Time to Give Up on Multiasset Inflation-Protection Funds?

Despite disappointing results, there's still an argument for these distinctive funds.

We recently released a study of the generally disappointing results that much-hyped objectives-based investments have delivered to investors. A summary of the research can be found on Morningstar.com, and the full paper is on our corporate site. Today's article looks more closely at multiasset inflation-protection funds.

Inflation is often equated to a tax that erodes investors' future purchasing power, and even periods of relatively low and steady inflation can accumulate to become significant drags on real returns over time. The current low-inflation environment has damped investor interest in inflation-fighting funds in recent years; a marked negative turn in performance, driven by the large commodities stakes commonly used in many of these funds, hasn't helped asset flows, either. But an unprecedentedly accommodative Fed rate policy following the global financial crisis did spark a flood of new products in anticipation of a money-supply-fueled jump in inflation; of the 31 multiasset funds that we classify as having an inflation-protection objective, 25 were launched between 2010 and 2014.

Few Inflation-Protection Bond Funds Have Been Truly Tested As a result of this timing, the vast majority of funds in the group have never been tested with anything beyond mild inflationary pressure or limited bouts of unexpected inflation. In this sort of steady-state environment, inflation is a relative nonissue for stocks and bonds, as inflation expectations are built into the discount rates used in those pricing models.

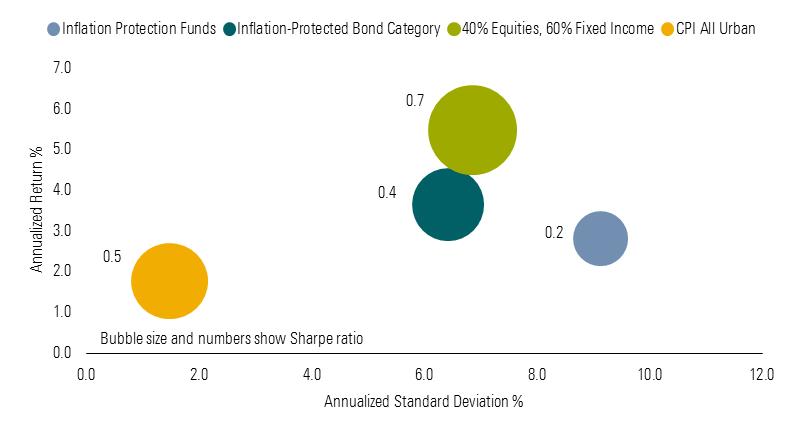

The low-inflation environment has produced a mixed record, as suggested by Exhibit 1. Over the past decade through March 2016, multiasset funds with an inflation-protection objective have generally met their mark and even come out ahead of inflation, as measured by the Consumer Price Index for All Urban Consumers. During that time, inflation grew by an annualized 1.8% per year, while inflation-protection funds gained 2.8%.

Exhibit 1: Inflation-Protection Funds Beat Inflation, Though Volatility Has Been High

10-year annualized returns, standard deviations, and Sharpe ratios, April 1, 2006, to March 31, 2016.

Source: Morningstar.

However, a comparable 40% equity, 60% fixed-income blended index and the typical inflation-protected bond fund each delivered better gains, and they did so with markedly lower volatility. Inflation-protection funds' relatively high volatility comes largely from the exposure to REITs and commodities that typically represent significant portions of these strategies. Those asset classes, along with Treasury Inflation-Protected Securities, make up the primary triumvirate of holdings that distinguishes these funds from most allocation funds and inflation-protected bond funds (other investments often used in multiasset inflation-protection funds include gold and currency).

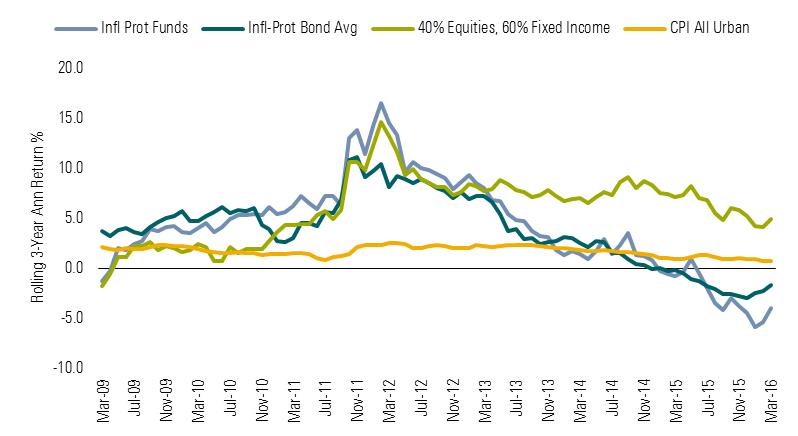

Commodities: Earlier a Blessing, Now a Curse As Exhibit 2 indicates, inflation-protection funds enjoyed fairly strong returns for the first half of the past decade, with returns that easily outstripped inflation and the blended index. Much of those gains came on the back of a booming commodities market, driven primarily by a Chinese investment-led growth model that vastly outstripped all historical economic precedents. (Morningstar's stock analysts have covered the topic extensively, including here, here, and here. Disclosure: The author of this article is married to the author of the cited articles.) But as China has moved toward a more balanced, consumption-led economy, commodities have suffered. As a result, most inflation-protection funds have delivered negative annual returns since 2013, even as inflation has crept modestly upward.

