What to Know About the Federal Thrift Savings Plan TSP G Fund

Be mindful of the opportunity costs of this conservative investing option.

With over $845 billion across more than 7 million participants at the end of 2023—including 116,000 TSP millionaires—the US Government’s Federal Thrift Savings Plan stands as the world’s largest retirement savings plan. This series of articles answers some of the questions we’ve most frequently received from TSP investors. Have a question about TSP investments? Send it to our TSP feedback survey.

Question: What is the TSP G Fund? How should I use it, and should I be using the G Fund as part of my bond asset allocation? Something else?

Answer: We’ve written a few times about the marvel that is the Federal Thrift Savings Plan’s G Fund. As my colleague John Rekenthaler put it, “If anything resembles the G Fund, I have yet to encounter it.” The G Fund, also known as the Government Securities Investment Fund, pays investors the higher yield that comes from longer-term US government bonds, but it does so without the risk of their day-to-day market price fluctuations.

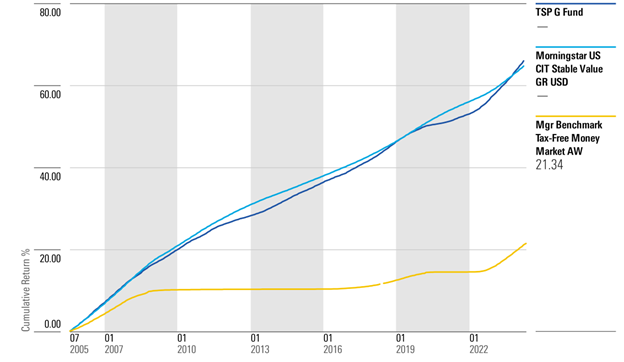

For all practical purposes, this makes TSP G Fund like a stable-value fund or a supercharged money market fund: Investors can generally expect the G Fund to never lose money and to pay a modest yield over time. As shown in the exhibit below, from July 2005 (the first available month of returns) through March 2024, TSP G Fund basically follows the same return path as the Morningstar US CIT Stable Value Index. Stable-value funds’ roughly 2% yield advantage on an annual basis over money market funds has resulted in cumulative returns over that almost 20-year period of about 65% for TSP G Fund and stable value funds and 21% for money market funds.

TSP G Fund Resembles Stable-Value Funds, Outpacing Money Market Offerings

TSP G Fund Cash Is King

As a place to stash cash, there are few more attractive options than the G Fund. This can include, for example, your emergency or cushion fund, which is a crucial part of any financial plan. If a situation arises where you need to use these funds, you would do so via a loan or a withdrawal. The former allows current federal civilian workers or members of the uniformed services to borrow money from their account and repay the loan over time, with interest. The latter would not require loan repayments but does include other conditions, such as being subject to taxes and demonstrating need. Using the Roth TSP feature ensures that you will not be subject to taxes, as Roth contributions are made after taxes have been paid.

For those close to or in retirement, TSP G Fund is also a great liquid asset to hold money you expect to need over the next few years that may not be covered by Social Security or pension payments. The Bucket approach to asset allocation suggests that any money you plan to use over the next two to three years would be a good candidate to keep safe in TSP G Fund.

TSP G Fund Less Attractive for Longer-Term Investors

Besides serving as a cash alternative, there are fewer reasons for all but the most risk-averse investors to allocate substantial amounts to TSP G Fund. For the typical TSP investor, especially one who expects to work for several decades and needs their savings to grow in order to reach a savings balance that will allow them to comfortably retire, TSP G Fund will not likely provide that necessary growth over the long run. Equities, through a mix of the US large-cap-stock-focused TSP C Fund, US small- and mid-cap-focused TSP S Fund, and international-stock-focused TSP I Fund, are the most likely to be able to provide the bulk of that capital appreciation.

TSP F Fund, also known as the Fixed Income Index Investment Fund, should also play an important role in the portfolio as TSP investors move closer to retirement and their time horizons shorten. TSP F Fund tracks the Bloomberg US Aggregate Bond Index, which is similar to iShares Core US Aggregate Bond ETF AGG and consists of US corporate and US government-backed investment-grade bonds. Unlike TSP G Fund, TSP F Fund comes with credit and price risk and the accompanying risk of loss. Over long-enough time periods, though, investors should expect greater returns from TSP F Fund, which the exhibit below demonstrates has generally been the case. From July 2005 through March 2024, TSP G Fund’s average annualized five-year return was 2.4% versus TSP F Fund’s 3.8%.

TSP F Fund Rewards Longer-Term Investors Over TSP G Fund

The jaggedness of TSP F Fund’s returns versus the smoothness of TSP G Fund demonstrates how the higher returns from TSP F Fund come with more volatility and periods of loss. In the last three years, as interest rates have risen and bond prices have suffered, TSP F Fund has been particularly volatile. Focusing on the longer term and ignoring shorter-term market fluctuations can help investors bear these periods of market drought. So can paying attention to overall portfolio results rather than individual funds, which premixed allocation funds can help do.

Using TSP G Fund Comes With Opportunity Costs

Unlike many retirement savers in the private sector, TSP investors do not have static, premixed allocation funds, like a 60/40 stock/bond balanced fund typically found in 401(k) menus. The TSP plan does have target-date funds via TSP L Funds or Lifecycle Funds, which change allocation over time as investors get closer to retirement. For many reasons—like relatively low equity allocations and lack of exposure to high-yield or non-US bonds—TSP L Funds are among the most conservative target-date offerings in the industry.

The L Funds’ notably large exposure to TSP G Fund makes that conservative stance especially prominent. TSP L Income Fund, for example, which is intended for retired workers, has almost a 70% allocation to TSP G Fund. TSP L 2035, meant for investors who still have a decade before retiring, has a whopping 27% allocation. Without seeing the assumptions underlying TSP L Funds’ asset-allocation decisions—data that TSP has declined to provide—it’s harder to analyze the appropriateness of that decision. While asset-allocation optimization tools might mathematically favor the predictability offered by TSP G Fund and stable-value funds, it’s common to see allocators limit stable-value allocations to no more than half of a fixed-income allocation in order to make way for the portfolio growth that most workers need to reach a comfortable retirement. Considering that the government workers served by TSP often enjoy pension benefits and relatively high job security, they’re better equipped than the average worker to bear market risk. TSP L Funds’ large allocation to TSP G Fund so close to retirement may help protect savings when account balances are near their peaks, but it also mutes the opportunity for substantial future growth.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/44f33af1-4d5c-42fb-934a-ba764f670bc6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XLBBRDZCH5HV7PZBIFSY6DM72E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/L4B22R7UFVDBJN2ZYJWBSMCIJA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHBXSNJYDNAY7HDFQK47HGBDXY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/44f33af1-4d5c-42fb-934a-ba764f670bc6.jpg)