How to Find the Right Value Fund for Your Portfolio

Do you need deep value, classic value, or flexible value?

Let’s take a look at the large-value Morningstar Category.

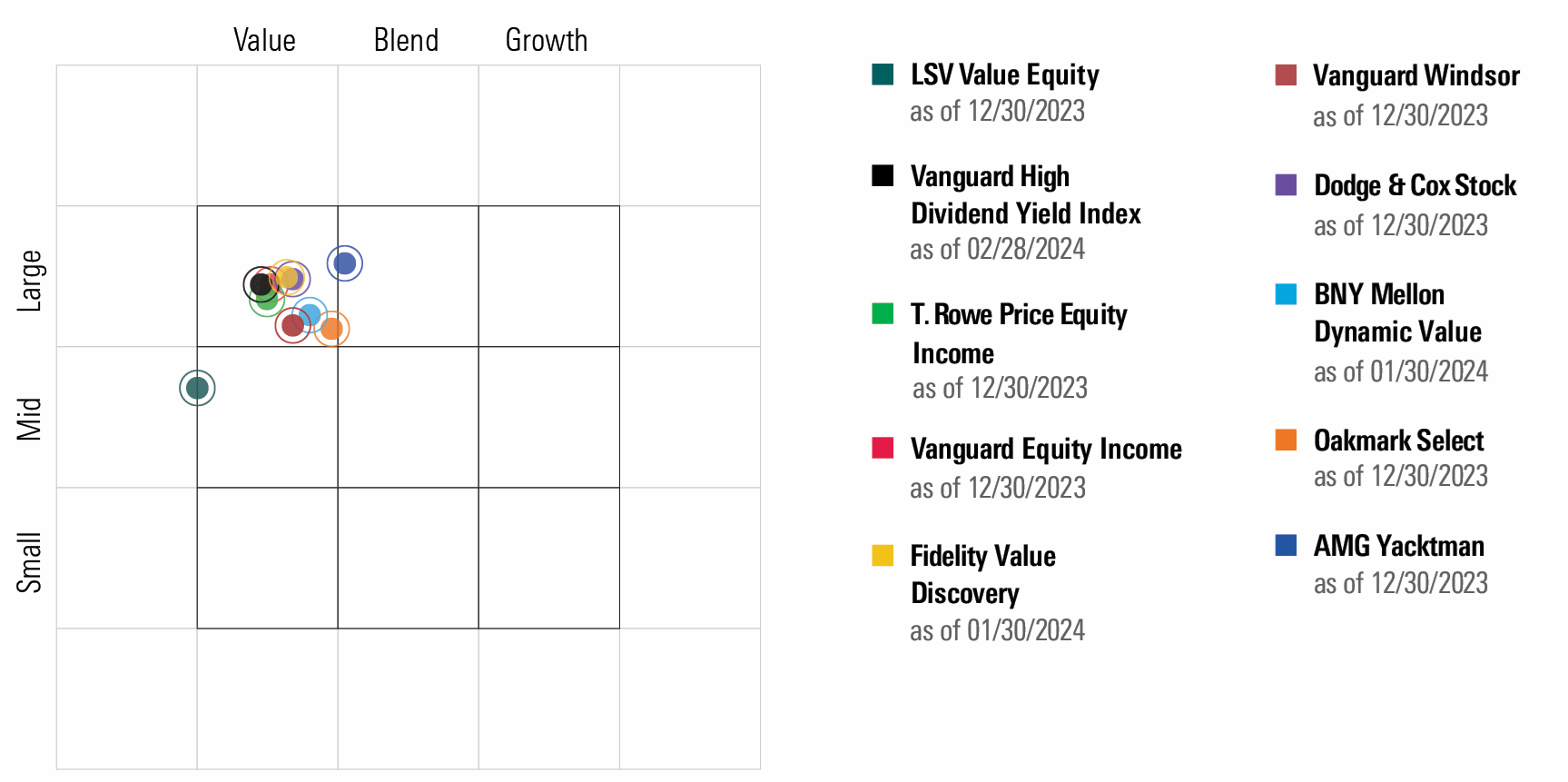

I have some funds on the value/blend border but wanted something further to the value side to increase diversification and provide more ballast for the next growth selloff. For this article, I looked beyond those more-pure value strategies to cover those in the deep-value, equity-income, fundamental value, and flexible value cohorts.