Exhibit 2: Inflation Has Climbed, but Inflation-Protection Funds Have Declined

Rolling three-year annualized returns, April 1, 2006, to March 31, 2016.

Source: Morningstar.

Don't Give Up on Inflation-Protection Funds Despite those uneven results, there's still some argument to be made for multiasset inflation-protection funds over a portfolio of TIPS. True, TIPS are one of the most direct approaches to protecting against both expected and unexpected inflation because their principal amounts change with the Consumer Price Index, not something theoretically correlated with the CPI. And while their prices can fluctuate because of changes in inflation or real yields, they're an effective hedge when held to maturity.

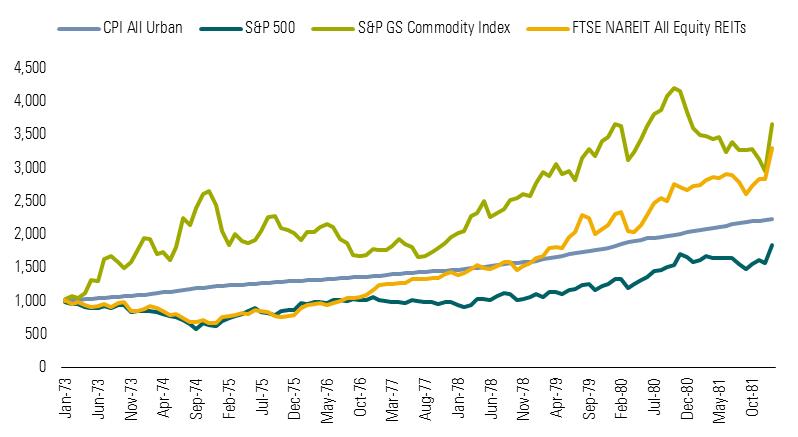

But TIPS only provide inflation protection for the money invested in them. To protect a larger pool of assets, history suggests that commodities and REITs have effectively combated periods of more extreme unexpected inflation when more-traditional asset classes have not held up as well. For instance, between January 1973 and December 1981, inflation climbed 9.2% annually, while the S&P 500 increased only 5.2%, resulting in a real-return loss of 4.0% annually. (We use the S&P 500 instead of the blended index, as neither the Barclays U.S. Aggregate Bond Index nor the MSCI ACWI ex USA have return histories that go back that far.) Exhibit 3 demonstrates that during that time, a broad basket of commodities and REITs proved to be effective hedges against inflation. Of course, there's the question of how well the past will represent the future.

Exhibit 3: REITs and Commodities Have Been Effective Inflation Hedges in Past High-Inflation Environments

Growth of $1,000, from Jan. 1, 1973 to Dec. 31, 1981.

Source: Morningstar.

Recommended Inflation-Protection Funds Given their relatively specific objectives and unique portfolios, we pay closer attention to how well funds with an inflation-fighting mandate live up to their objective when rating them. Our recommended inflation-protection funds have generally outpaced inflation over their histories. While they fall short of their more specific "CPI-plus" goals (most of which are relatively ambitious), we believe they're still poised to serve investors well over the long term.

PIMCO All Asset and PIMCO All Asset All Authority

Since PIMCO All Asset's 2002 inception through August 2016, portfolio manager Rob Arnott has fallen just 13 basis points shy of meeting the fund's ambitious target, and its Sharpe ratio of 0.64 tops the S&P 500's 0.56 during that period. Arnott and his Research Affiliates team invest in a mostly solid lineup of PIMCO funds using a models-based approach that looks beyond traditional stocks and bonds in pursuit of high-yielding assets with attractive valuations. For instance, its equity stake has averaged less than 10% of the portfolio since its inception, whereas inflation-oriented strategies--TIPS, commodities, and REITs--have averaged more than 25%.

Arnott manages PIMCO All Asset All Authority using a similar process, though he also may leverage the portfolio by up to 50% of net assets (it's been about 40% in the past three years). While Arnott has used the leverage responsibly, a rough patch from 2013 through 2015 caused the fund's overall record to fall short of its performance target. From its 2003 inception through August 2016, the fund's 5.3% annualized return lagged the 8.6% mark of CPI plus 6.5%. The fund's 0.47 Sharpe ratio also came in below the S&P 500's 0.53 during that period. Still, we believe that Research Affiliates' disciplined, contrarian approach remains well-poised to reward long-term investors.

Principal Diversified Real Asset

The fund aims to generate a 3- to 5-percentage-point premium above inflation over a full market cycle. It appeared on track to meet that objective after a few strong years out of the gate--the fund launched in March 2010--but a recent string of negative quarterly returns has hindered results. While the fund's 3.6% annualized gain since its inception through August 2016 tops the CPI's 1.7% annualized increase, it falls short of the desired premium. Diversification has helped steady the fund's returns at times. For instance, meaningful exposure to REITs and global infrastructure lifted returns above TIPS in 2012. When TIPS and commodities declined in 2013, the fund still posted a modestly positive return as MLPs and global infrastructure generated double-digit returns.

Associate director of multiasset strategies Jeff Holt, CFA, contributed to this report.

/s3.amazonaws.com/arc-authors/morningstar/44f33af1-4d5c-42fb-934a-ba764f670bc6.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-31-2024/t_68607a5db29e471d8bf1a155ea356f7c_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/3WXR46JX6VF2HMOMAWQGCO67DM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/44f33af1-4d5c-42fb-934a-ba764f670bc6.jpg)