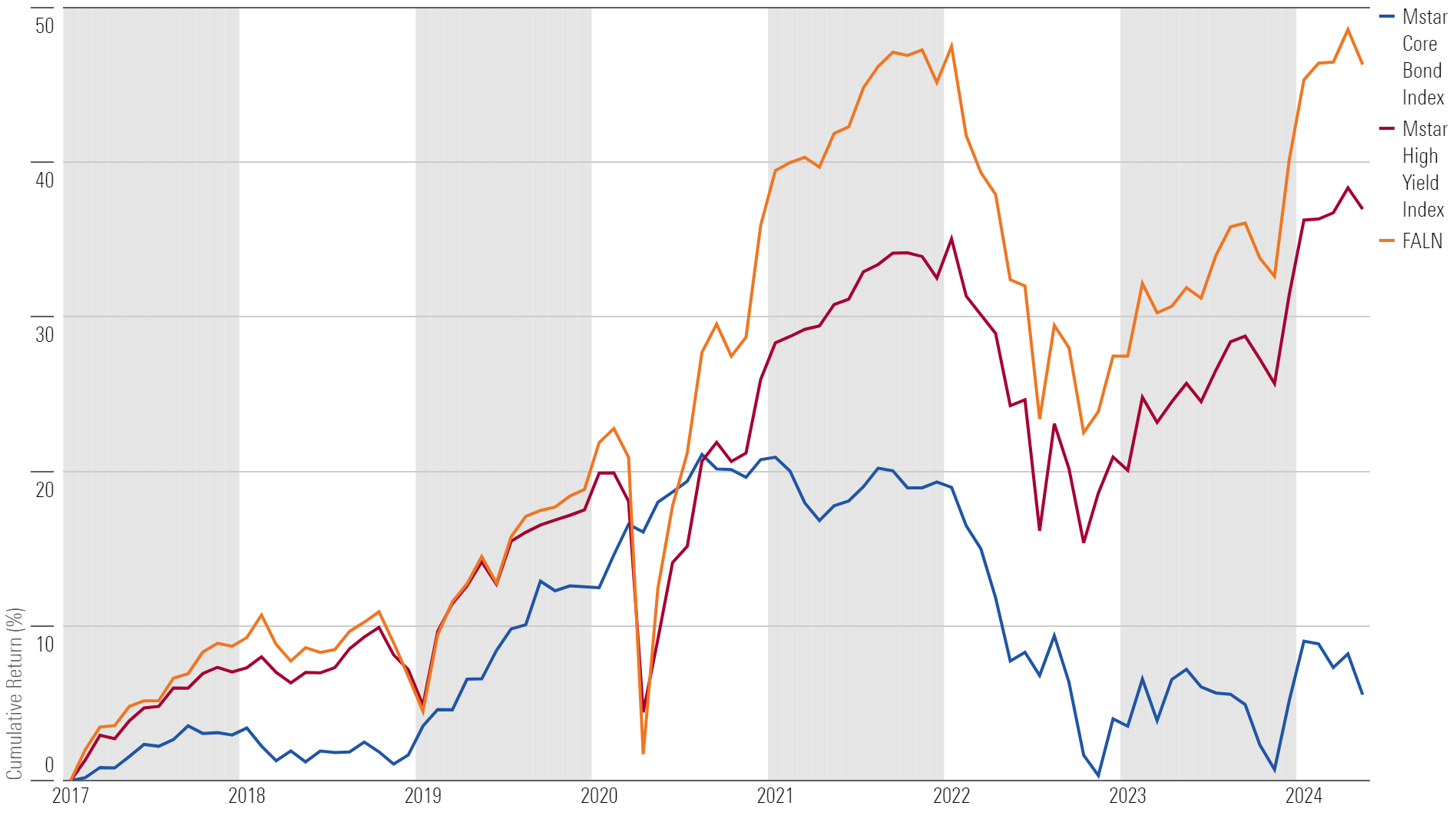

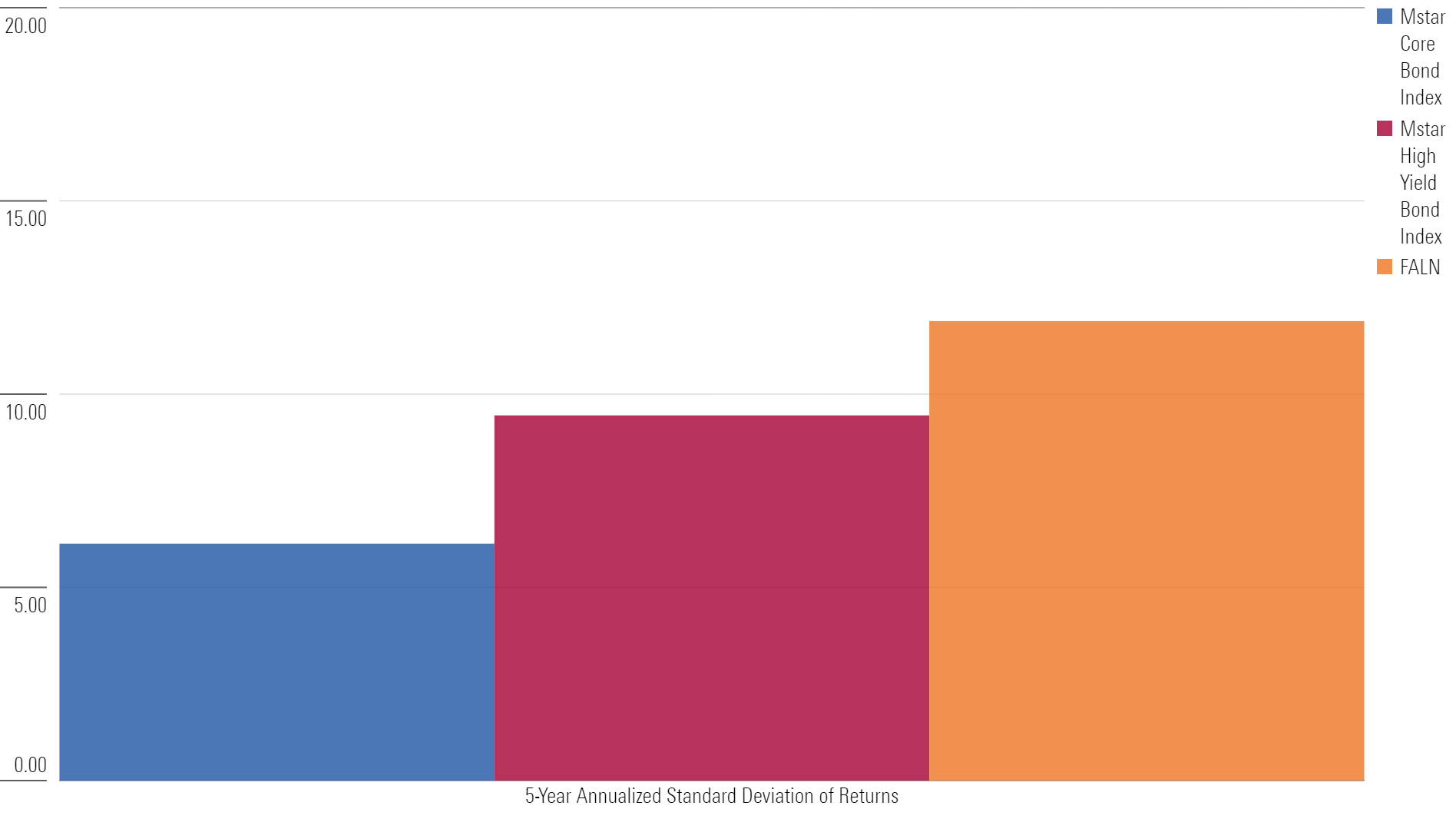

Despite operational challenges, fallen angel strategies, including iShares Fallen Angels USD Bond ETF, have performed well relative to their high-yield category peers and broader fixed-income universe. Since iShares Fallen Angels USD Bond ETF’s 2016 inception, it returned a sturdy 6.1% annualized, 2 percentage points better than the high-yield category norm and 5.7 percentage points better than the Morningstar US Core Bond Index. However, because the fund usually collects bonds during volatile price movements, the fund tends to be considerably more volatile than the investment-grade universe and still more volatile than many high-yield funds. Short-term price movements of the underlying bonds overwhelm the volatility-damping effects of a relatively high-quality portfolio.

Fallen Angels Are Risky

Investors in this ETF need to understand what they’re getting. Price movements depend little on the credit and interest-rate risk profile and instead on the pricing peculiarities of fallen angels themselves.

The high-yield bond market is less efficient than most, and that inefficiency is exacerbated for fallen angels. Trading activity depends less on relative fundamentals and more on the investment mandates of the major owners of those bonds. This can lead to outstanding performance for a time, but it’s usually coupled with heightened volatility. The historical risk/return profile looks more like an equity fund than many bond funds as a result. For an investor who understands the risks and dynamics of this strategy, it can add a little juice to an otherwise sleepy fixed-income allocation. But for an investor seeking ballast, they might be surprised by the choppy ride.

[1] Bloomberg Barclays US High Yield Fallen Angel 3% Capped Index

[2] Following a downgrade, the fund buys the bonds at its next scheduled rebalance.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/5db00d6b-9c2f-4da7-8f94-da4290cf3b4a.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-31-2024/t_68607a5db29e471d8bf1a155ea356f7c_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/3WXR46JX6VF2HMOMAWQGCO67DM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5db00d6b-9c2f-4da7-8f94-da4290cf3b4a.jpg)