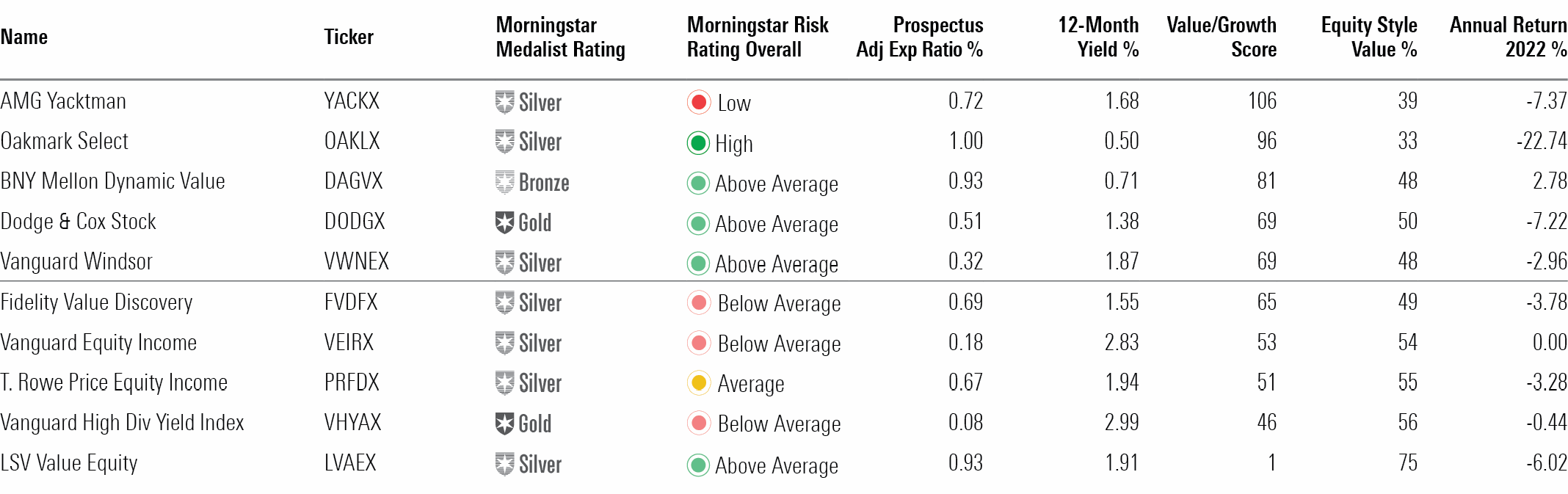

I focused on a few measures: a fund’s Morningstar Risk rating; value/growth score, where 1 is the extreme value side and 100 is on the border with blend; loss in the growth meltdown year of 2022; yield; and portfolio percentage in value.

Deep Value

Let’s begin with the deepest value fund. LSV Value Equity LVAEX, which has a Morningstar Medalist Rating of Silver, is a quantitative fund with a value/growth score of just 1 and the most value exposure of all our funds at 75%. LSV looks for low-valuation stocks that are showing hints of improvement. At that extremity of value, volatility kicks up as it comes with tremendous economic sensitivity.

In 2022, the fund lost 6%, worse than most on this list, but it does enjoy moments in the sun and really is a nice diversifier. Just don’t put too much in deep-value funds like this one because they are vulnerable when a recession hits.

Equity Income

I’ve got three equity-income funds for you to choose from. I’m a big fan of this incredibly dull old-fashioned strategy. They make nice core holdings. The income is nice, but I like the fact that a focus on yield keeps the strategies from chasing faster-growing stocks that pay small or zero dividends. You want a well-designed process, though. We’ve seen some exchange-traded funds that track indexes that simply buy the biggest-yielding names. That’s incredibly risky since those stocks often have high yields because investors don’t think the companies can sustain their payouts. Yield moves in the opposite direction of price; when investors flee distressed dividend payers, their yields rise.

Vanguard High Dividend Yield Index VHYAX looks for companies with above-average yields but weights them based on their liquidity and market caps, which moves the fund toward safer bets. It’s also widely diversified, so it doesn’t have much riding on any one bet. The fund’s 3% yield is the highest among the funds in this article, and its value/growth score of 46 gives it the second-lowest valuations. In 2022, it lost just 0.44%, making it third best by that measure. You also can buy this Gold-rated gem in the ETF format with Vanguard High Dividend Yield ETF VYM.

I ended up choosing Vanguard High Dividend Yield Index because it’s well-designed, cheap, and unlike anything else in my portfolio.

Vanguard Equity Income VEIRX gives Vanguard High Dividend Yield Index a good run for its money. This Silver-rated fund is actively managed, but it charges just 10 basis points more and, not coincidentally, offers a yield that’s only 16 basis points lower. (Expenses are subtracted from dividends before they are paid out.) Matthew Hand of Wellington Management runs most of the fund, while Sharon Hill of Vanguard’s Quantitative Equity Group also runs a sleeve. Hand aims to balance yield with good growth prospects and decent valuations.

The fund was flat in 2022, second best in the group, and its 53 value/growth score puts it smack dab in the middle of value.

T. Rowe Price Equity Income PRFDX has a little lower yield of 1.94%, owing partly to a higher fee and John Linehan’s slightly more modest emphasis on income. The Silver-rated fund has been a steady performer and very much in the heart of value, though it did lose 3.3% in 2022. It’s running modestly ahead of the Russell 1000 Value Index since Linehan took the helm in November 2015 and is a good complement to T. Rowe’s growth funds.

Classic Value

Now we move to funds where yield is less important than good stock fundamentals and valuations. These funds are a little closer to blend and less of a pure-value play, but they are good stock-selection vehicles that ply classic value strategies.

Fidelity Value Discovery FVDFX is rated Silver and, importantly, earns a Below Average risk rating thanks to manager Sean Gavin’s cautious streak. Gavin focuses on capital preservation, so he looks for companies with strong competitive positions, healthy profit margins, and low valuations. He also stresses low volatility and builds a diversified portfolio that should be fairly resilient. The fund did lose 3.8% in 2022, but it remains ahead of its peers over the 12 years that Gavin has been at the helm.

Vanguard Windsor VWNEX has settled in nicely. David Palmer has led Wellington’s sleeve of 70% of assets since 2019, and for Pzena Investment Management’s sleeve, Rich Pzena has been on the fund since 2012, Benjamin Silver since 2014, and John Flynn since 2017. Fees are a nice, low 0.32%, giving management a low bar to clear. The Silver-rated fund’s five-year returns are a robust 12.4% annualized, which is well ahead of the category’s 9.9% and Russell 1000 Value Index’s 9.4%. The fund lost 2.96% in 2022, but otherwise, it’s been smooth sailing.

Dodge & Cox Stock DODGX is one of my favorites for its depth of management, analysts, and patient fundamental investing. It all comes at a very reasonable fee, and the firm is employee-owned. I’m confident the fund will be doing 10 or 20 years from now what it’s been doing all along. I once asked the late Vanguard founder Jack Bogle what firms he admired, and he said, “Dodge & Cox. My God, they are boring!” In Jack’s world, boring is a tremendous compliment because it means you aren’t trying to distract investors with flashy new things. The Gold-rated fund is also right in the middle of value. Note that it did lose 7.2% in 2022.

Moving a little closer to the blend border, we have Bronze-rated BNY Mellon Dynamic Value DAGVX. Interestingly, the fund was the best performer in 2022 when it gained 2.78%. As the name implies, things move more quickly here with turnover north of 80%. The fund runs quantitative screens for fundamentals, value, and catalysts, and because those catalysts change, turnover is high. After the screens, analysts research the most promising names. The fund’s bias toward cyclical names helped in 2022 as did some other timely moves. The fund has beaten peers in five straight years despite all the changes in the market over that time.

Focused and Flexible

Now we come to a pair of focused funds that are perched right on the value/blend border. The combination of focus and a flexible approach to value makes them a little unpredictable year to year, but they’ve been winners over the long haul. They have some differences, though; Oakmark Select OAKLX has a High risk rating, and AMG Yacktman YACKX has a Low one.

At Oakmark Select, Bill Nygren and team own around 20 stocks of companies that they judge to be well-run and well-positioned in their industries but still offer great potential returns because they trade at discounts to their intrinsic values. The Silver-rated fund has 40% in financials but also owns tech giant Alphabet GOOGL. This is why the fund has a value/growth score of 96, putting it just to the value side of the value/blend border. Succession is top of mind with this fund as Nygren is nearing retirement age, though he hasn’t chosen a retirement date. Robert Bierig and Alex Fitch became comanagers in 2022 and figure to succeed Nygren when he retires. We’ll be watching closely.

We end with AMG Yacktman, which has produced great risk-adjusted returns. The Silver-rated fund’s current portfolio is just over the line into blend because of its mix of eclectic names. (Our categories are based on three-year portfolio averages, so it remains in the large-value category for the time being.) There really are no other funds with a similar absolute return focus and an emphasis on good companies that are undervalued because of some structural flaws. The fund has a fair number of foreign names, like top holding Bollore SA BOL of France, as the managers turn over many stones to find attractive risk/return profiles. They also have more obvious high-quality stocks like Microsoft MSFT and Johnson & Johnson JNJ that are key to its Low risk rating. Stephen Yacktman and Jason Subotky have built an excellent long-term record here.

Conclusion

There are quite a few flavors of value investing, as you can see. The right style depends largely upon the rest of your portfolio and your goals. While I understand the excitement for some amazing tech and healthcare stories on the growth side, value is a time-tested strategy and an important portfolio building block.

Large-Value Tale of the Tape

Value Funds by the Numbers

This article first appeared in the April 2024 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting this website.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-31-2024/t_68607a5db29e471d8bf1a155ea356f7c_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/3WXR46JX6VF2HMOMAWQGCO67DM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)